Social Wealth

OUR MOTIVATING CHALLENGE

From the oil and gas that have fueled the global economy for a century, to metals like lithium and cobalt that are critical to the energy transition today, natural resources provide governments with significant wealth — windfalls that can strengthen their economies, or distort them. History shows that robust governance and strategic investment can make the difference between a resource curse and a resource blessing. While some governments have built permanent, multi-generational investment structures to grow and invest their natural resource wealth, others have struggled to seize the opportunity.

In the face of this challenge, JFI’s Social Wealth initiative helps governments structure and invest pools of public capital, especially those derived from natural resource revenues, in order to preserve shared wealth while catalyzing inclusive and sustainable economic growth. Adopting a producer-country perspective, with a focus on low and middle income countries, we are particularly attentive to strategies that can help natural resource producers move up the value chain.

OUR WORK AND IMPACT

We help partner governments to gather and compound the proceeds from natural resource extraction throughout the world to benefit the public in the form of social wealth funds. We use financial modeling and governance expertise to transform these revenues into portfolios of public assets, and then to devise strategies to actualize these funds’ long-term missions — to facilitate productive investment that is socially beneficial and environmentally sustainable.

In Brazil, we have strengthened the management of over $1 billion public funds for social programs in territories covering 4.6 million residents. In summer 2024, we supported local partners in their efforts to write and pass Law 14.937 authorizing the country’s subnational SWFs and charging Brazil’s SEC with the authority to regulate them (included as an amendment to a bill from the national development bank BNDES). The legislation formalized the existence of these funds (which previously had no clear basis in federal law) and established who should regulate them.

Beyond Brazil, we have engaged with governments and sovereign wealth funds around the world, and are currently working on proposals and modeling for a multi-sovereign investment fund in partnership with the climate-vulnerable nations that comprise the V20. We are also collaborating with the International Forum of SWFs on impact metrics, an essential but underdeveloped component of this ecosystem, and will host a convening in May 2025 on models and practicalities.

OUR CAPABILITIES

Software Development

In partnership with public managers and policymakers, our international team of software developers and financial modelers builds and adapts custom planning software to support revenue management, portfolio modeling, and scenario analysis.

Fund Structuring and Governance

Alongside public officials, we work with fund managers to hone the purpose and strategic orientation of sovereign investment vehicles, implement best practices around governance and transparency, and productively engage peer institutions and potential collaborators, in country and internationally.

Capital Markets Engagement

At the heart of our work is a conviction in the power of building bridges between the managers of public capital, particularly in low and middle income countries, and the spaces in which global institutional investors build partnerships and make deals. Increasingly, sovereign investment is seen as a powerful signal to market actors. Using public finance to anchor follow-on investment can catalyze strategic sectors and contribute to national development objectives.

Impact Strategy and Measurement

Strategic investment funds require sophisticated methodologies for evaluating social outcomes that align with ESG principles while reflecting local and cultural nuances. Our team of econometricians and social scientists employs quantitative methods (descriptive statistics, cross-tabulation, comparative analysis, and data visualization) alongside qualitative methods (thematic analysis and case study selection) to help fund managers target and assess economic and social impact.

OUR GOALS

Our goal is to become the premier global advisor to sovereigns, sub-sovereigns, and other public entities seeking to make permanent public investment in resilient infrastructure and the energy transition. We seek cross-cutting support from public, private, and philanthropic actors to support work with policymakers and other high-impact partners across the world.

PARTNER WITH US

We partner with social wealth fund managers, academics, policymakers, and government officials in the US and abroad. Examples of this work include a study of financing and infrastructural options to support cash transfers and economic development in Compton, California, as well as our ongoing collaboration with UFF and the Treasury of Niterói, Brazil to develop tools and resources for the newly created Fundo de Equalização da Receita (Budget Stabilization Fund), including stochastic modeling software for portfolio analysis and risk management.

