Financing the Energy Transition

Launched in 2024, Financing the Energy Transition (FETI) provides international policymakers with the technical assistance, modeling, and financial structuring needed for a just green transition.

The speed of global decarbonization will directly determine how extensive the effects of climate change are; this, in turn, will affect the lives of most of the human population. Curbing global warming ultimately means averting suffering; the more quickly it is done, the more harm we avoid. In our view, success hinges on solving the coordination problem: how to get nation-states with competing national interests, and corporations with profit mandates, to build and deploy green replacements to our fossil fuel infrastructure. We don’t yet know how to make the kind of rapid green transition that scientists tell us the world needs financially viable.

Like all coordination problems, this challenge requires structures that align incentives and create enforceable mutual obligations. Governments are now directly participating in markets and interacting with industry on levels not seen for generations. Yet our contacts within US governmental entities and globally, in finance ministries of climate-vulnerable nations, tell us they lack the tools to incentivize and encourage investment. They need new forms of technical and financial expertise, and sophisticated modeling capacities, in order to design the taxes, tariffs, concessions, and new public financing required for meaningful global decarbonization. These are the capacities FETI has been designed to provide.

WORK WITH US

Our partners include policymakers at the national and subnational levels domestically and abroad, private investors, and NGOs. If you’d like to hear more about partnering with us, please email us; we welcome questions and comments. FETI provides a combination of policy design, modeling, and direct assistance in its four primary areas of work:

Sovereign Fund Architecture

- We gather and compound the proceeds from natural resource extraction throughout the world to benefit the public in the form of social wealth funds.

- We use financial modeling and governance expertise to transform these revenues into portfolios of public assets, and then facilitate productive investment that is both socially and environmentally beneficial.

