From Idea to Reality: Getting to Guaranteed Income

This series is meant to explore some of the key questions and obstacles that policymakers and advocates will face in pursuing some form of national guaranteed income.

With guaranteed income increasingly in the policy mainstream, and governments and foundations experimenting with cash transfers as a means for blunting the impact of Covid-19, much remains unknown about how to design such policies most effectively. Drawn from several contributors and with guidance from experts across a range of related disciplines, this series aims to envision what comes next.

The power of cash transfers is well-established. Ample research shows that unrestricted cash assistance can not only alleviate material hardship but also reduce domestic violence, generate investments in education, and improve physical and mental wellbeing. At the same time, fears of attendant declines in labor force participation or increases in spending on temptation goods have proven unfounded. We are heartened to see a growing consensus around the viability of such policies as a means to combat inequality and amplify the existing social safety net.

Of course, cash transfers can take many forms. And, as many of the governmental and philanthropic responses to Covid-19 have revealed, any cash transfer policy is only as effective as the identification and disbursement systems that underlie it. What infrastructure is needed to make a national basic income possible? How large, and frequent, should such transfers be? How will they be funded? And how can the political will be mobilized to realize them?

In order to take guaranteed income seriously as policy – and we should – advocates and program designers must begin confronting these questions. In the following papers, our experts put forward preliminary answers of their own. Each focuses on a key element of guaranteed income policy: the necessary infrastructure; the ideal benefit; the financing; and the path to political viability. Each surveys the relevant literature and ongoing implementation efforts to chart what we know and what remains to be learned – all in an attempt to provide a roadmap for policymakers committed to making a national basic income a reality.

In This Series

Building a Helicopter: Pathways for Targeting & Distributing a US Guaranteed Income

Reweaving the Safety Net: The Best Fit for Guaranteed Income

Model Behavior: A Critical Review of Macroeconomic Models for Guaranteed Income and The Child Tax Credit

The Political Economy of Guaranteed Income: Where Do We Go From Here?

Robust evidence for $1400 relief and recovery checks

Paul Williams and James Medlock on paternalism, market failures, and welfare policy in the US

They Worked: Claudia Sahm on the effects of $1,400 relief payments on families and the economy

JFI Position on Guaranteed Income, August 2021

Assessing Non-filer Rates & Poverty Impacts for the American Rescue Plan Act’s Expanded CTC

Recent Updates

Halah Ahmad speaks on guaranteed income at the American Bar Association’s Economic Justice Summit

JFI vice president Ahmad spoke on a panel covering "What is the role of lawyers in guaranteed income programs and...

Editorial: The Future of Guaranteed Income Is At The Community Level

Next City op ed by Halah Ahmad, Steve Nuñez, and Hope Wollensack

Do Basic Income Experiments Influence Policy?

A virtual and in-person panel hosted at the 2022 Basic Income Earth Network (BIEN) Congress taking place in Brisbane, Australia between...

JFI’s guaranteed income analysis in the New York Times

The article, "Guaranteed Income Programs Spread, City by City," features JFI's political economy research

Halah Ahmad speaks at the BIG conference on guaranteed income pilots and policy

Ahmad spoke alongside Madeline Neighly (Economic Security Project) and Kathrine Cagat (Mayors for a Guaranteed Income)

Research Session: A Critical Review of Macroeconomic Models for Guaranteed Income & the Child Tax Credit

Hourlong session on Friday, Nov 19 at 3pm ET

Claudia Sahm on evidence for $1400 relief and recovery checks

Drawing on over a decade of research, JFI Senior Fellow Claudia Sahm presents evidence in favor of additional $1400 checks for...

Research Briefing: Macroeconomic Effects of the Child Tax Credit

A brief overview of a JFI report that explores the macroeconomic effects of regular cash transfers, such as the new...

New Release: A Critical Review of Macroeconomic Models for Guaranteed Income & The Child Tax Credit

Part of JFI’s white paper series on guaranteed income, the new report examines economy-wide impacts of these income support...

JFI’s Critical Review of Macroeconomic Models is covered in Insider

Alex Yablon: "Empirical research suggests government money doesn't discourage work"

New Analysis: Assessing Non-filer Rates and Poverty Impacts for the Expanded CTC

The brief provides results of a range of scenarios for CTC take-up rates among eligible children, showing poverty reduction resulting...

Press Release: JFI Position on Guaranteed Income

A new position paper by JFI's guaranteed income research team draws on years of policy research to define basic parameters...