SELECTED PARTNERS

-

Forum of Brazilian Sovereign Wealth Funds

-

International Forum of Sovereign Wealth Funds

-

The Vulnerable Twenty Group (V20)

-

Brazilian Development Bank (BNDES)

-

Association of Brazilian Development Banks (ABDE)

-

Universidade Federal Fluminense (UFF)

Featured Partners

Social Wealth Contributors

Adriel Araujo

Research Fellow

Andrea Gama

Affiliate Researcher

Francis Tseng

Lead Developer

Jason Windawi

Fellow

Jonathan Calenzani

Fellow

Paul Katz

Senior VP

Sina Sinai

Senior Research Associate

Thaís Donega

Fellow

Related Tools

Tooling

Tooling

FeMCI

Tooling

Tooling

Public Banking Simulator

Related Publication Series

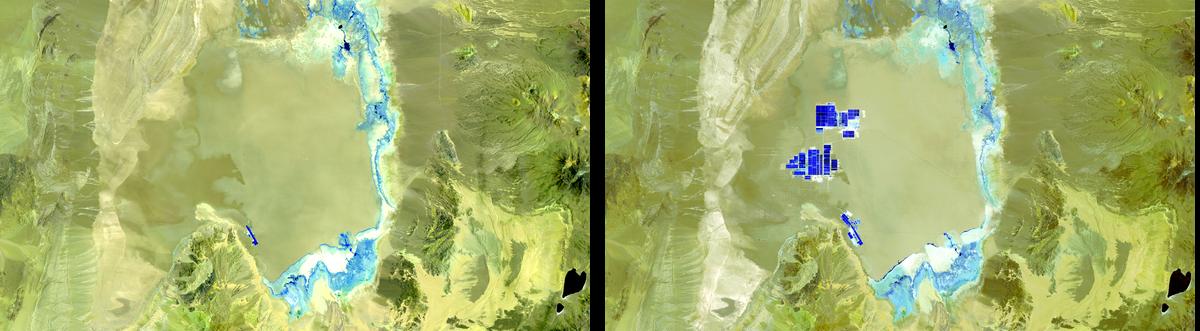

Mineral Wealth and Electrification

Municipal Public Banking

Social Wealth Seminar

Recent Updates

Transition Finance 101 – Expert Hour with Elizabeth Harnett

Join us on Zoom, Thursday, August 28, at 12:00 pm ET.

New Report Explores How Sovereign Wealth Funds Integrate Social Impact

Survey-based report is the first systematic look at how social impact is defined, measured, and monitored across the $13 trillion SWF...

The State of SWF Social Impact Integration: Trends and Opportunities

"The sovereign wealth sector has moved past the question of whether social impact matters and on to questions of clarifying...

Regulation roundtable at the Fórum de Fundos Soberanos Brasileiros

JFI's Paul Katz moderated a panel on strategic investment

Experts Convene to Discuss Social Impact Practices for Sovereign Wealth Funds

High-level workshop gathers SWF representatives, academic researchers, international financial institutions, and asset managers to debate social impact measurement and monitoring.

JFI and Climate Vulnerable Forum move towards multi-sovereign investment fund

April 23 meeting with V20 representatives from eleven member countries kicks off discussions on new South-South mechanism to organize climate investment.

Mineral Wealth and Electrification — Technical Appendix

On data sources and data processing.

Part of the series Mineral Wealth and Electrification

Mineral Wealth and Electrification — Report

This report adopts a producer-country perspective centered on the potential for wealth creation and public value capture and investment.

