Policy brief: Analysis of the new Child Tax Credit proposal

Responding to live debates in Congress on Child Tax Credit reform, Research Associate Jack Landry has released a new analysis of the new proposal, “Bipartisan Child Tax Credit Expansion: Analysis of the Tax Relief for American Families and Workers Act of 2024.”

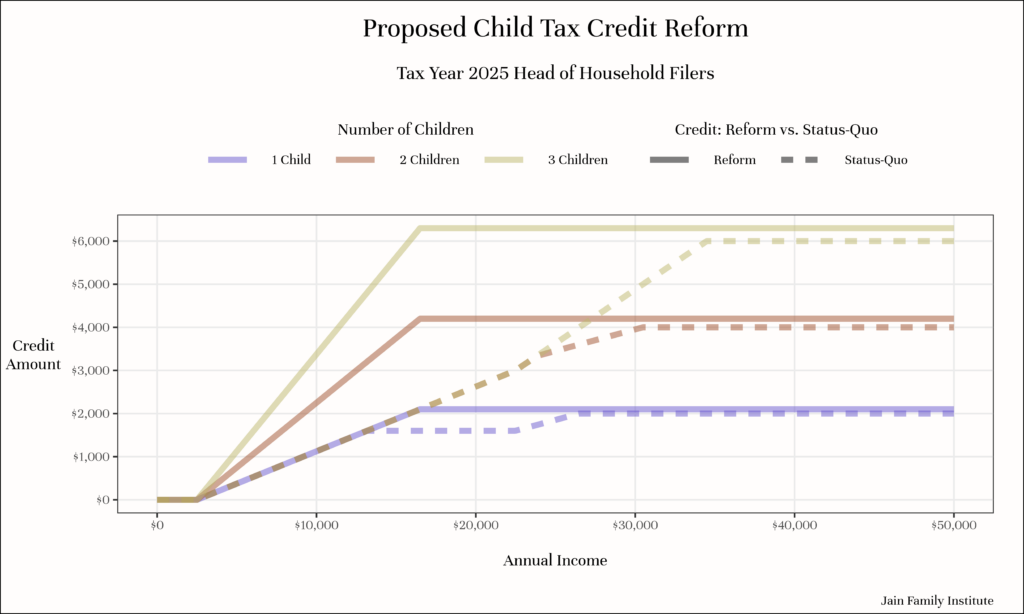

IRS data shows that the vast majority of low-income recipients of the 2021 expansion had some positive income, but not enough to receive the full credit under current law. I estimate ninety percent of these parents would see an increase in their benefits under the proposed expansion. While families with no income—thus those with the greatest need—are largely excluded from the proposal, the reforms would still reach the vast majority of low-income children who benefited from the 2021 expansion.