New Report: The Impact of Families with No Income on an Expanded Child Tax Credit

Research Associate Jack Landry has published a report assessing the impact of including parents with no earnings to the 2021 child tax credit expansion. Read a summary below and read the full report here.

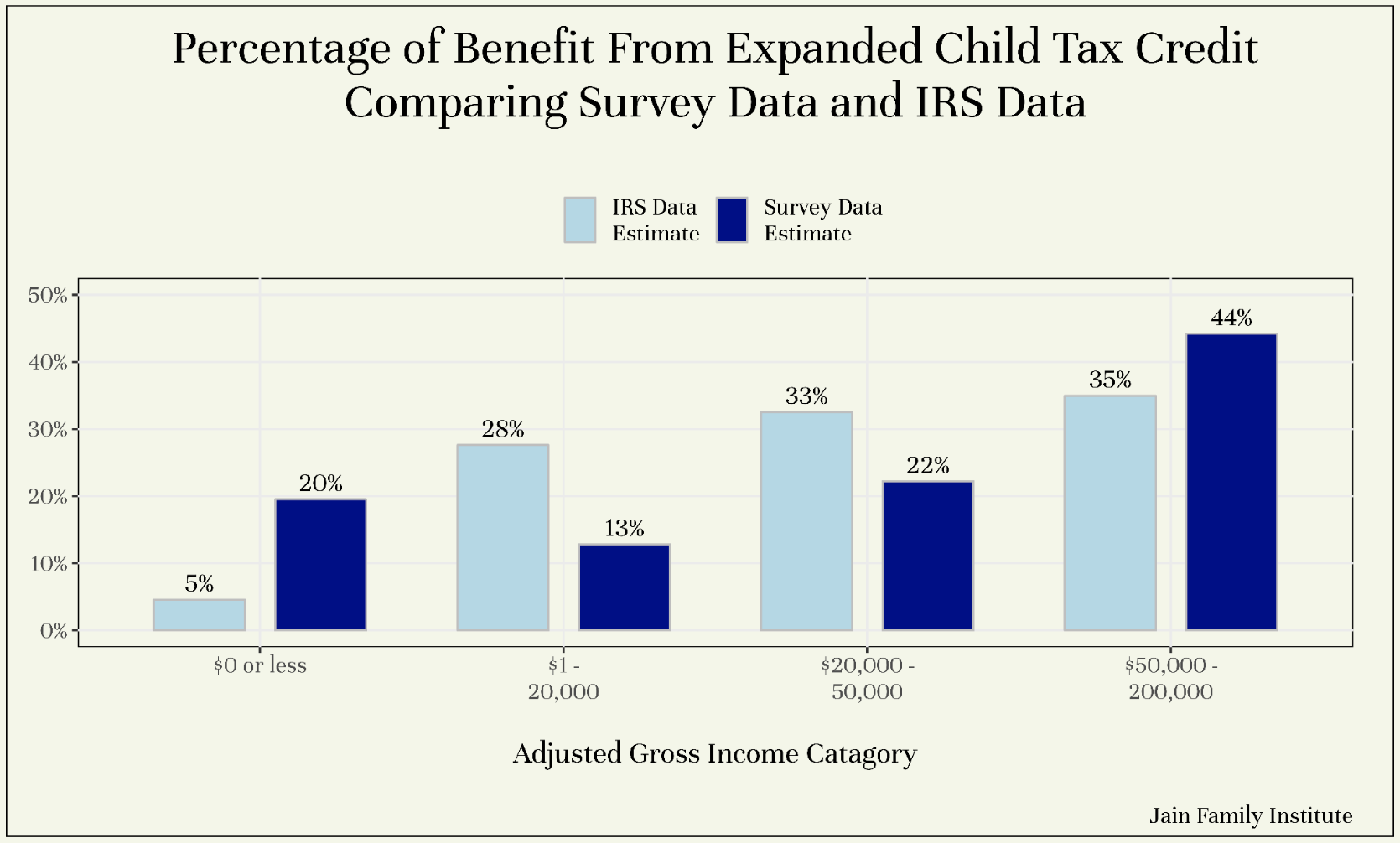

The most controversial aspect of the 2021 expanded CTC was providing benefits to parents out of the labor force. Using administrative IRS data on the incomes of families that received the CTC, I show that families with no income only received 5% of the total increase in benefits from the expansion. Two other groups received the vast majority of the benefits: low-income families who previously didn’t receive the full credit because it phased in slowly, and middle-income parents who benefited from the increase in the value of the credit from $2,000 per child to $3,000 ($3,600 for children under six).

An alternative methodology used by many other think tanks relies on simulating who benefits from the credit using survey data. Survey data misleadingly shows that families with no income consume four times as much of the benefit as the IRS administrative data, while understating the benefits accruing to low-income families. The discrepancy is likely the result of both incomplete take-up among families with no income and inaccuracies in the incomes reported in survey data. IRS data on the incomes of families who claimed the 2021 CTC provides the ground truth on who benefited from the CTC expansion and provides the best guidance on the implications of future CTC expansion designs.

These results provide important context for the debate over extending CTC benefits to families out of the labor force. While controversial, giving benefits to families without earnings made up a small part of the total benefit of the expanded CTC. This rebuffs some criticism that sought to paint the CTC expansion as a program primarily for parents out of the workforce similar to pre-reform cash welfare.

The results also imply that a future CTC expansion that excluded families out of the labor force could still preserve the vast majority of benefits to low-income families. For instance, if the expanded CTC excluded families with no income, but gave the full value of the credit to families with any positive income, it would have reduced the total benefits to families with incomes below $25,000 by just 12%. Alternatively, a phase-in does not provide any credit to families with no income but gives the full CTC at $10,000 of income would provide about 75 percent of the benefits of a fully refundable $2,000 CTC using my methodology based on 2021 filing patterns. While full refundability is important to reducing deep child poverty, an expanded CTC with a fast phase-in may well reduce poverty nearly as much as one that is fully refundable.