Millennial Student Debt

Student loans, the racial wealth divide, and why we need full student debt cancellation

By Andre M. Perry, Senior Fellow, Metropolitan Policy Program, Brookings; Marshall Steinbaum, Senior Fellow, Higher Education Finance, Jain Family Institute, Assistant Professor of Economics, University of Utah; and Carl Romer, Research Assistant, Metropolitan Policy Program, Brookings.

June 24, 2021. Cross-posted from Brookings Metro.

Join the authors for a Brookings webinar on Monday, June 28, 2021.

“No matter what you want to do with your life, I guarantee that you’ll need an education to do it,” President Barack Obama said in a 2009 national address to students. Such guidance is regularly told to Black people: The way to get out of poverty and achieve middle class status is to get a college degree.

But a college degree does not eliminate the income gaps between white and Black workers. Black students finance their education through debt, and thus college degrees actually further contribute to the fragility of the upwardly mobile Black middle class. And because education does not achieve income parity for Black workers, the disproportionate debt Black students are taking to finance their education is reinforcing the racial wealth gap. Today, the average white family has roughly 10 times the amount of wealth as the average Black family, while white college graduates have over seven times more wealth than Black college graduates.

Most analysts believe there is a student debt problem in the United States, and even conservative scholars acknowledge some debt must be forgiven. Tuition is outpacing students’ ability to pay, and the share of students taking out loans to finance their degrees rose from roughly half (49%) to over two-thirds (69%) from 1993 to 2012, according to the Pew Research Center. Between 1993 and 2020, the average loan amount grew nearly three-fold, surpassing $30,000.

Past discrimination should compel researchers and experts to seek solutions to the student debt crisis that center the experience of Black people. The Black-white wage gap is getting worse, while Black communities’ indebtedness is increasing. If we can create systems that recognize these lived experiences, we can create more equitable outcomes for everyone.

Figure 1. Changes in student debt and median income by race

A focus on incomes hides the Black student debt crisis

Disagreement on the extent of the student debt problem tends to center on the positive correlation between educational attainment and income. Scholars who downplay the problem of student debt tend to assume that that relationship is causal, and that student borrowers are largely able to repay their loans out of the higher income their borrowing financed. However, too great a focus on income can lead researchers to wrongly assume that people with similar incomes have the same ability to pay back student loans.

