Policy Brief

The Tax Liability Red Herring: Defending Child Tax Credit Reforms

Analysis responding to the latest Congressional debates: Insisting CTC improvements go to families who have federal tax liability would ensure...

Part of the series Policy Microsimulations

Responding To the Bipartisan Child Tax Credit Expansion Critics: The Tenuous Evidence Behind Work Disincentives

This report attempts to explain comprehensively why objections to the CTC reforms on the grounds of disincentivizing work are mistaken.

Part of the series Policy Microsimulations

Bipartisan Child Tax Credit Expansion: Analysis of the Tax Relief for American Families and Workers Act of 2024

Congressional tax negotiators have announced an agreement to expand the Child Tax Credit (CTC). The proposal significantly increases benefits for...

Part of the series Policy Microsimulations

The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

Part of the series Policy Microsimulations

Cash at the State Level: Guaranteed Income Through the Child Tax Credit

Eleven states have passed refundable CTCs ranging in value from $300 to $1,750 per eligible child.

Municipal Bank of LA: Interactive Balance Sheet Simulator

The simulator enables the public to allocate resources among the proposed public bank lending programs, testing cost and profit assumptions...

Part of the series Municipal Public Banking

Municipal Bank of LA: Clean Energy Portfolio Options

Paired with new federal incentives through the Inflation Reduction Act, this briefing covers ways a public bank could crucially accelerate...

Part of the series Municipal Public Banking

Municipal Bank of LA: Financial Justice Portfolio Options

This briefing analyzes innovative financing mechanisms that could help employees purchase small businesses from a "silver tsunami" of retiring owners...

Part of the series Municipal Public Banking

Municipal Bank of LA: Democratic Governance Frameworks

A briefing by Michael McCarthy of the Berggruen Institute on deliberative democracy for public finance and investment.

Part of the series Municipal Public Banking

Revisiting the Child Tax Credit for the Lame Duck Session: Comparing Parameters for Anti-Poverty Impacts

JFI researchers review recent CTC proposals and simulate the effects of varying key reforms that increase the policy's anti-poverty impacts,...

Part of the series Policy Microsimulations

The Expanded Child Tax Credit and Parental Employment: Tenuous Evidence Points to Work Disincentives

Some academics and policymakers argue that the expanded Child Tax Credit will disincentive work; this report points out the weak...

Part of the series Policy Microsimulations

Memo: Cost Simulations of a Fully-Refundable Child Tax Credit (CTC) 2022-2031

Jack Landry and Stephen Nuñez publish ten-year CTC full refundability estimates, illustrating compromise proposals that retain CTC poverty impacts...

Part of the series Policy Microsimulations

Analysis of Full Refundability of the Child Tax Credit Without Expansion

Recent reports indicate that the Build Back Better legislative package will allow the increased Child Tax Credit value to continue...