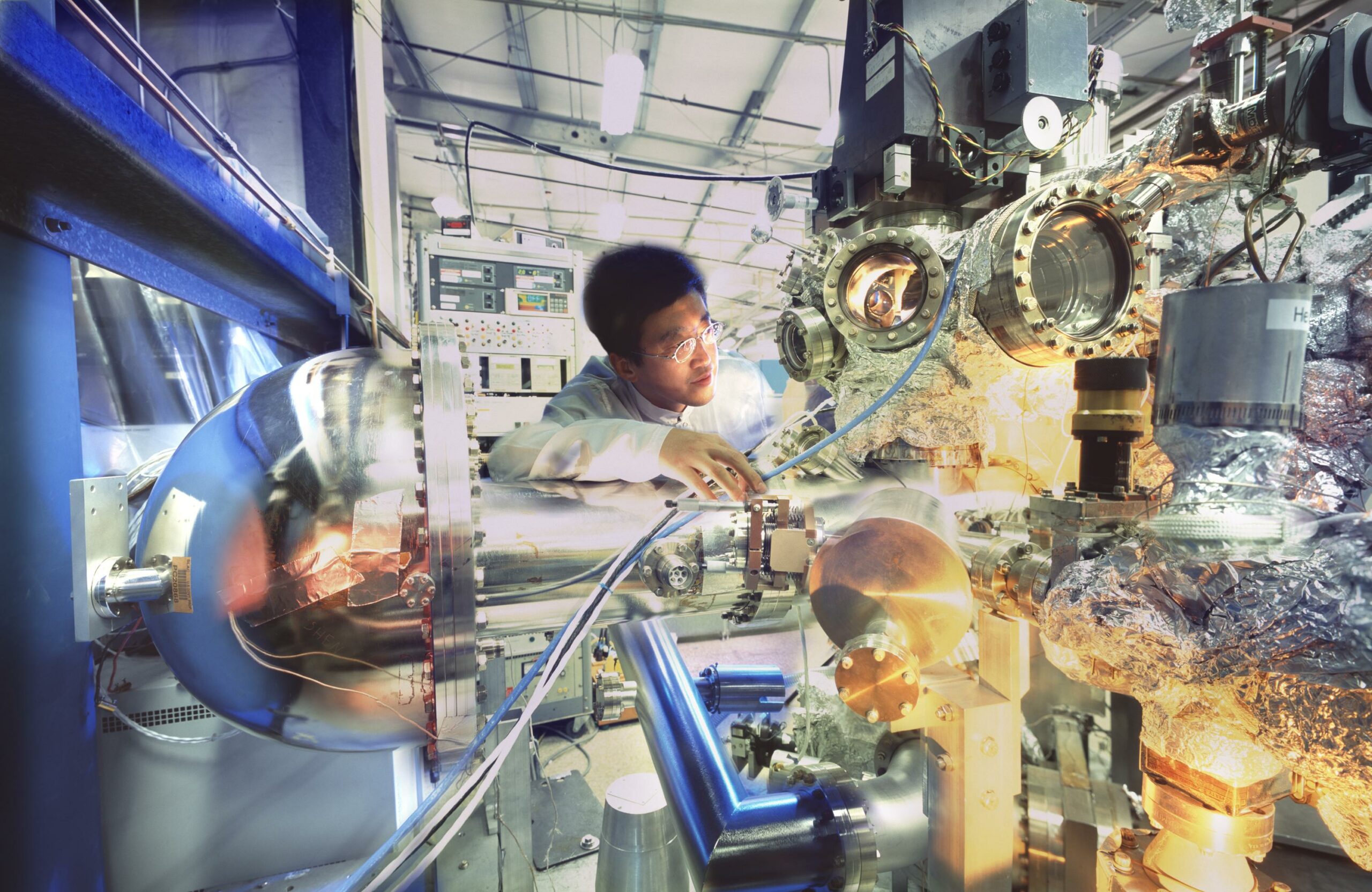

Critical Minerals

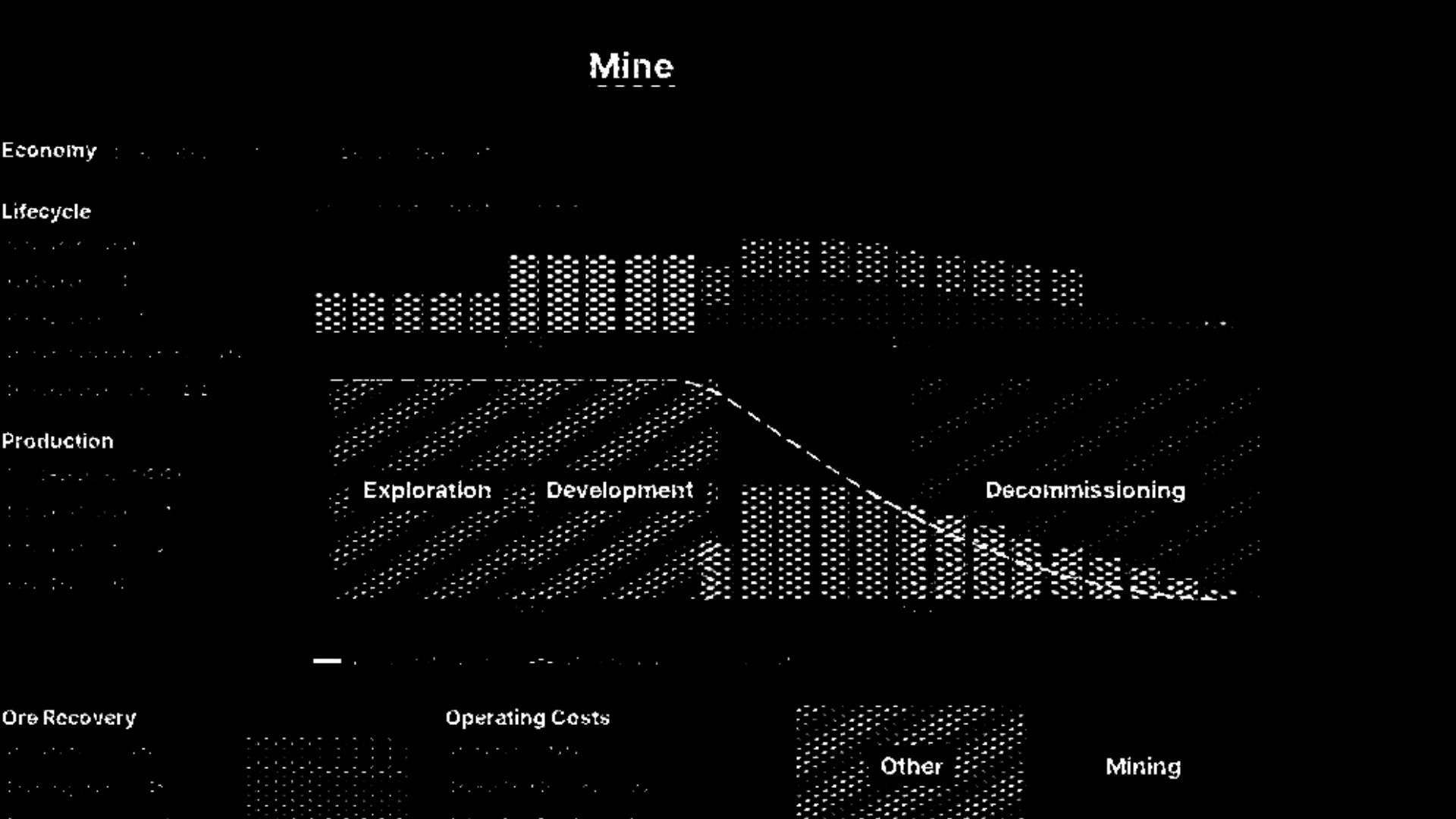

- We build tools for policymakers to map value chains that are central to the green transition, such those of as batteries and copper wiring, from