Publications

Publication Series

Recent Publications

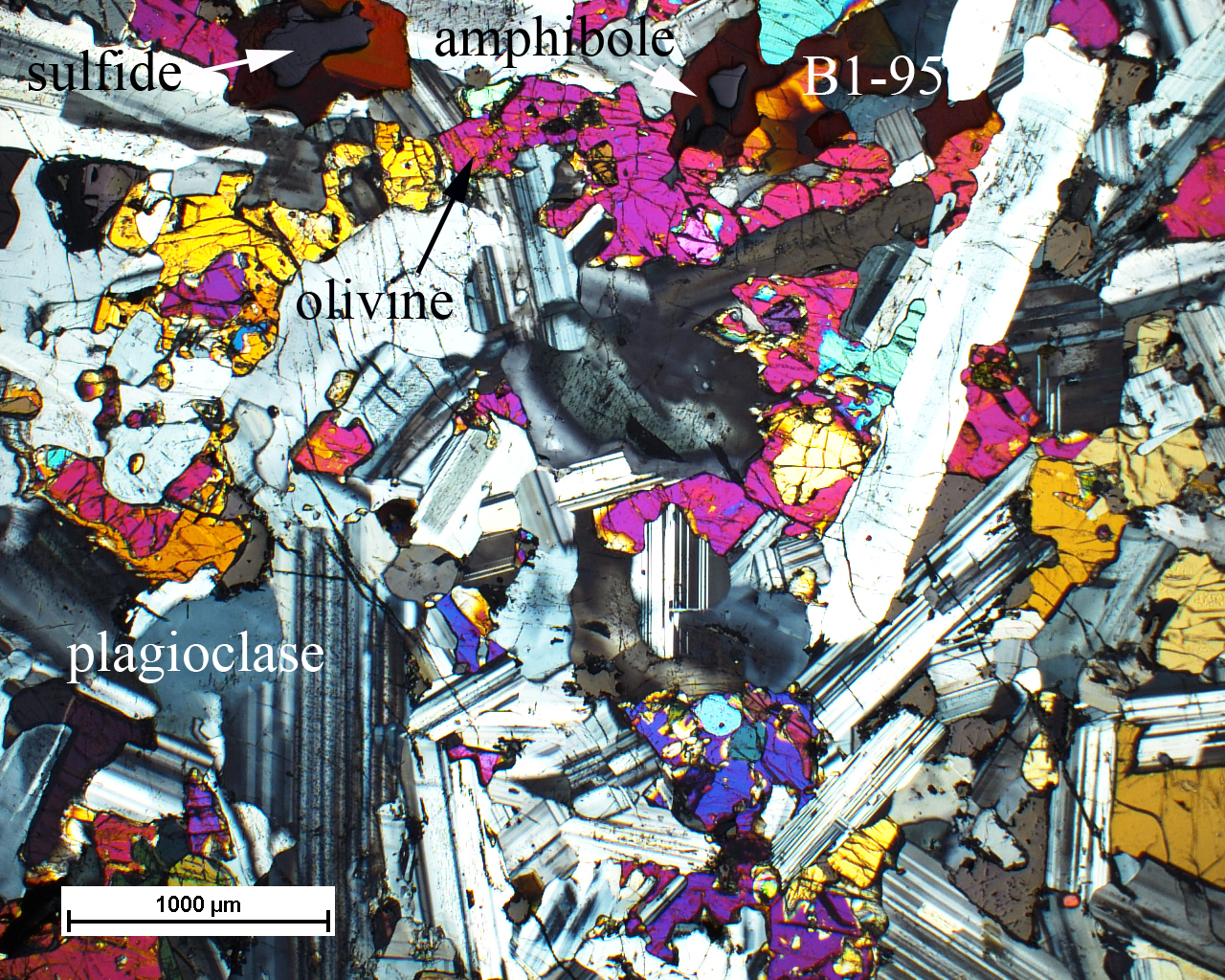

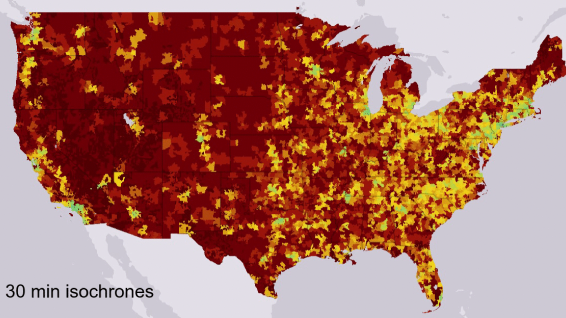

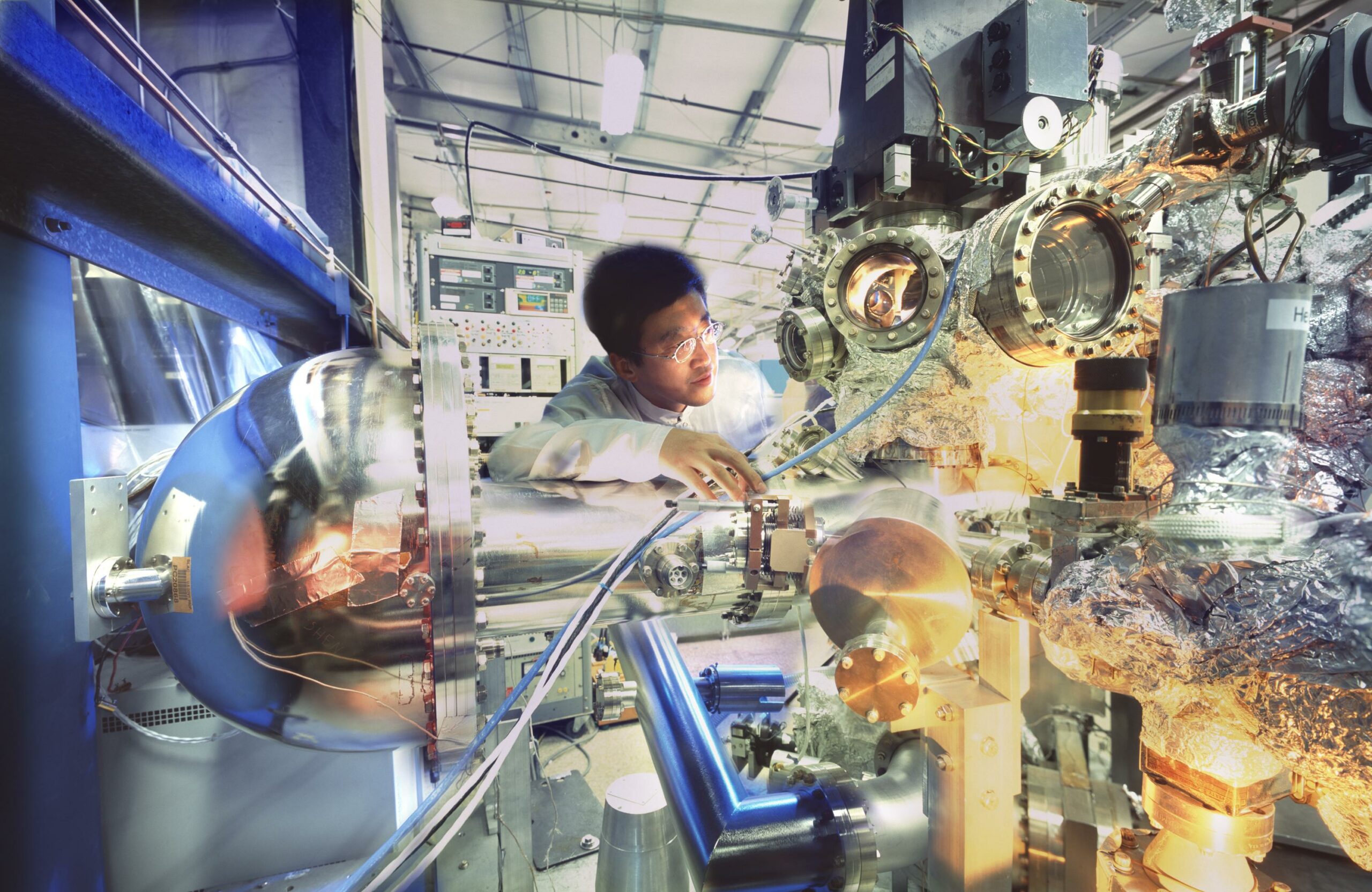

Unpacking Mineral Markets: Visual Summary

An overview of key figures.

Part of the series Unpacking Mineral Markets

Unpacking Mineral Markets Memo: Situating the Opportunities

On the diversity of opportunities and challenges for mineral-rich countries as they grapple with the material demands of decarbonization.

Part of the series Unpacking Mineral Markets

Brief 1: Minerals-Based Industrial Policies in a Fragmenting World: Lessons from Indonesia and Australia

The first paper in a series on how mineral-producing countries are pursuing industrial policy.

Part of the series Minerals-Based Industrial Policies in a Fragmenting World: Lessons from Indonesia and Australia

The (In)accessibility of OBBB’s New Tax Cuts

"The new deductions are a minor and ineffective token of targeted support to the middle and working class in an...

The State of SWF Social Impact Integration: Trends and Opportunities

"The sovereign wealth sector has moved past the question of whether social impact matters and on to questions of clarifying...

