Millennial Student Debt

Student Debt Relief for Borrowers with Negative Amortization

Part 14A in our Millennial Student Debt Series.

AN OVERVIEW OF THIS REPORT

During a pivotal moment in U.S. student loan policy, this report offers a thorough analysis of student loan debt, with a specific focus on borrowers experiencing negative amortization — a scenario where borrowers owe more than they originally borrowed. We present this analysis in the context of the Department of Education’s 2023-2024 Negotiated Rulemaking session, centered around student loan debt relief. Our key findings and analyses include:

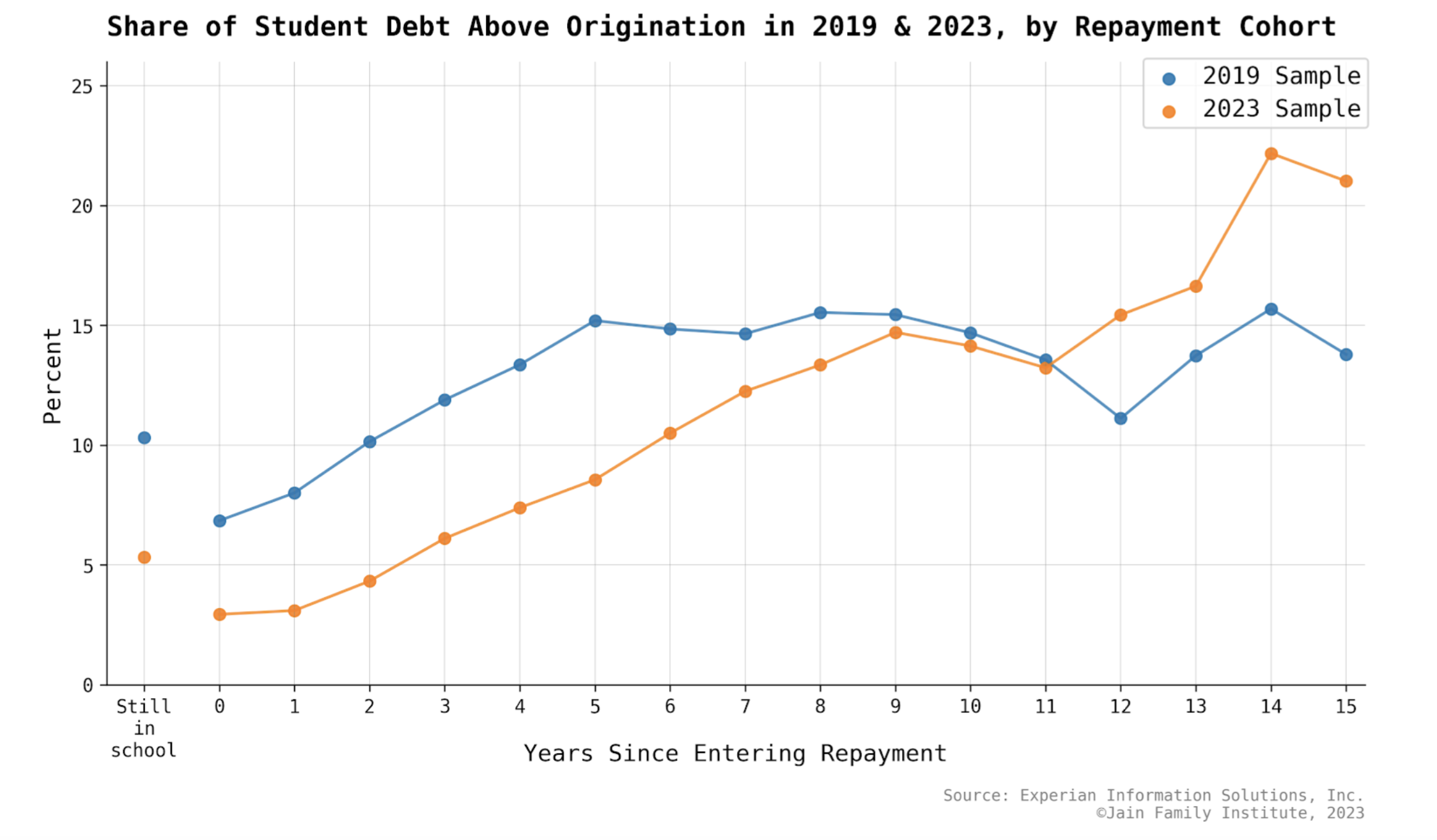

- Repayment and Negative Amortization: We observe that the majority of borrowers, in both the 2019 and 2023 samples, are making slow progress in repaying their loans. We noted a significant deceleration in loan repayment among older cohorts in 2023 compared to those in 2019, indicating a lengthening trend in the time taken to repay student loans. Alarmingly, a substantial portion of borrowers are experiencing negative amortization, a condition which, once established, is unlikely to be reversed.

- Impact of the Repayment Pause: Our findings indicate that the repayment pause significantly aided younger cohorts in avoiding interest accrual, thus reducing negative amortization occurrences. We see these distinct differences after analyzing the repayment patterns for the 2019 and 2023 samples. We note a persistent trend of non-repayment among older cohorts, contrasting sharply with the positive impact of the repayment pause on newer cohorts.

- Policy Recommendations: Based on our findings and previous research, we advocate for a policy that caps the total balance on federal student loans at the origination amount. This recommendation is in line with the SAVE repayment plan’s principles and addresses systemic issues in student loan repayment. Our study highlights the urgency for timely and proactive measures; as we show, prolonged periods of negative amortization significantly decrease the likelihood of repayment. The Department of Education can prevent unpayable debt spirals by being proactive and ensuring that negative amortization is a thing of the past.

Our main objective is to provide a unique and substantial contribution to the ongoing policy discussions on student debt relief. We aim to inform policy makers and stakeholders whose decisions can greatly impact the financial circumstances of borrowers, and guide the Department of Education towards creating more equitable and effective student debt relief policies. The implementation of these policies will not only provide immediate relief but also contribute to a more sustainable student loan system in the long run, benefiting current and future borrowers.