Market Microstructure and Financial Stability: Is there a Link?

A Jain Family Institute (JFI) Market Microstructure & Yale School of Management Financial Stability Program (YPFS) Symposium hosted by Volatility & Risk Institute at NYU Stern

Date: Monday, July 8

Location: KMEC 1-70, Henry Kaufman Management Center, NYU Stern

Organizing Committee:

Elham Saeidinezhad (JFI, Columbia and NYU Stern)

Steven Kelly (Yale Program on Financial Stability)

Itai Dreifuss (Columbia, BlackRock)

RSVP: Seating is limited. Please email editorial@jainfamilyinstitute.org with “Market Microstructure” in the subject line if you would like to attend.

Overview

This symposium, “Market Microstructure and Financial Stability: Is There a Link?” is a joint initiative by JFI and YPFS. This collaborative effort aims to facilitate an open dialogue between financial stability experts and market practitioners to discuss the relationship between market microstructure and financial stability. JFI’s Market Microstructure project focuses on the infrastructures that connect markets and engage practitioners, whereas YPFS’s unique financial stability perspective is based on the firsthand experiences of policymakers during crisis management. The symposium aims to bridge the gap between market participants and policymakers.

Panels

Session I: Private Credit Market Structure and Financial Stability

Panelists

- Kevin Meyer, Churchill Asset Management LLC

- Fang Cai, Federal Reserve Board

- James Snyder, Sidley Austin LLC

- Kevin McPartland, Coalition Greenwich

- Daniel Sullivan, PwC (Moderator)

Panel Description

The private credit market allows institutional investors to access private debt instruments, which are rapidly expanding. For instance, in the market for financing leveraged buyouts (LBOs), the size of the debt market based on public ratings, such as the broadly syndicated loan (BSL), is decreasing while the share of funding from the private credit market is increasing (Figure 1). The same trend is occurring for non-LBO transactions financed in the BSL market compared to those in the private market (Figure 1). In this context, the panels will discuss whether shifting credit pricing and provision from public to private financial markets can impact financial stability.

Session II: Inefficiencies in US Treasury Market Hedging and Financial Stability

Panelists

- Nathaniel Wuerffel, Head of Market Structure – BNY Mellon

- Amar Reganti, Wellington Management, Fixed-Income Strategist

- Samim Ghamami, SEC

- Steven Kelly, Associate Director of Research, Yale Program for Financial Stability

- Eric Wallerstein, Chief Markets Strategist at Yardeni Research, Inc. (Moderator)

Panel Description

High-profile, high-volatility events in March 2020 and March 2023 have heightened concerns regarding the safety of the US Treasury market. While financial stability experts attribute these events to leveraged funds’ behavior, such as bond funds’ “leveraged portfolio” and hedge funds’ “basis trading strategy,” this overlooks the market’s underlying vulnerability and the factors driving basis trading. The conventional explanation points to fixed-income fund managers increasing risk tolerance by shifting portfolios from US Treasury securities to UST futures, causing a price divergence known as “basis.” However, this may stem from managers’ challenges in finding effective hedges through interest rate swaps due to a duration mismatch, termed “duration drift.” In this panel, we discuss whether regulators underestimate the extent of mismatch in alternative markets sought by bond managers, leading to underreporting and financial stability risks in the US Treasury market.

Session III: Interest Rate Swaps’ Role in Short-Term Funding

Panelists

- Joshua Younger, Federal Reserve Bank of New York, Senior Policy Advisor

- Mark Cabana, Bank of America, Interest Rate Strategist

- Jordan Brooks, Co-Head of the Macro Strategies Group, AQR Capital Management & NYU

- Elham Saeidinezhad, Columbia University, JFI Fellow (Moderator)

Panel Description

Swaps are often considered instruments used for hedging, where a party that pays a fixed rate and receives a floating rate can offset the devaluation of bonds caused by fluctuations in interest rates. However, swaps can serve a far more significant purpose than previously believed. They can be used to fill funding gaps and compensate for failures in the repo market. By considering swaps as a type of synthetic repos, we can gain a better understanding of funding liquidity and develop alternative funding solutions. This shift suggests that swaps have become a viable alternative to traditional wholesale money markets and that the repo market alone cannot provide all dimensions of liquidity. In this discussion, the panel examines the structure of the swap market and its role in the overall funding landscape. They also consider the effectiveness of central bankers in stabilizing markets during times of heightened volatility.

Session IV: Payment System Design and Intraday Credit Solutions

Panelists

- Michael Brady, JPMorgan & Chase

- Susan Mclaughlin, Yale Program on Financial Stability

- Aaron Klein, Brookings Institution

- Hannah Lang, Reuters (Moderator)

Panel Description

This panel will discuss how the firms’ credit needs and payment system structures interact to impact financial stability. The panelists will focus on new payment-related initiatives such as the Fed’s Policy on Payment System Risk. This policy has two primary goals: first, to standardize the design of public and private infrastructures that support the payment system, and second, to enhance the efficiency of public emergency liquidity provisions. These provisions, including the discount window, help private entities manage payment challenges during systemic financial distress. The payment system infrastructure is a public-private hybrid, meaning entities with different priorities and business models must work together to ensure the smooth daily settlement of retail and wholesale payments. Additionally, the Fed is responsible for easing liquidity pressures on this infrastructure by providing temporary intraday credit to private institutions. This panel will evaluate the effectiveness of the design and the payment system’s resilience against systemic risks.

