Financing the Energy Transition

JFI’s Financing the Energy Transition Initiative addresses a question fundamental to building a greener future: how do we shape markets for various energy projects to incentivize the private sector to come online in force?

Our team of data analysts and energy markets experts leverages particularized financial modeling analysis as well as larger-scale market simulation to understand the structure of, and the possibilities within, the energy transition.

WORK WITH US

We offer three capacities to policy and private finance partners: we conduct financial and levelized cost analyses of green energy technologies; we conduct regular surveys of investor sentiment analysis by sector; and we’ve built a first-of-its-kind agent-based model, Impulse, to evaluate the effect of public policy and concessionary credit on the propensity of private energy investors to invest in energy technology to clear thresholds of large-scale commercial viability.

Financing the Energy Transition Contributors

Eduard Nilaj

Data Science Research Associate

Francis Tseng

Lead Independent Researcher

Jack Landry

Research Associate

Jerome Hodges

Jonah Allen

Research Associate

Jonathan Calenzani

Fellow

Laura Beamer

Lead Researcher

Mikhael Gaster

Fellow

Natalie Leonard

Fellow

Nolan Lindquist

Executive Director

Paul Katz

VP and Lead Researcher

Sina Sinai

Research Associate

Related Publication Series

Financing the Energy Transition

Labor Market Policy and the Energy Transition

Recent Updates

Levelized Cost of Solar Model

A model for estimating the lifetime cost of solar energy generation.

A Tale of Two Solar Technologies

"Protective tariffs enacted to insulate domestic manufacturers from market forces will inevitably come at a cost to downstream solar developers,...

Part of the series Financing the Energy Transition

JFI’s Tuesday Climate Week Event in Bloomberg Green

Join us September 24 at 4pm.

