Jack Landry

Lead Researcher

Jack Landry is the Lead Researcher in Guaranteed Income at JFI. Previously, he was a Research Professional at the University of Chicago-Harris School of Public Policy, working on projects on education and gender issues. He has a bachelor’s degree in Economics and Political Science from Rutgers University-New Brunswick.

Related Publication Series

From Idea to Reality: Getting to Guaranteed Income

Policy Microsimulations

Related Initiatves

Publications

Guaranteed Income In The Wild: Summarizing Evidence From Pilot Studies and Implications for Policy

How to make sense of competing claims about guaranteed income?

A First Look at Student Debt Cancellation

The first analysis of the policy-driven student debt cancellation that has been enacted over the last several years.

Part of the series Millennial Student Debt

The Tax Liability Red Herring: Defending Child Tax Credit Reforms

Analysis responding to the latest Congressional debates: Insisting CTC improvements go to families who have federal tax liability would ensure...

Part of the series Policy Microsimulations

Responding To the Bipartisan Child Tax Credit Expansion Critics: The Tenuous Evidence Behind Work Disincentives

This report attempts to explain comprehensively why objections to the CTC reforms on the grounds of disincentivizing work are mistaken.

Part of the series Policy Microsimulations

Bipartisan Child Tax Credit Expansion: Analysis of the Tax Relief for American Families and Workers Act of 2024

Congressional tax negotiators have announced an agreement to expand the Child Tax Credit (CTC). The proposal significantly increases benefits for...

Part of the series Policy Microsimulations

The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

Part of the series Policy Microsimulations

Cash at the State Level: Guaranteed Income Through the Child Tax Credit

Eleven states have passed refundable CTCs ranging in value from $300 to $1,750 per eligible child.

Municipal Bank of LA: Financial Justice Portfolio Options

This briefing analyzes innovative financing mechanisms that could help employees purchase small businesses from a "silver tsunami" of retiring owners...

Part of the series Municipal Public Banking

Municipal Bank of LA: Housing Solutions and Portfolio Options

An analysis of how a public bank in Los Angeles could support the city’s broader infrastructure, housing, and sustainability...

Part of the series Municipal Public Banking

Revisiting the Child Tax Credit for the Lame Duck Session: Comparing Parameters for Anti-Poverty Impacts

JFI researchers review recent CTC proposals and simulate the effects of varying key reforms that increase the policy's anti-poverty impacts,...

Part of the series Policy Microsimulations

The Expanded Child Tax Credit and Parental Employment: Tenuous Evidence Points to Work Disincentives

Some academics and policymakers argue that the expanded Child Tax Credit will disincentive work; this report points out the weak...

Part of the series Policy Microsimulations

Memo: Cost Simulations of a Fully-Refundable Child Tax Credit (CTC) 2022-2031

Jack Landry and Stephen Nuñez publish ten-year CTC full refundability estimates, illustrating compromise proposals that retain CTC poverty impacts...

Part of the series Policy Microsimulations

Analysis of Full Refundability of the Child Tax Credit Without Expansion

Recent reports indicate that the Build Back Better legislative package will allow the increased Child Tax Credit value to continue...

