Higher Education Finance

The American higher education system is afflicted by a crisis of quality, affordability, and access that belies its role in building an equitable and just society. This has found most pernicious expression in the mounting problem of student debt, a $1.7 trillion burden affecting over 42 million people. This burden often now extends to students’ families, and is disproportionately shouldered by historically marginalized groups. Absent any meaningful constraint on college costs, the student debt trap risks putting higher education – and its promise of economic mobility – out of reach for ordinary and low-income Americans.

JFI approaches the problem of higher education finance in two principal ways: researching the system as it exists, and formulating new mechanisms for financing higher education in the future. We have broken new ground in our analysis of individual- and institution-level datasets, including pioneering work with credit reporting panel data, to offer a detailed picture of student debt, examining race, ethnicity and class intersections, labor markets, intergenerational wealth, and the impact of institution type and geographic concentration. Our findings have highlighted issues with the system for financing higher education well beyond rising tuition, questioning the assumption that student debt “pays for itself” through increased earning power. We have extended the policy picture to cover the problem of labor market credentialization and resulting non-repayment, especially for nontraditional borrowers whose economic life cycles are thereby delayed, as well as institutional segregation in the higher education system. Through this work, we have shined a light on the true long-term costs of a system financed by individual-level student loans.

With this analysis, we aim ultimately to identify high-impact policy interventions to address the existing debt burden and the broader affordability crisis. In an earlier phase of our work, we designed, consulted on, and produced research on income-contingent financing, an alternative to traditional student loans under which students pledge a percent of their income over a limited period.

PARTNER WITH US

We welcome academic and philanthropic partners interested in using our student debt data for collaborative or independent research. We have collaborated with educational institutions, scholarship funds (notably, the Student Freedom Initiative), workforce development agencies, and a range of investors on income contingent finance pilots, and we welcome further inquiries. We also provide analytics, evaluation, and design consulting for existing providers in order to ensure equitable, transparent and accountable financing.

