Policy Microsimulations

Reducing Refundability of the Child Tax Credit: Assessing Poverty Impacts and Trade-offs

By Jack Landry and Stephen Nuñez

Download the full PDF here for best reading experience.

Summary

The Biden administration’s expanded Child Tax Credit (CTC), implemented as part of the American Rescue Plan, represents a milestone in US safety net policy. Assuming full takeup, the program has the potential to cut child poverty by 40 percent over the pre-pandemic status quo (1). However, as structured, the expansion is a temporary measure applied only to the 2021 tax year. Recent negotiations over its extension have raised the prospect of once again limiting the refundability of the CTC—only providing the full benefit for families with a significant income (also called a “work requirement”). This brief assesses the potential impacts of reducing the refundability of the CTC on child poverty compared to the original Biden administration design. It also calculates the cost savings from excluding the lowest income families from the CTC. Finally, it outlines the major challenges in enrollment and payment frequency that this change in refundability entails for IRS benefit administration.

The main findings are as follows:

- Treating the Biden CTC as a baseline, limiting the refundability of the CTC would increase child poverty by 53 percent, leaving behind 3.2 million children.

- The largest impacts would fall on Black children, increasing the Black child poverty rate by 83%.

- Limiting refundability would reduce the cost of the CTC by only 21%: an amount equal to 1% of the federal budget in 2018.

- The CTC’s current, fully-refundable structure is critical to maintaining the viability of monthly prepayments and increased enrollment via the non-filer portal.

The Structure of the CTC Under Limited Refundability

The Biden administration’s expansion of the CTC had three main parts:

- It expanded the credit to make 17 year olds eligible.

- It expanded the credit amounts by $1000-$1600 per child for families with an income below $150,000 ($112,500 for single parents).

- It made the credit fully refundable so that families with low or no reported income would still receive the full credit in the form of a tax refund.

While there appears to be Democratic consensus on keeping the first two CTC reforms in place, recent debate on the budget reconciliation package has surfaced a proposal to restore some form of “work requirement,” or limited refundability to the benefit. This has become a major point of contention in negotiations over the extension of the Biden CTC. Critics of full refundability may have varying ideas about what a work requirement means and how it should be structured, but most have not been specific about suggested changes. Some, however, have explicitly suggested that Congress restore the refundability formula used before the Biden CTC plan. For our analysis, we explore the implications of restoring this refundability formula, which was originally implemented as part of the 2017 Tax Cuts and Jobs Act (TCJA).

Under the Biden expansion, all parents with incomes less than $150,000 ($112,500 for single parents) receive the full value of the credit. Under the TCJA refundability formula, the credit starts to phase in at $2,500 adjusted gross income at a rate of 15% per additional dollar earned, stopping at 70% of the total credit value. The CTC then fully phases-in (above 70% of the credit value) when families start to have tax liability before applying refundable credits that can be offset by the value of the CTC. Figure 1 illustrates the structure of the current “Biden” CTC (red), the credit after bringing back the Tax Cuts and Jobs Act refundability formula (blue), and the credit before the Biden expansion under TCJA (green). We use the example of a married family filing jointly with two children between the ages of 6 and 16, but the basic phase-in and benefit-structure is the same regardless of family composition. For this example, the limited-refundability expanded CTC maxes out starting at about $43,000 adjusted gross income and then retains the original, fully refundable CTC structure. The appendix details the specific formula used to calculate the credit.

Figure 1:

Estimated Impacts

To estimate the impact of the CTC on family income and poverty, we use the 2019 Current Population Survey’s Annual Social and Economic Supplement (referring to 2018 incomes), adding the value of the expanded CTC with and without full refundability relative to the CTC under the Tax Cuts and Jobs Act (2). Similar to other analyses, we estimate that the fully-enrolled and expanded CTC reduces child poverty by 40% over the TCJA-era status quo. Implementing a CTC expansion that retained the TCJA limited refundability formula would instead have cut child poverty by just 8%—less than a quarter of the impact of the unadulterated expansion. To put this another way, if we treat the child poverty rate under expanded CTC as the status quo and the proposal to limit refundability as the policy change, limiting refundability would increase the child poverty rate 53 percent, leaving 3.2 million additional children in poverty.

