New Release: JFI’s Annual Student Debt Report, 2022

“Student Debt and Young America” annual report shows increased payments and lower balances, despite continuing equity and non-repayment issues for Millennial and Gen Z borrowers during the pandemic.

Press Release

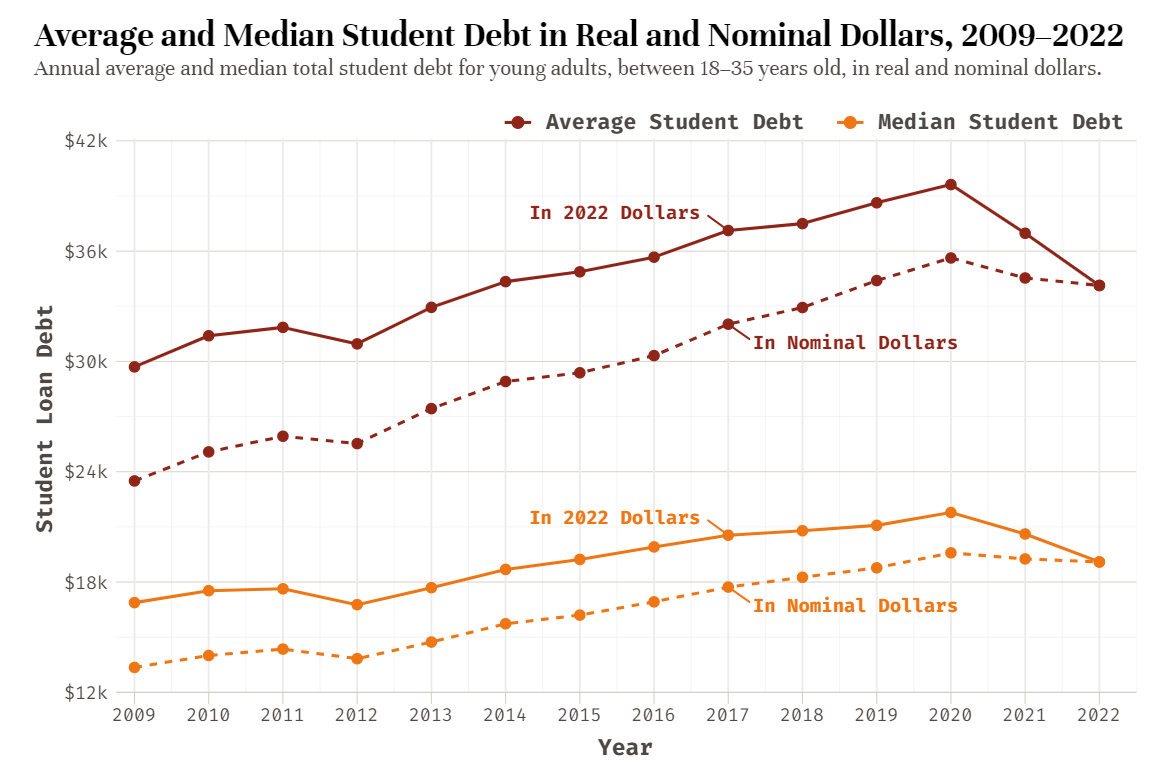

New York, NY, December 22, 2022 — JFI’s “Student Debt and Young America in 2022” annual report, part of the ongoing Millennial Student Debt project, finds several promising trends in student debt three years into the federal student loan repayment pause. The report uses the latest available data, from 2009 through 2022, to provide a picture of how young Americans are experiencing a continued student debt crisis—examining trends across race, income, and wealth, as well as impacts related to homeownership, debt relief and income-driven repayment.

This is the second annual report released through the Millennial Student Debt (MSD) research project, and the eleventh report in the series. Accompanying the report is JFI’s newest interactive data comparison tool, exposing the severity and ubiquity of the crisis nationwide and at the state and neighborhood level. The data tool provides an accessible look at regional differences in student outcomes, reflecting variations in higher education policy and access.

Key findings from this report include:

- Many student loan holders accelerated payments on privately-held debt during the pandemic repayment pause.

- For the first time in our cross-sectional sample, student debt balances have decreased for two years in a row. The decreases are concentrated amongst low-income and minority borrowers, suggesting that targeted relief may be working. However, incomes dropped for borrowers as well in this period.

- Lower balances during the past two years are a combination of an enrollment slump, federal debt not accruing interest, private loan holders paying off their debts, and initial waves of borrower defense, total and permanent disability debt discharge, and closed school debt discharges.

- Decreased balances across new loans signal that young borrowers have become more hesitant to take on debt during the pandemic, despite the interest rate moratorium.

- Systemic student debt disparities along lines of race and wealth are greater determinants of a borrower’s continued indebtedness than higher incomes.

- Homeownership rates of young borrowers increased in 49 states and DC from 2020 to 2022. Despite this increase, we find a negative and significant relationship between student loan debt and homeownership for young borrowers in 2022.

- Student debt cancellation reduces debt burdens across the country, especially among Black borrowers and those with the lowest incomes. The average amount of debt relief across the country could be as high as $16,173, pending further legal challenges.

- The new Income-Driven Repayment (IDR) plan could address both unaffordable repayments and ballooning balances, as debt repayment improved substantially since 2020. However, policy change must address both affordable payments relative to income (IDR) as well as borrowers’ ability to pay down their balances—a continuing issue acutely affecting Black and Latinx borrowers.

Read the full report here, available as both a PDF and interactive web page.

The report is written by Laura Beamer and Eduard Nilaj, with visualizations in collaboration with Francis Tseng. JFI’s previous reports cover topics such as student debt after the 2008 recession, regional disparities in student debt, and the inadequacy of income driven repayment to address the expanding crisis.