Policy Microsimulations

Guaranteed Income

Cash Transfer Microsimulations

JFI’s microsimulations allow for a rapid scrutiny of federal tax policy proposals. The associated special project, by researcher Jack Landry, consists of timely briefs on live federal policy debates about changes to taxes and transfers.

View the related series of research releases here. Contact us at [email protected] for demos.

Connected Output

New Research: The (In)accessibility of OBBB’s New Tax Cuts

Does the One Big Beautiful Bill benefit working families?

The (In)accessibility of OBBB’s New Tax Cuts

"The new deductions are a minor and ineffective token of targeted support to the middle and working class in an...

New Publication Series: Low-Income Families with Children and The Reconciliation Debate

"Rather than assessing the reconciliation package as a whole, this series focuses on the specific policies and debates that matter...

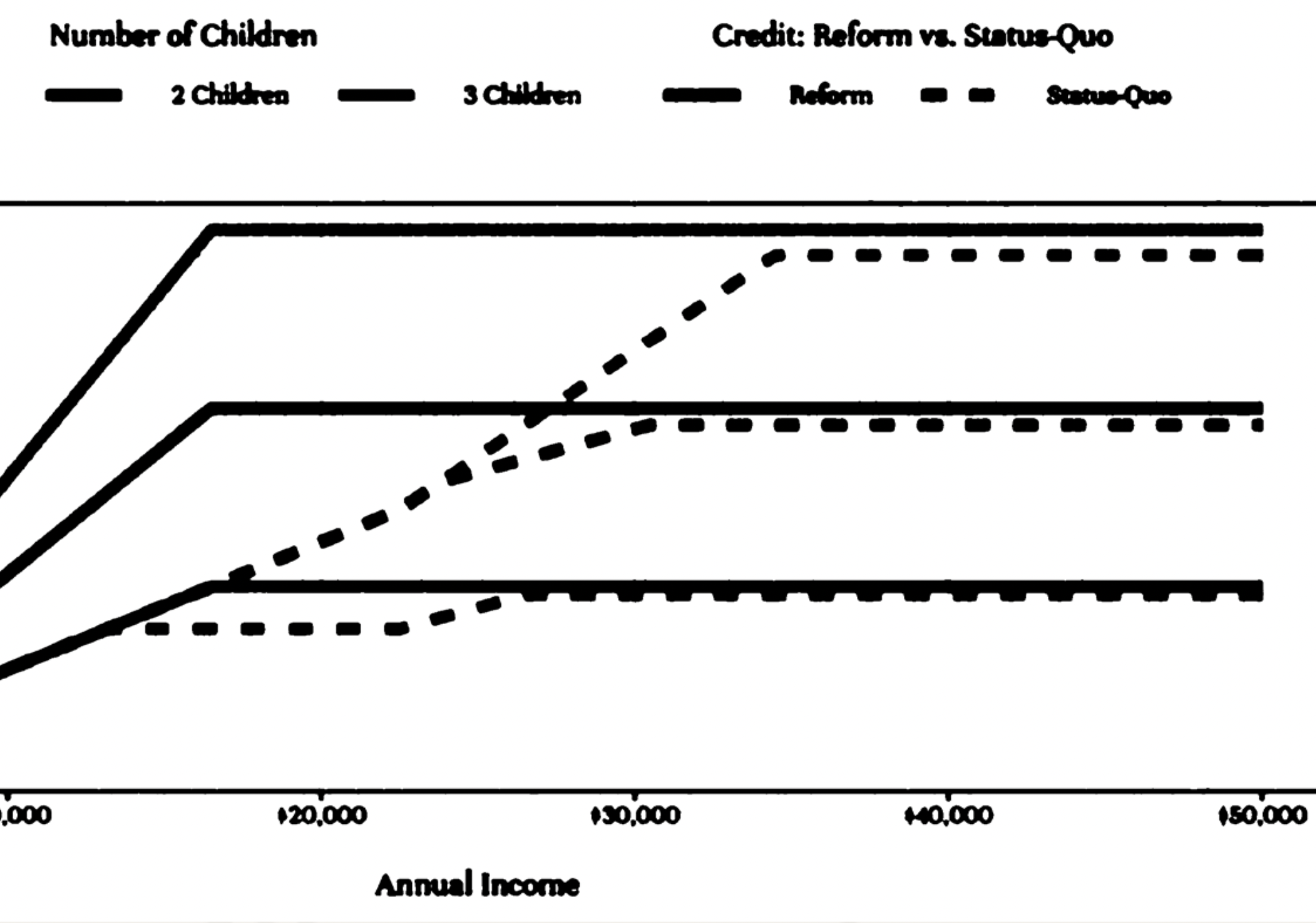

Tax Provisions of the House-passed ‘One Big Beautiful Bill’: Impact on Low-Income Families with Children

"The limited reach of OBBB’s CTC expansion appears poorly understood."

Part of the series Low-Income Families with Children and The Reconciliation Debate

EITC Certificates: How a Certification Mandate Would Function like a Universal Audit

"If all EITC recipients claiming children must comply with audit procedures to receive a certificate, they will effectively be audited...

Part of the series Low-Income Families with Children and The Reconciliation Debate

Without Improvements to Refundability, any Child Tax Credit Expansion Cannot Benefit Low-Income Working Families

"Refundability is the key mechanism for a CTC expansion to benefit low-income working families."

Part of the series Low-Income Families with Children and The Reconciliation Debate