New Research: Claudia Sahm assesses the effects of $1,400 stimulus checks

Sahm's new brief is "They Worked: The effects of $1,400 stimulus checks on families and the economy"

Position Paper: Paul Williams and James Medlock on paternalism, market failures, and US welfare policy

A new position post in JFI's "From Idea to Reality" series

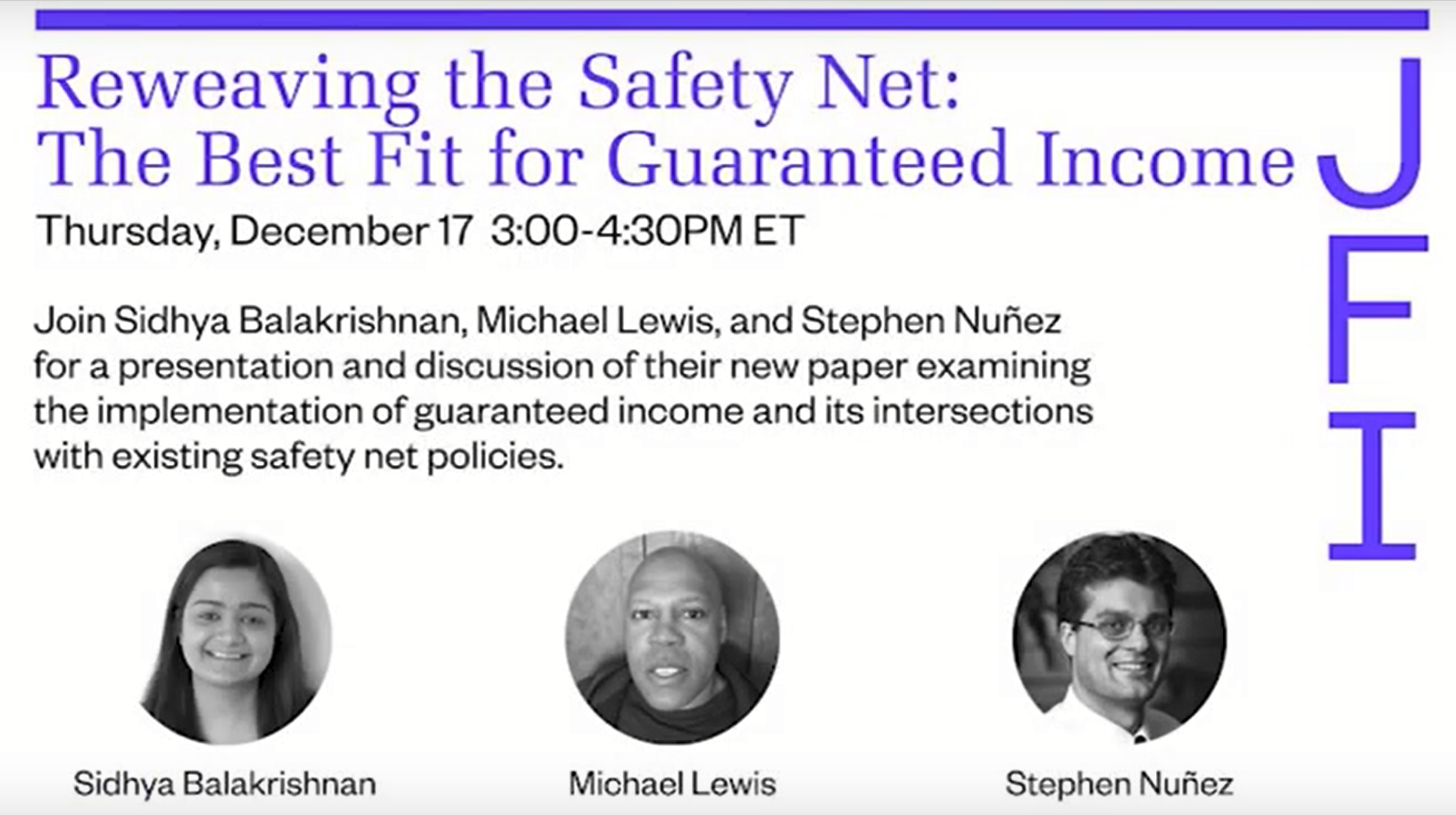

Event on Reweaving the Safety Net: The Best Fit for Guaranteed Income

Sidhya Balakrishnan, Michael Lewis, and Stephen Nunez presented on guaranteed income implementation on Thursday, December 17

Press Release: Reweaving the Safety Net: The Best Fit for Guaranteed Income

Part of “From Idea to Reality,” JFI’s white paper series on building guaranteed income in the US, the new...

From Idea to Reality: Getting to Guaranteed Income

Amid growing calls for a US guaranteed income, JFI releases a new series for lawmakers and advocates on how to...