Figure 2:

Differential Impacts by Race and Geography

The impact of restoring the TCJA refundability formula would not be experienced equally across all demographic groups. Those groups and geographic areas with the highest poverty rates would be disproportionately affected. Below we examine child poverty impacts by race and ethnicity as well as by state of residency. Figure 3 shows the percentage increase in child poverty from switching from a fully expanded CTC to a partially refundable CTC by race. While child poverty levels in each racial and ethnic category would increase from a shift toward partial refundability, the impacts are particularly severe for Black and Hispanic children. The overall child poverty rates for Black and Hispanic children would increase by 83 percent and 52 percent, respectively.

Figure 3:

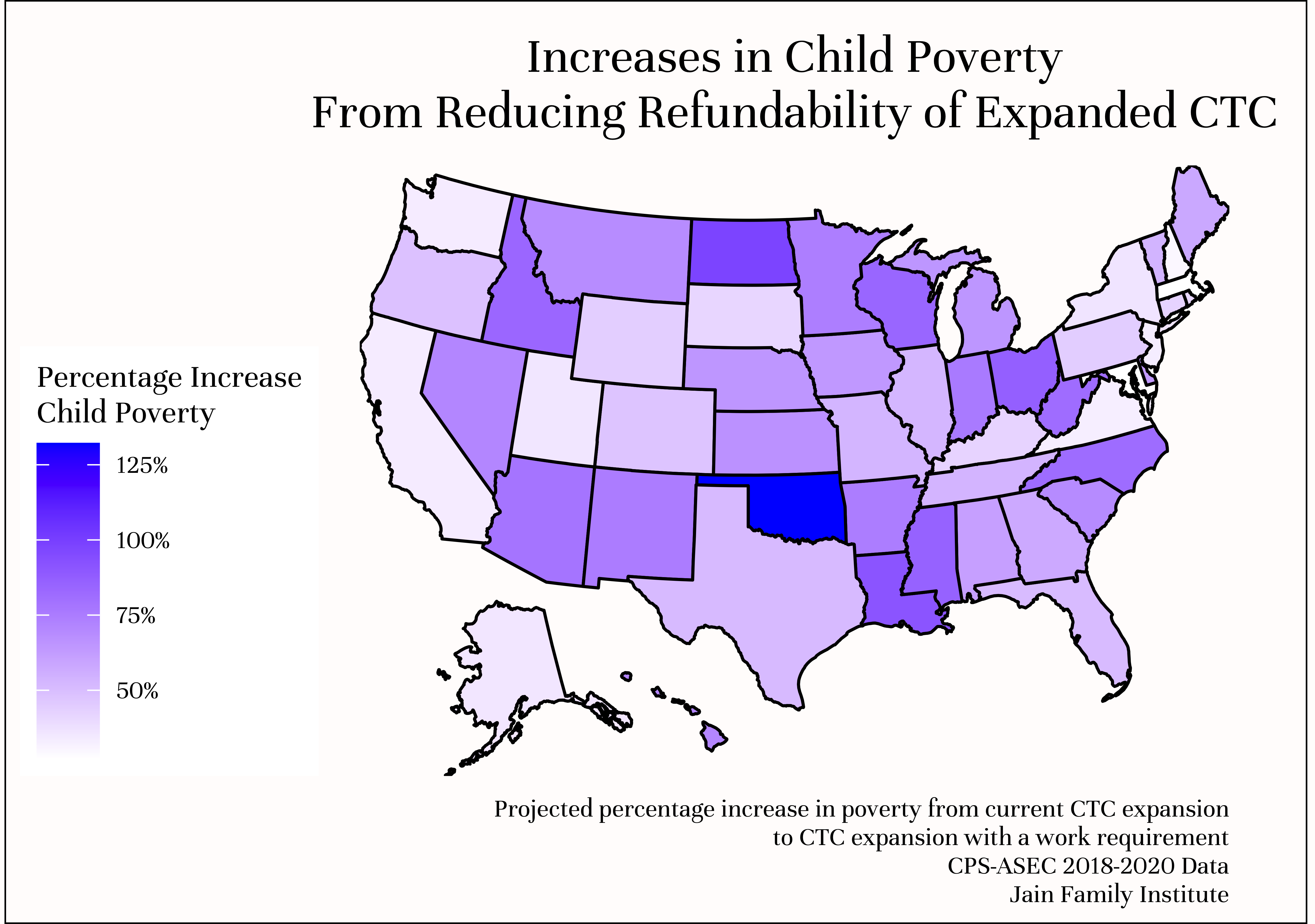

