Experts Convene to Discuss Social Impact Practices for Sovereign Wealth Funds

View this press release as a PDF.

The Jain Family Institute (JFI) partnered with the International Forum of Sovereign Wealth Funds (IFSWF) to host a workshop on social impact for sovereign wealth funds at New York Law School in Manhattan on May 12, 2025.

Titled “Measuring and Monitoring Social Impact: Best Practices for Sovereign Wealth Funds,” the event gathered 65 participants, including sovereign wealth fund representatives, academic researchers, international financial institutions, asset managers, and policy experts. Discussions centered on integrating methodologies for social impact assessment, strengthening reporting standards, demonstrating financial additionality, and refining responsible investment frameworks in light of global economic and political shifts.

Michael Stynes, CEO of JFI; Victoria Barbary, Director of Strategy and Communications at IFSWF; and Paul Katz, Senior Vice President of JFI, introduced the event, highlighting the role sovereign wealth funds play in driving sustainable social outcomes alongside financial returns.

The first panel, “How SWFs Can Advance Social Impact in an Uncertain Global Climate,” was moderated by Adam Robbins, Partner at Collective Global Management. Panelists included Ashley Schulten, Head of ESG Investment, Global Fixed Income at BlackRock; Dr. Robert Mogielnicki, Senior Resident Scholar at the Arab Gulf States Institute and Adjunct Assistant Professor at Georgetown University; and Laura Herman, Partner at Dalberg Advisors. The session explored practical strategies for embedding social objectives within sovereign investment frameworks, the tension between fiduciary duty and impact mandates, and challenges in moving between enterprise- and portfolio-level impact assessment.

Renato Casagrande, Governor of Espírito Santo, Brazil, then joined Leandro Ferreira, Director of the Forum of Brazilian Sovereign Wealth Funds, for a fireside chat. Casagrande shared insights from Espírito Santo’s nearly $2B BRL ($350M USD) sovereign wealth fund. A leader among Brazil’s new generation of subnational royalty funds, the state has launched a new $500M BRL ($80M USD) vehicle to help Espírito Santo meet its target of reducing greenhouse gas emissions by 27% by 2030.

Panel two, “The Data Challenge: Strengthening Social Impact Measurement and Reporting,” moderated by JFI Research Fellow Marcella Cartledge, featured Luyen Tran, Advisor at the International Finance Corporation; Mark Campanale, Founder of the Carbon Tracker Initiative; and Larry Abele, Founder and CEO of Impact Cubed. Panelists debated the merits of disclosure mandates, the challenges of standardization and comparability, and the opportunities that new data collection technologies represent for increased credibility in impact reporting.

The third panel, “Measuring Financial Additionality: How SWFs Can Prove Their Unique Contribution,” was moderated by JFI’s Paul Katz and included Nick Ashmore, Director of the Ireland Strategic Investment Fund; Luciana Costa, Director of Infrastructure, Energy Transition and Climate Change at the Brazilian Development Bank; and Drew Johnson, Associate Director at IE University’s Sovereign Impact Initiative. The discussion examined frameworks for evaluating the distinct impact of sovereign investments, focusing on methods to quantify crowding-in effects and to avoid deadweight and displacement.

Over lunch, JFI researchers Roberta Costa, Ege Aksu, and Sina Sinai presented early results from a joint IFSWF-JFI survey of 21 sovereign wealth funds. The findings revealed widespread recognition of the importance of social impact, coupled with challenges around defining scope, accessing reliable data, and linking metrics to actionable investment outcomes. A full report will be published in the coming weeks

Winston Ma, Executive Director of the Global Public Investment Funds Forum at New York University, then delivered the keynote address, “SWFs in the Sovereign AI Era: Co-Evolution of Investment, Technology, and Impact.” His remarks explored the risks and opportunities posed by artificial intelligence to sovereign investment governance and impact modeling.

The final panel, “Embracing Responsible Investing: Defining the Next Generation of Impact Metrics for SWFs,” was moderated by IFSWF’s Victoria Barbary and featured Amit Bouri, CEO of the Global Impact Investing Network; Rich Nuzum, Executive Director, Investments and Global Chief Investment Strategist at Mercer; Aaron Cantrell, Executive Director of Future Nexus and Just Transition Specialist at the UN Environment Programme Finance Initiative; and Anya Pineau, US Senior Strategy Manager at Clarity AI. Panelists considered how to reconcile global benchmarking standards with local contexts, and how to design metrics that capture both qualitative and quantitative social outcomes.

“Reflecting on the workshop, Barbary stated, “As sovereign wealth funds play a central role in addressing global challenges, they are increasingly working to ensure that they can clearly articulate the social impact of their investments.”

