Financing the Energy Transition

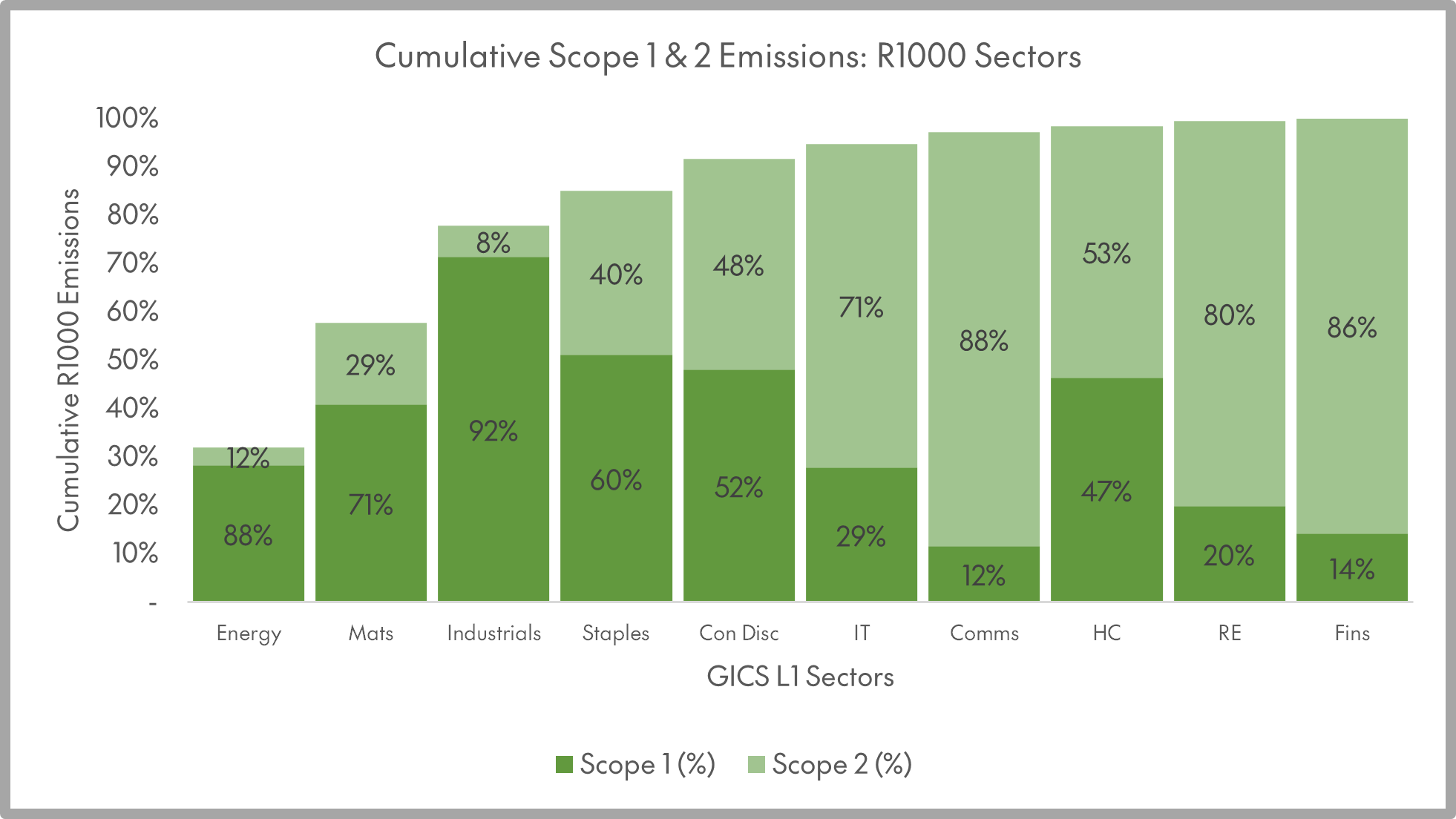

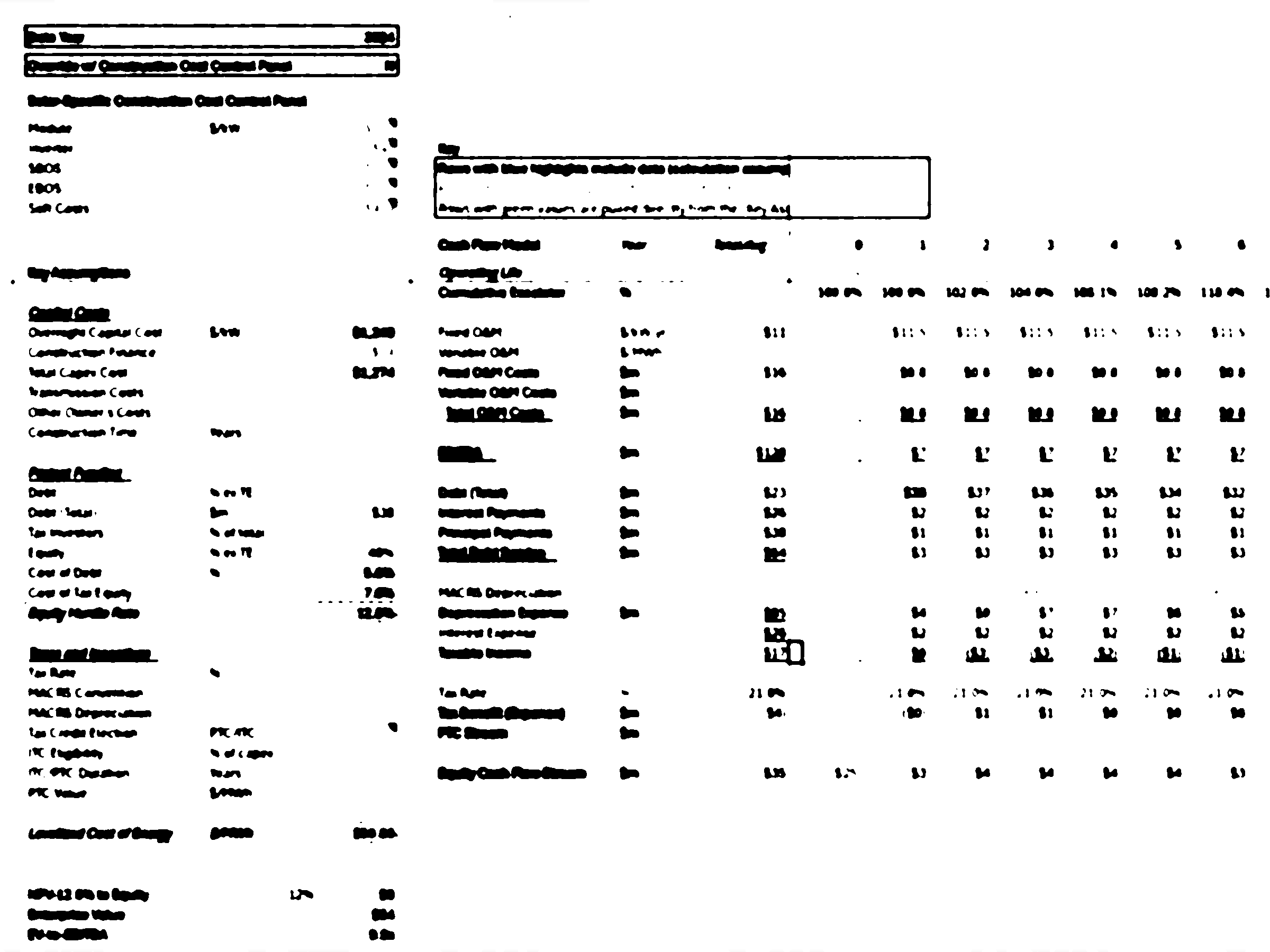

This series presents investors and policymakers with a high-level picture of the factors influencing the financing and bankability of green technologies in the United States. For each technology — including nuclear, solar, wind, hydrogen, long duration energy storage, carbon capture, and industrial decarbonization — our team of data analysts and market experts conducts in-depth interviews with investors and scholars to ground sector-specific levelized cost models. These models, in turn, allow us to capture the key sensitivities governing each technology’s cost profile and identify the most important levers for optimizing their financial viability. With these reports, we aim to equip decisionmakers, on both the investment and the policy sides, with the insights they need in order to make informed decisions that will accelerate the transition to a low-carbon economy.

In This Series

Nuclear Memo

State of Play: Proxy Season 2024

Solar Memo

A Tale of Two Solar Technologies

Financing the Energy Transition Contributors

Jonah Allen

Lead Researcher, Energy Transition Value Chains

Jonathan Calenzani

Fellow

Sina Sinai

Senior Research Associate

Tools

Tooling

Tooling

Levelized Cost of Energy

Recent Updates

JFI at Climate Week 2025

JFI will be hosting several events during Climate Week, starting September 23.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?

New Research: Solar Power in the US

A scrutiny of the present and future of US solar power by JFI's FInancing the Energy Transition team.

Press Release: Proxy Season 2024

Center for Active Stewardship releases report highlighting key corporate annual meetings for climate-focused investors.

New Research: Nuclear Power in the US

The first in a series from JFI's Financing the Energy Transition initiative.

Atlantic Council brief: “Clean industrial policies: A space for EU-US collaboration”

JFI fellows Jonah Allen and Théophile Pouget-Abadie wrote this brief as part of our affiliate initiative with the Atlantic...