PARTNERS

Featured Partners

Higher Education Finance Contributors

Eduard Nilaj

Senior Research Associate

Ege Aksu

Fellow

Francis Tseng

Lead Developer

Laura Beamer

Lead Researcher

Marshall Steinbaum

Senior Fellow

Roberta Costa

Research Manager

Sérgio Pinto

Fellow

Sultana Fouzia

Research Fellow

Yunjie Xie

Fellow

Related Tools

Tooling

Tooling

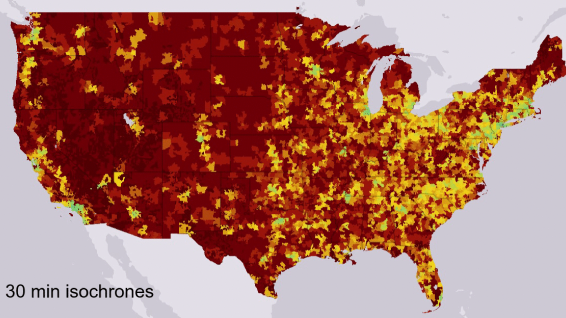

Mapping Student Debt

Tooling

Tooling

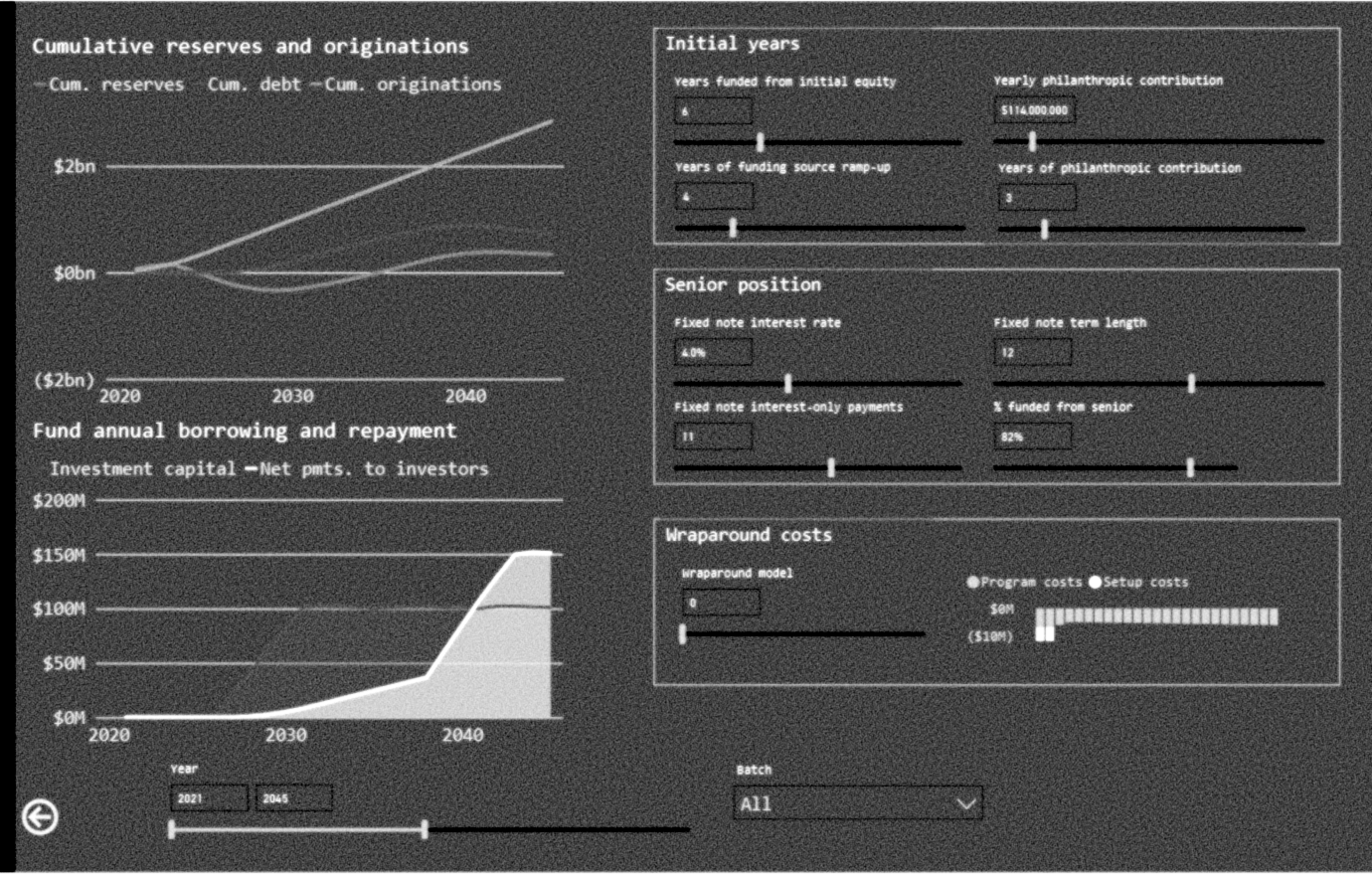

SFI Model

Related Publication Series

Millennial Student Debt

Recent Updates

Dubravka Ritter

Dubravka Ritter of the Federal Reserve Bank of Philadelphia presented two papers at a JFI Research Session this November.

Marshall Steinbaum

Steinbaum presented a paper on student debt

ISAs in the Financial Times

JFI quoted in “American Education and the Rise of Philanthropic Capital”

ISAs in ImpactAlpha

An article on JFI’s partners, Better Future Forward

Income Share Agreements at Purdue

A video from PBS Newshour explains how ISAs work.

New Research: Borrowing Arrangements and Returns to Education

A JFI paper on higher ed finance and ISAs

Report: DREAMers’ perceptions of ISAs

Results from focus groups on higher education financing