Higher Education Finance

The American higher education system is afflicted by a crisis of quality, affordability, and access that belies its role in building an equitable and just society. This has found most pernicious expression in the mounting problem of student debt, a $1.7 trillion burden affecting over 42 million people. This burden often now extends to students’ families, and is disproportionately shouldered by historically marginalized groups. Absent any meaningful constraint on college costs, the student debt trap risks putting higher education – and its promise of economic mobility – out of reach for ordinary and low-income Americans.

JFI approaches the problem of higher education finance in two principal ways. First, we analyze interlinked, nationally-representative datasets to offer a detailed picture of student debt, examining race, ethnicity and class intersections, labor markets, and the impacts of institution type and geographic concentration. With this analysis, we identify high-impact policy interventions to address the existing debt burden and the broader affordability crisis. Second, we design, consult on, and produce research on income-contingent financing, an alternative to traditional student loans under which students pledge a percent of their income over a limited period. Designed with adequate safeguards, income-contingent financing reduces students’ risk by ensuring their payments never exceed their ability to pay.

PARTNER WITH US

We welcome academic and philanthropic partners interested in using our student debt data for collaborative or independent research. We have collaborated with educational institutions, scholarship funds (notably, the Student Freedom Initiative), workforce development agencies, and a range of investors on income contingent finance pilots, and we welcome further inquiries. We also provide analytics, evaluation, and design consulting for existing providers in order to ensure equitable, transparent and accountable financing.

PARTNERS

Featured Partners

Higher Education Finance Contributors

Eduard Nilaj

Data Science Research Associate

Ege Aksu

Fellow

Francis Tseng

Lead Independent Researcher

Laura Beamer

Lead Researcher

Marshall Steinbaum

Senior Fellow

Roberta Costa

Research Manager

Sérgio Pinto

Fellow

Sidhya Balakrishnan

Director of Research

Yunjie Xie

Fellow

Related Publication Series

Millennial Student Debt

Recent Updates

JFI report by senior fellow Marshall Steinbaum examines the crisis of non-repayment of student debt

A new analysis in the Millennial Student Debt series finds that student debt loads are increasingly difficult for students to...

Announcing the Outcomes Center in collaboration with the San Diego Workforce Partnership

The Outcomes Center contains tools and information for workforce income share agreements

JFI student debt research featured in Higher Ed Not Debt campaign

In a week-long virtual action on the Hill for student loan forgiveness, Higher Ed Not Debt coalition members utilized JFI...

