From Idea to Reality: Getting to Guaranteed Income

Policy Microsimulations

Assessing Non-filer Rates & Poverty Impacts for the American Rescue Plan Act’s Expanded CTC

By Jack Landry and Stephen Nuñez

Download the full PDF here for best reading experience.

Summary

Early analysis of the Biden Administration’s expanded Child Tax Credit (CTC) suggested the policy could be transformational, with the potential to cut child poverty in the United States by 40 percent or more (1). These analyses rely on nearly all eligible children receiving the benefit, a limitation widely acknowledged within these reports. In practice, because the CTC is administered through the tax code, many eligible households who do not file taxes may not receive any payments. Although reliable statistics are not available, families who do not file taxes (non-filers) are disproportionately lower income. While the CTC has reached more than 60 million eligible children and recently launched an improved non-filer enrollment portal, the impacts on child poverty could be greatly diminished if policymakers do not ensure poor non-filers receive the CTC (2). In addition to the immense ongoing outreach efforts, better administration is possible through data sharing to enroll those families accessing other benefits systems.

This brief presents results from a series of microsimulations that calculate the estimated poverty impacts of the expanded CTC under different assumptions about which children are in non-filing households. It responds to three key questions:

- How many non-filer households with eligible children are there?

- What are the implications for program effectiveness if they do not receive the benefit?

- How might more eligible households be reached?

Given the quality and constraints of available data within federal government agencies’ fragmented data collection systems, precise answers to these questions are evasive. Our analysis conservatively estimates that upwards of 6.4 million eligible children will not receive the benefit, resulting in an estimated child poverty reduction of 11 to 18 percent, and a 92 percent take-up rate. We do not know exactly who these children are, but we find a substantial portion—at least 71 percent—receive other government benefits, meaning that better data sharing between state and federal benefits agencies could offer a crucial avenue for enrollment. Greater enrollment could dramatically increase the child poverty reduction, up to 40 percent.

Methods

The number of children in non-filer households

Reliable data on the number of non-filers is difficult to come by. For example, researchers at the Department of Treasury recently attempted to identify the number of non-filers by analyzing 1095 health insurance form data and comparing this to tax records. They estimate that there are roughly 2.3 million children who show up in the health insurance data but were not claimed by any family who filed taxes in the last two years. This sets a lower bound on non-filers but one that the researchers admit is woefully inadequate as it does not include uninsured children or those who are insured but not covered by 1095 records.

To estimate the number of non-filer children, we calculate the number of children eligible for CTC payments from detailed survey data, then subtract the reported number of children receiving the benefit. A small number of children live in wealthy households with earnings beyond the CTC phase-out point. We estimate that roughly 2.3 percent of children in the Current Population Survey’s Annual Social and Economic Supplement (CPS-ASEC), a nationally representative sample, are ineligible for the benefit for this reason. Undocumented children are not eligible for CTC payments either (though citizen children of undocumented parents are (3)). While hard numbers are difficult to come by, there are an estimated 675 thousand undocumented children in the U.S. Combined, this suggests that 96.8 percent (roughly 71 million) of U.S. children are eligible for the benefit. This number is consistent with estimates produced by other studies.

In May 2021, the IRS released a statement suggesting that the CTC would reach approximately 65 million children or roughly 88 percent of all children in the US. When the first CTC payments were sent out in mid-July, the IRS released a new statement saying that they distributed benefits to 59.3 million children rather than the originally estimated 65 million. The IRS did not offer an explanation of this discrepancy. While the initial estimate may have been an overcount (in August they announced an additional 1.6 million children are now receiving the benefit), there is at least one other reason the number of payments disbursed may be lower than anticipated: Households may opt out of the advance monthly payments in favor of receiving the entire benefit in a lump sum at tax time. Because the IRS has not released data on the number of households that have exercised this option, it is difficult to determine how many households in this ~5 million-child gap are simply going to receive the benefit in a different manner. Given this issue and given that our analysis focuses on yearly rather than monthly estimates of child poverty, we therefore use the original 65 million child estimate. This leaves us with about 6.4 million children in non-filer households, a participation rate of approximately 92%.

