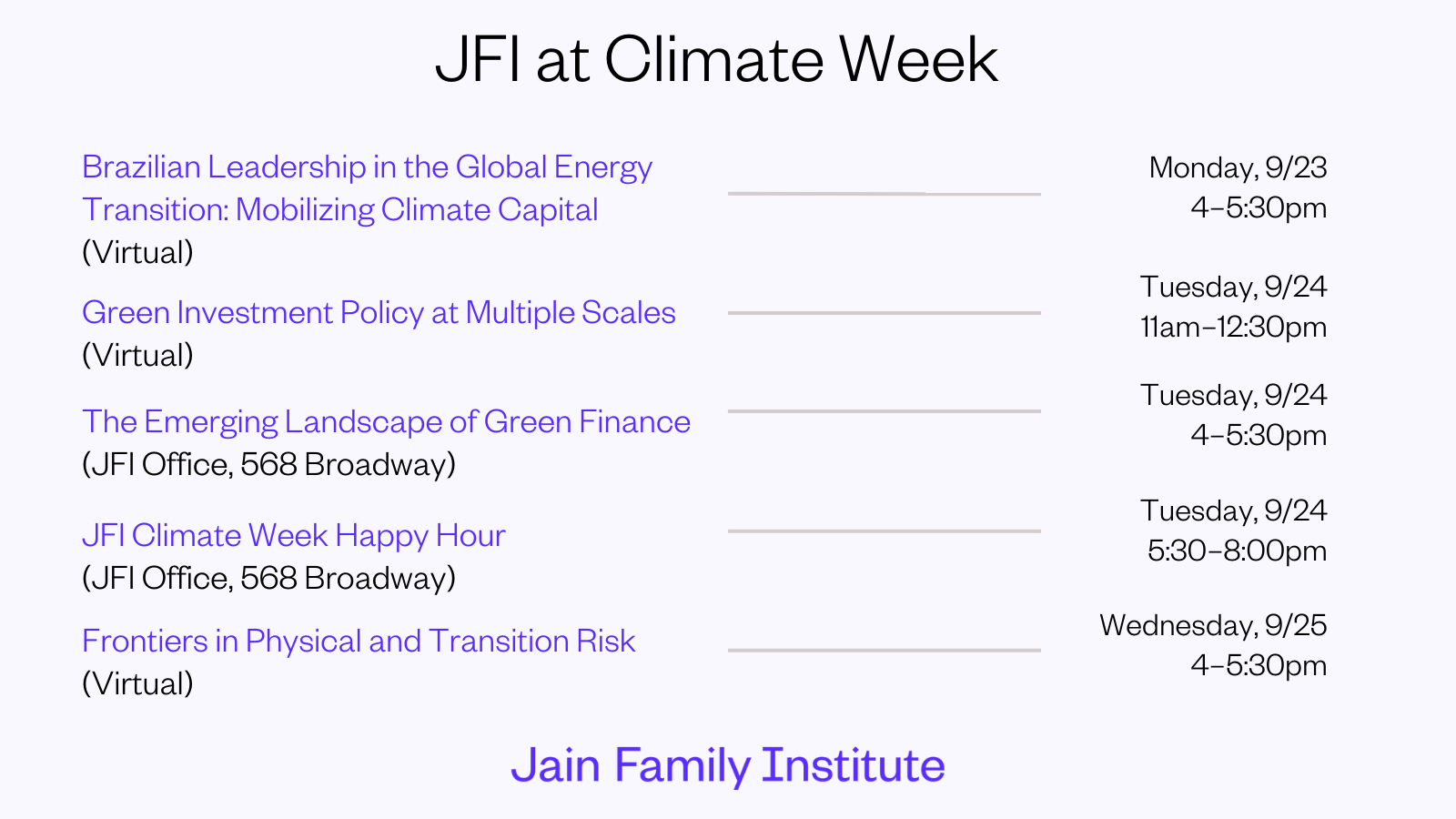

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week. Join us!

Monday, September 23, 2024 | 4–5:30pm NYC, 17–18h30 Brasília

Virtual Event | Brazilian Leadership in the Global Energy Transition: Mobilizing Climate Capital

Registration link: bit.ly/climate_capital_brazil | Organized by JFI Social Wealth

Brazil, one of the world’s largest carbon sinks and cleanest energy systems, is uniquely situated to steward the energy transition. To unlock its strategic potential, significant climate capital must meet high–impact climate projects. Join JFI and invited speakers for a conversation on the innovative strategies and structures that can mobilize public and private capital at transition–critical scale.

