Mineral Wealth and Electrification

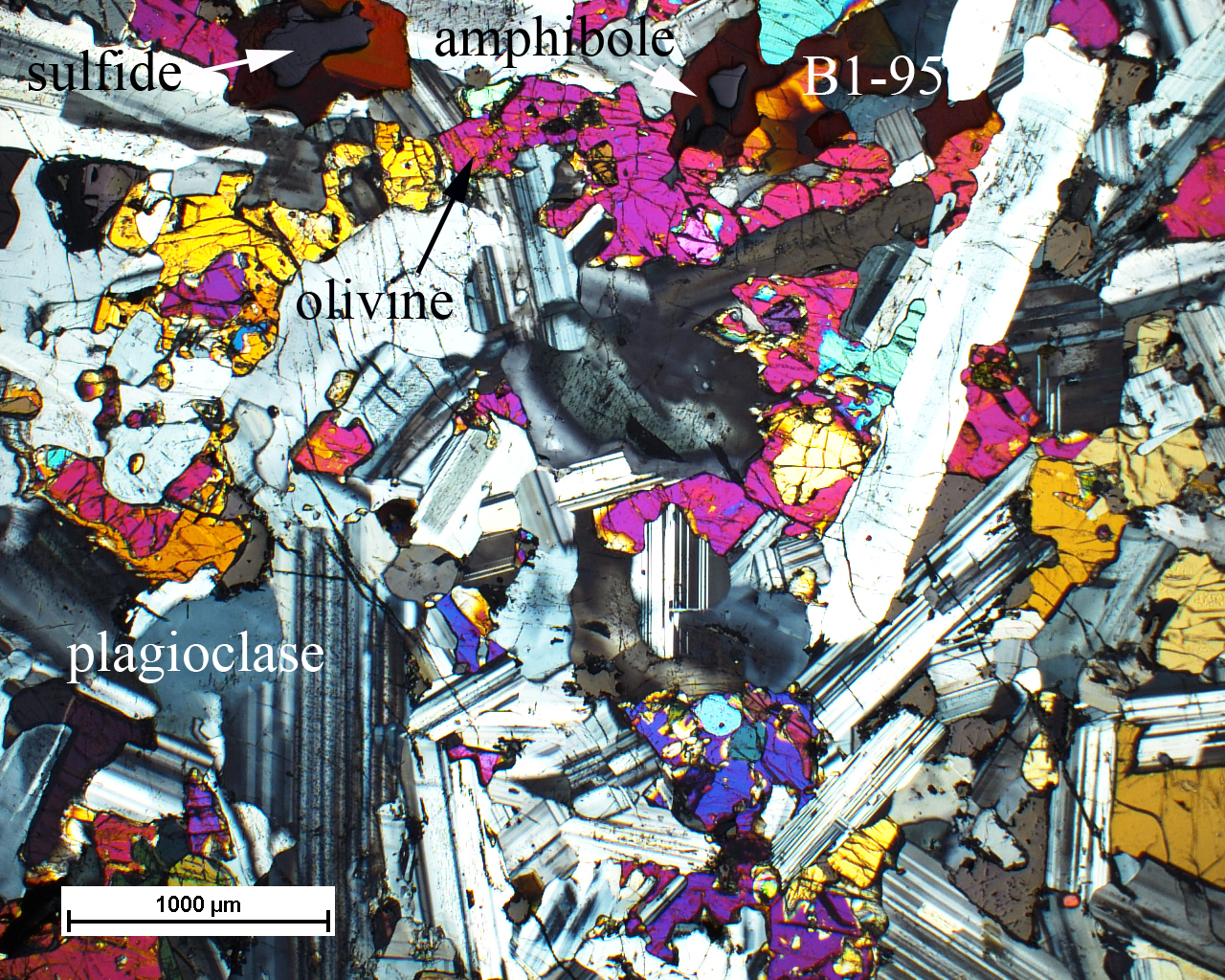

The energy transition represents a significant opportunity for countries producing the materials critical to electrification. In this series, we look at eight such materials: aluminum, cobalt, copper, natural graphite, iron, lithium, manganese, and nickel. As demand for so-called “critical minerals” grows, producer countries must develop robust strategies for effective value capture to transform a temporary windfall into an opportunity to grow shared wealth and climb the value chain. Doing so demands both institutional capacity and political will.