extraction to final product assembly.

- We address key questions around siting and financing, as well as tax, duty, licensing, and royalty schemes, considering strategies that can permit producer countries to retain long-term value from resource extraction and trade.

Green Technology Market Design

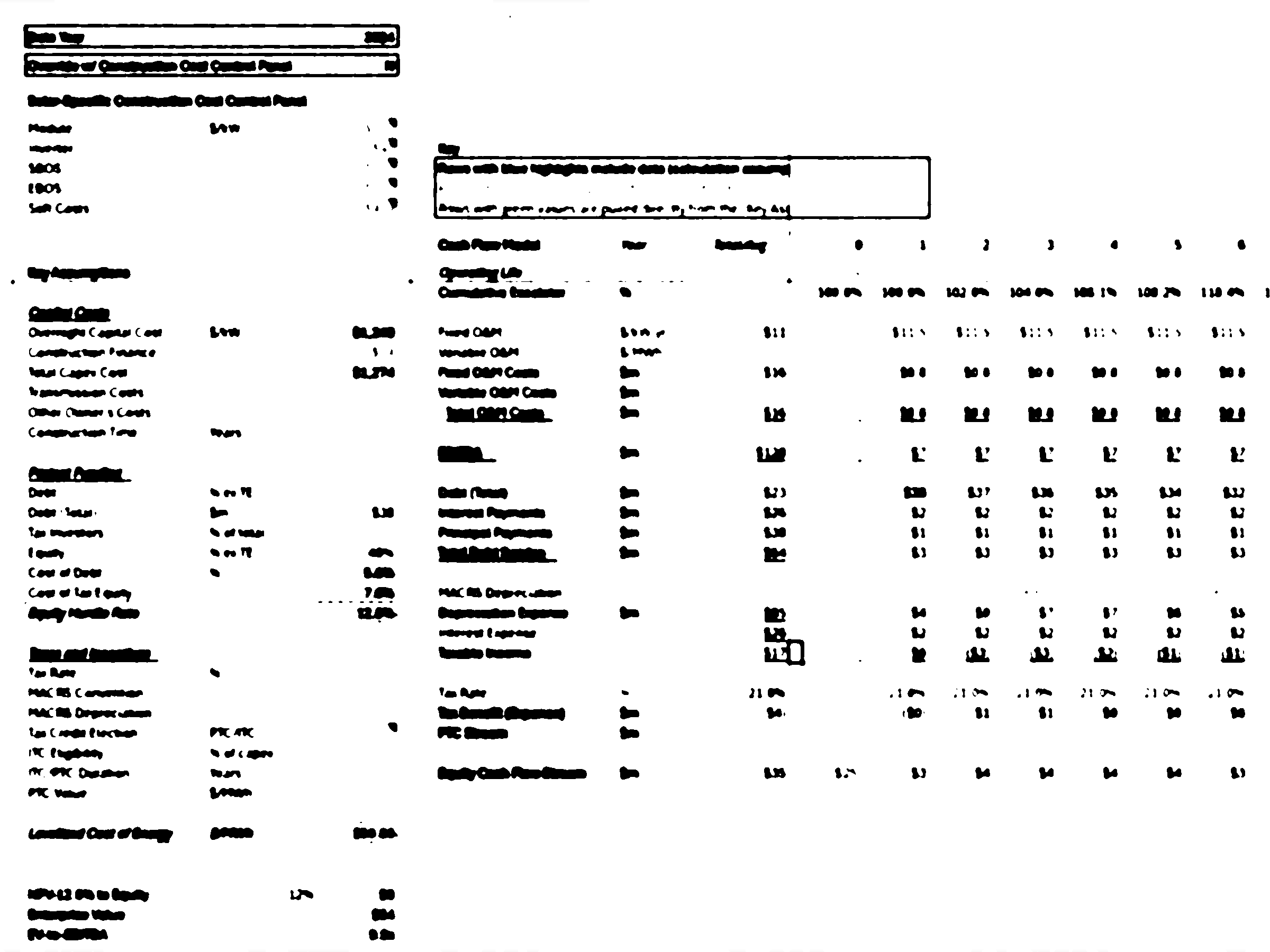

- We build Levelized Cost of Energy (LCOE) models to advise governments and investors on integrated financial strategy for green investment.