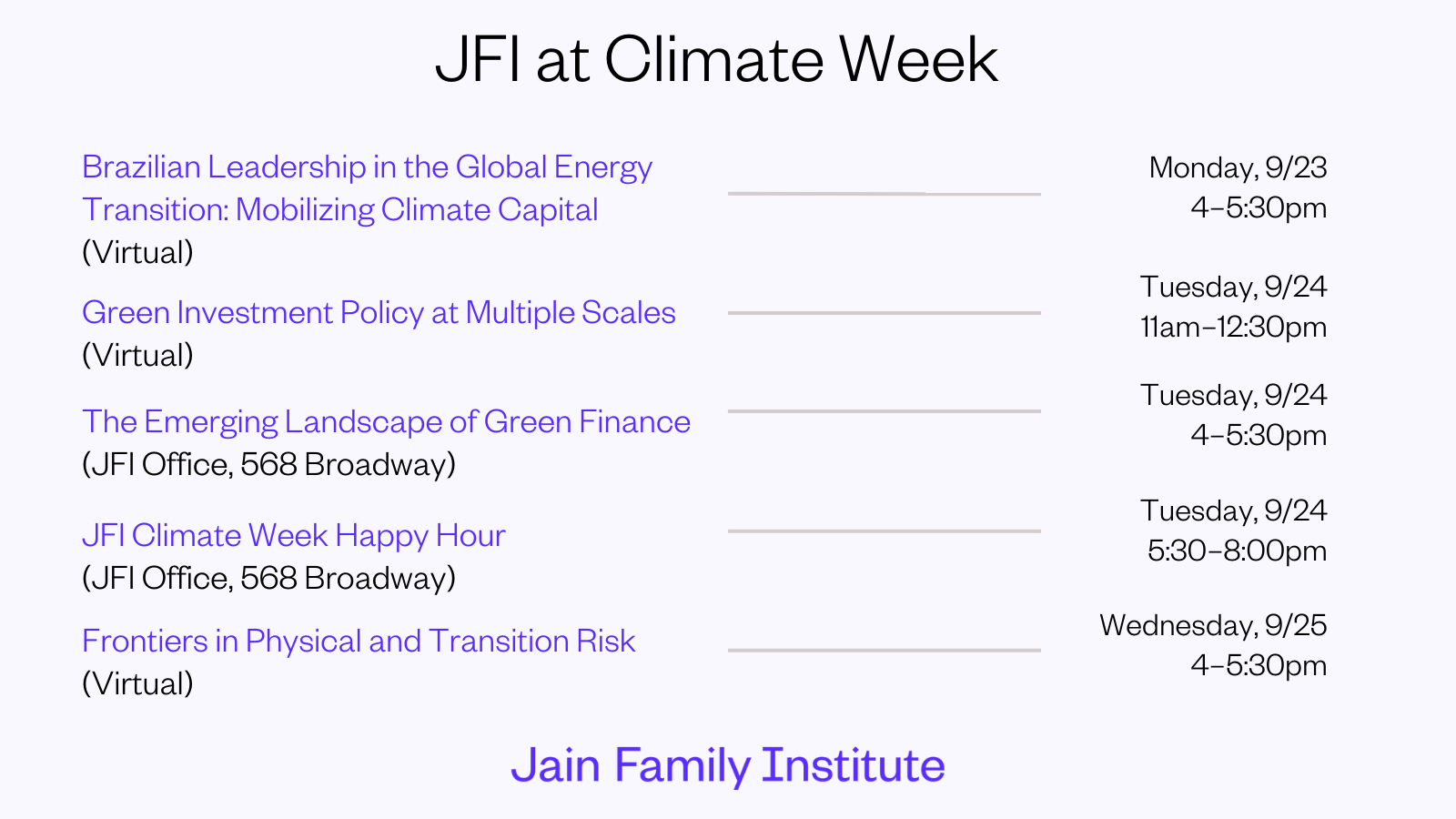

JFI at Climate Week

JFI and our affiliate initiative, the Center for Active Stewardship, are hosting a series of events during NYC Climate Week.

Climate Week with JFI, CAS, and CPE: In-person panel

How will the green transition be financed in the US?

New Research: Solar Power in the US

A scrutiny of the present and future of US solar power by JFI's FInancing the Energy Transition team.

Solar Memo

"Solar is by far the fastest growing power generation technology in the US." On solar module assembly in the US.

Part of the series Financing the Energy Transition

State of Play: Proxy Season 2024

In this report, CAS highlights 21 upcoming annual meetings where our benchmarking raises concerns about the pace of progress on energy...

Part of the series Financing the Energy Transition

Press Release: Proxy Season 2024

Center for Active Stewardship releases report highlighting key corporate annual meetings for climate-focused investors.

