Panel April 17: ESG’s Second Act: “Climate-Related Risks and Opportunities” After the IRA

The Center for Active Stewardship (CAS) is hosting a virtual panel discussion ahead of the upcoming proxy season, at 1:00 PM ET on April 17th. Register here to join.

CAS is tracking over 100 climate-focused shareholder proposals headed to a vote this year, even though asset manager support has continued to decline.

We’ll be digging into the disconnect between NGO priorities and how investors in public and private markets are analyzing “climate-related risks and opportunities.” The big question facing activists is how to make the case that additional climate-related targets and disclosures are financially material in a world where net zero commitments are table stakes.

We’ll be joined by:

- Lee Harris (Financial Times)

- Nolan Lindquist (Center for Active Stewardship)

- Marian Macindoe (Head of ESG Stewardship, Parnassus Investments)

- Michael O’Leary (Partner and Co-Head of Impact, L. Catterton)

- Jessica Whitt (US Head of ESG Research, Barclays)

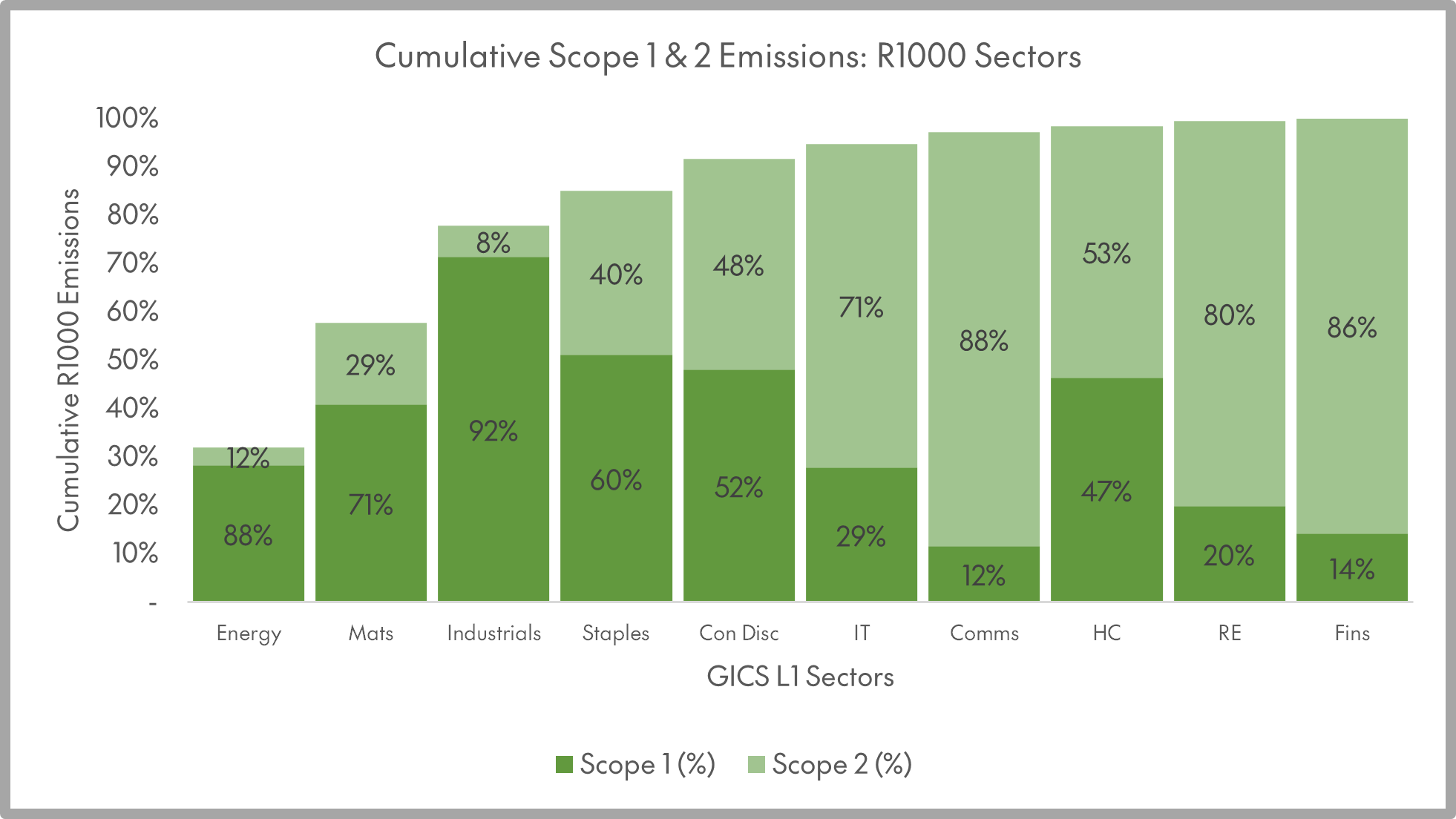

CAS is an affiliate project of the Jain Family institute, focused on connecting the dots between sustainable investing and the economics of the energy transition. CAS’s most recent white paper, “Material World,” makes the case that energy efficiency is a more important financial driver for most public companies than Scope 1 and Scope 2 emissions. Sign up to read more energy transition news and analysis at the CAS blog.

Related

Market Microstructure and Financial Stability: Is there a Link?

On Monday, July 8, at NYU Stern: A symposium hosted by JFI and the Yale Project on Financial Stability.

Press Release: Proxy Season 2024

Center for Active Stewardship releases report highlighting key corporate annual meetings for climate-focused investors.

Center for Active Stewardship’s Splice tool in the Financial Times

"The case against carbon emissions as a universal metric"