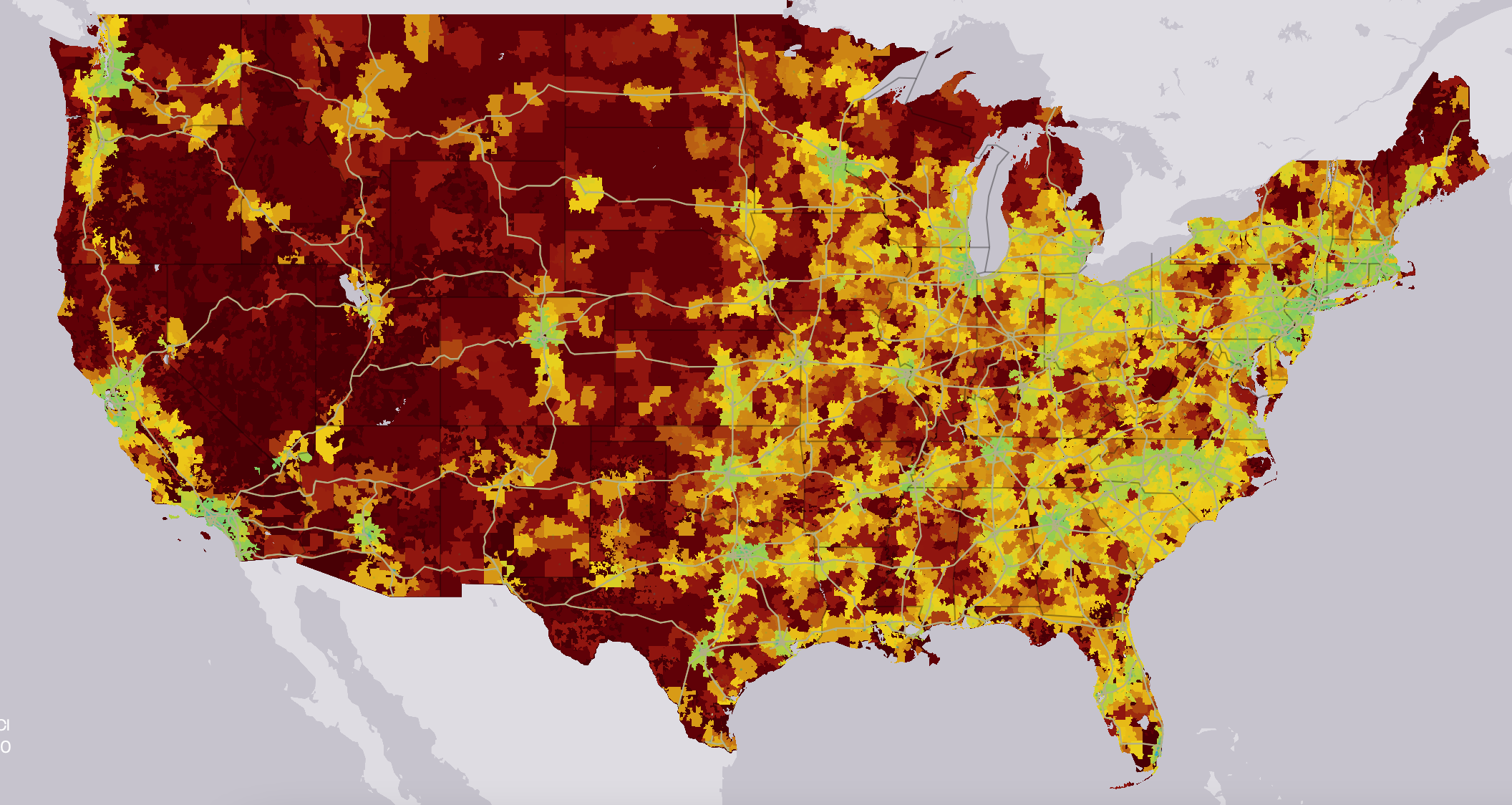

Congressional Overlay

An interactive map of congressional-level student debt trends from 2009 to 2019.

Part of the series Millennial Student Debt

JFI releases map of student debt disparities across congressional districts, states

Following last week’s release of student debt trends since 2009, JFI provides a comprehensive tool for congressional advocacy on the...

Yahoo! Finance piece highlights JFI findings on rising student debt burdens

The article discussed Senators Warren and Schumer's resolution for up to $50,000 in federal debt forgiveness amid disproportionate levels of student...

