New Research in Millennial Student Debt: Relief for Borrowers with Negative Amortization

Today, Laura Beamer, Eduard Nilaj, and Marshall Steinbaum of JFI’s Higher Education Finance initiative published the first installment of part 14 of their flagship Millennial Student Debt research series.

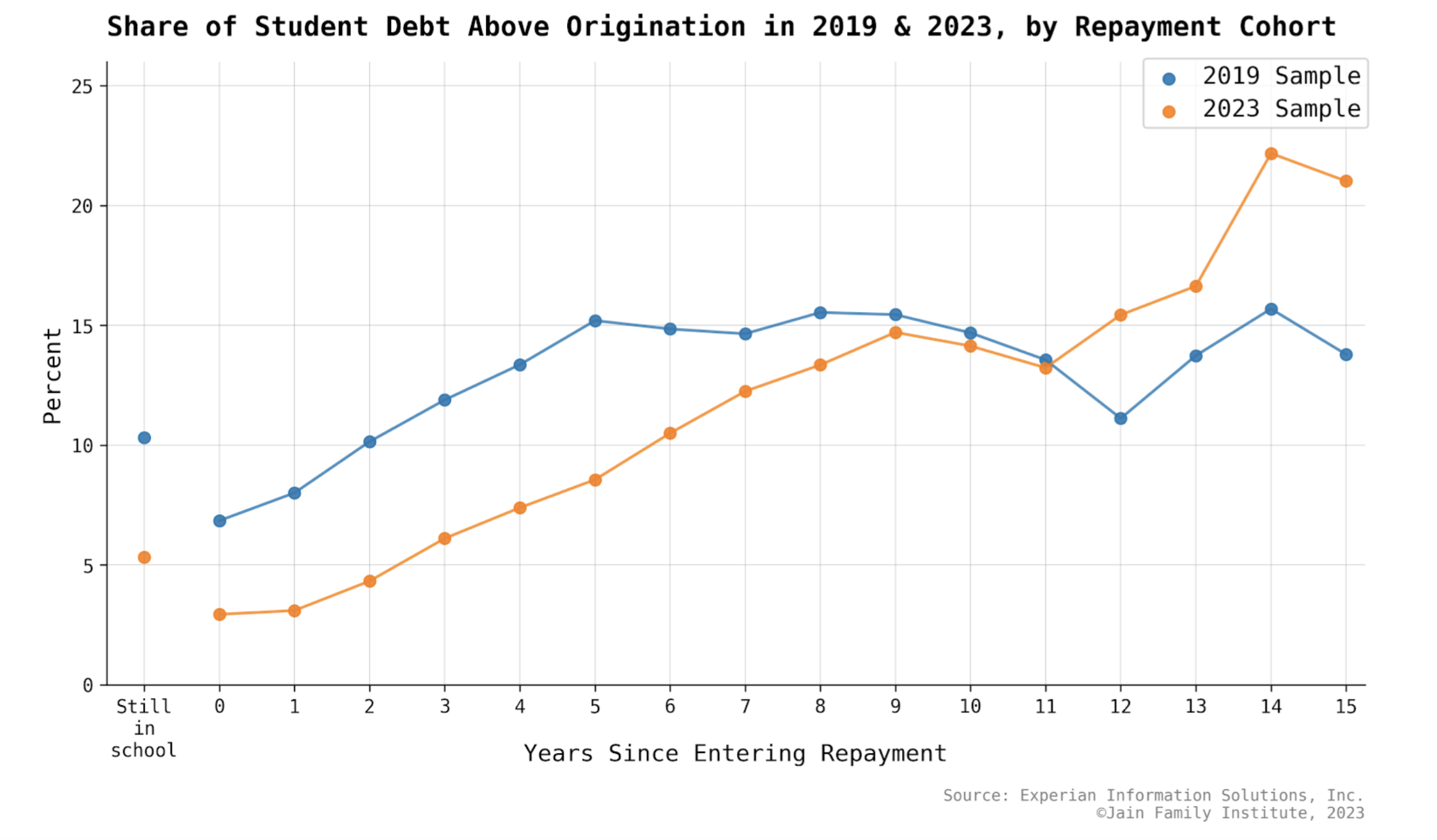

The new report, “Student Debt Relief for Borrowers with Negative Amortization,” analyzes the impact of the repayment pause—the two and half year period in which repayment of federal student loans was formally paused thanks to the pandemic repayment moratorium—with a specific focus on borrowers experiencing negative amortization, a scenario where borrowers owe more than they originally borrowed.

From the summary:

Our findings indicate that the repayment pause significantly aided younger cohorts in avoiding interest accrual, thus reducing negative amortization occurrences. We see these distinct differences after analyzing the repayment patterns for the 2019 and 2023 samples. We note a persistent trend of non-repayment among older cohorts, contrasting sharply with the positive impact of the repayment pause on newer cohorts.