Speakers include:

- Jorge Arbache (Professor of Economics, University of Brasília)

- Marta Bandeira (Sustainability Manager, BNDES)

- Duncan Bonfield (CEO, International Forum of Sovereign Wealth Funds)

- Frederic de Mariz (Head of Sustainable Finance, UBS BB)

- Anna Mortara (Economic Development Manager, Systemiq / AYA Institute) – moderator

- Paul Katz (VP and Lead Researcher in Social Wealth, Jain Family Institute) – moderator

Tuesday, September 24, 2024 | 11am–12:30pm NYC

Virtual Event | Green Investment Policy at Multiple Scales

Registration link: bit.ly/green_investment_webinar | Organized by CAS & JFI

Join the Center for Active Stewardship and JFI for an interdisciplinary discussion of how policymakers around the world are attempting to stimulate investment in low–carbon value chains, with a panel of experts across academia, finance, and public policy:

- Jonas Nahm, Associate Professor, Johns Hopkins (prev. White House Council of Economic Advisors)

- Thierry Philipponat, Chief Economist, Finance Watch

- Gregor Semieniuk, Senior Climate Change Economist, World Bank

- Jens Van ‘t Klooster, Assistant Professor, Universiteit van Amsterdam

Governments around the world, including in the United States, are using tariffs, subsidies, and even direct investment to promote the growth of low–carbon energy and industry. At the same time, regulators and central bankers are experimenting with new tools for conceptualizing – and managing – climate–related financial risks. Our panelists have worked on both sides of this divide.

We are bringing them together for a virtual discussion during NYC Climate Week to talk about how climate risk and green investment are being conceptualized at both the macro–scale of monetary policy and the meso–scale of industrial policy – and the ways each set of levers overlaps and interacts.

Tuesday, September 24, 2024 | 4–5:30pm NYC

In–Person Event: 568 Broadway, Suite 604B, Soho, Manhattan 10012 | Public Finance and the US Green Transition

Registration link: https://bit.ly/jfi_cpe_cas | Organized by JFI, CAS, and the Center for Public Enterprise

Since the passage of the Inflation Reduction Act (IRA) in 2022, US investment in clean energy has nearly doubled. Beyond promoting overall green investment, the IRA is bringing a new set of players to the table, by making it possible for non–profit and public sector developers to monetize tax credits, by supercharging the CDFI sector with the $27 billion Greenhouse Gas Reduction Fund (GGRF), and by enabling state green banks and project developers alike to access extremely concessional financing from the Loan Programs Office (LPO).

The Center for Active Stewardship, the Center for Public Enterprise, and the Jain Family Institute are convening a panel discussion on what these shifts mean for the future of green finance in the US.

Join us for a conversation featuring perspectives from government, markets, and researchers. We’ll discuss what the IRA means for state capacity at the ground level, and how it shapes the emerging landscape of public, private, and blended finance for clean energy projects, with a panel of experts:

- Advait Arun, Center for Public Enterprise

- Melanie Brusseler, Common Wealth

- Dave Burton, Norton Rose Fulbright

- Kerry O’Neill, Inclusive Prosperity Capital

- Stephen Boyd, Department of Energy Loan Programs Office

Tuesday, September 24, 2024 | 5:30–8pm NYC

Climate Week Hour at the JFI Office: 568 Broadway, Suite 601, Soho, Manhattan 10012

Friends and colleagues are invited to join us for an informal happy hour at JFI’s office in SoHo.

Wednesday, September 25, 2024 | 4–5:30pm NYC

Virtual Event | Frontiers in Physical and Transition Risk

Registration link: bit.ly/climate_disclosures_webinar | Organized by CAS & JFI

JOIN CAS and JFI for an interdisciplinary discussion of climate–related financial risks with a panel of experts spanning corporate law, accounting, fixed income investing, and journalism:

- Madison Condon, Associate Professor, Boston University Law School

- Tanya Fiedler, Senior Fellow, Climate Risk and Response, University of New South Wales (Australia)

- Justin Mikulka, Independent Journalist

- Jo Richardson, Managing Director and Head of Research, Anthropocene Fixed Income Institute

Climate–related financial disclosures are now mandated by regulators in many jurisdictions, most notably the EU, and have been adopted voluntarily by a majority of issuers in markets like the US. But corporate, and global, emissions continue to grow and many experts argue that physical and transition risk are not being effectively priced in equity and fixed income markets.

Our panelists work on a variety of topics related to identifying, disclosing, and acting on climate risks. We are bringing them together for a virtual discussion during NYC Climate Week to talk about the remaining white space and implementation gaps in climate reporting, as the world converges on a common set of standards.

Related

Experts Convene to Discuss Social Impact Practices for Sovereign Wealth Funds

High-level workshop gathers SWF representatives, academic researchers, international financial institutions, and asset managers to debate social impact measurement and monitoring.

JFI and Climate Vulnerable Forum move towards multi-sovereign investment fund

April 23 meeting with V20 representatives from eleven member countries kicks off discussions on new South-South mechanism to organize climate investment.

Global Green Industrial Policy After 2025

A discussion on the future of global green industrial policy. 3:30pm ET on Friday, April 18.