JFI report by senior fellow Marshall Steinbaum examines the crisis of non-repayment of student debt

Read the full press release here.

Press Release

New York, NY, November 17, 2020 — A new report from Marshall Steinbaum with support from Jain Family Institute researchers finds that increased uptake of income-driven repayment (IDR) and recovery from the recession have not diminished the student loan crisis. The fourth in an ongoing series on millennial student debt, this report builds upon JFI’s extensive interactive maps and analyses of student debt nationwide. Key findings from this report include:

- Income-driven repayment (IDR) programs are not helping borrowers fully repay debt. While they lower rates of delinquency and default, they give rise to mounting balances over time, rather than facilitating repayment on a delayed schedule. The result is a rising stock of outstanding debt that will never be repaid …

Related

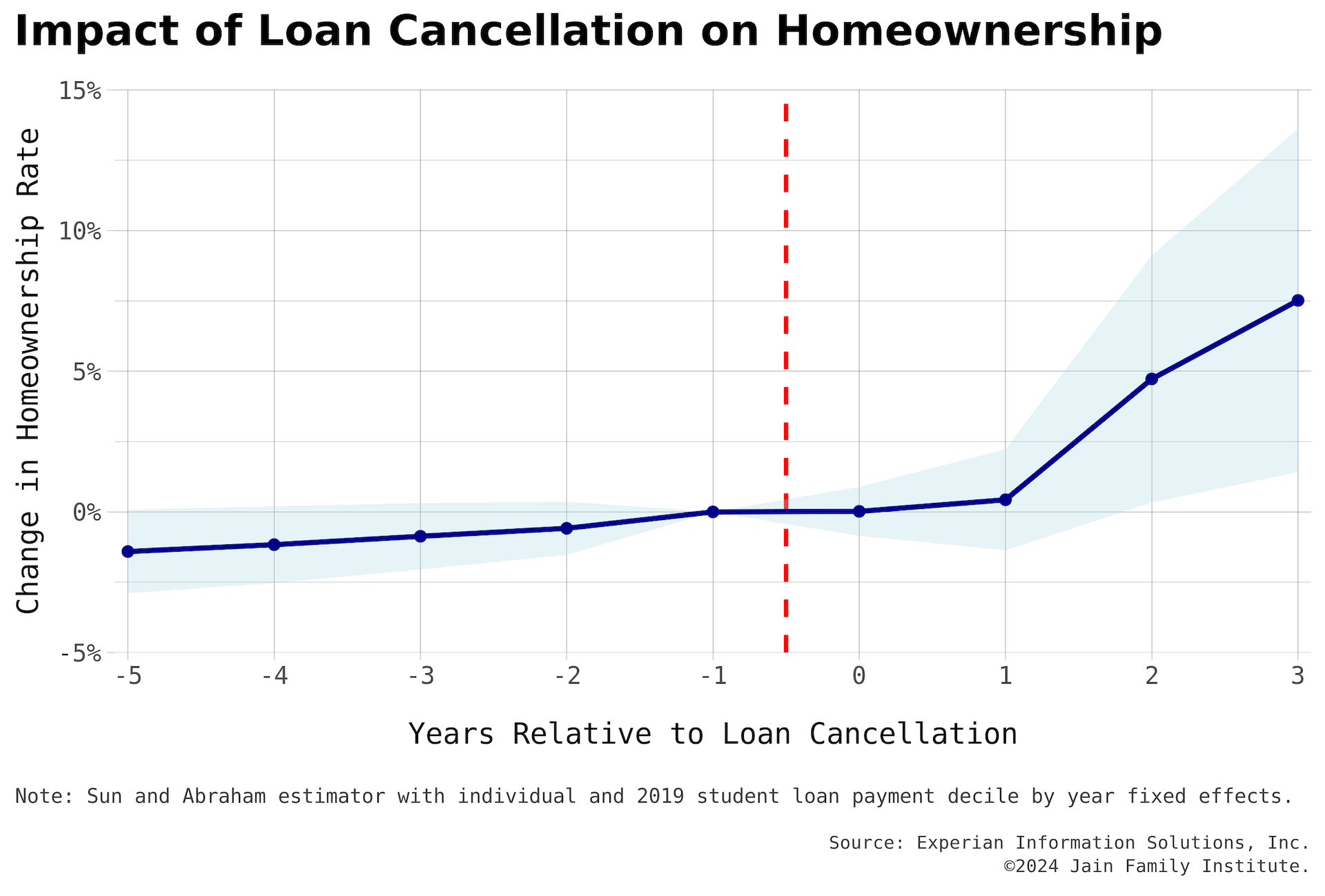

New Report on Student Debt Cancellation; Coverage in Marketwatch

Marketwatch: "The analysis is the first to provide a sense of who has benefited from the $153 billion in debt cancellation...

ISA research cited by White House and others

This research formed part of a White House issue brief, "The Economics of Administration Action on Student Debt."

Working Paper — Navigating Higher Education Insurance: An Experimental Study on Demand and Adverse Selection

A survey-based experiment in collaboration with the Philadelphia Federal Reserve.