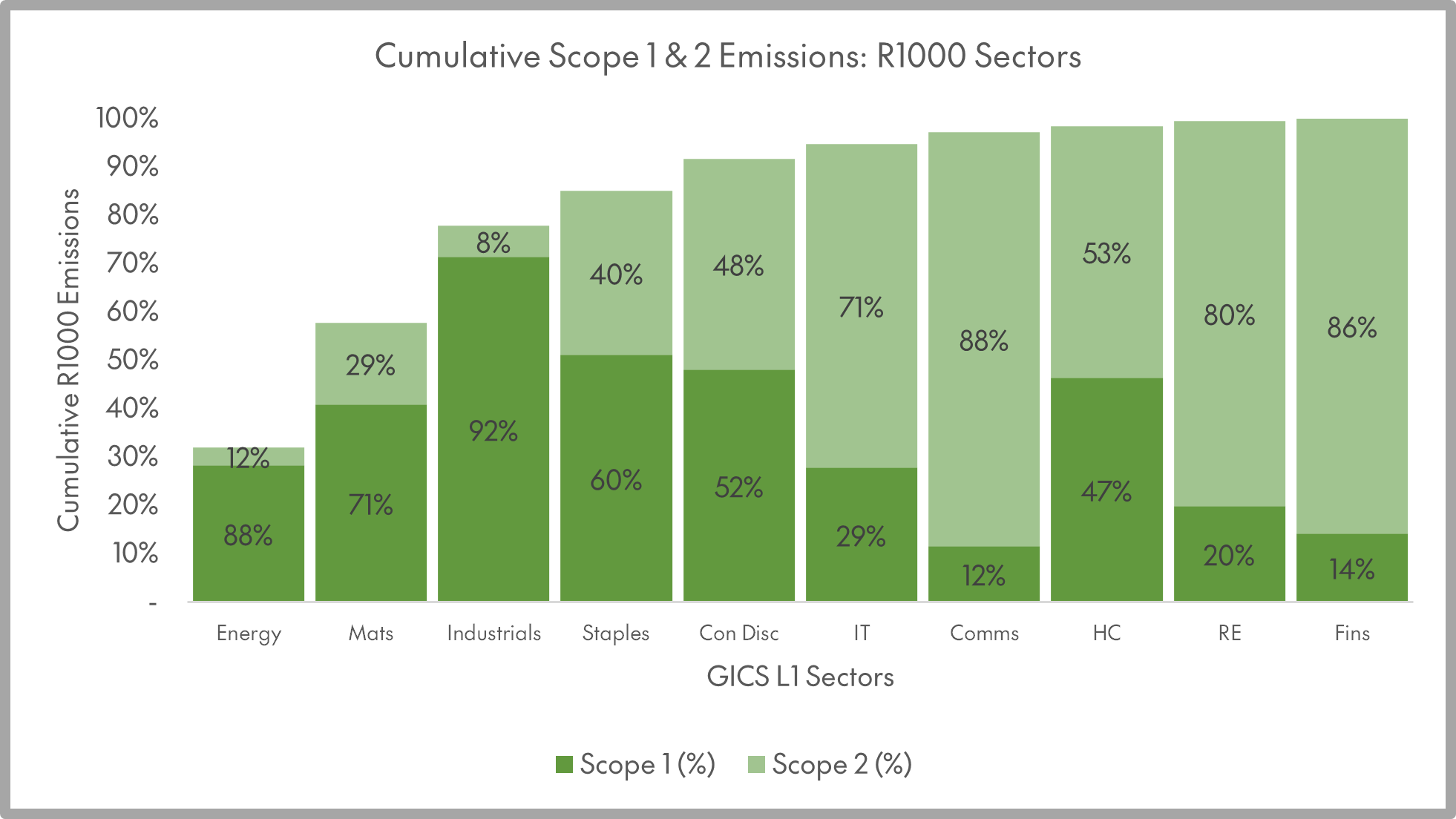

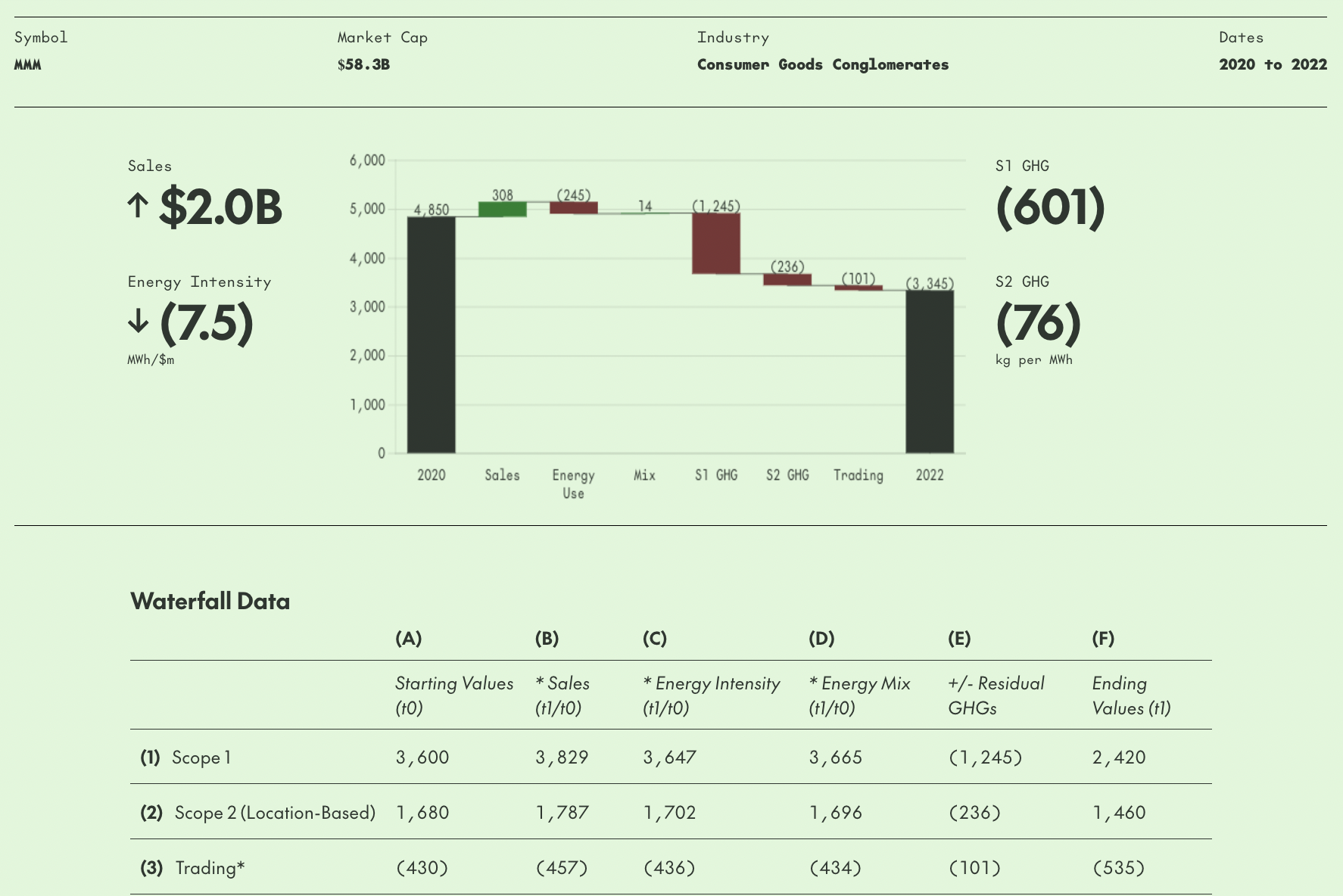

Center for Active Stewardship’s Splice tool in the Financial Times

"The case against carbon emissions as a universal metric"

Center for Active Stewardship launches Splice, a tool for visualizing how a company’s greenhouse gas emissions change over time

"When it comes to emissions reporting, it’s important to be able to separate signal from noise. Initiatives to reduce...

