Millennial Student Debt

The Millennial Student Debt study aims to present a country-wide analysis and visualization of student debt and its relationship with demographic characteristics, school characteristics and labor market characteristics, and how these relationships have changed over the past decade.

The project name refers to the key focus of our study–student debt, in its many forms, sizes and payment schemes–but we are especially interested in the decisions leading up to and following debt take-up. These decisions include, for example, things that affect a person’s student debt load, like demographic characteristics, location, degree pursued, school attended; we also examine how this particular type of debt shapes individuals’ repayment behavior on other debt types, status and mobility in the labor market (such as those statistics from ADP’s Workforce Vitality Report), and social decisions like when to marry and where to live.

Additional research on the effects of institutional concentration on net tuition costs, as well as the relationship between federal/state funding and workforce trends, complement and contextualize our research on student debt.

Project leads: Laura Beamer, Marshall Steinbaum, Francis Tseng, and Eduard Nilaj.

Contact us about this project: jfi@jainfamilyinstitute.org

In This Series

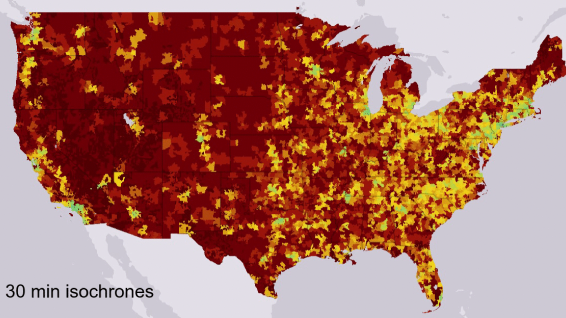

Unequal and Uneven: The Geography of Higher Education Access

Declining Access, Rising Cost: The Geography of Higher Education Post-2008

Unceasing Debt, Disparate Burdens: Student Debt and Young America

Congressional Overlay

The Student Debt Crisis Is a Crisis of (Non-)Repayment

Student Debt and Young America Annual Report and Comparison Tool

Student loans, the racial wealth divide, and why we need full student debt cancellation

Hysteresis and Student Debt

How Schools Lie: The Deceptive Financial Aid System at America’s Colleges

Homeownership and the Student Debt Crisis

Rules, Accountability, and the Student Debt Crisis

The Distribution of Student Debtors: Data, Narrative, and Debt Cancellation

Student Debt and Young America in 2022 – Annual Report and Data Comparison Tool

The Repayment Pause and the Continuing Crisis of Non-Repayment

Student Debt and Homeownership Barriers in Washington, D.C.

Student Debt Relief for Borrowers with Negative Amortization

The Right Way to Cancel Student Debt

Cost Deception at Elite Private Colleges

A First Look at Student Debt Cancellation

New York Times Opinion: America’s Student Loans Were Never Going to Be Repaid

An interactive exploration of our Millennial Student Debt findings by Laura Beamer and Marshall Steinbaum, published July 2023.

Millennial Student Debt Contributors

Eduard Nilaj

Senior Research Associate

Laura Beamer

Lead Researcher

Marshall Steinbaum

Senior Fellow

Recent Updates

JFI report shows dramatic increases in millennial student debt, interactive map of disparate impacts

New data shows fewer options, higher prices, and ballooning debt in higher education since 2009, with lowest-income communities of color hit...

Announcement and Summary: Declining Access, Rising Cost: The Geography of Higher Education Post-2008

A new report on the Phenomenal World and interactive map displaying the price of college throughout the US

New Research: The Geography of Higher Education Access

Preliminary results from JFI's ongoing study of access to higher education in the US.