The distribution of children in non-filer households

As difficult as it is to estimate the number of non-filing households, it is still harder to estimate their distribution across the income distribution. We assume that the 6.4 million children in non-filer households are all poor (4). That is, they reside in households that would be below the Supplemental Poverty Line even if they had received the other post-tax benefits (e.g. EITC) for which they are eligible. While this is an assumption, it comes from a body of research demonstrating that poverty is partly a “mental tax” that impedes takeup of safety net programs the poor would benefit from. There are certainly some non-filer households that are not poor, but we believe this number is small enough to ignore in favor of a parsimonious model. However, we provide alternative estimates in the appendix from allocating non-filing to low-income tax filing units.

As there are about 10 million children in poverty, the next question is logically how non-filer status should be allocated among them. Because we lack a good model for predicting non-filing status (5), we attempt instead to create bounds on the impact of non-filing among poor households by allocating children to poor, non-filing households in three ways:

-

Randomly assign poor households to get/not get the CTC

Sort poor children by the number of other state and local benefits (e.g. HCV, SNAP, TANF) the household is receiving, then

- i. Assign non-filer status first to those households receiving the most non-tax benefits and then continuing in descending order

- ii. Assigning non-filer status first to those households receiving the fewest non-tax benefits and then continuing in ascending order

Random assignment of non-filer status among poor households in the data gives us a sense of the reduction in CTC effectiveness associated with this issue if non-filers are representative of the typical poor family. The alternative method of sorting by benefits receipt allows us to construct bounds on the number of non-filer households that are present in the databases of state and local benefits. Such households are the low-hanging fruit in CTC outreach efforts but could also be automatically enrolled in the benefit through data sharing between the IRS and state or local benefits administrators.

