Working Paper — Navigating Higher Education Insurance: An Experimental Study on Demand and Adverse Selection

How do students respond to different framings of education financing? Insurance is a meaningful framing for income-share agreements, suggests a new paper from Sidhya Balakrishnan (JFI’s Director of Research), Eric Bettinger (Stanford University and NBER), Michael S. Kofoed (University of Tennessee at Knoxville), Dubravka Ritter (Federal Reserve Bank of Philadelphia), Douglas A. Webber (Board of Governors of the Federal Reserve), Ege Aksu (CUNY Graduate Center and Jain Family Institute), and Jonathan S. Hartley (Stanford University).

The abstract:

We conduct a survey-based experiment with 2,776 students at a non-profit university to analyze income insurance demand in education financing. We offered students a hypothetical choice: either a federal loan with income-driven repayment or an income-share agreement (ISA), with randomized framing of downside protections. Emphasizing income insurance increased ISA uptake by 43%. We observe that students are responsive to changes in contract terms and possible student loan cancellation, which is evidence of preference adjustment or adverse selection. Our results indicate that framing specific terms can increase demand for higher education insurance to potentially address risk for students with varying outcomes.

Related

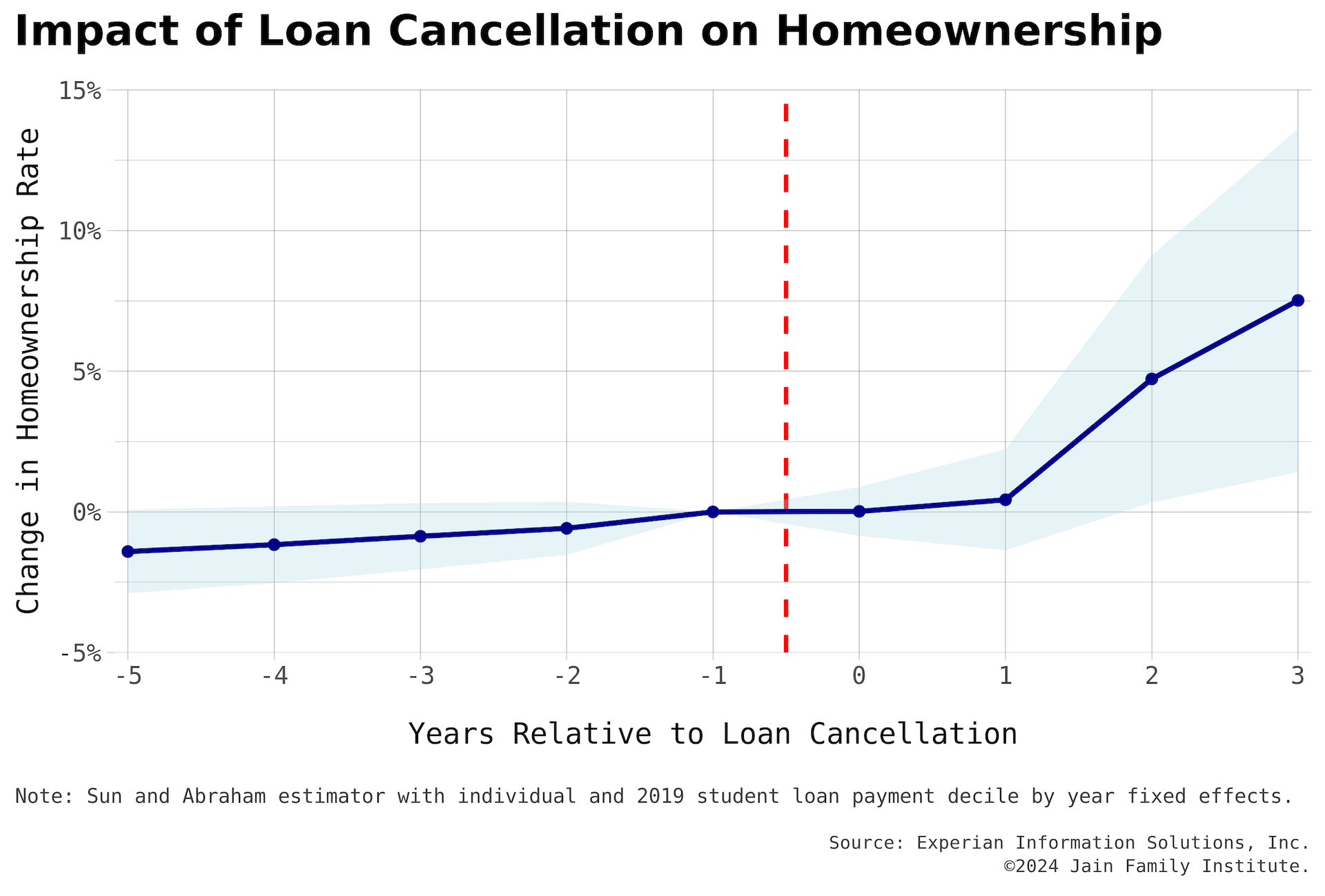

New Report on Student Debt Cancellation; Coverage in Marketwatch

Marketwatch: "The analysis is the first to provide a sense of who has benefited from the $153 billion in debt cancellation...