Part of the series Mineral Wealth and Electrification

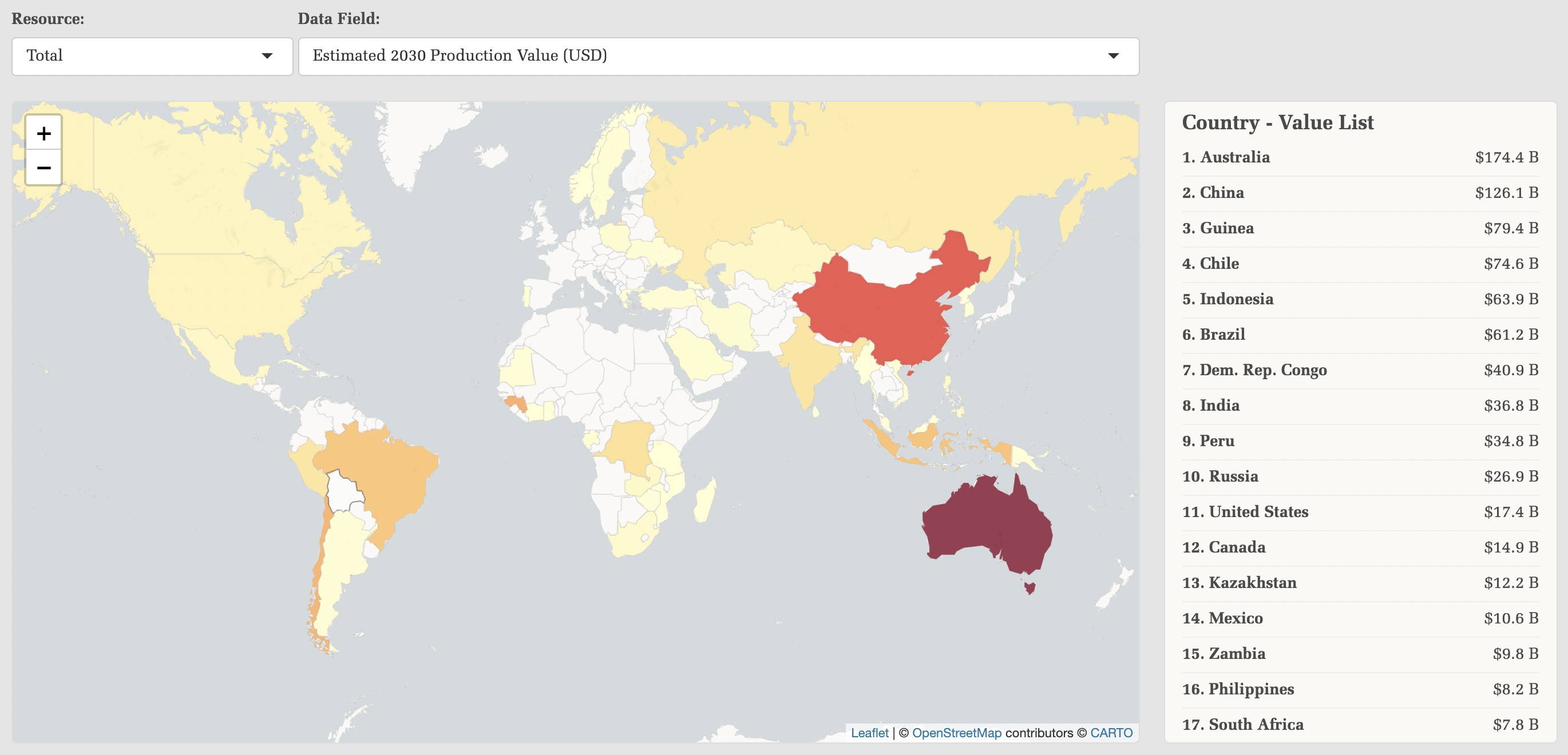

Transition-Critical Minerals: Wealth Endowments and Value Capture — Interactive Map

A high-level distribution of current and future mining production and potential royalty revenue globally through 2030.

Part of the series Mineral Wealth and Electrification

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?

Press Release: Mexico’s Petroleum Hedging Program as Counter-Cyclical Insurance

The Jain Family Institute released a new report assessing the remarkable petroleum hedging strategy that has been deployed for nearly...

Mexico’s Petroleum Hedging Program as Counter-Cyclical Insurance

A new report and modeling exercise point to the possible relevance of this successful petroleum hedging strategy to other exporting...

Brazilian Subnational Social Wealth Funds in Bloomberg and Washington Post

"Brazil’s Oil-Rich Cities Are Revolutionizing Its Public Wealth Management."

JFI’s public bank work in the Los Angeles Times

Los Angeles City Council has taken the next step towards a public bank.

Media coverage for JFI and the Berggruen Institute’s Municipal Public Banking research

NextCity covered the report's implications; the Los Angeles City Council has voted on next steps for implementation.

Event: We Take Mumbucas: Charting the Complementary Currency that’s Transforming a Brazilian City

A virtual event, Friday, June 30 from 1-2:30pm ET.

We Take Mumbucas: Charting the Complementary Currency That’s Transforming a Brazilian City

A new report by Andrea Gama and interactive visualization from Francis Tseng.

Part of the series Social Wealth Seminar

Press Release: Digital Complementary Currency Drives Revitalization of Brazilian City

Report and visualization offer first look at the impact of Maricá’s mumbuca, one of the most widely traded local...

JFI and Berggruen Institute Release Interactive Tool Exploring Impacts of a Public Bank

Digital web app allows anyone to build custom lending portfolios and see projected impacts on affordable housing, green energy, and...

