Connected to the portfolio:

Critical Minerals

Critical Minerals

Jonah Allen

Lead Researcher, Energy Transition Value Chains

Jonah James Allen is the Lead Researcher for the Energy Transition Value Chains portfolio at the Jain Family Institute. In collaboration with partners at the subnational and international levels, he leads research origination and dissemination, and advises projects across the portfolio to develop quantitative tools and insights that support more equitable benefit-sharing in the extraction, trade, and use of resources critical to the energy transition.

Jonah holds a Ph.D. in Mineral and Energy Economics from the Colorado School of Mines and a B.S. in Environmental Studies from UC Santa Barbara, along with certificates in Technology Business Management and the Circular Economy of Metals. His research spans mineral and energy markets, water policy, and sustainable finance, with publications in Environmental and Resource Economics, Environmental Research Letters, and Nature Sustainability. His professional background includes water management and renewable energy technology deployment, environmental remediation, and small business finance and operations.

Related Publication Series

Financing the Energy Transition

This series presents investors and policymakers with a high-level picture of the factors influencing the financing and bankability of green technologies in the United States. For each technology -- including nuclear, solar, wind, hydrogen, long duration energy storage, carbon capture, and industrial decarbonization -- our team of data analysts and market experts conducts in-depth interviews with investors and scholars to ground sector-specific levelized cost models. These models, in turn, allow us to capture the key sensitivities governing each technology's cost profile and identify the most important levers for optimizing their financial viability. With these reports, we aim to equip decisionmakers, on both the investment and the policy sides, with the insights they need in order to make informed decisions that will accelerate the transition to a low-carbon economy.

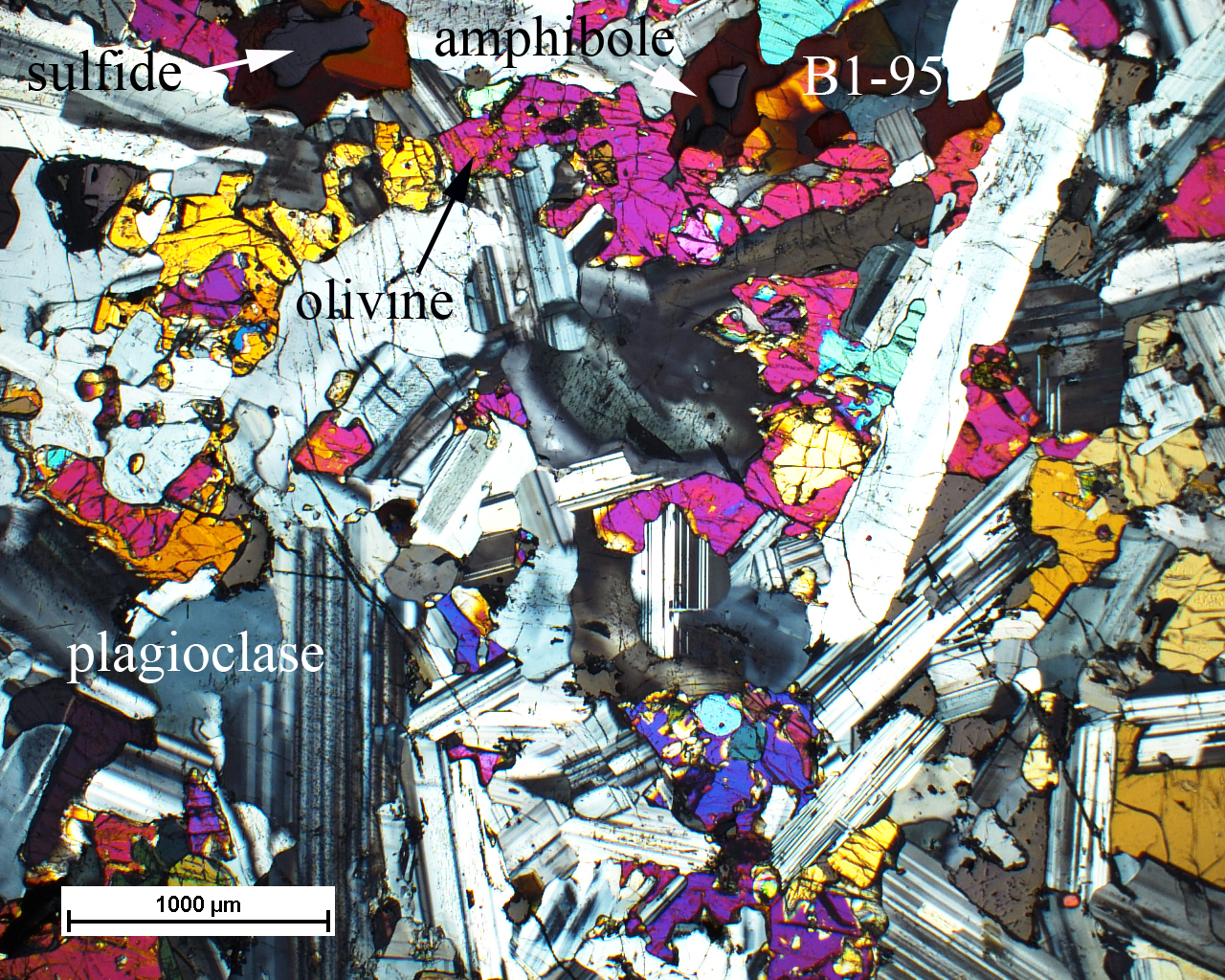

Mineral Wealth and Electrification

The energy transition represents a significant opportunity for countries producing the materials critical to electrification. In this series, we look at eight such materials: aluminum, cobalt, copper, natural graphite, iron, lithium, manganese, and nickel. As demand for so-called “critical minerals” grows, producer countries must develop robust strategies for effective value capture to transform a temporary windfall into an opportunity to grow shared wealth and climb the value chain. Doing so demands both institutional capacity and political will.