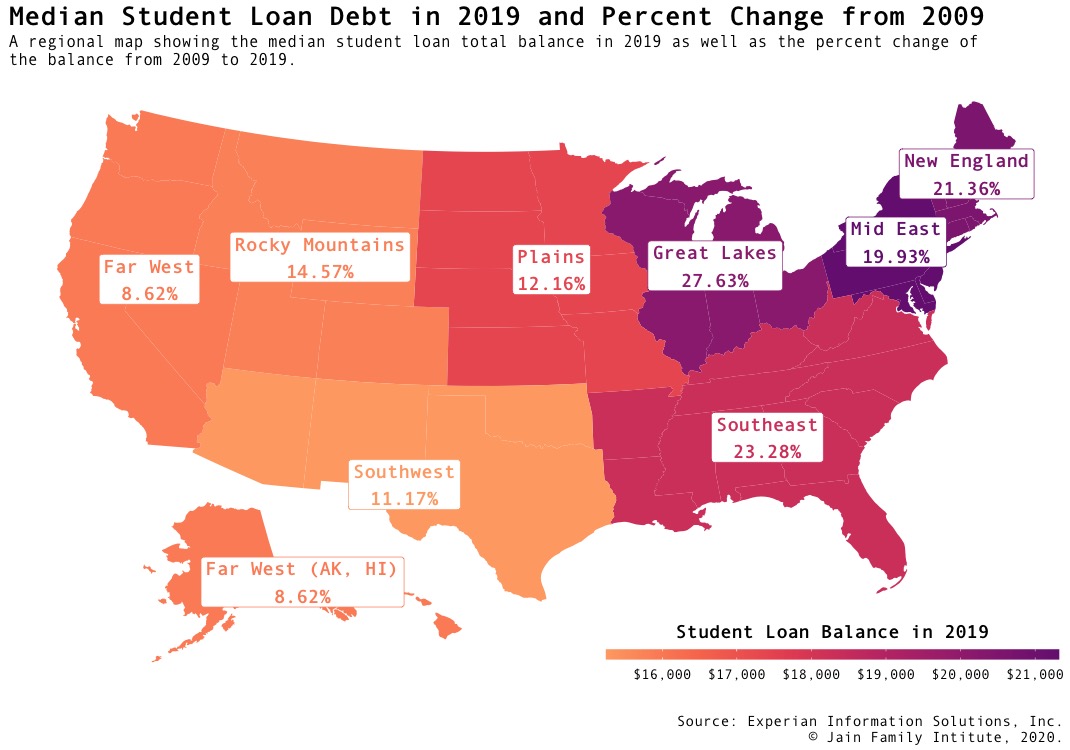

Unceasing Debt, Disparate Burdens: Student Debt and Young America

Since the Great Recession, outstanding student loan debt in the United States has increased by 122% in 2019 dollars, reaching the staggering...

Part of the series Millennial Student Debt

JFI report shows dramatic increases in millennial student debt, interactive map of disparate impacts

New data shows fewer options, higher prices, and ballooning debt in higher education since 2009, with lowest-income communities of color hit...

Policy Insights: ‘Legislating Relief’ – expert perspectives on higher education bills

Key takeaways of our August 7th panel with policy and research experts in higher education, providing crucial perspectives for the...