Part of the series Policy Microsimulations

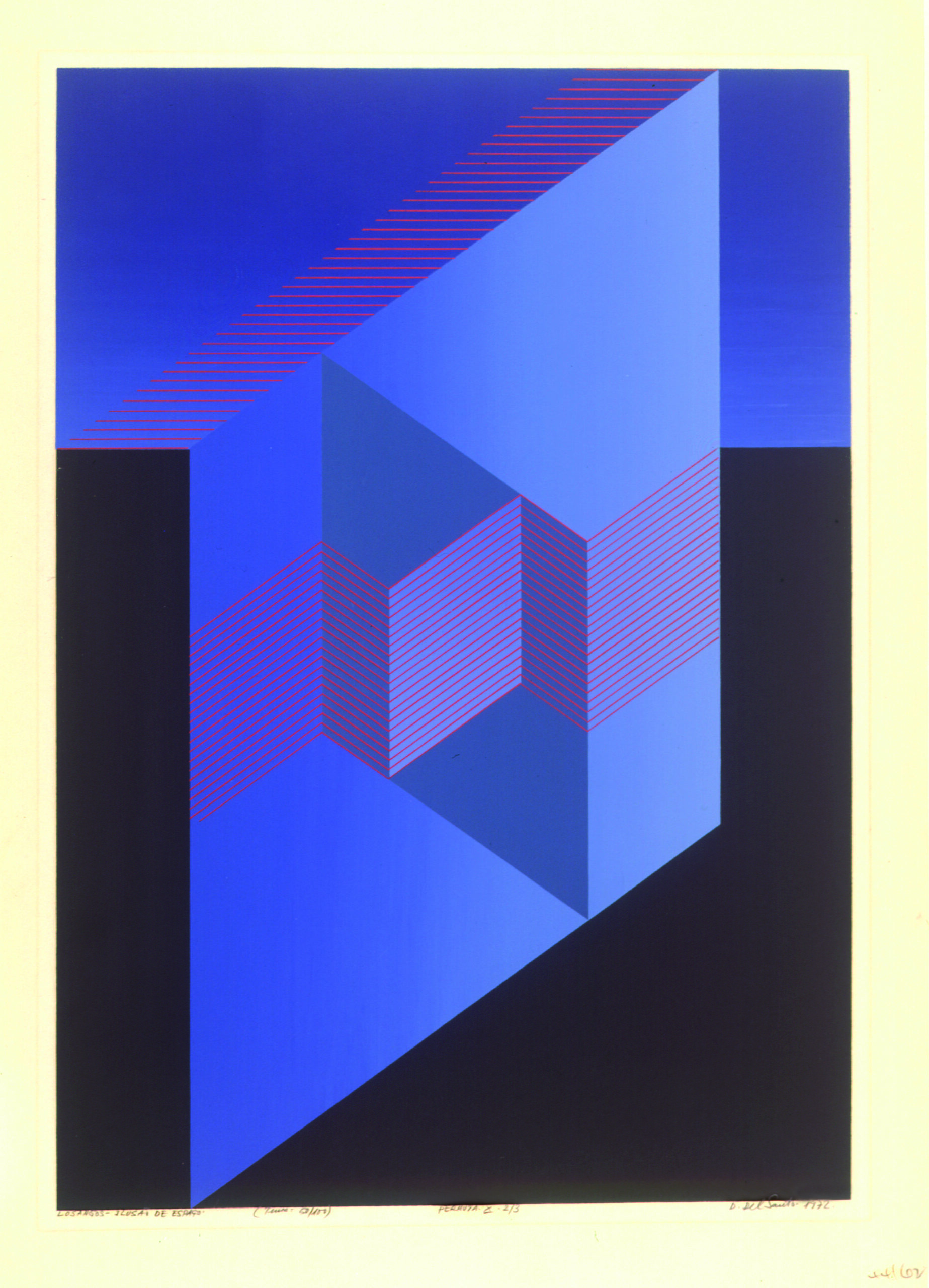

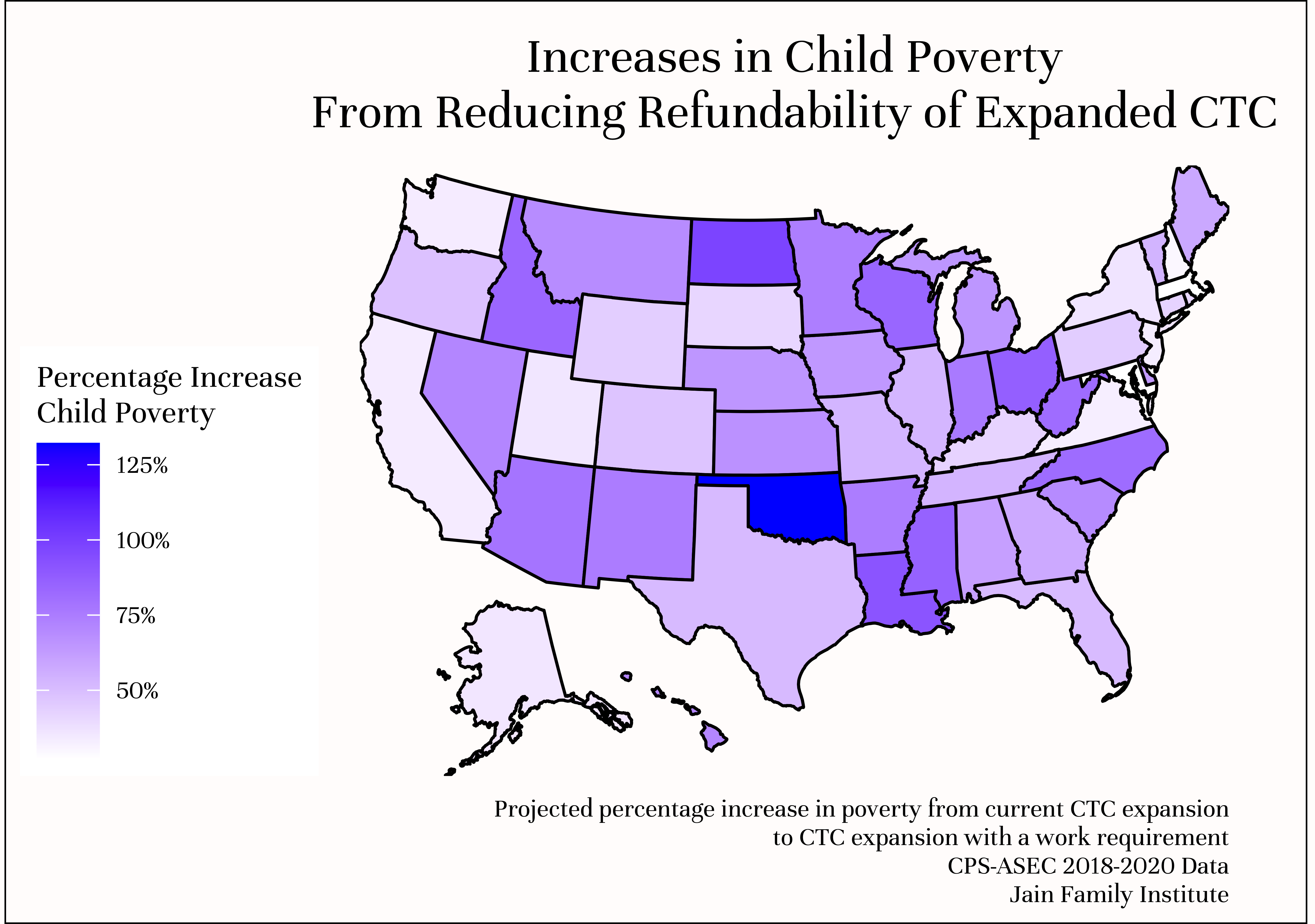

Reducing Refundability of the Child Tax Credit: Assessing Poverty Impacts and Trade-offs

A microsimulation brief finding that proposals to limit the refundability of the Child Tax Credit would increase child poverty by 53...