Part of the series Policy Microsimulations

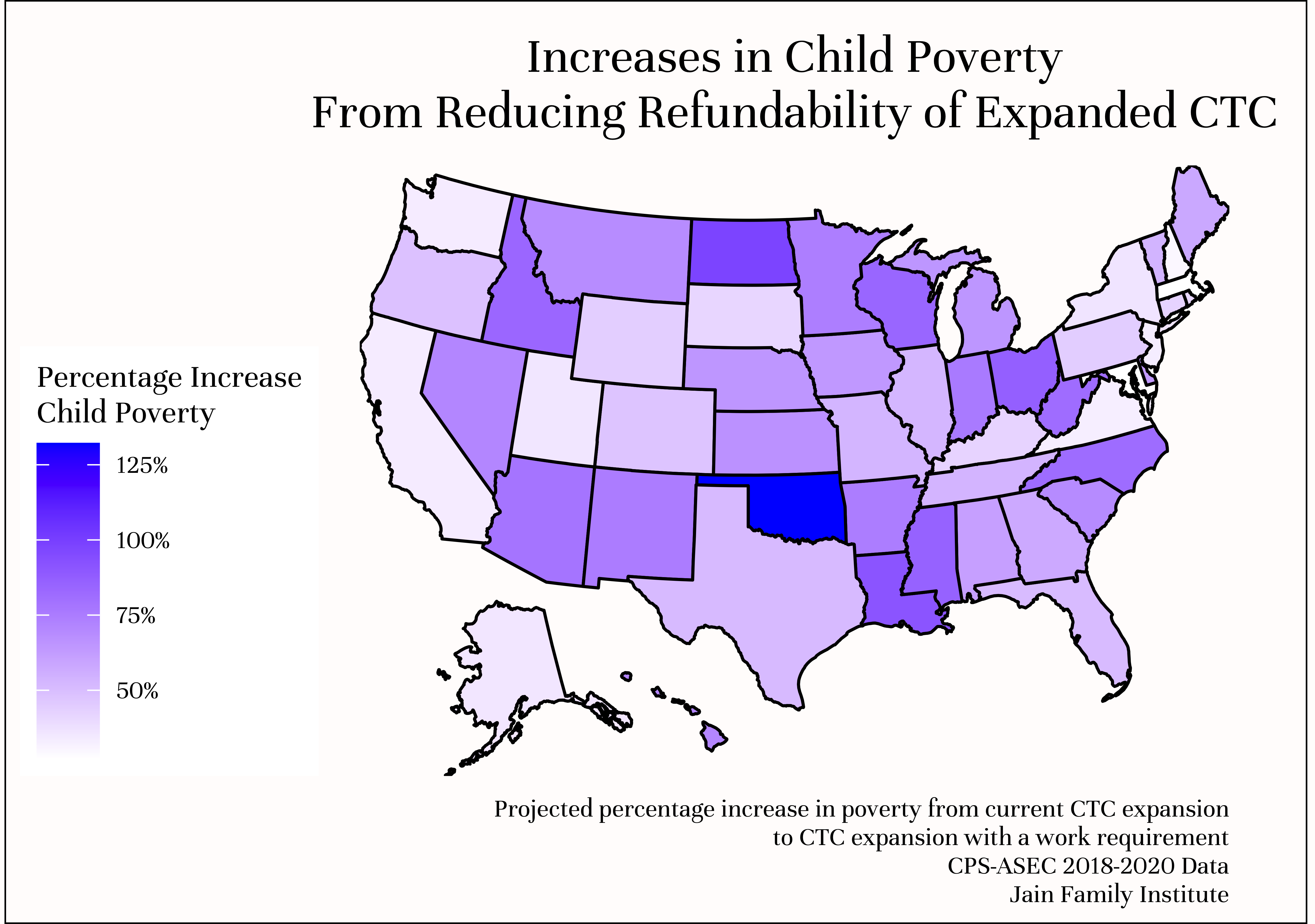

Reducing Refundability of the Child Tax Credit: Assessing Poverty Impacts and Trade-offs

A microsimulation brief finding that proposals to limit the refundability of the Child Tax Credit would increase child poverty by 53...

Part of the series Policy Microsimulations

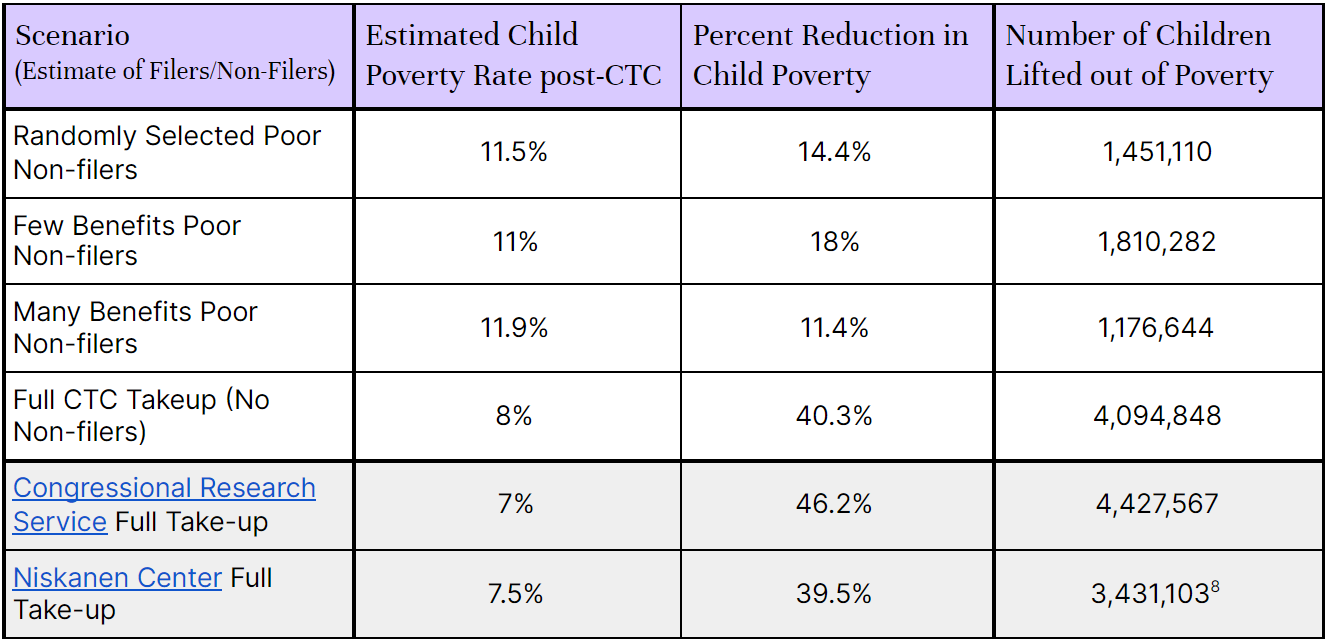

Assessing Non-filer Rates & Poverty Impacts for the American Rescue Plan Act’s Expanded CTC

A microsimulation of child poverty impacts and analysis of how to reach eligible non-filers for maximum poverty impacts

Part of the series From Idea to Reality: Getting to Guaranteed Income

Part of the series Policy Microsimulations