- Among our key topics are the cost and construction of green infrastructure, the design and coordination of relevant supply chains, and the relative cost-intensity and durability of different technologies.

Catalyzing Private Green Investment

- Our proprietary agent-based model, IMPULSE, addresses the question of how investment can be mobilized in support of the green transition using the policy tools available to the US government and like actors. In particular, IMPULSE aims to capture the systematic response among investors to influxes of catalytic capital into different generation technologies.

Critical Minerals

Financing the Energy Transition Contributors

Eduard Nilaj

Senior Research Associate

Francis Tseng

Lead Developer

Jack Landry

Lead Researcher

Jerome Hodges

Jonah Allen

Lead Researcher, Energy Transition Value Chains

Jonathan Calenzani

Fellow

Laura Beamer

Lead Researcher

Madeline Craig-Scheckman

Fellow

Mikhael Gaster

Data Science Research Associate & Lead Developer, CAS

Natalie Leonard

Fellow

Paul Katz

Senior VP

Shane Sethi

Research Fellow

Sina Sinai

Senior Research Associate

Related Tools

Tooling

Tooling

Levelized Cost of Energy

Tooling

Tooling

Mineral Market Dashboard

Tooling

Tooling

Mining Fiscal Regime Simulator

Tooling

Tooling

Transition Critical Minerals

Related Publication Series

Financing the Energy Transition

Labor Market Policy and the Energy Transition

Mineral Wealth and Electrification

Recent Updates

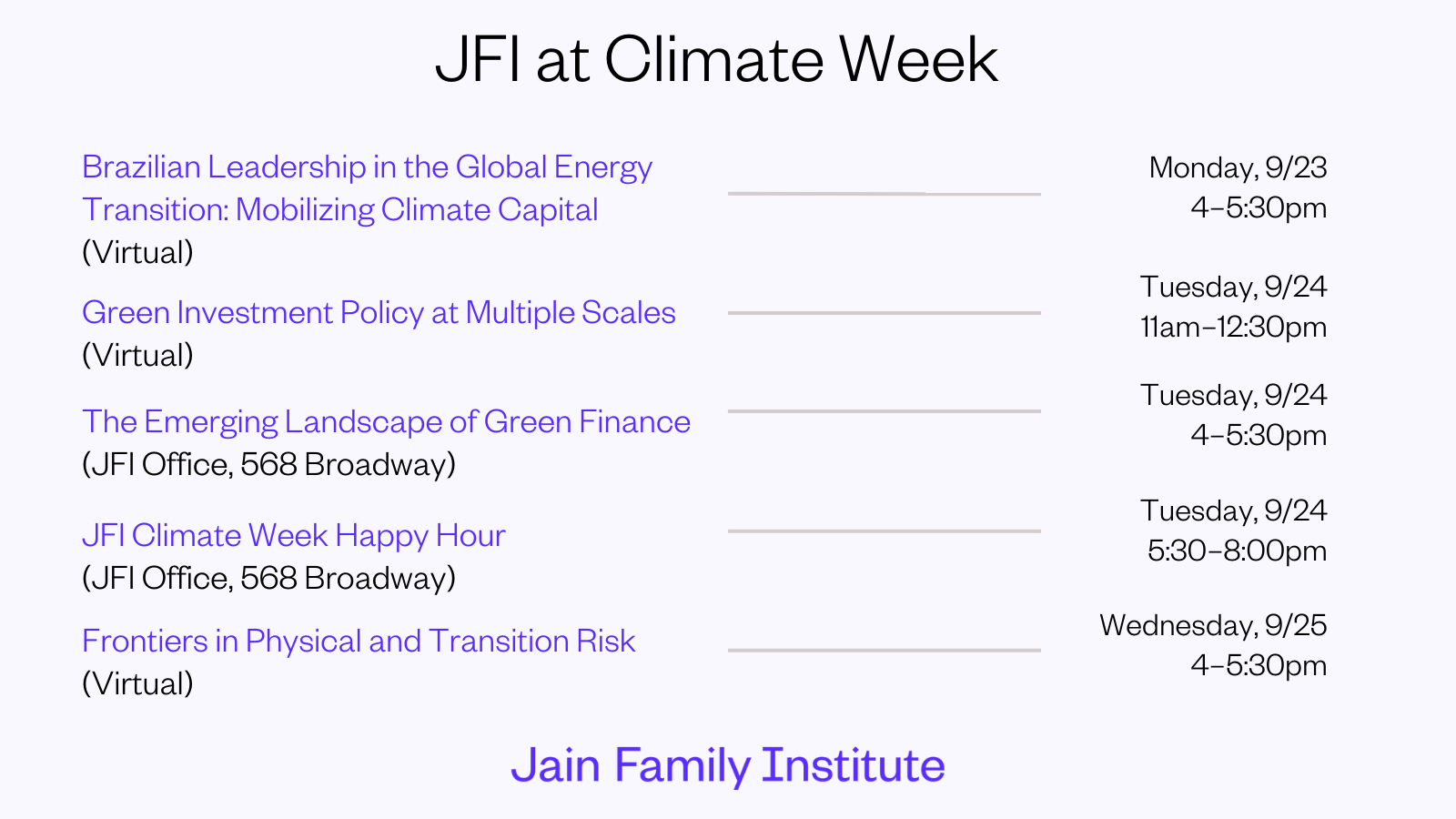

JFI at Climate Week 2025

JFI will be hosting several events during Climate Week, starting September 23.

Transition Finance 101 – Expert Hour with Elizabeth Harnett

Join us on Zoom, Thursday, August 28, at 12:00 pm ET.

New Publication: Benchmarking Opportunity in Transition-Critical Mineral Markets

On a new tool for policymakers from the Critical Mineral portfolio.

Benchmarking Opportunity in Transition-Critical Mineral Markets

"The most aggressive growth and price scenarios, which miners tend to favor in their feasibility studies, often embed optimistic assumptions...

The Role of Critical Minerals in Vehicle Electrification – Expert Hour with Beia Spiller

Join us on Zoom, Wednesday, June 18 at 2pm ET.

JFI and Climate Vulnerable Forum move towards multi-sovereign investment fund

April 23 meeting with V20 representatives from eleven member countries kicks off discussions on new South-South mechanism to organize climate investment.

Global Green Industrial Policy After 2025

A discussion on the future of global green industrial policy. 3:30pm ET on Friday, April 18.

Event: Mineral Wealth and Electrification: A Producer-Country Perspective

Join us for a Zoom panel discussion on December 12.