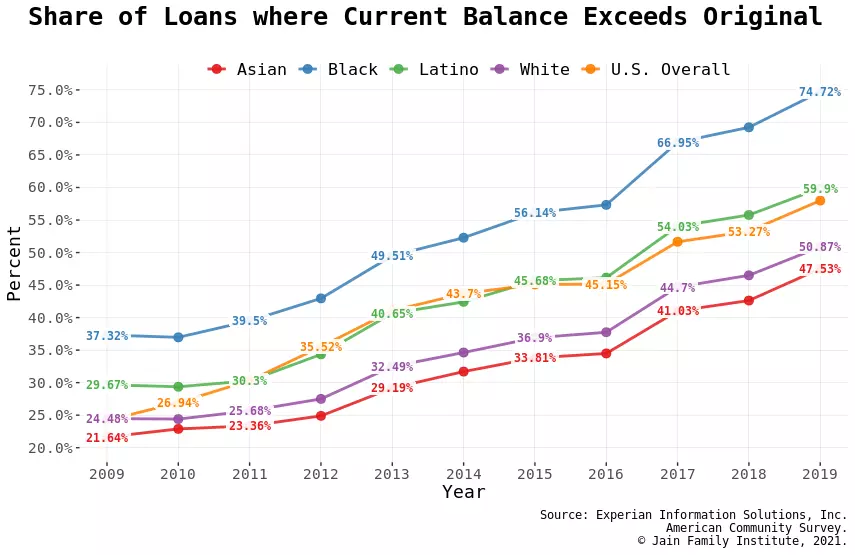

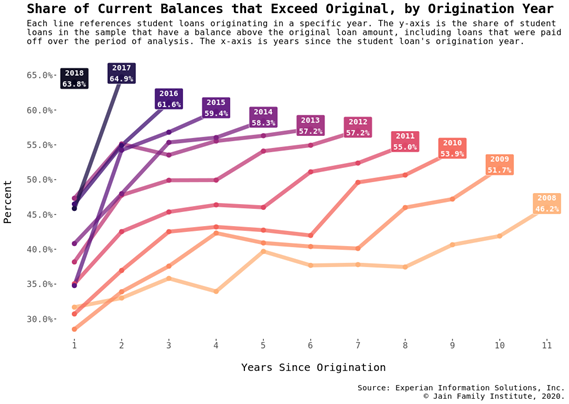

Regardless of the incomes they make after graduation, Black households carry more student debt, which pushes down their creditworthiness. Unsurprisingly, then, Black people with a college degree have lower homeownership rates than white high school dropouts. Moreover, research from the Federal Reserve Bank of St. Louis finds that after college graduation, white households receive wealth transfers from their family to help pay for things like the purchase of a home. Black households, on the other hand, transfer their increased post-college income to help their family. Different patterns of intergenerational transfers contribute to nearly three-quarters of Black borrowers’ student loans having a higher balance today than they did originally.

Figure 2. Share of loans where current balance exceeds original

The nation’s tax system invisibly subsidizes high-wealth households, who use Coverdell and 529 education savings accounts so that tuition functions as a tax-advantaged intergenerational transfer. For students with education debt, the IRS allows tax filers (married or single) to deduct up to $2,500 in student loan interest from their taxes each year. This means that borrowers with high debts will only be able to deduct a portion of their interest payments. According to our Brookings colleagues, four years after graduation, the average Black college graduate owes $52,726, compared to $28,006 for the average white college graduate. With federal interest rates between 2.75% and 5.3%, the average white household will be able to deduct their complete interest payment each year while the average Black household will not. The tax system prevents low-wealth, high-income households from ever catching up with high-wealth households.

Student debt cancellation is not regressive

The most frequent argument against cancelling student debt is that it would be regressive: Because student debtors have college educations, they are better off than those who ostensibly didn’t go to college. A variation on this claim is that higher-balance borrowers tend to have higher incomes. The former claim rests on a comparison of student debtors to those without student debt (and imputes incomes to each group), while the latter concerns comparisons between borrowers.

Neither claim is factual. First, having student debt does not entail that one went to college, let alone graduated. Many families assume student loans to contribute toward their children’s and grandchildren’s education; indeed, policy encourages this in the form of parent PLUS Loans, which institutions actively market to the parents of their enrollees.

Second, having student debt signifies that the debtor’s family did not pay for college. More and more people are going to college, which means that the set of people who have student debt within that group increasingly consists of people who financed college themselves. For that reason, having student debt is now a marker of relative disadvantage, because it means the student’s family did not pay their tuition.

Finally, proposals for student debt cancellation would cancel the majority of loans, for which the federal government is creditor. But a private market for student loan refinancing exists to offer generous terms to the most creditworthy borrowers. The borrowers who’ve refinanced out of the federal system are likely the highest earners and least likely to default—therefore, the beneficiaries of cancellation would be the lowest-income subset of student loan borrowers.