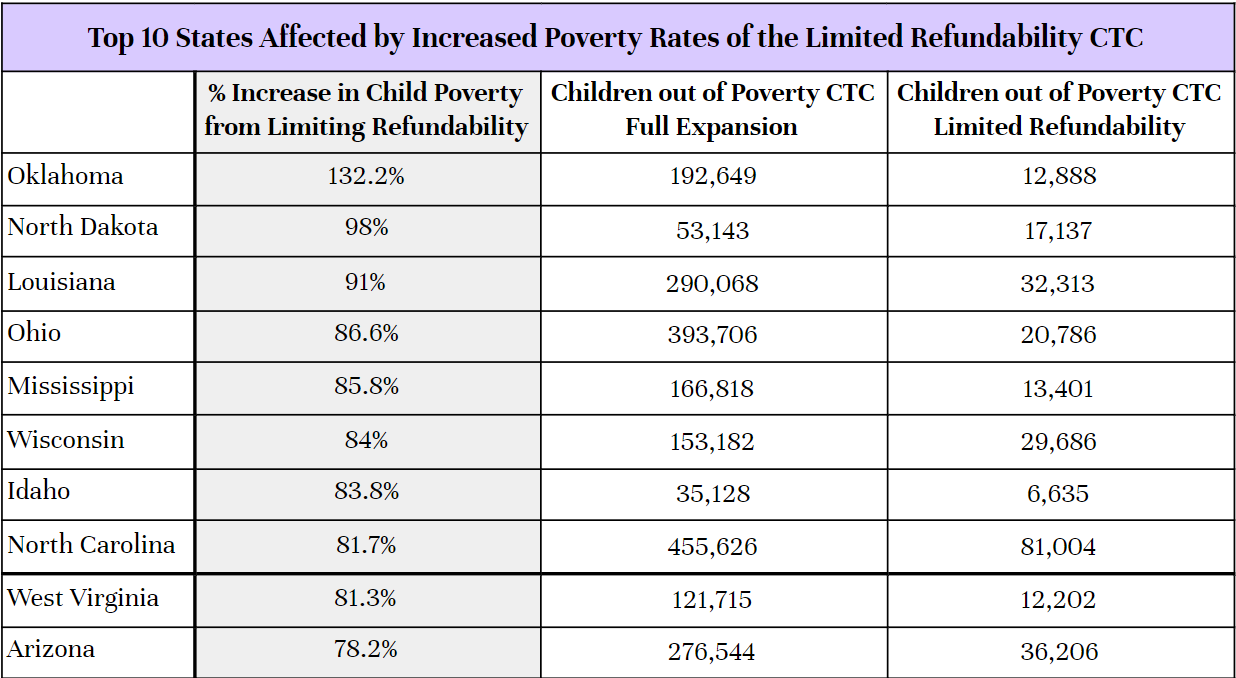

Similarly, as shown in Figure 4, the effects of the policy change would not be felt equally across states. While all states would see significant increases in child poverty (an average of 59%), the largest increases are upwards of 125% (3). Senator Joe Manchin, a Democratic senator from West Virginia, is a major proponent of a CTC “work-requirement,” and a key figure in the ongoing negotiations. However, a return to the TCJA refundability requirement would disproportionately disadvantage children in his state, with an 81% increase in child poverty. Other states with notable increases (the top 10 are enumerated in Figure 5) include Oklahoma, North Dakota, Louisiana, Ohio, and Mississippi.

Figure 4:

Figure 5:

A full list of the state-level impacts of limiting the refundability of the Biden CTC is included in the appendix.