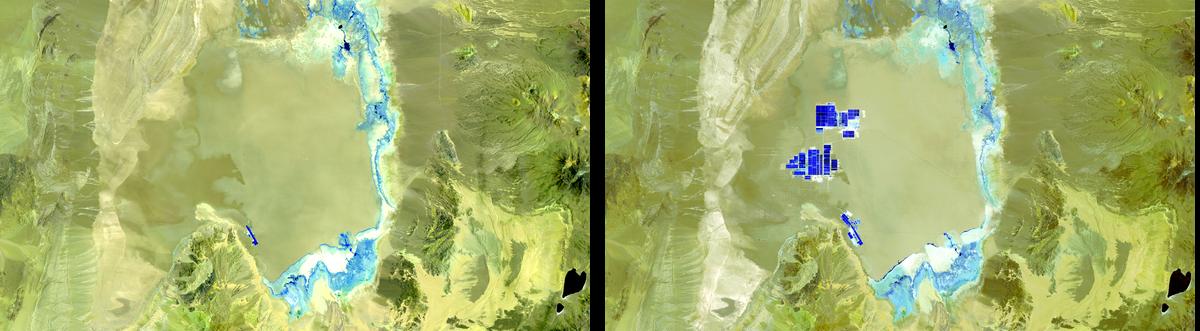

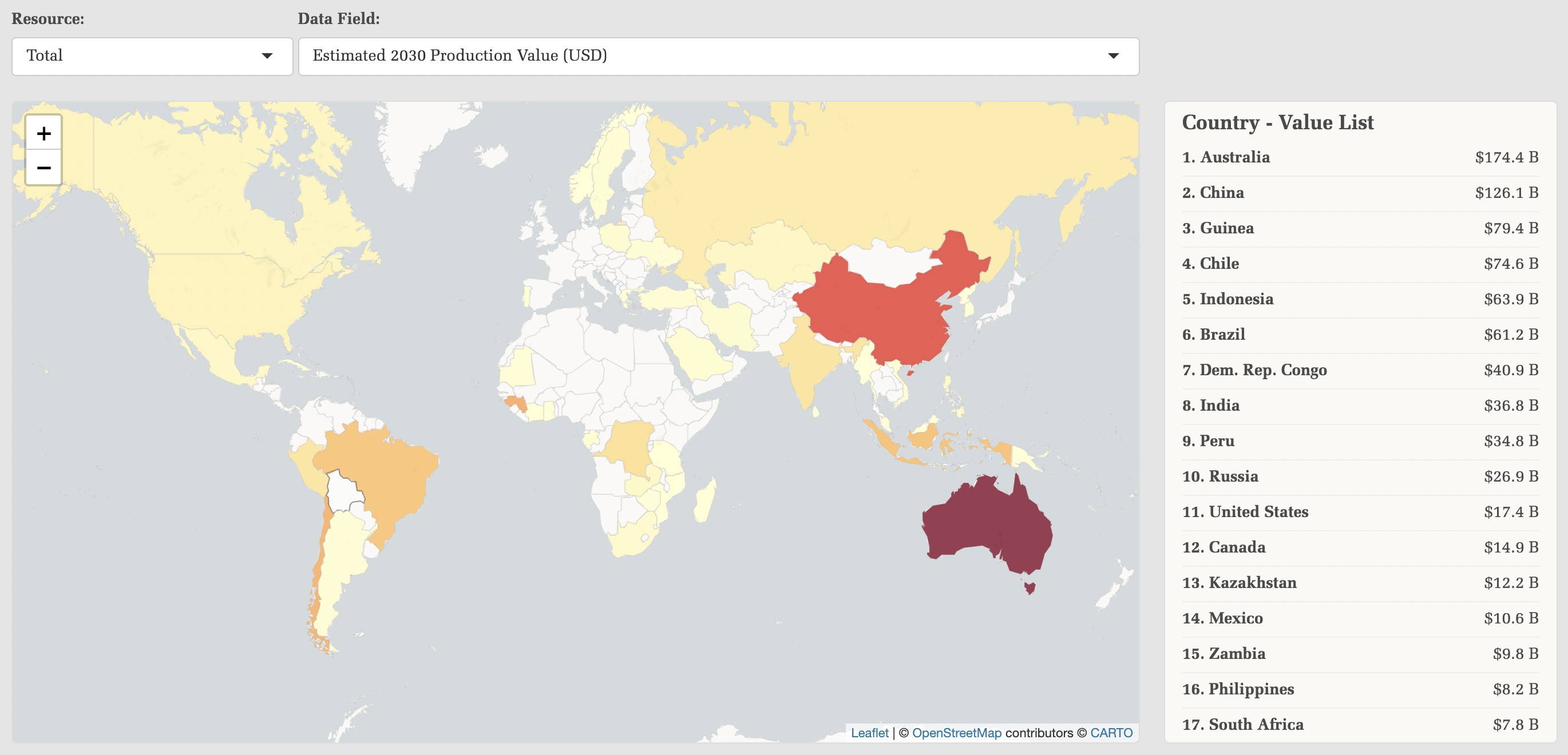

New series: Mineral Wealth and Electrification

On the shifting map of natural resource wealth, and new possibilities for strategic development.

Mineral Wealth and Electrification — Technical Appendix

On data sources and data processing.

Part of the series Mineral Wealth and Electrification

Mineral Wealth and Electrification — Report

This report adopts a producer-country perspective centered on the potential for wealth creation and public value capture and investment.

Part of the series Mineral Wealth and Electrification

Transition-Critical Minerals: Wealth Endowments and Value Capture — Interactive Map

A high-level distribution of current and future mining production and potential royalty revenue globally through 2030.

Part of the series Mineral Wealth and Electrification

Levelized Cost of Solar Model

A model for estimating the lifetime cost of solar energy generation.

A Tale of Two Solar Technologies

"Protective tariffs enacted to insulate domestic manufacturers from market forces will inevitably come at a cost to downstream solar developers,...

Part of the series Financing the Energy Transition

JFI’s Tuesday Climate Week Event in Bloomberg Green

Join us September 24 at 4pm.

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?