Stynes noted, “Sovereign wealth funds have significant potential to shape positive social outcomes. This workshop helps refine frameworks to enhance that potential.”

Katz added, “There is an opportunity now to sharpen the agenda for positive social impact among public asset owners and those who advise them. Continued dialogue and collaboration are essential, and we are excited to continue to deepen this line of research.”

Participants expressed enthusiasm for ongoing engagement and further discussions following the event.

JFI and IFSWF will soon release a comprehensive report based on insights from the workshop and survey data, contributing to global discussions on sustainable and impactful sovereign investing.

Related

JFI and Climate Vulnerable Forum move towards multi-sovereign investment fund

April 23 meeting with V20 representatives from eleven member countries kicks off discussions on new South-South mechanism to organize climate investment.

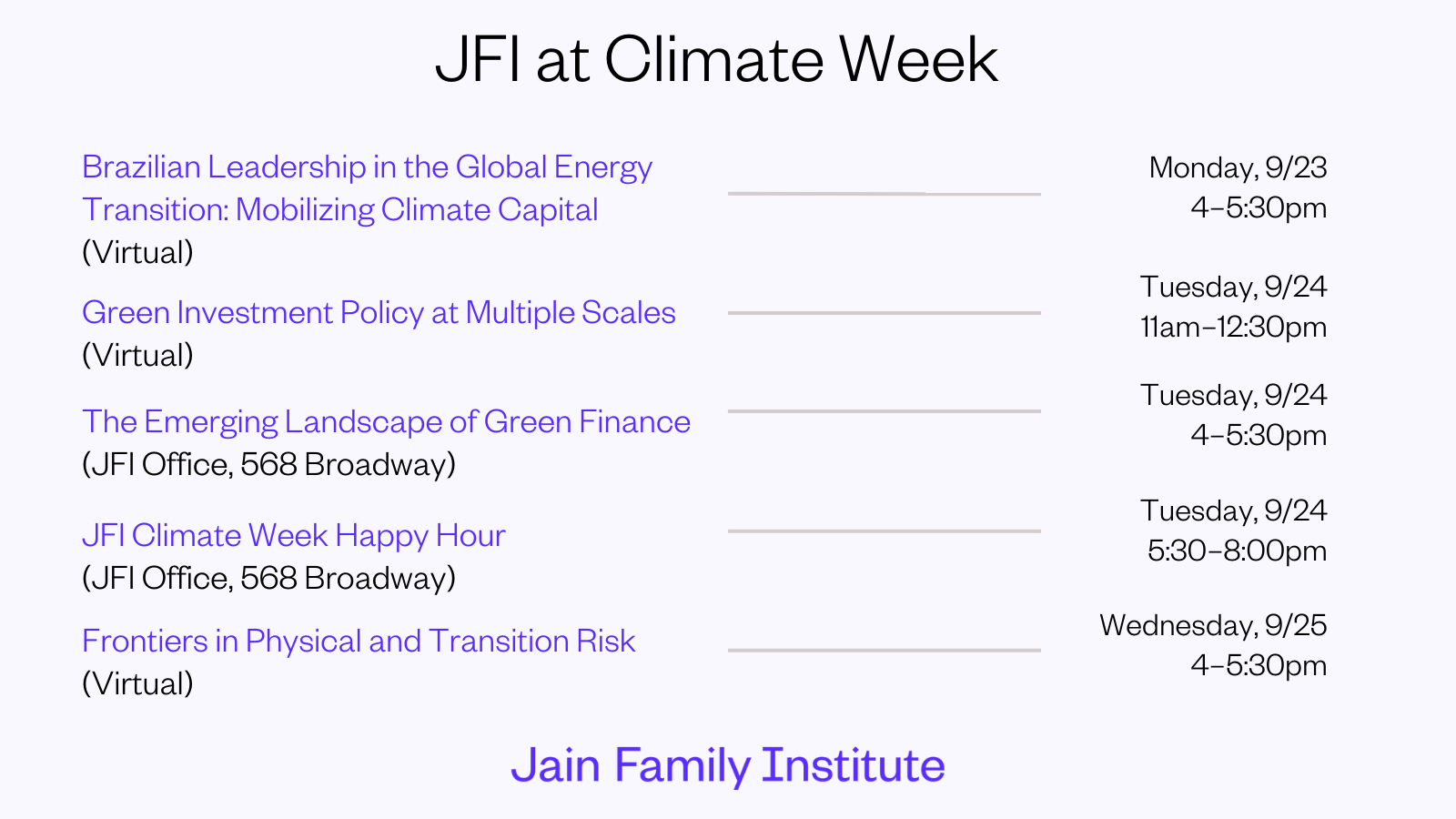

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?