Homeownership and the Student Debt Crisis: Latest research from the Millennial Student Debt project

A new report from JFI research associate Eddie Nilaj explores links between rising student debt and declining homeownership over the past decade.

This report is the eighth in the Millennial Student Debt series, which produces research and analysis on the geography of student debt across the nation.

Key points:

- The homeownership rate for student debt borrowers has declined over the last decade. Those with higher amounts of student loan debt are less likely to be homeowners, especially among relatively high-income borrowers.

- The homeownership rate among student borrowers declined by 24 percent from 2009 to 2019. Asian- and Black-plurality US Census Tracts saw the steepest declines in homeownership rates—47.7% and 40.6%, respectively.

- In 2009, the homeownership rate in the sample was 24.6%. By 2019, that number had dropped to 18.6%.

- Low earnings remains a massive barrier to homeownership—the homeownership rate for borrowers with estimated incomes of less than $100,000 never goes above 1.2 percent in the ten-year span from 2009 to 2019. As recent cohorts of student debt borrowers have lower incomes than their predecessors, this carries major implications for homeownership.

- In 2009, 42 percent of the sampled 18-35-year-olds had an estimated income over $100,000; by 2019 that share was slashed to 31 percent. The average income for the bottom half of the income distribution decreased from $41,600 in 2009 to $36,300 in 2019. For the next 40 percent of the distribution, the average dropped from $141,200 to $103,300. The median estimated income of our sample of student debtors shrank by 22.8 percent, dropping from $82,765 to $67,364.

- The decrease in incomes is occurring alongside an increase in debt: from 2009 to 2019 the share of borrowers with student debt balances of at least $25,000 increased by 19 percent.

- For borrowers with estimated incomes over $100,000, each successive year of the study corresponds with lower homeownership.

- The rise of credit score standards following the Great Recession has excluded the majority of student debtors from the housing market.