ISA research cited by White House and others

This research formed part of a White House issue brief, "The Economics of Administration Action on Student Debt."

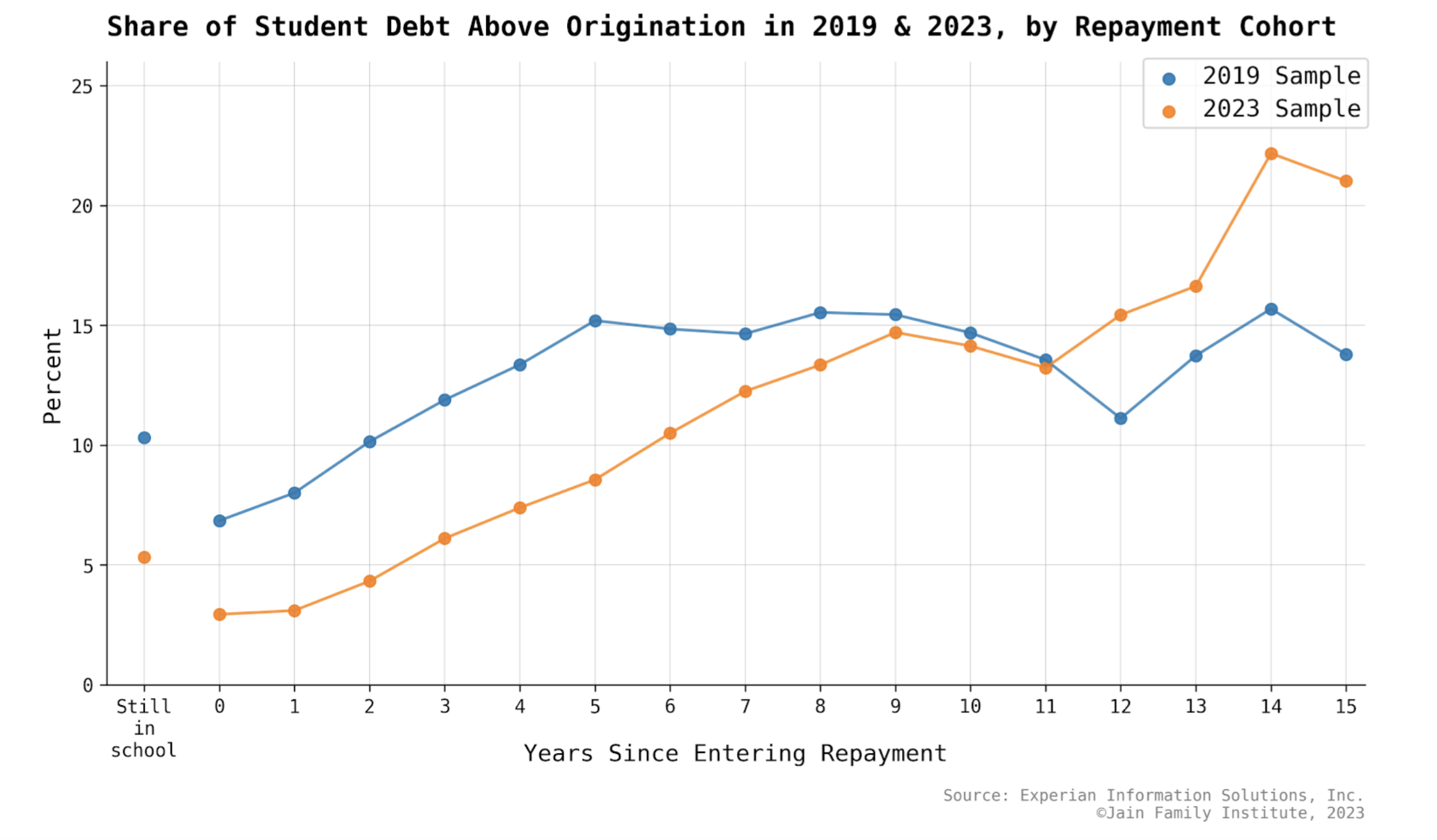

New Research in Millennial Student Debt: Relief for Borrowers with Negative Amortization

JFI's Higher Education Finance team publishes the first installment of part 14 of their flagship Millennial Student Debt research series.