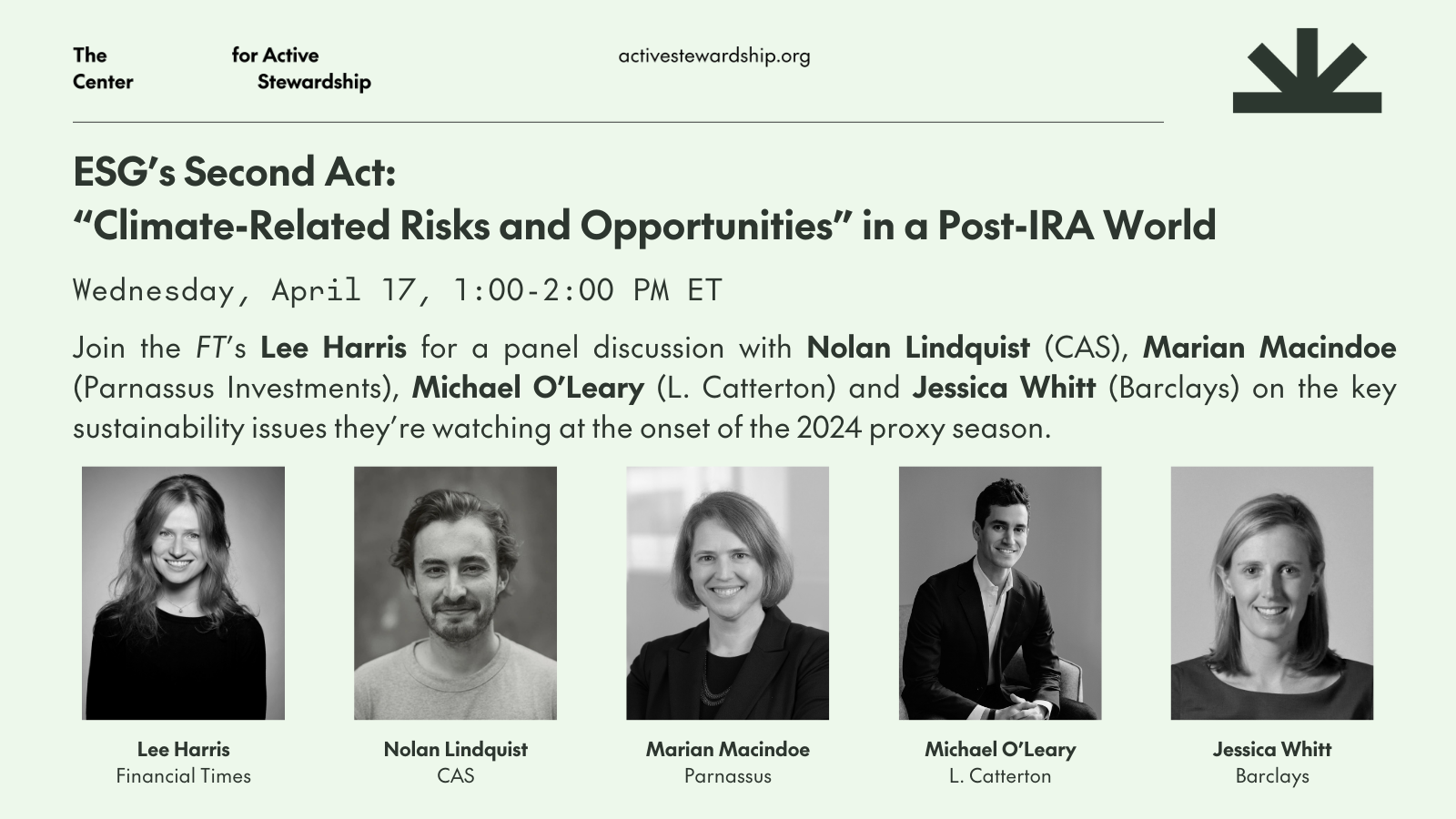

Panel April 17: ESG’s Second Act: “Climate-Related Risks and Opportunities” After the IRA

Exploring the disconnect between NGO priorities and how investors in public and private markets are analyzing "climate-related risks and opportunities"

Labor Market Policy and the Energy Transition: A Problem Statement

"Can skilled labor supply expand at the necessary pace to green our energy system, without wasting an opportunity to negotiate...

Part of the series Labor Market Policy and the Energy Transition

Nuclear Memo

"JFI modeling suggests that, even with existing reactor designs, greenfield nuclear power plants can be a competitive source of clean,...

Part of the series Financing the Energy Transition

New Research: Nuclear Power in the US

The first in a series from JFI's Financing the Energy Transition initiative.

Center for Active Stewardship in the Financial Times

Alphaville's Further Reading shares several posts by CAS executive director Nolan Lindquist.

Atlantic Council policy memo: “How to strike a grand bargain on EU nuclear energy policy”

JFI fellows Jonah Allen and Théophile Pouget-Abadie are co-authors on this policy memo as part of our affiliate initiative...

Atlantic Council policy memo: “A NATO-style spending target could fund long-term decarbonization”

JFI fellow Théophile Pouget-Abadie wrote this memo as part of our affiliate initiative with the Atlantic Council.