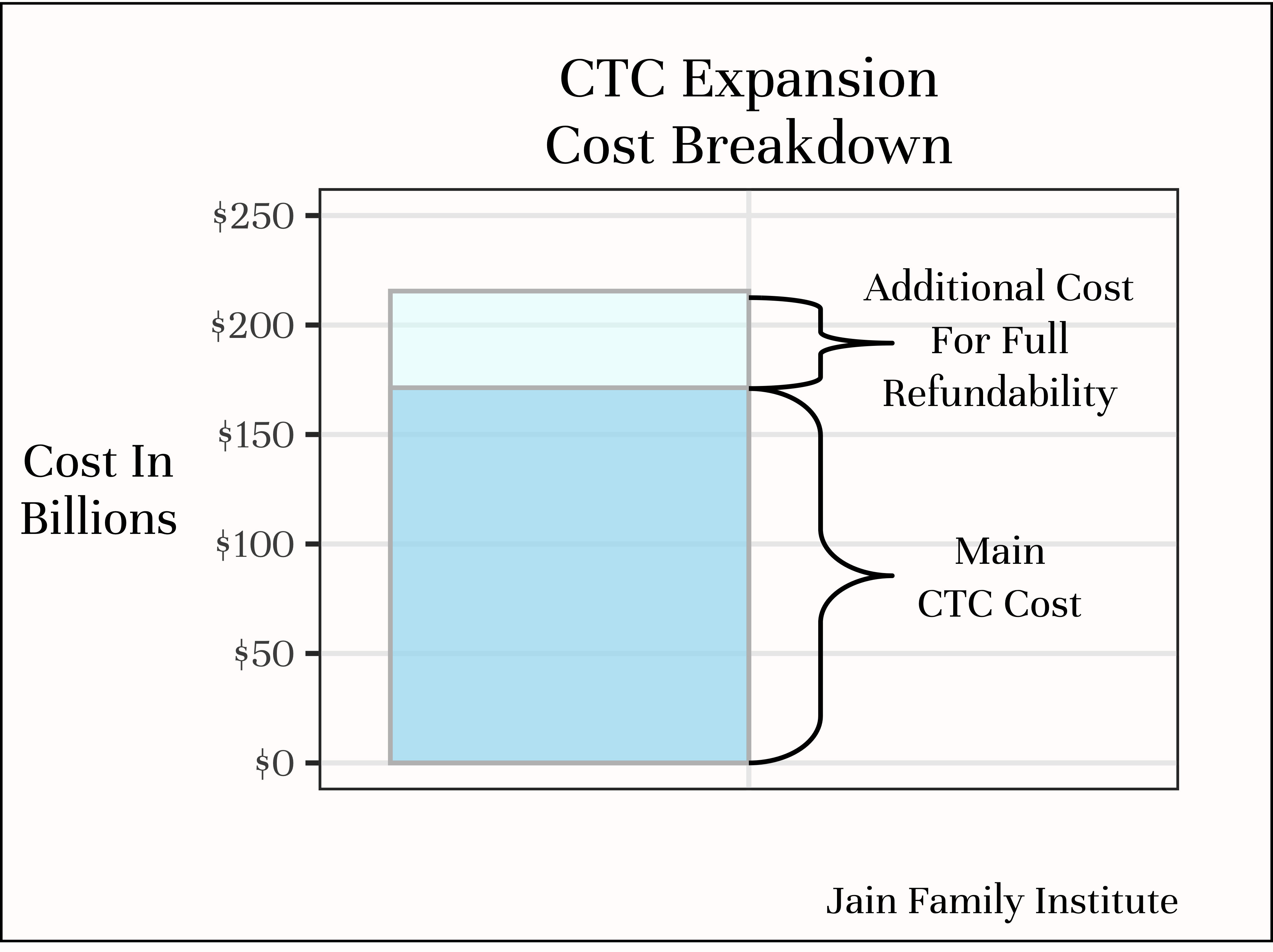

Cost Savings Associated with Limited Refundability

One potential argument in favor of limited refundability might be that it would significantly reduce the cost of the CTC and thus free up resources for other programs. We estimated the cost savings and present findings in Figure 6. Restoring the TCJA refundability formula would reduce the program’s annual cost by only 21%—from $215 billion to $171 billion dollars. This savings represents just 1% of the federal budget in 2018, before the Covid-related budgetary expansions. For further context, consider that the National Academies of Science has estimated that, prior to the pandemic, child poverty cost the economy of the United States between 800 billion and 1.1 trillion dollars per year. In addition, the Joint Economic Committee estimates that the expanded CTC creates over $18.6 billion in spending each month for local economies, given an estimated fiscal multiplier of 1.25 on monthly CTC transfers. Those spillover effects complicate the flat “cost savings” of limiting CTC refundability.