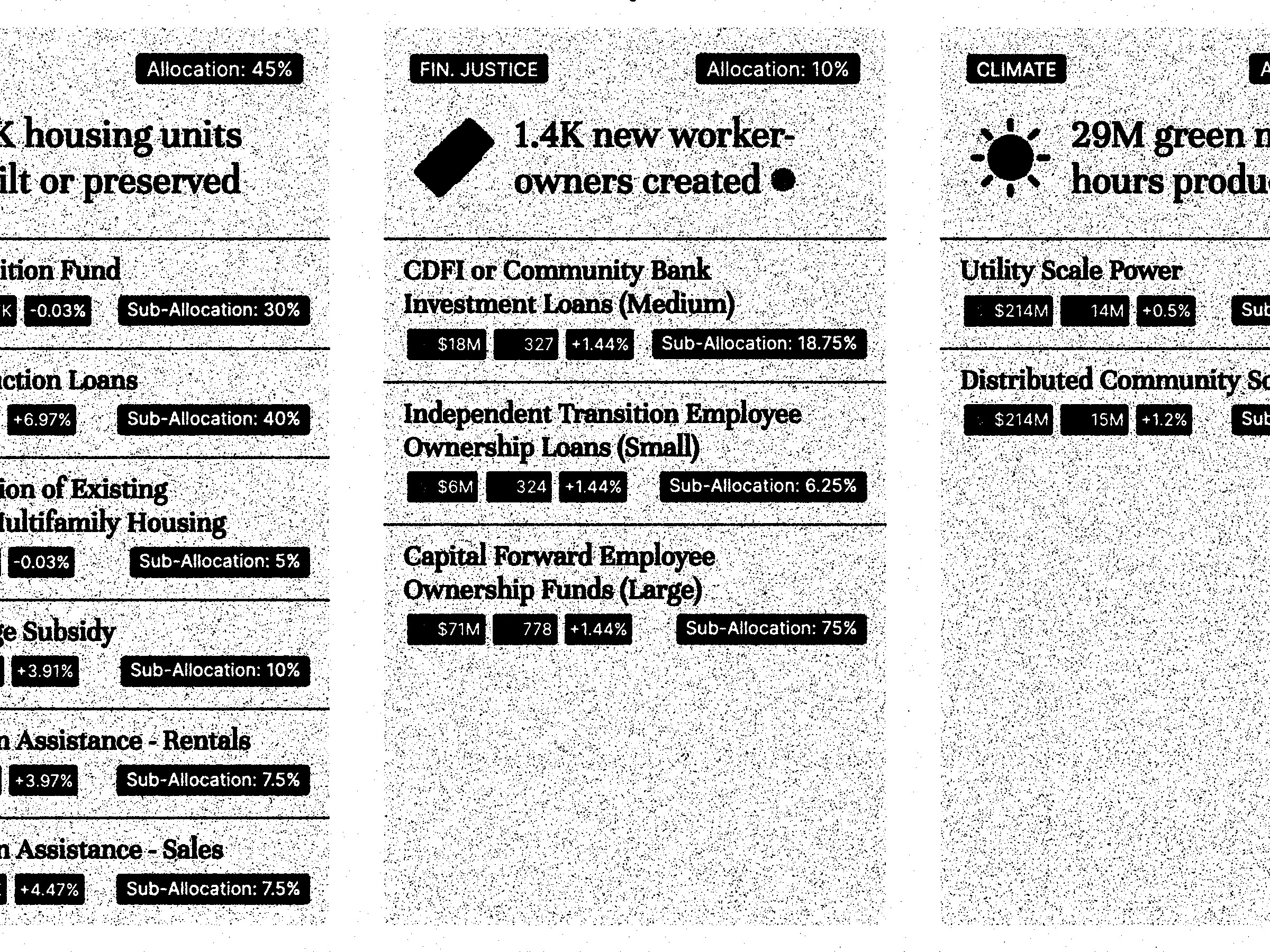

Municipal Bank of LA: Interactive Balance Sheet Simulator

The simulator enables the public to allocate resources among the proposed public bank lending programs, testing cost and profit assumptions...

Part of the series Municipal Public Banking

Press release: People’s assemblies should govern public banks

A new report from JFI and the Berggruen Institute's Municipal Public Banking series

Municipal Bank of LA: Democratic Governance Frameworks

A briefing by Michael McCarthy of the Berggruen Institute on deliberative democracy for public finance and investment.

Part of the series Municipal Public Banking

JFI and Berggruen Institute Report: Public Bank Could Finance Over 17,000 Affordable Homes in Los Angeles

Press release: Latest in publication series on public banking shows how low-cost city programs can help protect and expand affordable...