New Report: Guaranteed Income through the Child Tax Credit

Halah Ahmad and Jack Landry have published a scrutiny of state-level Child Tax Credits, which form a patchworked guaranteed income for families with children across the United States.

KEY TAKEAWAYS

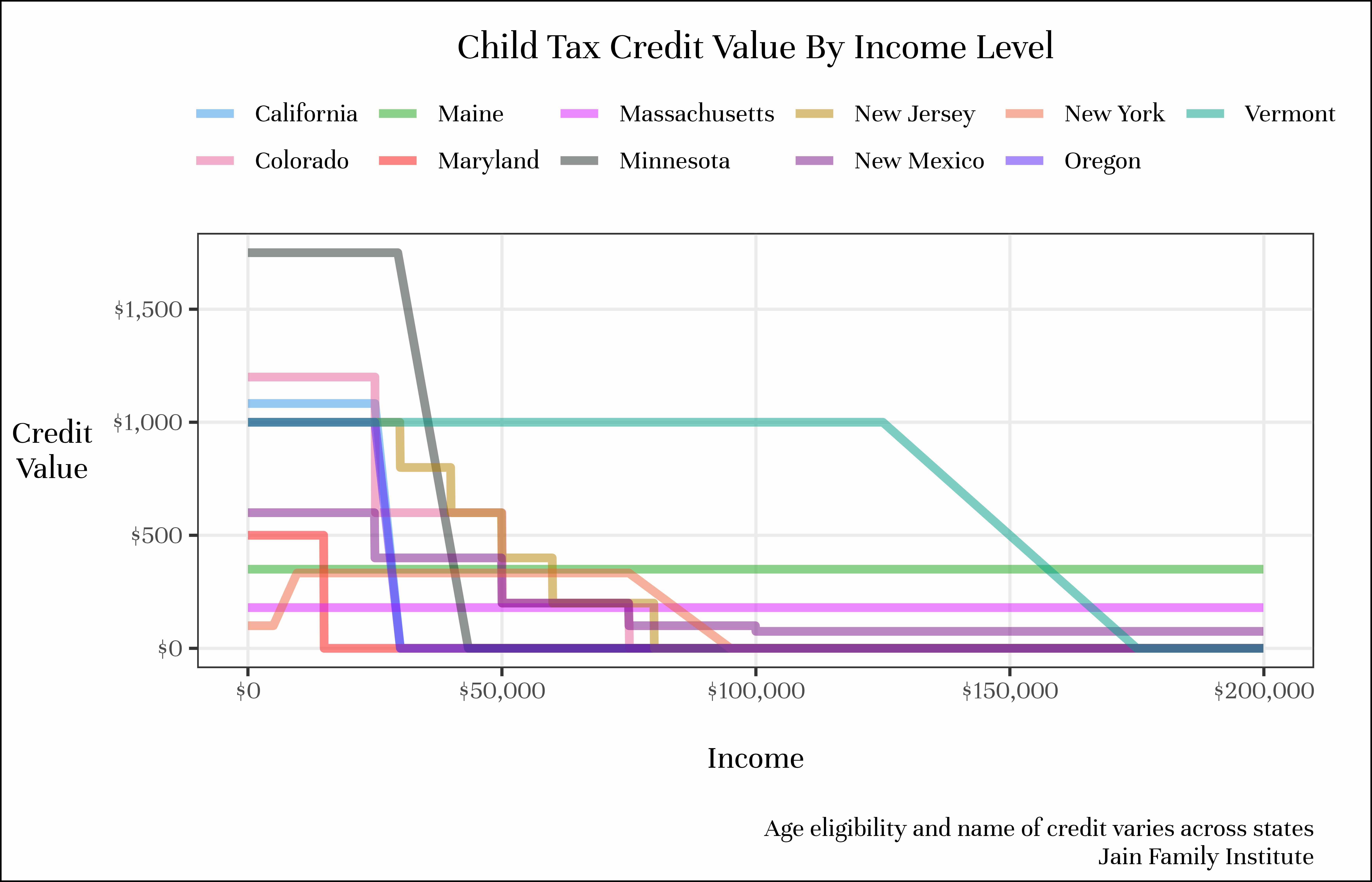

- Eleven states have passed refundable CTCs ranging in value from $180 to $1,750 per eligible child. Some are targeted at low-earner families, while others are universal or phase out at high income levels.

- While the states that have passed CTCs have Democratic majorities in their state legislatures, many of the credits have passed with substantial Republican support.

- Some states have relatively small benefits, but are likely to be expanded: Of the eleven states with refundable CTCs, six have already significantly expanded them.

- Beyond benefit amounts, the state CTCs vary in their income and age targeting, inclusion criteria, and administrative burden. We point to ways through which states can reduce administrative burdens, create monthly payment options, and ensure immigrant children receive benefits. Such changes align with best practices from the empirical literature on direct cash assistance.