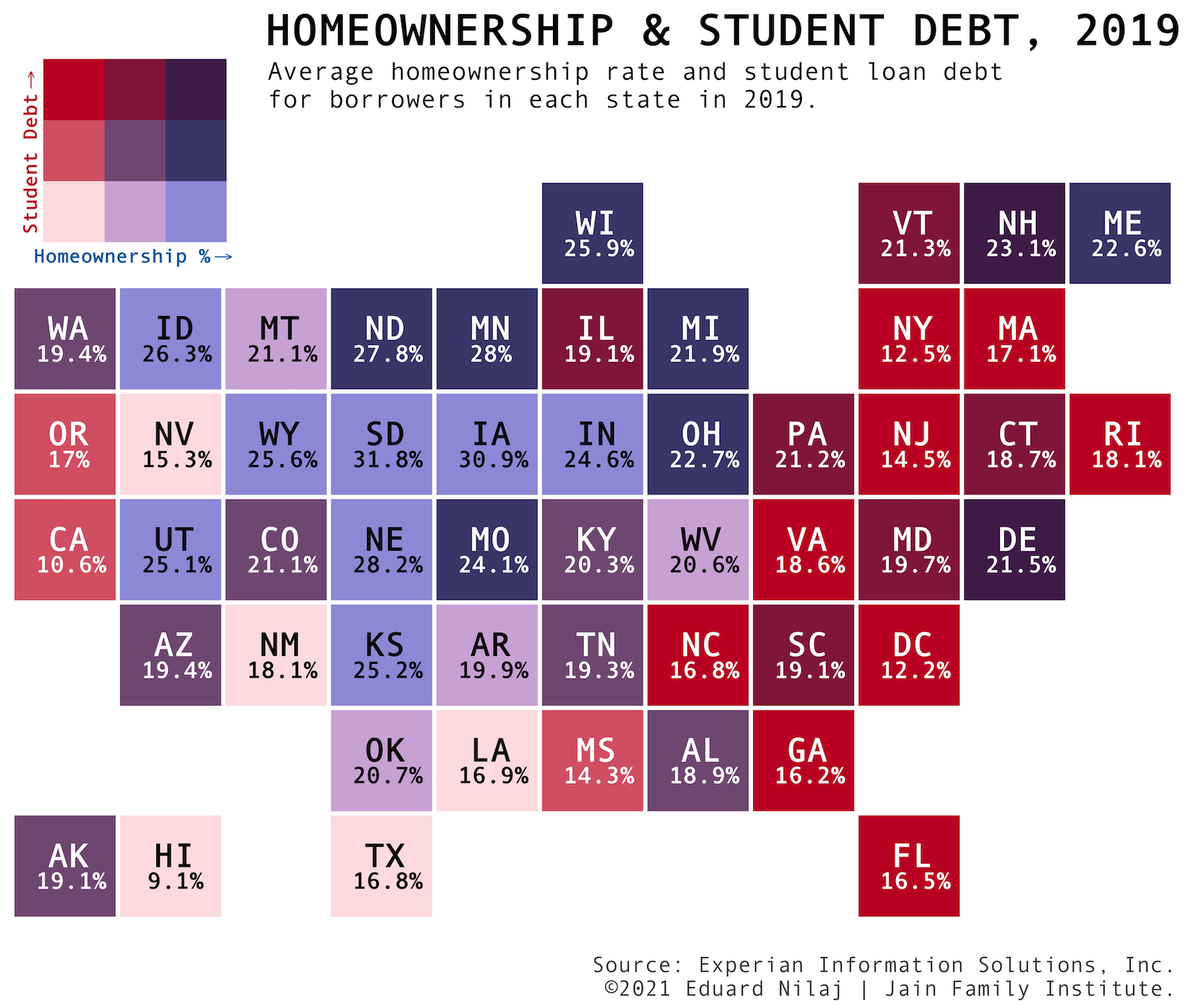

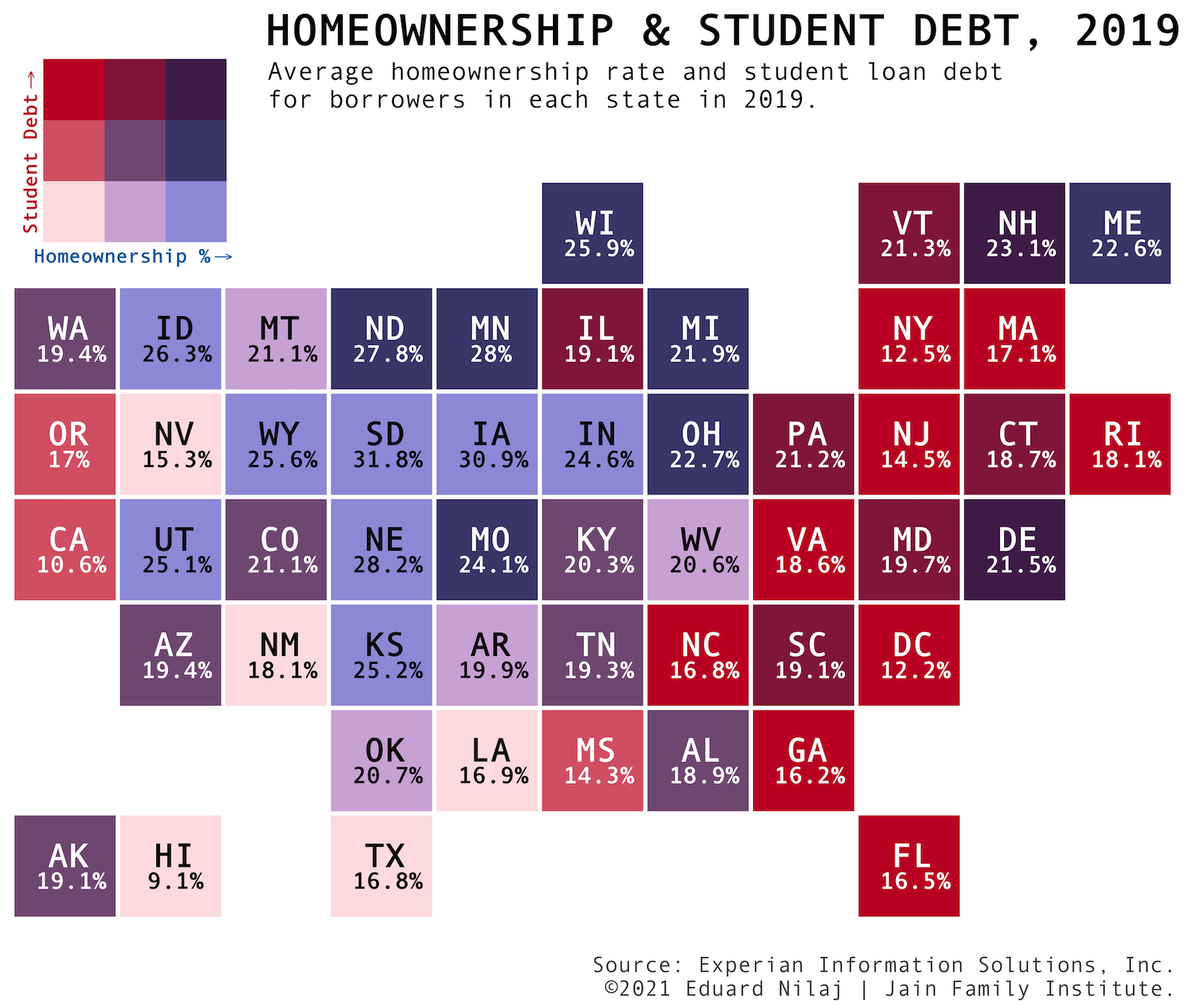

- Among states with the highest average amounts of student loan debt, the majority have among the lowest average homeownership rates.

Read the piece on the Phenomenal World.