Press Release: Proxy Season 2024

New York, NY — April 24, 2024 — This morning, the Center for Active Stewardship (CAS), an affiliate project of the Jain Family Institute, released a report entitled “State of Play: Proxy Season 2024,” highlighting 21 upcoming shareholder meetings where investors will have an opportunity to vote on climate-related proposals.

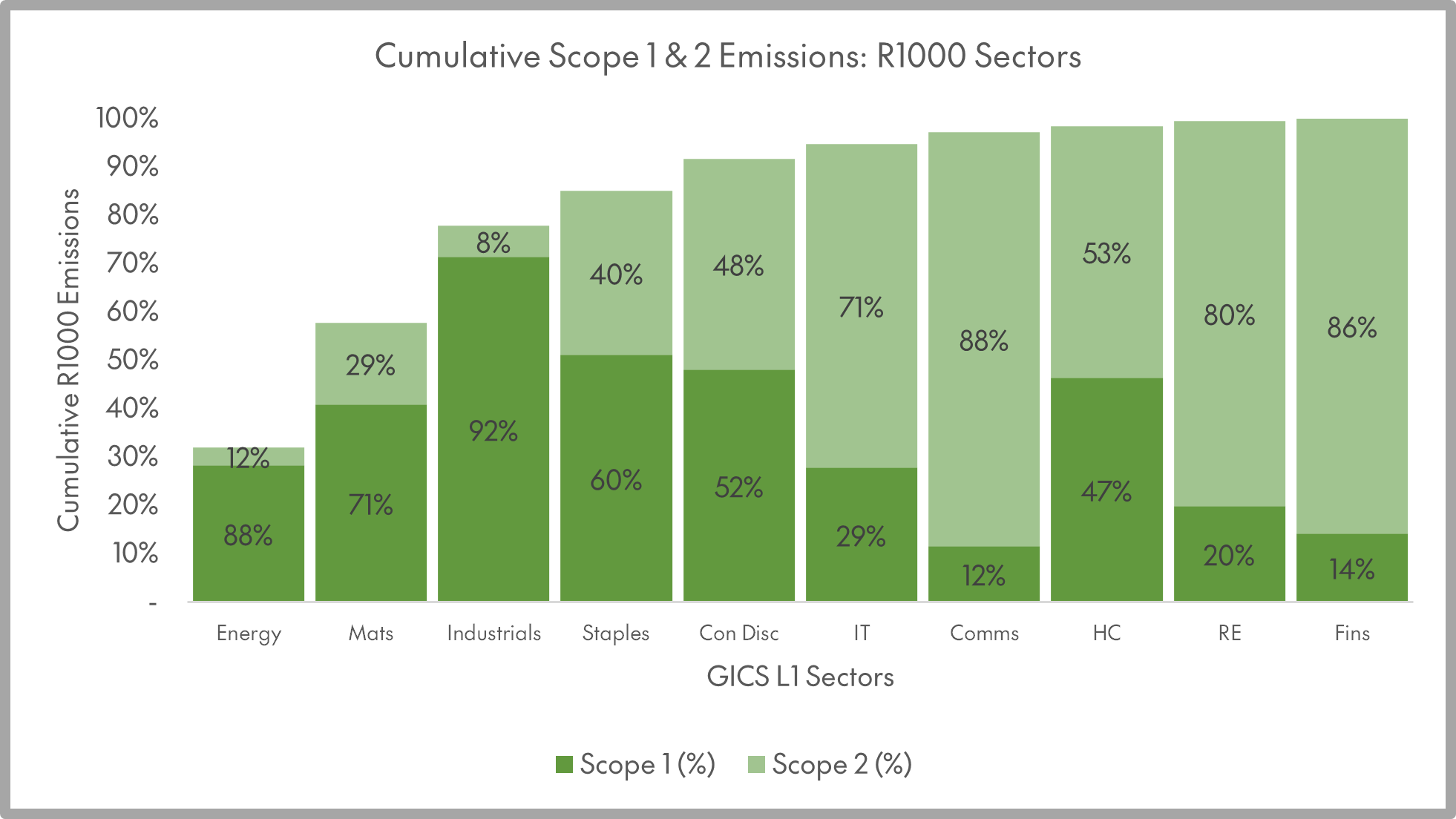

The report contextualizes this year’s slate of dissident climate resolutions in terms of a top-down analysis of the emissions of companies in the Russell 1000 (“R1000”) index, which make up over 90 percent of the total value of the US stock market. A relatively small group of sectors (and industries within those sectors) drives the vast majority of the index’s emissions, with less than 10 percent of the index by market capitalization driving over 80 percent of its direct emissions.

Alongside the report, CAS recently released a data visualization tool called Splice, which allows users to disaggregate trends in corporate emissions and attribute them to underlying drivers, such as changes in energy efficiency and the emissions intensity of the electric grid. These efforts complement CAS’s ongoing work to evaluate how mutual funds and ETFs vote on climate-related proposals.

A top-down, financial materiality focused analysis by CAS finds out of 68 upcoming shareholder meetings at which climate-related resolutions will be voted on, 21 warrant heightened attention to energy and climate issues by investors. Proposals filed by activist groups represent one potential escalation tactic as shareholders engage with boards and management teams on decarbonization.

Among other recommendations, the report argues that companies and issuers should shift their focus away from targeting headline emissions, and toward metrics and targets aimed at the underlying drivers of emission reduction, such as clean power procurement and investments in energy efficiency.

Nolan Lindquist, Executive Director of the Center for Active Stewardship, said:

“A company’s total emissions is an output, not an input. In a world where most big companies already disclose emissions and have some kind of net zero target, the focus should be on what’s going to drive long-term emission reduction. Because emissions are driven by just a few industries, investors can afford to get granular and drill down on industry-specific issues while still covering the vast majority of the emissions in the index.”