Related Initiatves

Related Tools

Mineral Market Dashboard

The dashboard benchmarks varying projections for transition-critical mineral market growth.

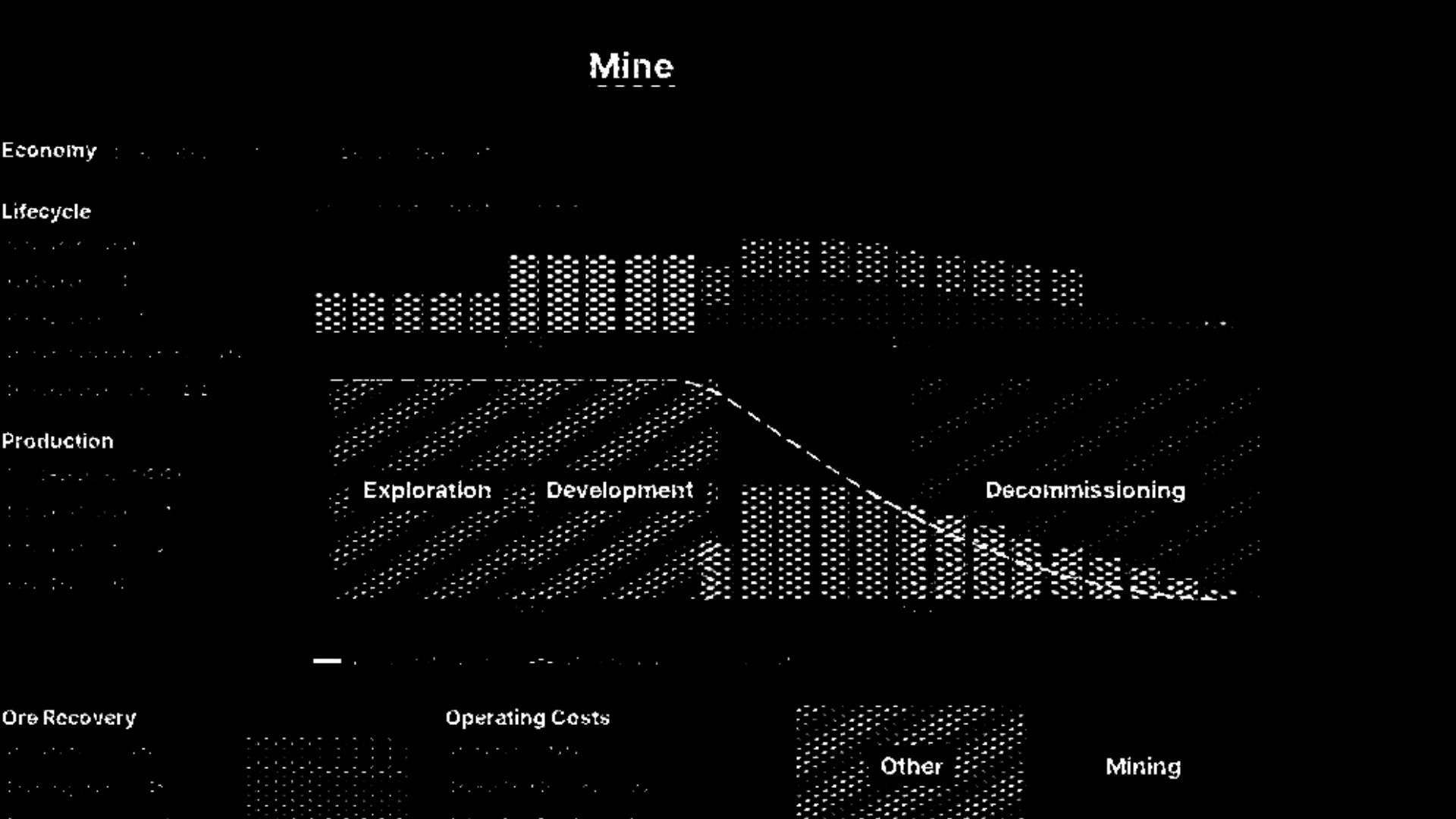

Mining Fiscal Regime Simulator

Enables more informed and critical comparison of the varying tax and royalty pathways for producer country value capture from the mining sector.

Publications

Benchmarking Opportunity in Transition-Critical Mineral Markets

"The most aggressive growth and price scenarios, which miners tend to favor in their feasibility studies, often embed optimistic assumptions...

Mineral Wealth and Electrification — Report

This report adopts a producer-country perspective centered on the potential for wealth creation and public value capture and investment.

Part of the series Mineral Wealth and Electrification

Solar Memo

"Solar is by far the fastest growing power generation technology in the US." On solar module assembly in the US.

Part of the series Financing the Energy Transition

Nuclear Memo

"JFI modeling suggests that, even with existing reactor designs, greenfield nuclear power plants can be a competitive source of clean,...

Part of the series Financing the Energy Transition