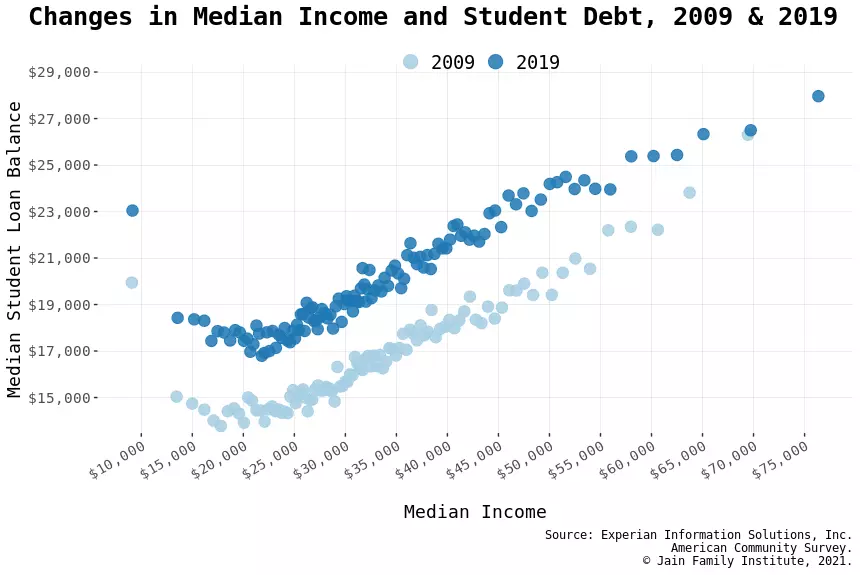

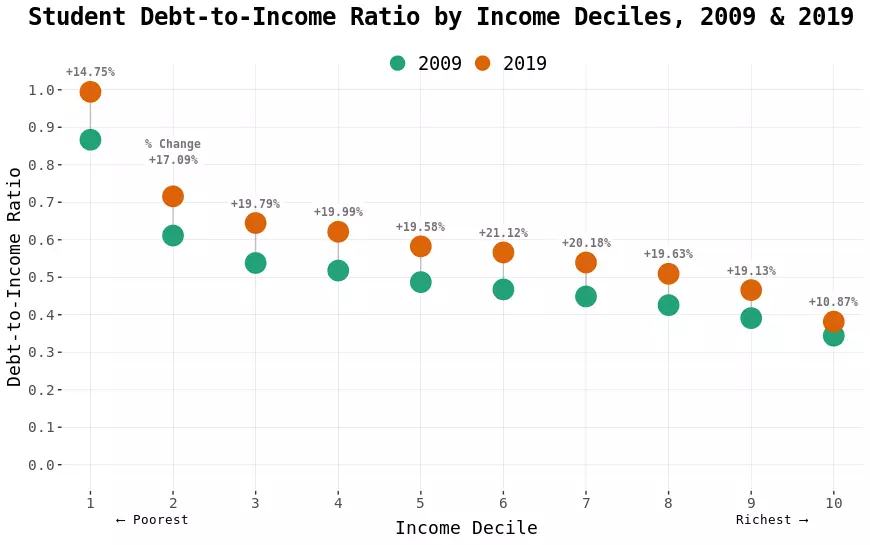

The other half of the claim—that student loan balances, in dollar terms, correlate positively with income—is true in a static sense, but it does not mean that cancelling student debt is regressive. Figures 3 and 4 below show the relationship between loan balance and census tract median income in a cross-section of student loan borrowers in both 2009 and 2019. (We do not observe the income of debtors specifically, so we impute it based on the median income in the neighborhood where they live.) They show that loan levels are growing rapidly, and student debt as a share of income is highest—and growing fastest—in the lowest-income areas.

Figure 3. Changes in median income and student debt, 2009 and 2019

Figure 4. Student debt-to-income ratio by income deciles, 2009 and 2019

That is why the claim that student debt cancellation is regressive is false. We measure regressivity in relationship to income (or wealth), not to raw dollar amount. The latter metric would mean that Social Security is a regressive social program since it pays out higher benefits to higher-income beneficiaries, and that consumption taxes are progressive because higher-income consumers spend more dollars on their consumption. Of course, Social Security is widely and correctly credited as the federal program that does the most to reduce poverty, and consumption taxes are canonically regressive taxes, because poorer people expend a larger share of their income on consumption and save little. Because loan balances as a share of income are highest for lower-income borrowers—and so much higher as to be negative for low-wealth borrowers (many of whom have negative balance sheets thanks to student debt)—cancelling student debt would make the income and wealth distributions more egalitarian and nearly eliminate negative net worth households from the wealth distribution. That is the definition of a progressive—not regressive—program.