New Research: Solar Power in the US

A scrutiny of the present and future of US solar power by JFI's FInancing the Energy Transition team.

Solar Memo

"Solar is by far the fastest growing power generation technology in the US." On solar module assembly in the US.

Part of the series Financing the Energy Transition

State of Play: Proxy Season 2024

In this report, CAS highlights 21 upcoming annual meetings where our benchmarking raises concerns about the pace of progress on energy...

Part of the series Financing the Energy Transition

Press Release: Proxy Season 2024

Center for Active Stewardship releases report highlighting key corporate annual meetings for climate-focused investors.

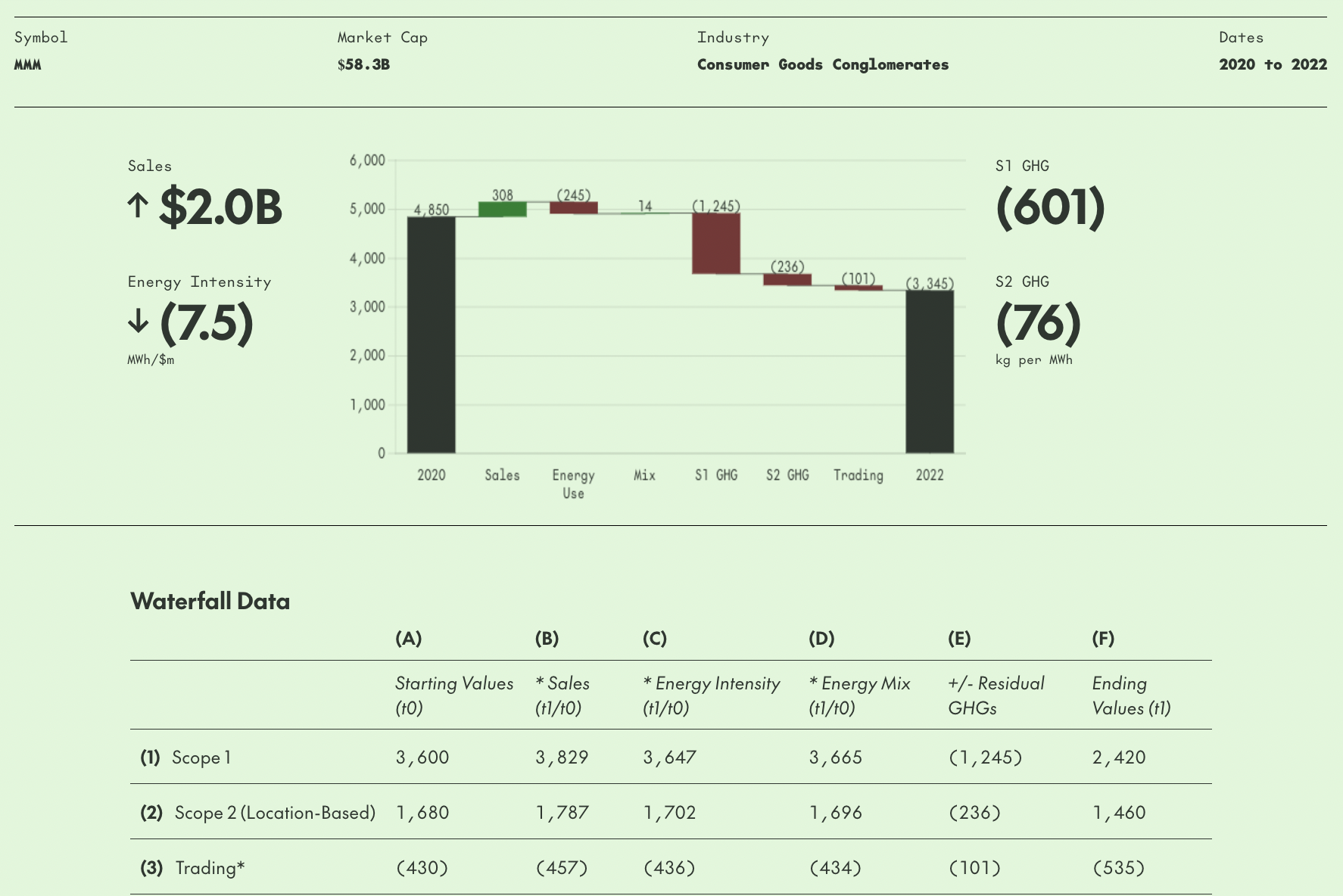

Center for Active Stewardship’s Splice tool in the Financial Times

"The case against carbon emissions as a universal metric"

Center for Active Stewardship launches Splice, a tool for visualizing how a company’s greenhouse gas emissions change over time

"When it comes to emissions reporting, it’s important to be able to separate signal from noise. Initiatives to reduce...

