Millennial Student Debt

The Distribution of Student Debtors: Data, Narrative, and Debt Cancellation

Overview

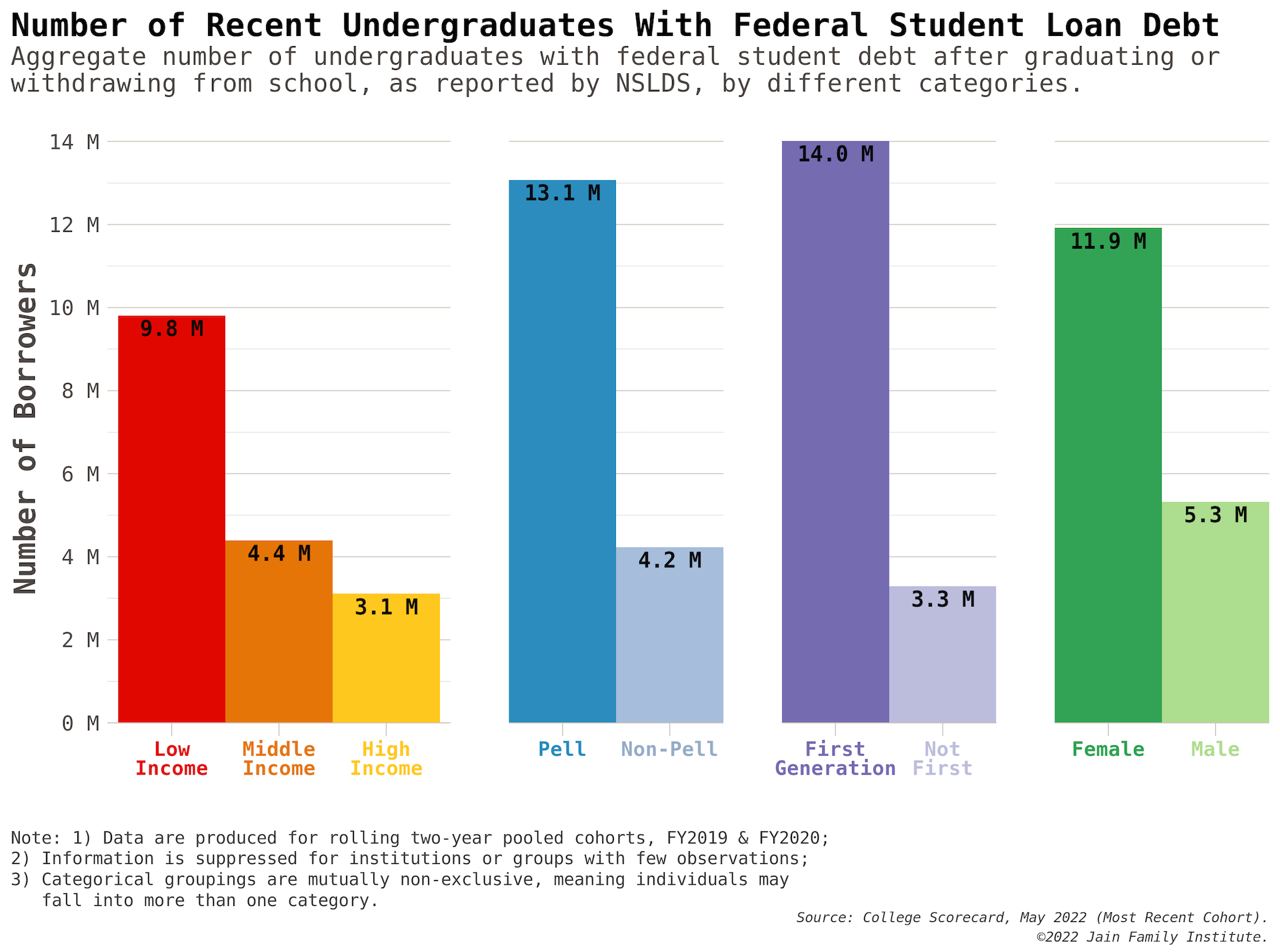

The first sentence of President Biden’s student debt cancellation announcement calls student loan obligations “lifelong burdens” that no longer promise a pathway to a middle class life. The announcement raises how socioeconomic factors determine a borrower’s experience of the student debt crisis—minorities and low-income borrowers utilize debt at higher rates and amounts than their peers, and therefore benefit more from debt cancellation. This report uses three datasets to explore those distributive characteristics of student debtors—a loan-level credit bureau sample, College Scorecard, and the Survey of Consumer Finances—along with revenue projections on the Department of Education’s federal lending program to provide a clearer picture of how debtors stratify along the income and wealth distribution, and how they fare throughout repayment. The prevailing narrative is that most borrowers hail from advantaged backgrounds or will become wealthy due their future cash flows. The resulting analyses directly contradict these claims.

The tenth installment in the Millennial Student Debt project, this report combines three data sources to analyze the demographic distributions of student debt burdens and repayment, providing a counterpoint to narratives that suggest the wealthy are disproportionately burdened by student debt and an inability to repay their loans. The report also suggests trends persist in student borrowing with incommensurate payoffs, casting doubt on the notion of debt-financed credentialization as a “ticket to the middle class.”

Read the full report here.