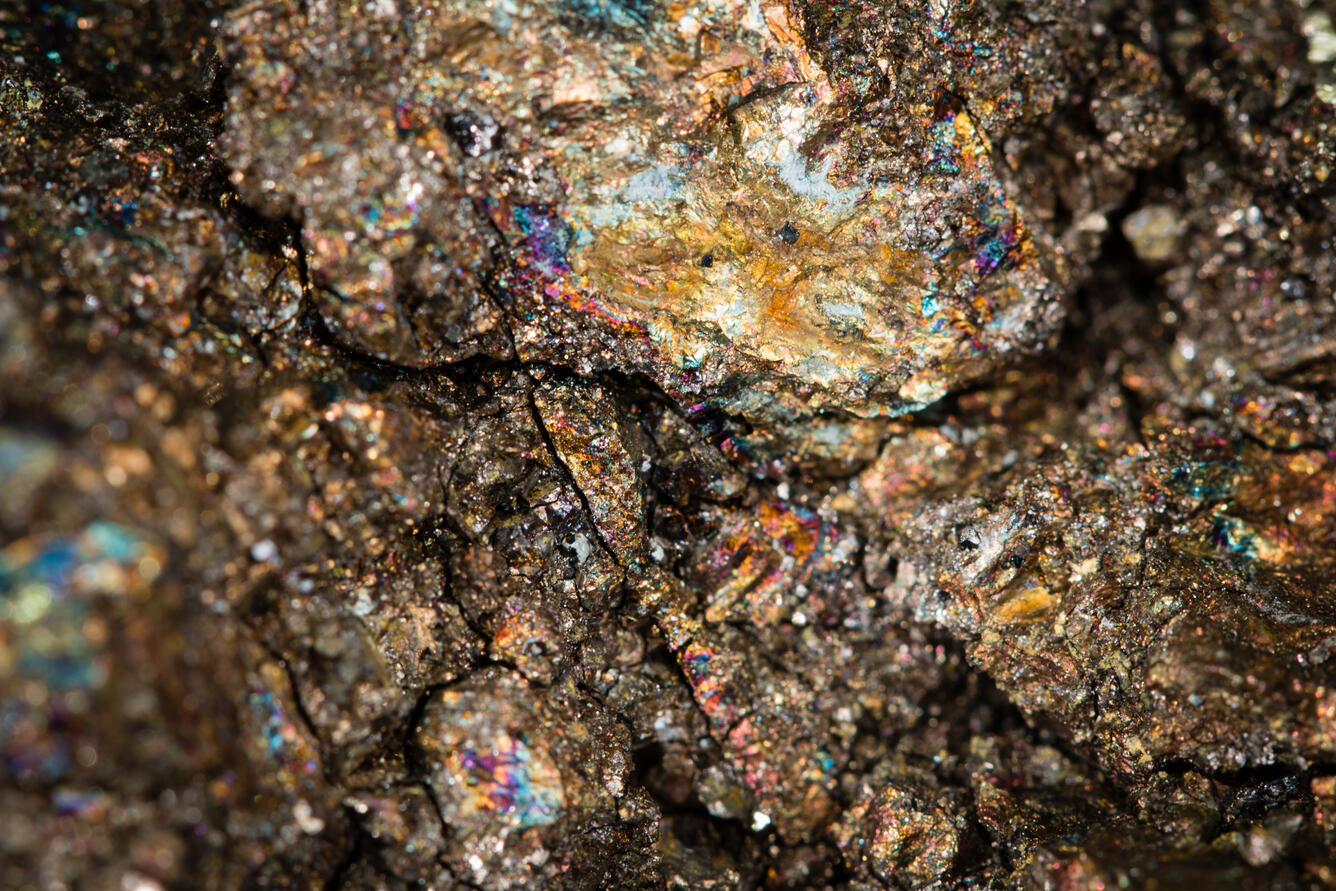

Benchmarking Opportunity in Transition-Critical Mineral Markets

"The most aggressive growth and price scenarios, which miners tend to favor in their feasibility studies, often embed optimistic assumptions...

Tax Provisions of the House-passed ‘One Big Beautiful Bill’: Impact on Low-Income Families with Children

"The limited reach of OBBB’s CTC expansion appears poorly understood."

Part of the series Low-Income Families with Children and The Reconciliation Debate

EITC Certificates: How a Certification Mandate Would Function like a Universal Audit

"If all EITC recipients claiming children must comply with audit procedures to receive a certificate, they will effectively be audited...

Part of the series Low-Income Families with Children and The Reconciliation Debate

Without Improvements to Refundability, any Child Tax Credit Expansion Cannot Benefit Low-Income Working Families

"Refundability is the key mechanism for a CTC expansion to benefit low-income working families."

Part of the series Low-Income Families with Children and The Reconciliation Debate

Correcting the Record on Child Tax Credit Compliance Concerns

"There is strong evidence that most incorrect CTC payments are benign errors—the bulk of incorrect claims come from close...

Guaranteed Income In The Wild: Summarizing Evidence From Pilot Studies and Implications for Policy

How to make sense of competing claims about guaranteed income?

Mineral Wealth and Electrification — Technical Appendix

On data sources and data processing.

Part of the series Mineral Wealth and Electrification