Figure 6:

Administration

In addition to the large increases in child poverty, removing the full refundability of the CTC would have important knock-on effects that would make the administration of the credit worse for beneficiaries. First, the full refundability of the CTC enabled low-income families to go through a simplified tax filing process (the non-filer portal) to claim their benefits. Since low-income workers would get the full CTC benefits regardless of their precise income level, they do not need to fill out a full tax return to verify their income (4). If refundability was removed, the value of the credit would be entirely dependent on the income of the recipient, which would necessitate a full tax return and make the non-filer portal obsolete. Because this is a burdensome process for a potentially meager benefit, many families will not file and thus will not receive any credit—diluting the anti-poverty impact even further. Adding a “work-requirement” to other public assistance programs has not increased working, but has vastly reduced the number of people claiming benefits (even among the eligible) due to the increased administrative burden needed to verify eligibility (5).

Second, limiting refundability would complicate the CTC’s monthly prepayment schedule, likely making it unworkable. Currently, CTC payments are being made based on tax returns from 2020 or 2019, though the credit will eventually be based on 2021 earnings. This structure works under the current CTC full-refundability structure because if families lose income, they will only get a larger credit. If the CTC again phases in based on income, families who lose income around the phase-in threshold will get a smaller credit, and prepayments based on the previous year’s income will be overpayments that need to be paid back at tax time. For families facing income loss, this will only compound their hardship and heighten the effects of income volatility. Overpayments under the current structure accrue only to families who see increases in income, which are far less problematic and limited by the CTC’s safe harbor provisions.

Conclusion

We have argued elsewhere that conditioning safety net benefits on work extracts a heavy toll on American households and on the economy itself. The results of this microsimulation underline these costs. Imposing work requirements by limiting the refundability of the Child Tax Credit would impoverish millions of children and save little money in the short run while imposing huge costs on the economy in the long run. A move to limited refundability may be considered “penny wise, pound foolish” when accounting for the trade-offs outlined in this brief. The Biden CTC represents the clearest break yet from the failed logic of the Welfare Reform era inaugurated by the Personal Responsibility and Work Opportunity Reconciliation Act of 1996. The federal government has an opportunity to create an effective anti-poverty tool and major investment in the economy—rather than return to business as usual.

Appendix

View the PDF here for full appendix.

Specifics of the “Work-Requirement,” Limited Refundability CTC Policy

To model the CTC with a work requirement, we follow the refundability structure of the CTC under the Tax Cuts and Jobs Act (TCJA), but retain the higher benefits amounts and 17-year-old eligibility as in the America Rescue Plan Act’s (ARPA) expansion. In practice, this modifies the CTC to create a “phase-in” of the credit, rather than providing the full credit amount to all low-income families.

Under the TCJA, the CTC first offsets tax liability. If, after applying all other refunds and credits, a tax-unit had a tax liability greater than the total amount of their CTC credit, they would receive the full credit in the form of a lower tax bill. Tax-units who had negative tax liability after applying the CTC credit were entitled to a partial refund (a larger refund than they would get without the CTC). The partial refundability calculation worked as follows: Tax-units with an adjusted gross income (AGI) over $2,500 could start to receive a larger refund of 15% of their total AGI above $2,500. For instance, a tax-unit with an AGI of $10,000 could receive a refund of $1,125 if they had no net tax liability before applying the Child Tax Credit (6). However, the CTC refund amount under the TCJA was capped at $1,400 per child, while the maximum credit for those offsetting their tax liability was $2,000 per child. We use the same fraction to calculate the total potential refund (70%) for our modeling, so the maximum refundable portion of the expanded CTC with a work requirement would be $2,100 per child. ($2,520 per child under 6.) For tax-units with tax-liability partially offset by the CTC, the remaining portion of the CTC could be refunded per the refund formula (15% of AGI above $2500) as long as it did not exceed the maximum refundable amount. For simplicity, we ignore the alternative refund formula that could apply to a small fraction of households with three or more children. We do not modify the phase-out structure, so the partially and fully refundable CTCs both phase-out the same way.