Estimated Poverty Impacts

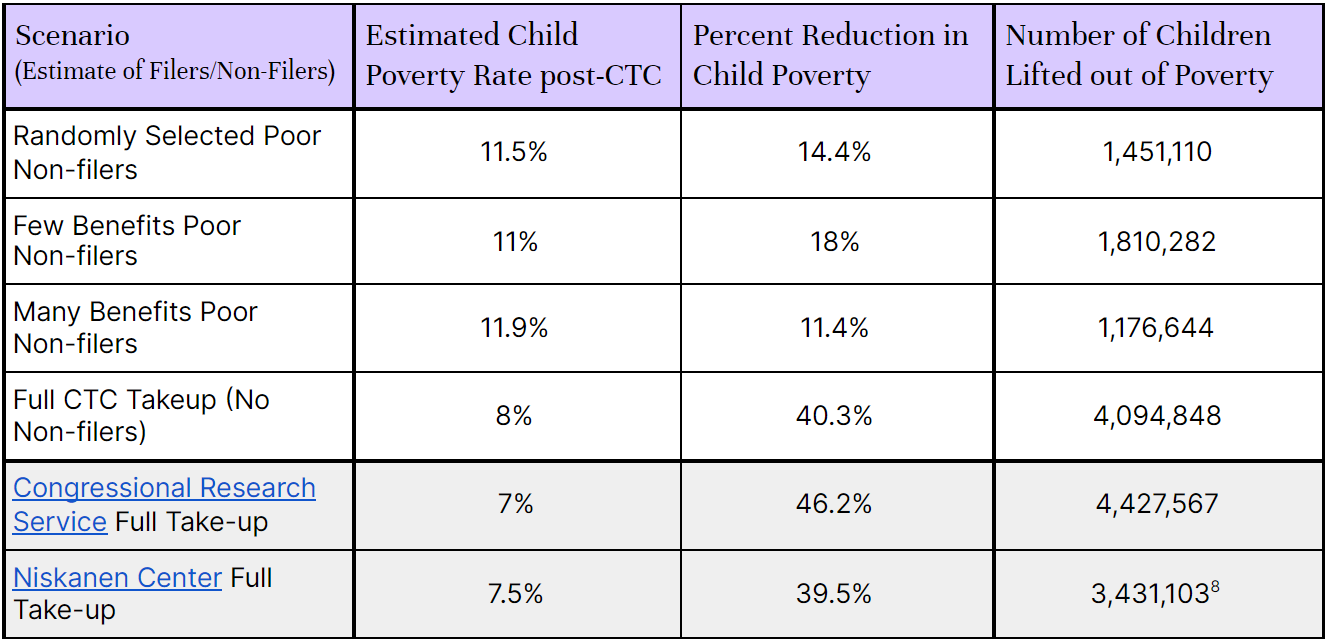

In concurrence with other analyses, including those described above, our simulation of the CTC impacts using CPS-ASEC data (see appendix for details) finds that the program would reduce child poverty by 40.3 percent (from 13.42 to 8.01 percentage points) if every eligible child received it (6). Accounting for the estimated 6.4 million children in poor non-filing households, however, greatly reduces its efficacy. We find that, depending on the distribution of non-filers, the CTC reduces child poverty by between 11 and 18 percent (7). On its own, this is a major achievement, and would represent the largest drop in child poverty since reliably recorded, and a policy already making a concrete impact on people’s lives. Considering poverty rates within the past year, this impact could be even greater. However, to realize the CTC’s full poverty-fighting potential, uptake must increase. Figure 1 below summarizes these findings, and Figure 2 (next page) shows the percentage reduction in child poverty under our four scenarios for CTC take-up.

Figure 1: Simulations of CTC child poverty impacts under varying non-filer assumptions

Figure 2:

While these numbers are less optimistic than previous assumptions, we also find that at least 71 percent of eligible children not receiving the CTC reside in households receiving 1 or more benefits (typically Medicaid, CHIP or SNAP). This indicates that non-filers are not totally disconnected from the government benefits system, and points to a pathway for reaching the majority of children in non-filer households. Moreover, benefits receipt is underreported in the CPS-ASEC, which means that even more households are reachable through the current welfare system than Figure 3 implies (9).

Figure 3:

As we have learned repeatedly during the pandemic, state capacity to administer benefits cannot be an afterthought; the impact of anti-poverty programs relies on the government’s ability to identify eligible recipients and disburse aid quickly and correctly. As such, we end this paper with a brief discussion of the issue and how the situation can be improved.

How to Increase CTC Uptake

The IRS’s difficulty reaching all CTC-eligible households plagues other important anti-poverty programs administered through the tax code, such as the Earned Income Tax Credit, and previous economic stimulus payments (10). Research on prior benefits expansions has found that even large increases in benefits have only resulted in a small increase in tax filing when benefits are administered through the tax code. However, relief provided through successive rounds of Economic Impact Payments and expansions during the COVID-19 pandemic have indicated that efforts to make benefits administration more robust and inclusive are within reach, provided adequate resources, data-sharing, and outreach efforts.

While low awareness of benefits is a contributing factor it is far from the only cause of non-filing. For example, several field experiments have tested the effectiveness of outreach campaigns to non-filers who were likely to be eligible for the EITC. The specific details vary, but all of the campaign’s experiments reached out to low-income people via letters or text messages to encourage them to file a tax return. Some specifically highlighted potential benefits from the EITC and/or directed recipients to VITA sites or the IRS free file program. Regardless of the specific message, no experiment increased filing by more than 1 percent. While it is possible that better designed messages would be more effective, these results throw cold water on the idea that light-touch interventions can significantly increase take-up of benefits administered through the tax code. Other factors influencing uptake that need to be dealt with include misunderstanding of the requirements, stigma, or the difficulty in actually filing a tax return. And each of these requires more substantial engagement.

In other words, a passive strategy of better available information is unlikely to close the non-filing gap. One important step is making filing taxes simpler—especially for families with minimal earned income. On this front, the non-filer portal for the Economic Impact Payments and its new, much more usable format rolled out at the end of August represent important improvements. Yet even a simplified enrollment process requires eligible households to come forward. Active outreach (giving people information but also answering their questions and guiding them through the sign up process) would be better, especially a strategy that capitalizes on information already available through state and local benefits databases as noted above. But again, research suggests this will only offer marginal improvements, with less uptake among those in most extreme poverty.

In addition to these efforts, the federal government must invest in a system of benefits-linkage: enrolling households in federal benefits when they contact any point in the welfare system, or even auto-enrolling people based on information in other systems. As we have indicated above, upwards of 71 percent of non-filers likely access at least one form of public benefits. While auto-enrolling children based on receipt of other safety-net benefits cannot ensure 100% participation of all children, it would boost participation among the children most in-need and most likely to not be receiving benefits already. Going forward, the IRS should also focus particularly on automatic enrollment of newly-born children. Currently, there is no way to sign up children for periodic payments if they were born in 2021, even among tax filers. However, the birth of a child is also a point of contact with the state (e.g. the Social Security Administration) and thus an opportunity to enroll an eligible child.