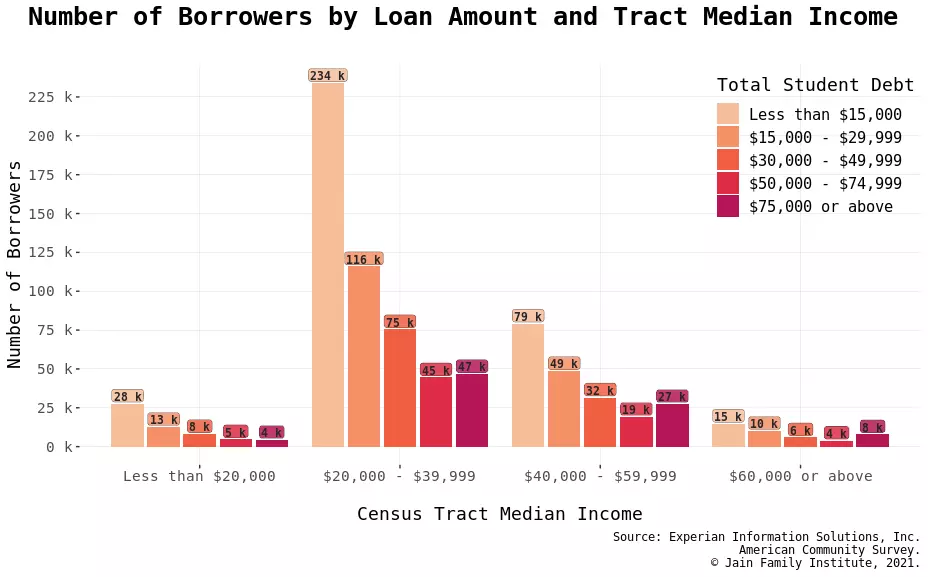

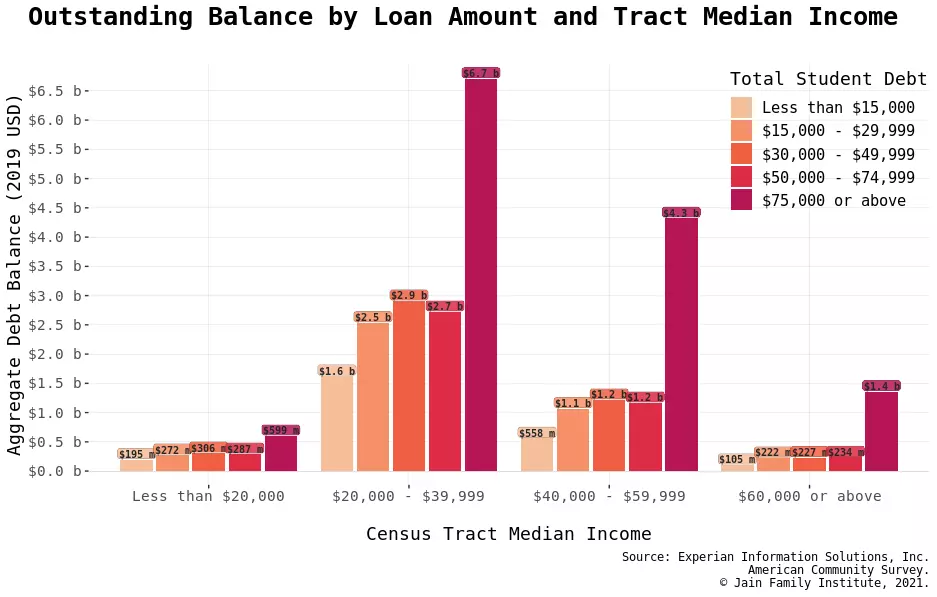

The picture of who has student debt is further detailed by looking at the intersection of income, loan amounts, and the probability of borrowing. Figure 5 below plots the number of borrowers by outstanding balance according to census tract median income. Figure 6 shows the total loan balance according to census tract median income—i.e., what amount of total outstanding debt is held by borrowers who hold a given total balance and live in a tract with a given income?

The claim that student debt cancellation is regressive tends to be followed by pointing out that a large number of borrowers have a small amount of debt, and a relatively small number of borrowers carry a large portion of the total debt burden. That much is true, but the unstated implication is that the low number of high-balance borrowers that would benefit the most from cancelling outstanding balances tend to also have higher incomes.

That implication is false. The plurality of outstanding debt is held by borrowers with higher balances who live in census tracts in which the median income is between $20,000 and $40,000. Meanwhile, high-income census tracts account for a very low number of borrowers, suggesting that better-off people are less likely to have student debt. The claim that student debt cancellation is regressive rests on a mistaken understanding of who has student debt and who has what amount of student debt. It vastly overinterprets the positive cross-sectional correlation between loan balance and income, and misconceives the definition of regressivity in the first place.