Part of the series Policy Microsimulations

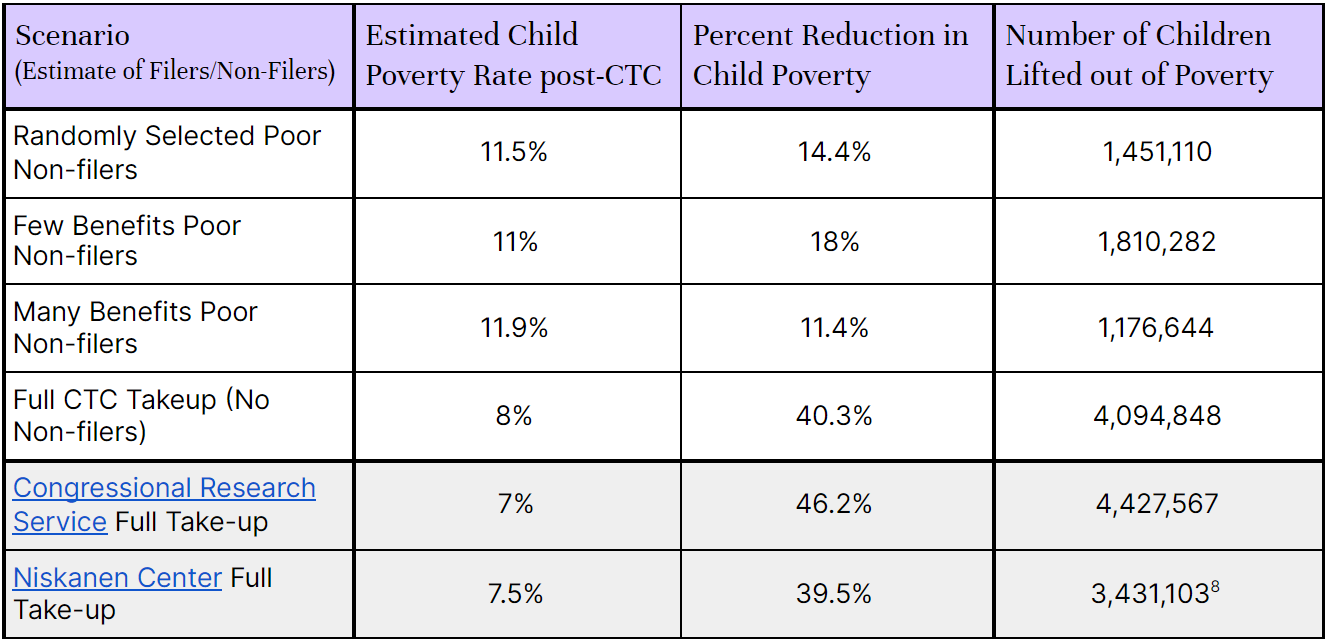

Assessing Non-filer Rates & Poverty Impacts for the American Rescue Plan Act’s Expanded CTC

A microsimulation of child poverty impacts and analysis of how to reach eligible non-filers for maximum poverty impacts

Part of the series From Idea to Reality: Getting to Guaranteed Income

Part of the series Policy Microsimulations

Toolkit on guaranteed income in the U.S. for pilots, research

JFI released guaranteed income toolkit of collective best practices, pilot efforts & policy as cash initiatives continue to grow and policy...

Part of the series From Idea to Reality: Getting to Guaranteed Income

Part of the series Messaging Guaranteed Income

The Right Way to Cancel Student Debt

A collaboration between JFI and Debt Collective, the issue brief makes a data-driven case for universal, automatic, and generous debt...

Part of the series Millennial Student Debt

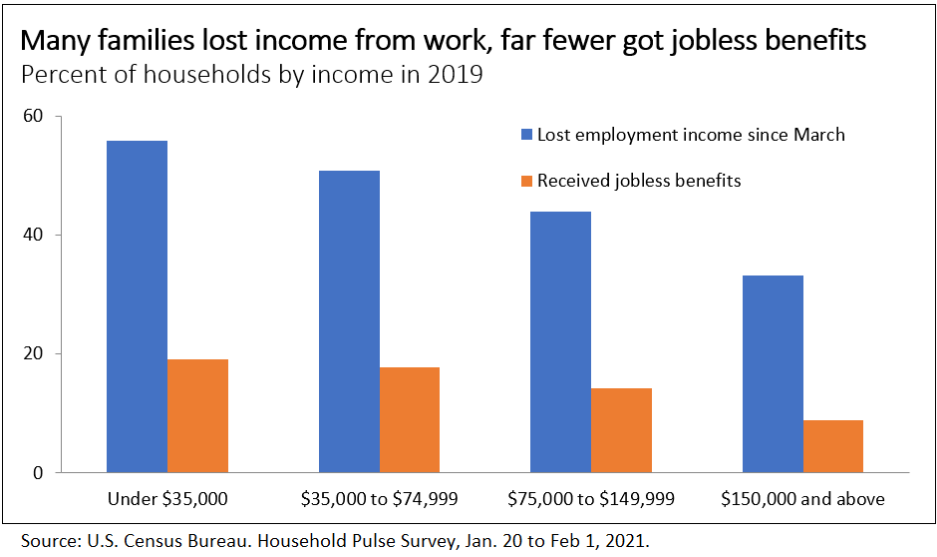

Robust evidence for $1400 relief and recovery checks

Drawing on over a decade of rigorous research, JFI Senior Fellow Claudia Sahm presents evidence in favor of additional $1400 checks...

Part of the series From Idea to Reality: Getting to Guaranteed Income

Comparing bipartisan proposals for a federal child allowance expansion

JFI researchers compare child allowance proposals from the perspective of extensive cash-transfer expertise

Congressional Overlay

An interactive map of congressional-level student debt trends from 2009 to 2019.

Part of the series Millennial Student Debt

Policy Insights: ‘Legislating Relief’ – expert perspectives on higher education bills

Key takeaways of our August 7th panel with policy and research experts in higher education, providing crucial perspectives for the...

Social Wealth Seminar: Yakov Feygin

“Sovereign Wealth Funds and Public Wealth Building Institutions in the Context of the Global Dollar System.”

Part of the series Social Wealth Seminar

Social Wealth Seminar: Naomi Zewde

“Inequalities in Wealth and Health: Things to Consider when Building a Generation."

Part of the series Social Wealth Seminar

Inside Out: A Webinar

On May 20, 2020, JFI hosted a virtual briefing on a report on renewable energy, the future of mining, and the re-localization...

Part of the series Inside Out: Mining and Renewable Energy