Conclusion

The Biden Child Tax Credit (CTC) reform and expansion represents an important milestone in the development of an effective social safety net. Poverty takes a heavy toll on children, their families, and, indeed, the economy overall. Social policies that invest in children have shown some of the greatest “returns on investment” for long term impacts on social mobility and other outcomes. Likewise, the experiences of other countries have demonstrated that direct, unconditional cash assistance can be an important and effective tool against child poverty. The CTC is no exception. Still, the greatest poverty impacts depend on ensuring all eligible children receive the benefit. In the long term, efforts to move CTC disbursement to a dedicated benefits administrator, such as the Social Security Administration or a dedicated benefits administrator within the IRS (11), could greatly improve take-up if coupled with continuous data-sharing agreements across relevant federal benefits agencies.

Appendix

Part 1: Underlying CPS-ASEC data from 2018

We use 2018 income data from the Current Population Survey’s Annual Social and Economic Supplement to estimate CTC eligibility. While 2019 data is available, it was collected in March 2020 and suffered from high, pandemic-related nonresponse biases. Using 2018 data simulates the “steady state” economy to reflect the CTC’s long-term impact better and is consistent with other analyses. It also excludes newborns from the analysis, who, at the time of this writing, are universally not receiving advance CTC payments if they were born after December 31st, 2020.

Part 2: Estimates include CTC impacts only

We only simulate the Child Tax Credit’s impact on poverty and omit other recent policy changes, including expansions to SNAP, unemployment insurance, the EITC, and the child and dependent care credit. Among all the America Rescue Plan Act’s policy changes, the CTC expansion is expected to make the largest dent in poverty, and the Biden administration plans to extend the expansion until 2025. However, the anti-poverty impacts of other provisions of the American Rescue Plan Act that operate through the tax code are also somewhat overstated by assuming perfect uptake among the eligible.

Part 3: Filing units in the JFI microsimulation modules

To form filing units in the CPS-ASEC, we use the methods from Jones and Ziliak, which showed greater accuracy at matching administratively-measured EITC distributions relative to the Census tax model’s filing units in the CPS. To estimate CTC payments for each filing unit, we use the Policy Simulation Library’s Tax Calculator Version 3.2.1. All poverty references use the Supplemental Poverty Measure. Even though CTC payments are disbursed between 2021 and 2022, we estimate the anti-poverty impact of the CTC, counting the entire credit as 2021 income, which is consistent with other reports on the CTC’s impact.

Part 4: How poverty impact estimates may shift

To the extent enrollment increases between now and tax-filing season, we will underestimate the CTC’s impacts on child poverty. However, we already conservatively estimate that the difference between initial IRS disbursement expectations and current disbursement rates is exclusively driven by families opting-out of advance payments. It is likely that the initial IRS announcement of reaching 88% of children was overly optimistic, and opt-out rates are lower than what we assume in the brief. Future publications CTC on disbursements should report the number of children associated with filing units opting out of advance payments to evaluate how successful the CTC is at reaching all eligible children. The IRS could also compute and release the number of children associated with tax-filing units too rich to qualify for CTC payments. While we estimate this quantity with survey data, an official IRS number would help nail down the number of children eligible but not receiving the CTC with more certainty.

Part 5: Alternative methods for allocating non-filing

In the main text of the brief, we assign children in poor households to non-filing status, such that only children in poor households do not receive the CTC. Another way to assign non-filing status involves focusing not on families in poverty, but on tax-filing units with a low amount of taxable income. This is similar to the methodology of Columbia’s Center on Poverty and Social Policy and the Urban Institute for imputing non-filing (12). For filing units with dependent children, the threshold where they are required to file is between $18,650 to $27,400 of gross income. While many of these households would benefit from filing (they would receive a refund), they are generally not required to file by law.

Among this population (children in filing units not required to file), we assign non-filing two different ways. For the first method, we assign non-filing at random to tax-filing units below the filing threshold. For the second method, we assign non-filing to tax-filing units with the lowest adjusted gross income, moving up from zero income until we assign 6.4 million children to be non-filers (the number of eligible children not receiving the CTC calculated in the main text of the brief). The two methods should provide reasonable bounds for estimating the anti-poverty effects for any methodology that assigns non-filing to low-income tax filing units.