Key takeaways

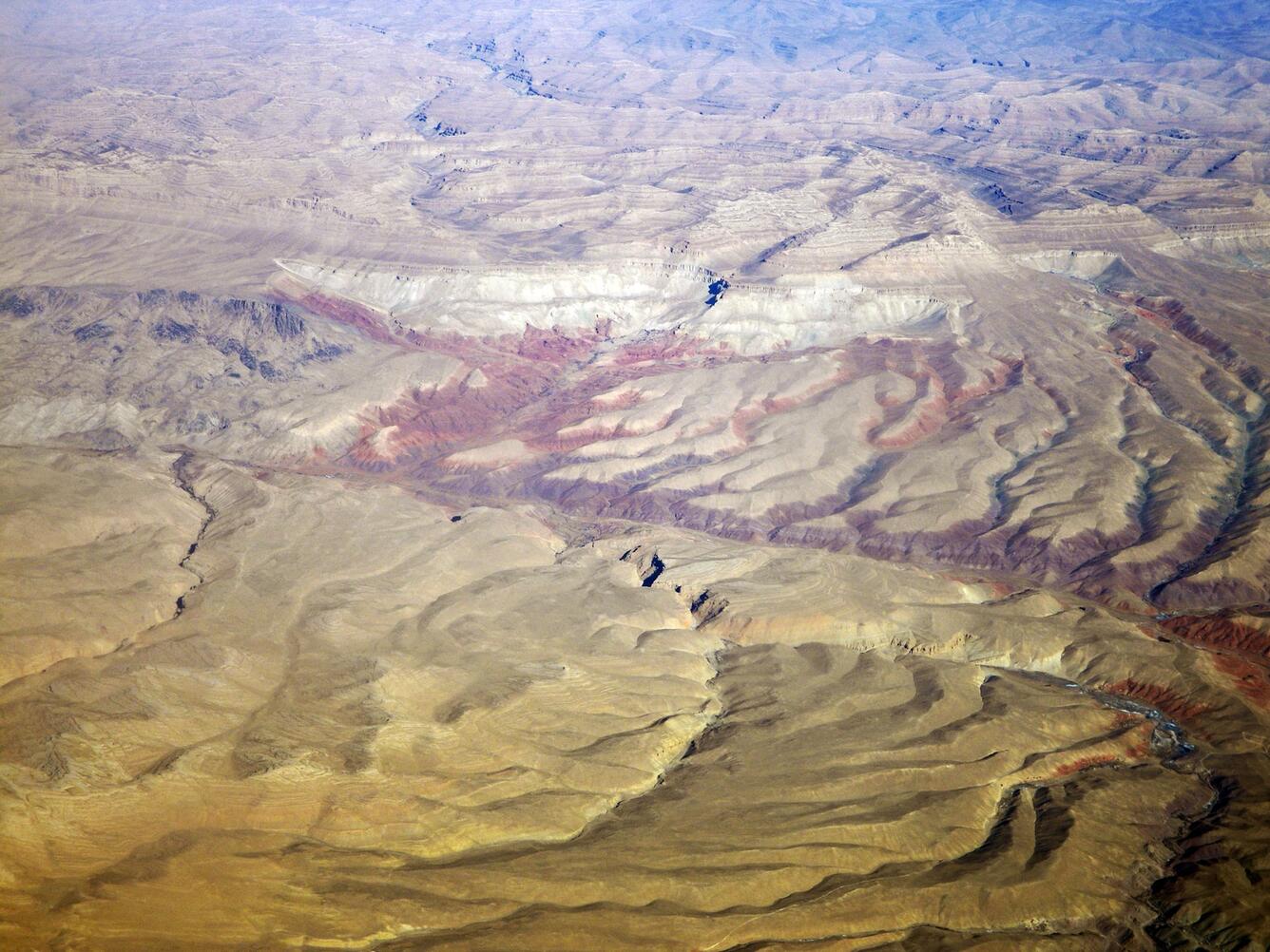

- Electrification is driving a growing demand for critical minerals, creating new opportunities for producer countries rich in these materials, as represented in our interactive online transition-critical minerals map.

- While criticality is often considered in light of the needs of countries consuming these materials as inputs of higher value-added products, we adopt a producer-country perspective centered on the potential for wealth creation and public value capture and investment.

- Sovereign wealth funds and other revenue management strategies can play a vital role in managing volatile commodity revenues, providing stability and promoting long-term investment.

In This Series

Transition-Critical Minerals: Wealth Endowments and Value Capture — Interactive Map

Mineral Wealth and Electrification — Report

Mineral Wealth and Electrification — Technical Appendix

Mineral Wealth and Electrification Contributors

Eduard Nilaj

Senior Research Associate

Francis Tseng

Lead Developer

Jonah Allen

Lead Researcher, Energy Transition Value Chains

Paul Katz

Senior VP

Sina Sinai

Senior Research Associate

Recent Updates

Event: Mineral Wealth and Electrification: A Producer-Country Perspective

Join us for a Zoom panel discussion on December 12.

New series: Mineral Wealth and Electrification

On the shifting map of natural resource wealth, and new possibilities for strategic development.