Figure 5. Number of borrowers by loan amount and tract median income

Figure 6. Outstanding balance by loan amount and tract median income

Why income-driven repayment is not a solution to student debt

There’s another good reason to cancel student debt: For many borrowers, it’s never going to be paid back. In fact, current policy encourages nonrepayment while at the same time failing to confront its implications. This is why student debt cancellation isn’t comparable to other policies for redistributing wealth or income—its impact, distributional or otherwise, can’t be evaluated de novo, because it’s already happening.

As student loan balances have escalated and the set of borrowers has diversified, repayment has become increasingly difficult. The policy solution for student loan default has been multifaceted, including refinancing defaulted loans with loans that are not (yet) in default. But perhaps the most effective cure has been to simply reduce required payments to a given percentage of “disposable income,” which has been done through income-driven repayment (IDR). The result is converting the short-term problem of delinquency into a long-term problem of nonrepayment.

IDR radically shifts the premise of the student loan program, away from a given principal balance and a fixed repayment term (generally 10 years), and toward income as the basis for repayment amounts. If IDR reduces required payments, the effect is to lengthen repayment terms (if payments are sufficient to cover interest) or to increase principal balances (if they aren’t). IDR programs all have this common structure: Borrowers are required to make payments equal to a given percentage of their disposable income for a certain number of years, and if any principal remains outstanding after that term, it is forgiven.

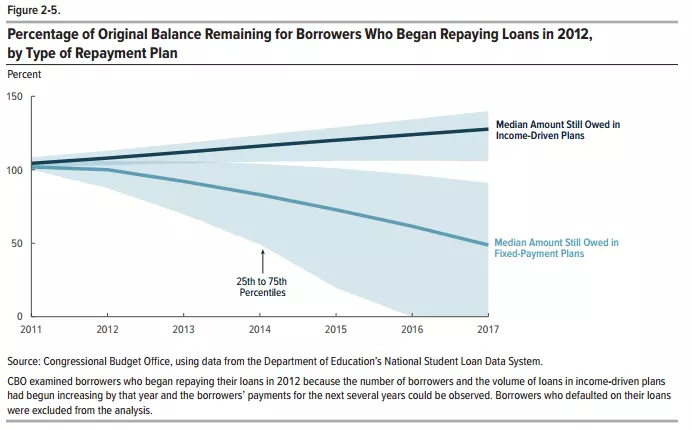

Figure 7. Percentage of original balance remaining of borrowers who began repaying loans in 2012, by type of repayment plan

The expansion of IDR enrollment has had its intended effect: Student debt defaults are down since 2015, as is repayment. Figure 7 comes from a Congressional Budget Office report on IDR, and shows repayment for loans in traditional plans versus IDR for borrowers who commenced repayment in 2012. Not surprisingly, balances on loans in IDR are increasing over time rather than decreasing.

To further illustrate this point, in Figure 8 we show nonrepayment on student loans across origination year. Our data shows that the share of loans in which the balance is increasing rather than being paid down is rising both over time and across origination years, to the point that a majority of loans now have a higher balance than they did initially. This is why we assert that these loans are never going to be repaid—the only question is whether borrowers carry the nominal balance until they reach the end of the IDR repayment period, or whether the bad debt is acknowledged now and the balance written down in the interim.

Figure 8. Share of current balances that exceed original, by origination year

The premise of expanding IDR appears to have been that student debt default must be due to temporary factors such as difficulty finding a job at an income sufficient to pay off loans. If the causes of delinquency and default are temporary, then, IDR is a temporary solution to that failure of income to line up with required payments. This effectively extends the forbearance that is a standard feature of student loans, lasting six months following completion, into the future indefinitely on an opt-in basis, until such time as the borrower is able to find a job.

Like much else about the federal student loan system, that diagnosis is based on an oversimplified picture of who students are—that all students attend college before entering the workforce, at which point they will enjoy higher earnings thanks to the college wage premium. It also assumes higher education will always result in an earnings increase sufficient to retire debt, at least eventually. These false assumptions render IDR ineffective at addressing underlying problems; we’ve shifted the increased cost of higher education away from state governments and onto the shoulders of an increasingly diverse student population (with less ability to rely on parents to pay for more education). Meanwhile, earnings stagnated thanks to a macro-level reduction in worker bargaining power.