The resulting poverty reduction figures are shown in Appendix Figure 1. For ease of comparison, the first bar again shows the poverty impact of the CTC if all eligible children received the benefit. The second bar shows the results of the first method: assigning non-filing status randomly to tax-filing units with children whose incomes are below the filing threshold. The third bar shows the results of allocating non-filing to children in tax filing households with the lowest taxable income. Overall, the poverty reduction effects of the CTC are substantially larger when imputing non-filing to low-income filing units rather than poor households, because some low-income filing units live in non-poor households. Using these methods, the CTC reduces child poverty between 26-28%.

Appendix Figure 1:

Appendix Figure 2 displays how many non-filers live in households that receive safety net benefits using the alternative, low-income allocation method described above. For both methods, a large fraction of households receive at least one benefit. This shows that regardless of the specific assumptions about who non-filers are, most non-filers can be reached through the existing government benefits system, especially when considering benefit receipt is underreported in survey data.

Appendix Figure 2:

Footnotes

- For example, see analyses by researchers at the Niskanen Center, the Congressional Research Service, and the initial analysis by researchers at the Columbia University’s Center on Poverty and Social Policy.

- For more on the deficiencies of U.S. cash disbursement infrastructure, see JFI’s recent report, “Building a Helicopter: Pathways for Targeting & Distributing a US Guaranteed Income.”

- This is similar to estimates from the People’s Policy Project and a NBER working paper by Jacob Goldin and Katherine Michelmore.

- The CPS-ASEC does not include any indicator of immigration status, so some fraction of children who are assigned to be non-filers may also be undocumented and thus ineligible for the CTC. Most analyses of the CTC’s effect on poverty do not remove undocumented children, upwardly biasing “full-uptake” measures of the CTC’s impact on poverty. (including our own).

- The CPS-ASEC includes a non-filer variable, but it comes from an imputation model—not from asking respondents about their tax filing. The details of how the imputation model determines filing status is not documented, but an examination of the data compared to the few facts we know about non-filers suggests it is not accurate. For instance, we know a substantial number of people are eligible for the EITC but do not receive it because they do not file taxes. However, the CPS-ASEC non-filing variable assumes virtually perfect EITC take-up—98% of non-filing tax units with no wage income. Using the CPS-ASEC data on non-filers to determine how many children are not receiving CTC benefits also gives a smaller estimate than our estimation method.

- We do not remove undocumented children from the eligible (we do not have data on citizenship status), and thus slightly overstate the CTC’s impact on child poverty.

- In the appendix, we show the results of another analysis that allocates non-filers to low income tax-filing units who have an income below the threshold for which they are required to file a return. Using this methodology, we find the CTC reduces poverty between 26% and 28%.

- Other reports in the table do acknowledge the potential for incomplete enrollment to attenuate the CTC’s poverty impact—one of our main contributions is to estimate concrete numbers behind this phenomenon.

- The underreporting of benefits may also bias our estimates of the antipoverty impact of the CTC, though in an ambiguous direction. On one hand, the underreporting of benefits biases poverty estimates upward, which would cause us to exaggerate the impact of the CTC. On the other hand, underreporting of benefits may mean that more people are just below the poverty line, and would be put over the poverty threshold by the CTC, which would cause us to understate the impact of the CTC.

- Anticipating this issue for the Economic Impact Payments, the IRS set-up a (much maligned) non-filer portal to provide an alternative path to receive payments. They also automatically paid some non-filers benefits based on information from the Social Security Administration, the Department of Veterans Affairs, and the Railroad Retirement Board. For the Child tax credit, the IRS again created a non-filer portal, and has paid out benefits to 720,000 children who went through the non-filer portal for economic impact payments.

- JFI has discussed the need for a dedicated benefits administrator for guaranteed income policies, or regular cash transfers of this kind, in our 2021 position paper here: https://www.jainfamilyinstitute.org/assets/jfi-gi-position-paper-august-2021.pdf

- Using this methodology, we find a similar anti-poverty impact of the CTC as that of Columbia’s Center on Poverty and Social Policy, which also accounts for non-filing. We find a smaller poverty reduction than the Urban Institute because they make more optimistic assumptions about the eventual number of non-filers, while we estimate the current number of non-filers.