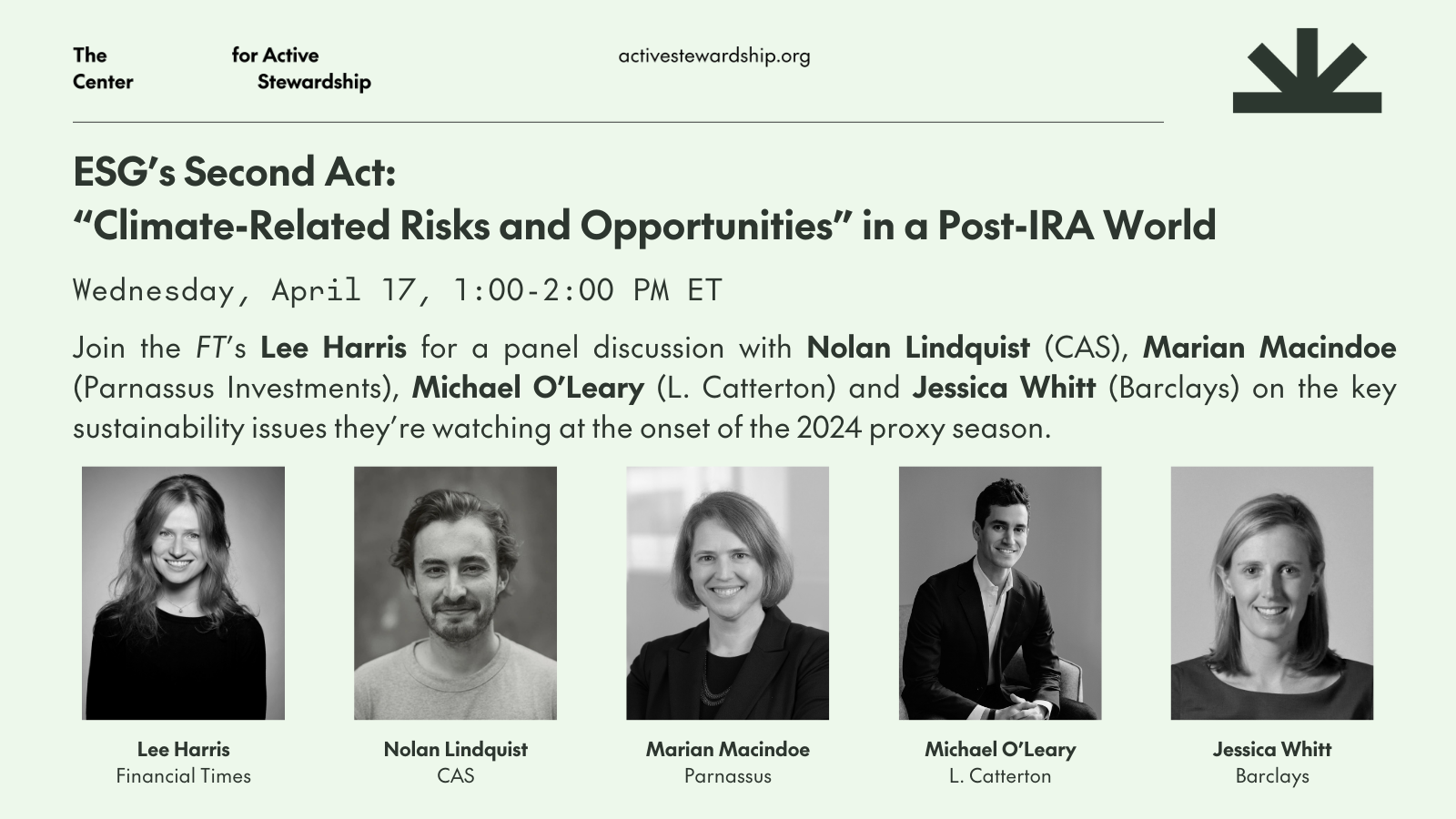

Panel April 17: ESG’s Second Act: “Climate-Related Risks and Opportunities” After the IRA

Exploring the disconnect between NGO priorities and how investors in public and private markets are analyzing "climate-related risks and opportunities"