Since IDR borrowers have come to rely on eventual cancellation (and thus the program is no longer reasonably understood to be temporary), the rhetoric in which it’s defended has shifted. Now the claim is that IDR is a de facto graduate tax—a (flat) income tax assessed on college graduates in perpetuity to pay for their degree. There are several major problems with that defense: First, not all college graduates have to pay the tax, since some had their education paid for by their families. In that sense, IDR-as-graduate-tax is obviously inequitable.

Moreover, in higher education systems that are significantly financed with a graduate tax, there’s no notional “debt” hanging over individuals and impairing their creditworthiness. One could debate whether a graduate tax is a more just way to finance higher education than doing so out of a general income tax assessed regardless of education, but that isn’t what expansion of and permanent enrollment in IDR is. The claim that IDR is a graduate tax appears to be aimed at establishing that this is a more just means of financing higher education than free college financed out of general revenues or student debt cancellation when prior cohorts didn’t benefit from it.

Some scholars claim that student debt cancellation is regressive because the lowest-income borrowers don’t have to pay it back thanks to IDR, so cancellation disproportionately benefits higher-income borrowers for whom IDR offers less. But this claim is misconceived; aside from its ignorance of the scholarship about who benefits from IDR, not repaying student debt is not a sign that someone isn’t burdened by their student debt—quite the opposite. The authors claim that Black borrowers are less burdened by their student debt than white borrowers because Black borrowers earn less money. They also ignore the refinancing out of federal loans that has already taken place, which disproportionately benefits well-off borrowers while removing them from any notional forgiveness of federal loans. For that reason, the claim that cancellation is regressive precisely because the lowest-income borrowers wouldn’t benefit from it (due to a tendentious and unempirical reliance on IDR) misses the fact that the highest-income borrowers also wouldn’t benefit from it.

The escalating balance on outstanding student loans and the difficulty borrowers have paying it back represent the accumulated consequences of shifting from public funding to tuition-based business models in higher education—all financed by federal student loans. The idea was supposed to be that increasing higher education attainment would cause earnings to increase to the point that those loans would be repaid. That hasn’t happened. Instead, the balance on the federal books represents the states’ disinvestment from higher education alongside increased enrollment and attainment across the population. Student debt as a means of running a mass higher education system dependent on tuition has failed. The policy question now is who is going to suffer the consequences.

Student debt is holding the Biden agenda back

President Joe Biden has committed to building back American society more fairly and inclusively through his American Jobs Plan and American Families Plan. And in June 2021, his administration announced plans to build Black wealth and narrow the racial wealth gap by addressing racial discrimination in the housing market, growing federal contracting with small disadvantaged businesses, and supporting community-led civic infrastructure projects in communities of color.

To succeed in these endeavors, Biden must first cancel student debt, for two reasons. First, cancelling student debt will grow the economy by boosting GDP and adding jobs. Black workers are still lagging behind the pandemic employment recovery seen by white workers; cancelling student debt would improve the labor market for Black workers. Second, Black Americans will be unable to take advantage of this attention and investment without student debt relief. Student debt can delay or change a household’s decisions on a number of issues: where to live, what type of work to do, starting a family, purchasing a home, or launching a business.

Cancelling student debt alone will not achieve equity between Black household wealth and non-Black household wealth, or achieve full employment for Black workers. But it will allow stronger participation in the economy. Once Black households can find better employment and become business and homeowners at the rate of non-Black households—which student debt cancellation can make possible—the Biden administration can actualize its stated objective.

Wealth is not a direct result of hard work and determination in college. And racial wealth disparities are not a direct result of differences in college completion rates. Anti-Black polices across multiple sectors have diminished wealth-building opportunities that accelerate economic and social mobility. To ignore wealth disparities in the search for solutions to the student debt crisis is to turn a blind eye to the systemic racism that created the crisis itself.

The authors thank Eddie Nilaj, Laura Beamer, and the Jain Family Institute’s Millennial Student Debt project for providing the data and figures used in this publication. The data on which the figures are based consists of an 2009-2019 annual cross-section of 1 million student borrowers between the ages of 18 and 34 from Experian’s master database, matched to race and income data from the American Community Survey using the individual borrower’s census tract of residence.