Keynote Panel

Market Microstructure and Financial Stability: Is There a Link? A Conversation between Richard Berner and Shyam Rajan

Shyam Rajan is the Global Head of Fixed Income for Citadel Securities. With responsibility for the firm’s fixed income risk and research functions, Shyam oversees the institutional sales and trading business, as well as the quantitative research, algo, and independent principal strategies teams.

Richard Berner is a Clinical Professor of Management Practice in the Department of Finance and, with Professor Robert Engle, is a Co-Director of the Stern Volatility and Risk Institute. Professor Berner served as the first director of the Office of Financial Research (OFR) from 2013 until 2017. He was a counselor to the Secretary of the Treasury from April 2011 to 2013.

See here for more information on JFI Market Microstructures, including the first piece of the series.

Related

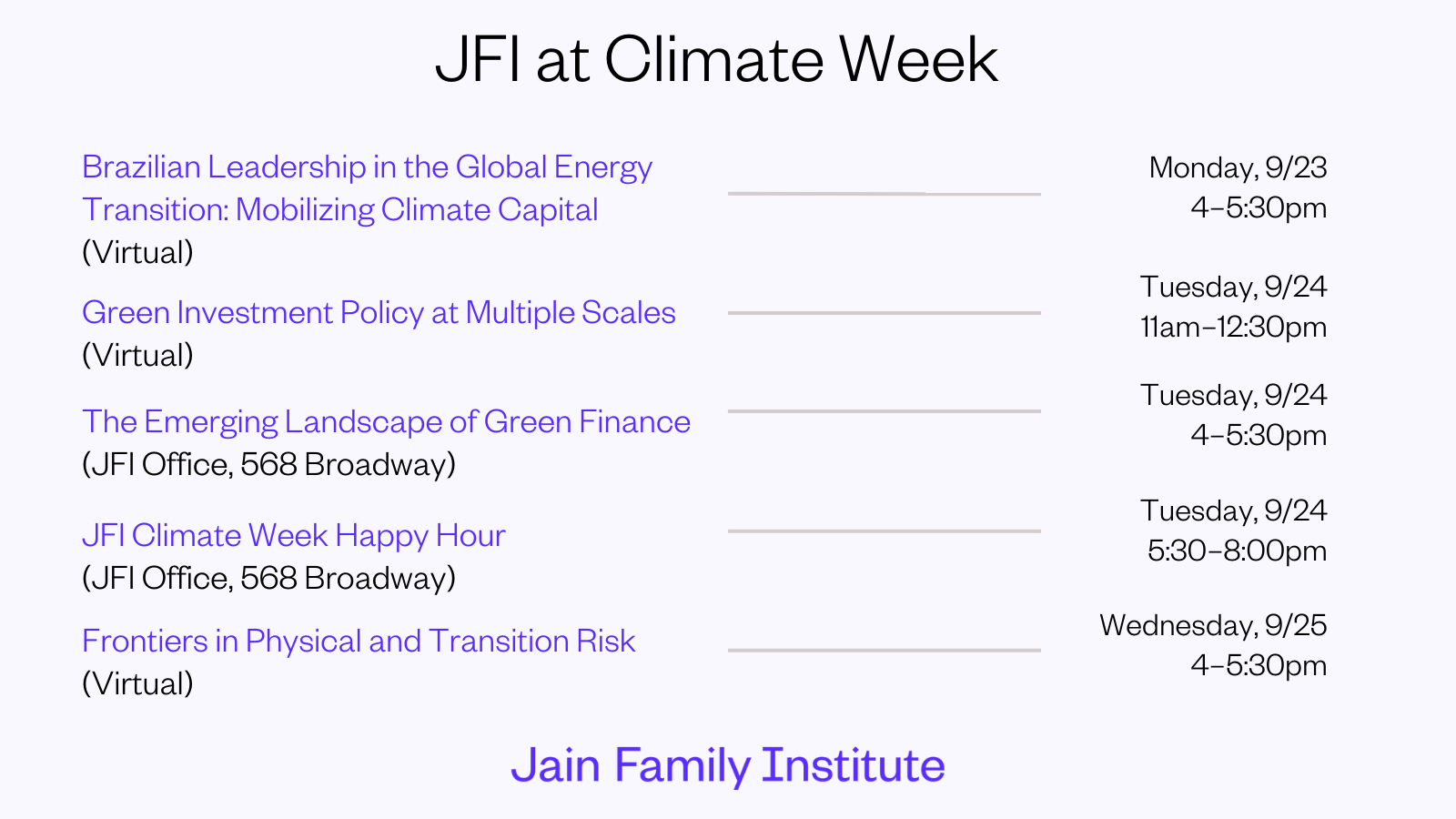

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?

Nolan Lindquist speaks with Robert Eccles about ESG

On JFI's affiliate Center for Active Stewardship and trends in ESG investing.