Some specific examples can help illustrate the formula. As in Figure 1, all examples will refer to a two-parent family filing jointly with two children between the ages 6 and 16. With $2,500 or less in income, this family would receive no credit under partial refundability, because they have no tax liability and are below the point where the refundability formula kicks in. With $10,000 of adjusted gross income, the family would get $1,125 in credits. The family still does not have tax liability, so their credit is solely determined by the refundability formula, which gives ($10,000-$2,500)*.15=$1,125. At $30,000 of income, the CTC would be worth $4622.65 This amount comes from adding both the amount given by the refundability formula ($30,000-$2,500)*.15=$4,125 and offsetting $497.65 of tax liability. At $35,000 of income, the CTC would be worth $5,197.65. Here, the refund formula would give $4,875 and offsetting tax liability would give $997.65. However, the maximum refundable amount is 70% of the full credit value, which, for two kids ages 6-17, is $6,000*.7=$4,200. The full value ($6,000) kicks just past $43,000 in adjusted gross income, where families have $1,800 of tax liability and get $4,200 from the refundability formula. Under the fully refundable CTC, this hypothetical family would receive the full value of the credit until they hit the initial phase-out region at $150,000 of adjusted gross income.

In Figure 1, the first slope divergence between the TCJA CTC and the Biden partially-refundable CTC happens because the TCJA CTC hits its maximum refundable level before the CTC expansion does. The next change in slope for the CTC expansion comes when tax liability post nonrefundable credits begins to take effect. At this point, the credit value increases via the refundability formula and via offsetting a net tax liability. The next slope change is due to the refundable CTC hitting its refund maximum—further increases exclusively come from reductions in tax liability. The TCJA CTC plateaus at the maximum refund level, then increases as it offsets tax liability until it reaches the maximum credit value.

Microsimulation Methodology Details

As noted in the main text, we use 2018 data (the 2019 CPS-ASEC) to simulate the impact of the CTC on a “steady state” economy rather than the pandemic-induced recession economy with abnormally high unemployment levels and a temporarily more generous safety net. Income is inflated to 2021 levels. Income data for 2019 was collected in 2020 at the start of the pandemic and thus is affected by Covid-related nonresponse bias.

To form filing units in the CPS-ASEC, we use the methods from Jones and Ziliak, which showed greater accuracy at matching administratively-measured EITC distributions relative to the Census tax model’s filing units in the CPS. To estimate CTC payments for each filing unit under the current expanded CTC and the TCJA CTC, we use the Policy Simulation Library’s Tax Calculator Version 3.2.1. CTC payments based on an expanded CTC with limited refundability were hand-coded. We only estimate how the expanded CTC would affect 2018 income and poverty, omitting other policy changes like expanded SNAP, unemployment insurance, etc. All poverty references use the 2018 Supplemental Poverty Measure. Even though CTC payments are disbursed between 2021 and 2022, we estimate the anti-poverty impact of the CTC counting the entire credit as 2021 income, which is consistent with other reports on the CTC’s impact. Similarly, we assess the impact of reduced refundability assuming all the changes affect a single year’s income.

Comparison of Cost Estimates

We estimate that the full cost of the CTC under the Biden expansion costs $216 billion dollars per year if fully enrolled. Limiting the expansion’s refundability would reduce the cost to approximately $171 billion dollars, and the CTC under the TCJA would cost $117 billion dollars. Therefore, we estimate the cost of the full CTC expansion relative to the TJCA is $99 billion dollars, similar to the JCT estimate of $105 billion dollars.

State-Level Poverty Rates of the CTC Proposals

View the PDF here for a full table of state-level poverty impacts of limited CTC refundability.

Footnotes

- Even if you account for people who are eligible but do not receive their CTC benefits (nonfilers), the reduction in child poverty from the CTC is set to be among the largest reductions in child poverty on record.

- We use 2018 data to simulate the impact of the CTC on a “steady state” economy, rather than the pandemic-induced recession economy with abnormally high unemployment levels and a temporarily more generous safety net. Data on 2019 incomes was collected in 2020 at the start of the pandemic, and thus is affected by Covid-related nonresponse bias. We also assume perfect uptake of the CTC among eligible families. While accounting for non-filers would reduce the poverty impact of the Biden CTC, it also reduces the impact for a hypothetical limited refundability CTC.

- We use three years of data (the 2018, 2019, and 2020 CPS-ASEC) for the state level impacts to compensate for small, single year samples in some states.

- Families with children are generally not required to fill out a tax return until they hit $18,650 to $27,400 of income.

- Even the conservative-leaning Tax Foundation projects that the CTC expansion will reduce hours worked by less than .05% and the total number of jobs by .03%.

- The refund calculation is ($10,000-$2500)*.15