Benchmarking Opportunity in Transition-Critical Mineral Markets

The new research brief from Jonah Allen, JFI’s Lead Researcher on Energy Transition Value Chains, and Eduard Nilaj, Senior Research Associate, analyzes how policymakers addressing mineral booms stand to benefit from reduced information asymmetries, and discusses how JFI’s Critical Minerals portfolio is developing tools to help.

From the introduction:

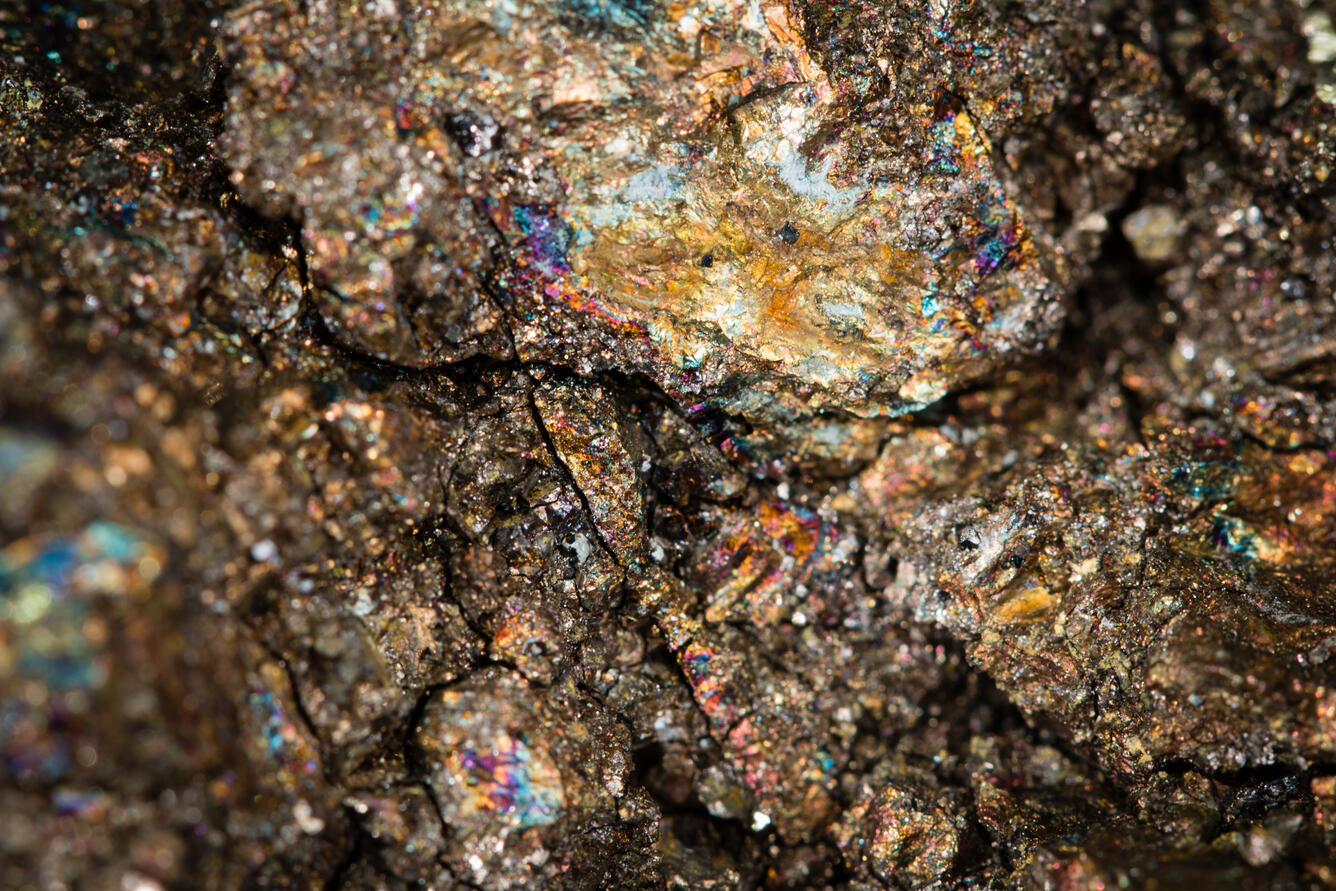

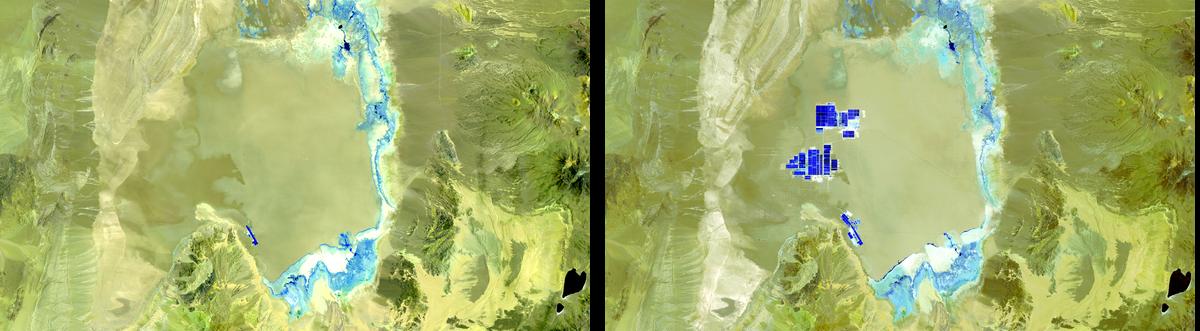

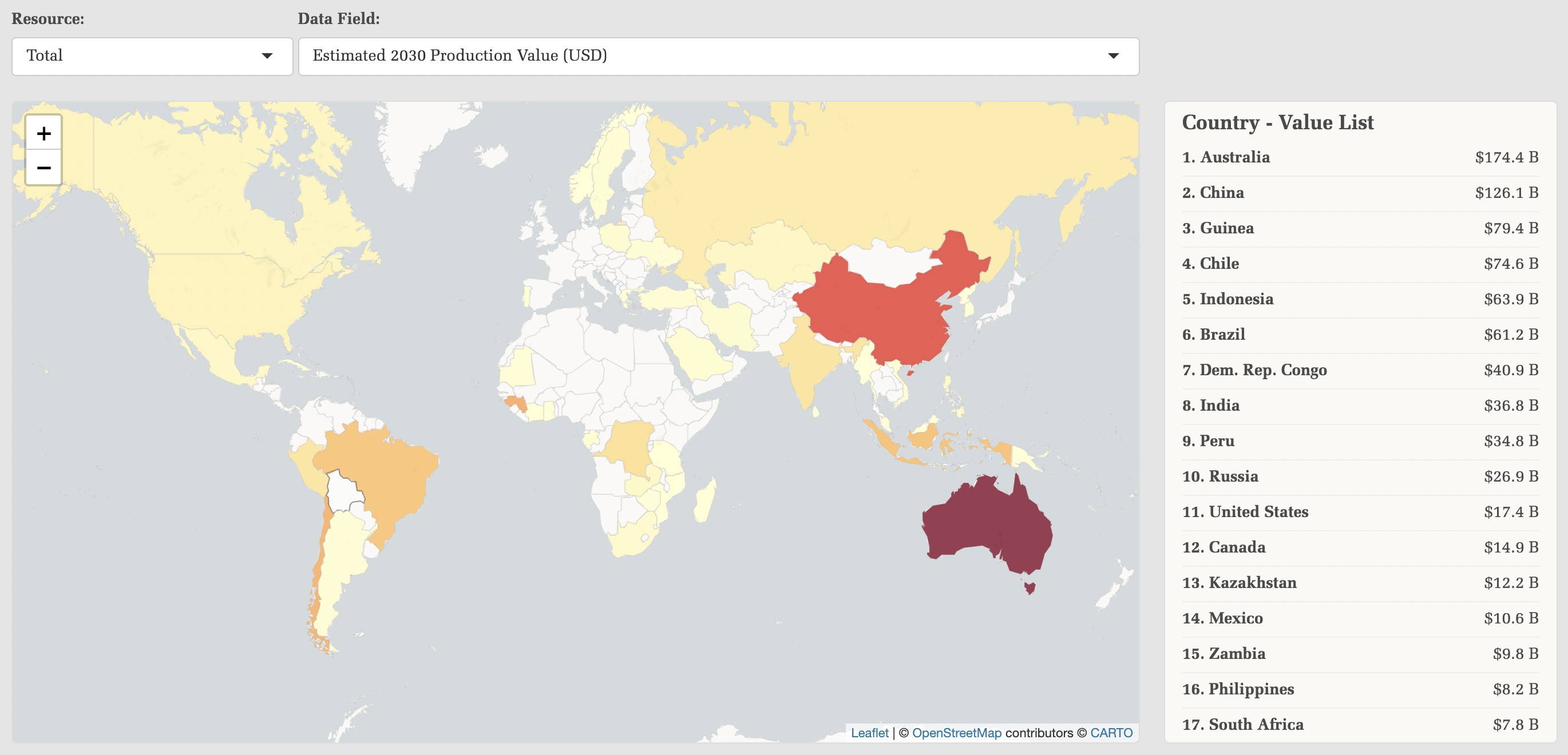

Producer countries seeking to turn transition-critical mineral booms into lasting development outcomes must navigate market volatility, complexity, and uncertainty. The recent rise and crash of lithium prices underscores how quickly market realities can outpace expectations; in Brazil and Ghana, over-optimistic projections and plans have translated into deflated public revenues and challenged downstream ambitions. Given these challenges, JFI is developing a suite of tools to reduce information asymmetries and support policymakers in assessing and managing market risks. We’ve begun with the Mineral Market Dashboard, which benchmarks varying projections for transition-critical mineral market growth and maps the distribution of historical production and current estimated resources and reserves to enable more grounded discussions on the scale and distribution of opportunity.

Related

Mineral Wealth and Electrification — Technical Appendix

On data sources and data processing.

Part of the series Mineral Wealth and Electrification

Mineral Wealth and Electrification — Report

This report adopts a producer-country perspective centered on the potential for wealth creation and public value capture and investment.

Part of the series Mineral Wealth and Electrification

Transition-Critical Minerals: Wealth Endowments and Value Capture — Interactive Map

A high-level distribution of current and future mining production and potential royalty revenue globally through 2030.

Part of the series Mineral Wealth and Electrification