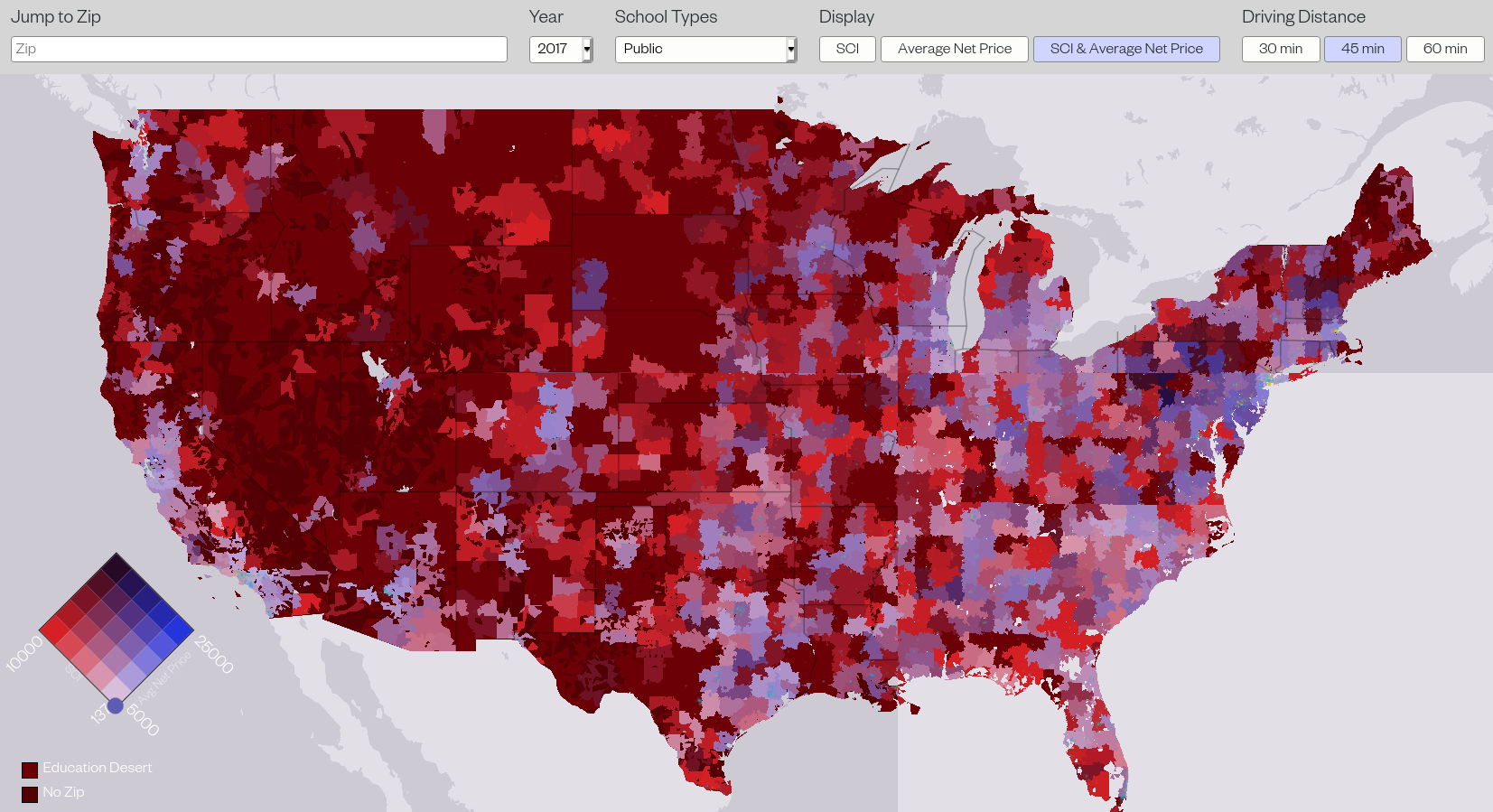

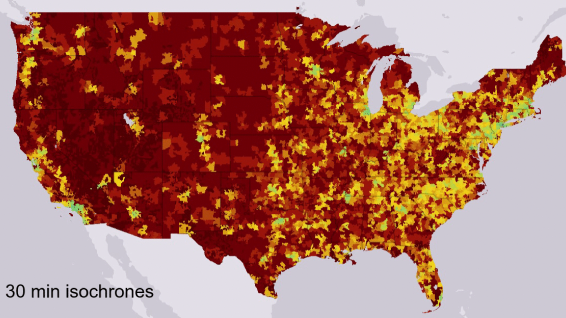

Declining Access, Rising Cost: The Geography of Higher Education Post-2008

Our goal in this study is to help policymakers understand the changing landscape of US higher education since 2008, and to...

Part of the series Millennial Student Debt

Announcement and Summary: Declining Access, Rising Cost: The Geography of Higher Education Post-2008

A new report on the Phenomenal World and interactive map displaying the price of college throughout the US

Time Magazine covers Robert Smith’s Student Freedom Initiative in partnership with JFI

The multi-billion dollar non-profit fund creates alternative financing options at HBCUs, with JFI partnering on program design, analytics, & research

Press Release: Announcing a Partnership between Robert Smith’s Student Freedom Initiative and the Jain Family Institute

JFI will offer design and analytics for Robert Smith’s major new nonprofit fund for historically Black colleges and universities

Yahoo! Finance features JFI higher ed access research

Laura Beamer, Lead Researcher on Higher Ed Finance, speaks with Yahoo! Finance on the findings of our first report on...

Press Release: Income Share Agreements – New Partnership

Outcome and JFI form an exclusive partnership to spearhead a new phase of growth for the income share agreement market...

USA Today covers JFI “Geography of Higher Ed” research

JFI Project Lead on Higher Ed, Laura Beamer, comments on higher education desserts and our newest research findings in USA...

Inside Higher Ed features JFI research on higher ed access

Higher Ed Finance Project Lead Laura Beamer and Senior Fellow Marshall Steinbaum speak with Inside Higher Ed on the implications...

Education Dive features JFI higher ed access research

More coverage of our recently-released research on "The Geography of Higher Ed" by Education Dive, with commentary on free-college proposals,...

Unequal and Uneven: The Geography of Higher Education Access

Previous research on the geography of higher ed has simply reported the number of institutions in a given area. But...

Part of the series Millennial Student Debt

New Research: The Geography of Higher Education Access

Preliminary results from JFI's ongoing study of access to higher education in the US.

Press Release: Higher education concentration – new study and interactive map

A new interactive map shows U.S. higher education access, including enrollment, concentration, and schools by ZIP code, and indicates...

Doug Webber

Doug Webber, Associate Professor of Economics at Temple University, joined us for a JFI Research Session to share the results...

Dubravka Ritter

Dubravka Ritter of the Federal Reserve Bank of Philadelphia presented two papers at a JFI Research Session this November.

Marshall Steinbaum

Steinbaum presented a paper on student debt