Working Paper: “UBI & the City”

Read the full working paper here.

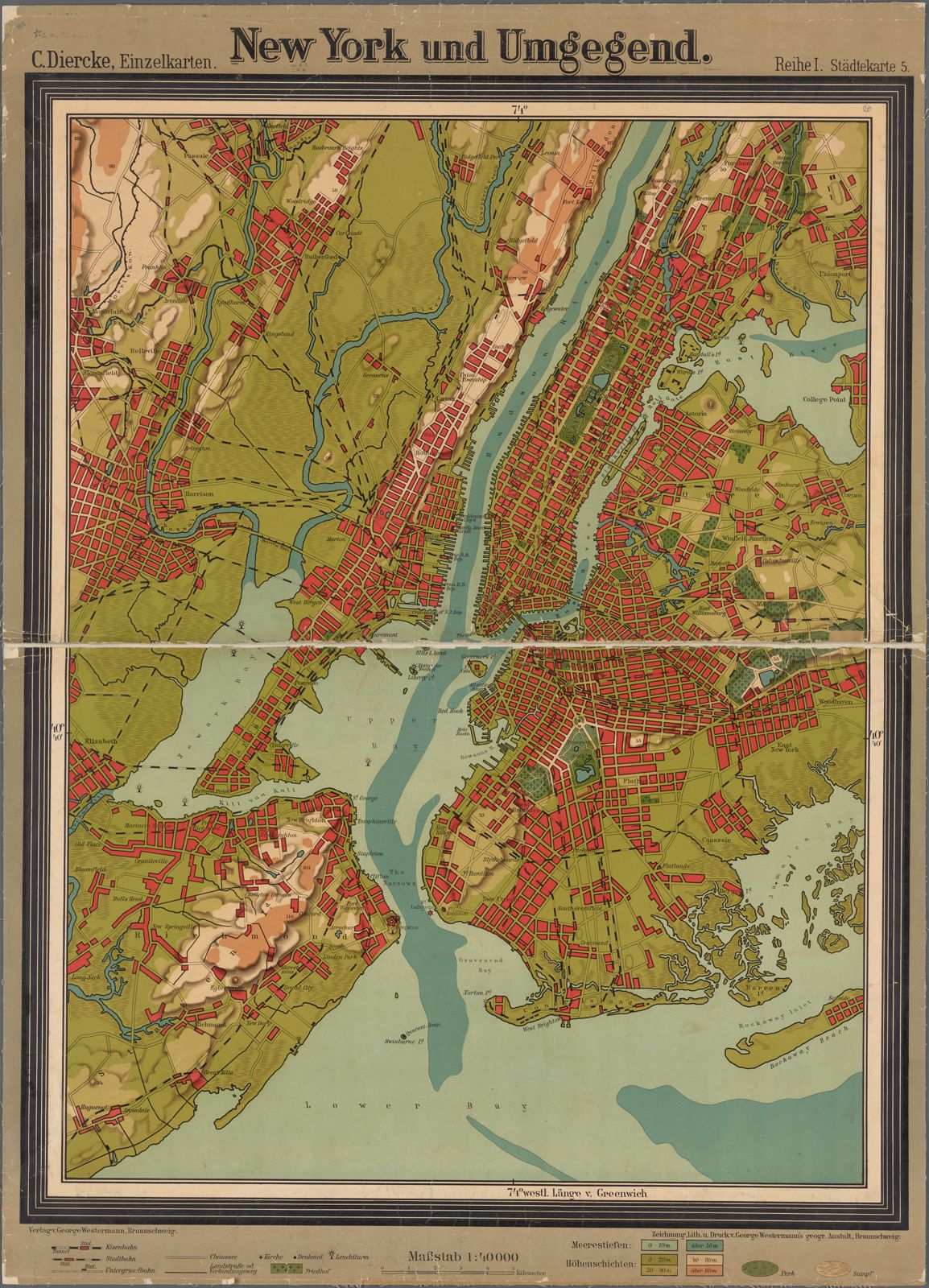

A new working paper, supported by the Jain Family Institute, presents the first attempt to model a UBI’s general equilibrium effects at the city level. In “Universal Basic Income and the City,” Khalil Esmkhani and Jack Favilukis of the University of British Columbia, and Stijn Van Nieuwerburgh of New York University, explore the effects of a guaranteed income policy implemented at the city-level in New York City. They find that, when financed through a progressive income tax, a $5,000-per-household-per-month UBI increases general welfare and, perhaps surprisingly, does not lead to housing market inflation. Their research sheds new light on the possible inflationary effects of basic income policies. It also suggests that the method used to finance a UBI has significant implications for the policy’s outcomes and characteristics.

Read our full press release about the paper, as well as an accessible summary of the research and its implications on Phenomenal World, written by JFI’s lead on the project, Stephen Nuñez.

Related

The (In)accessibility of OBBB’s New Tax Cuts

"The new deductions are a minor and ineffective token of targeted support to the middle and working class in an...

Tax Provisions of the House-passed ‘One Big Beautiful Bill’: Impact on Low-Income Families with Children

"The limited reach of OBBB’s CTC expansion appears poorly understood."

Part of the series Low-Income Families with Children and The Reconciliation Debate

EITC Certificates: How a Certification Mandate Would Function like a Universal Audit

"If all EITC recipients claiming children must comply with audit procedures to receive a certificate, they will effectively be audited...

Part of the series Low-Income Families with Children and The Reconciliation Debate