Guaranteed Income

OUR MOTIVATING CHALLENGE

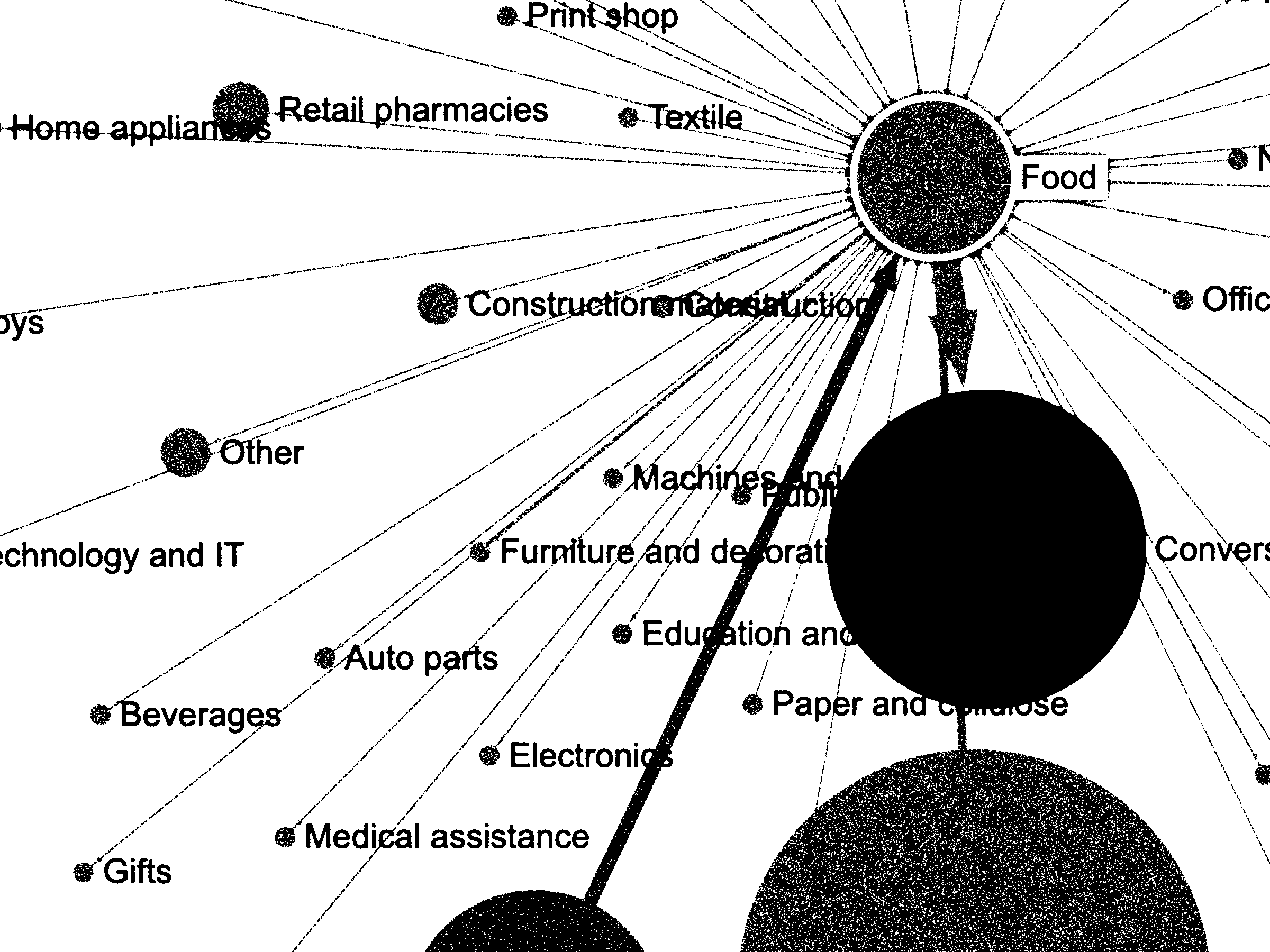

The US spends upwards of $400 billion every year on an extensive infrastructure of anti-poverty programs. While these programs have lifted millions of families above the poverty line, there is tremendous potential to make the safety net more effective, accessible, and cohesive. Many benefits are administered as inefficient in-kind vouchers, require complex application procedures, and either conflict with other programs or interact in ways that risk sudden loss of access.

Guaranteed income – aid in the form of unconditional cash – offers a solution to many of the core problems of the safety net. Instead of cumbersome in-kind benefits, guaranteed income provides flexible cash that empowers recipients to meet their unique needs. It eliminates unnecessary hurdles to access and replaces fragmented programs with a unified, cohesive benefit that avoids disincentives to upward mobility.

While the recent proliferation of pilots across cities and states has generated some momentum, a true guaranteed income policy at the federal or state level is highly limited by today’s political reality. Without diminishing the importance of research and advocacy over a long time horizon, there are incremental reforms, inspired by the underlying philosophy of guaranteed income, that can improve the quality of social support for low and moderate-income Americans in the short term. Without such a phased approach, we believe the energy and momentum behind unrestricted cash risks stalling.

JFI helped build the guaranteed income field from its infancy through a combination of pilot development, field research, and policy analysis. Our evolution of the Guaranteed Income portfolio recognizes that we are at an inflection point; rather than emphasizing foundational basic research on cash and guaranteed income, we aim to translate the principles of guaranteed income to an expanded set of possible complementary reforms to poverty relief and economic mobility programs.

Currently, the community of guaranteed income advocates, researchers, and policymakers have embraced certain forms of intermediate advancement—namely in the form of pilot cash demonstrations and the expanded child tax credit. These are important steps that set specific tractable and achievable targets. Our initiative aims to chart an expanded set of possible kindred policies informed by the core principles of guaranteed income.

WHAT WE DO

We pioneer research on high-impact policies to reduce poverty and facilitate upward mobility by applying the core principles of guaranteed income to improve the safety net: making more programs distribute cash, making programs more accessible, and better ensuring the plethora of individual programs create a cohesive whole. These core principles represent a continuum, not a dichotomy. Incremental reforms can move policy towards better approximating the flexibility, accessibility, and cohesiveness that guaranteed income envisions while still falling short of what staunch guaranteed income advocates would prefer. We embrace new programs to fill holes in the existing safety net, but we do not shy away from reforms of incumbent programs to make them more equitable and efficacious. Our work spans the entire continuum of policy development, from incubating novel ideas to partnering with policymakers and advocates around implementation details to turn ideas into reality.

OUR GOALS

Our goal is to transform the US safety net to reduce poverty and facilitate upward mobility by making the safety net better resemble the core principles of guaranteed income. While our applied work to date has been mostly focused on reforming tax credit programs, our future work will span across an array of different programs, from housing vouchers to disability programs to disaster assistance. Our north star is not simply research for the purpose of intellectual edification, but actual policy change. And we hope to help shape the agenda of the broader guaranteed income community towards a wide range of policy targets beyond the child tax credit and pilot demonstrations.

OUR IMPACT

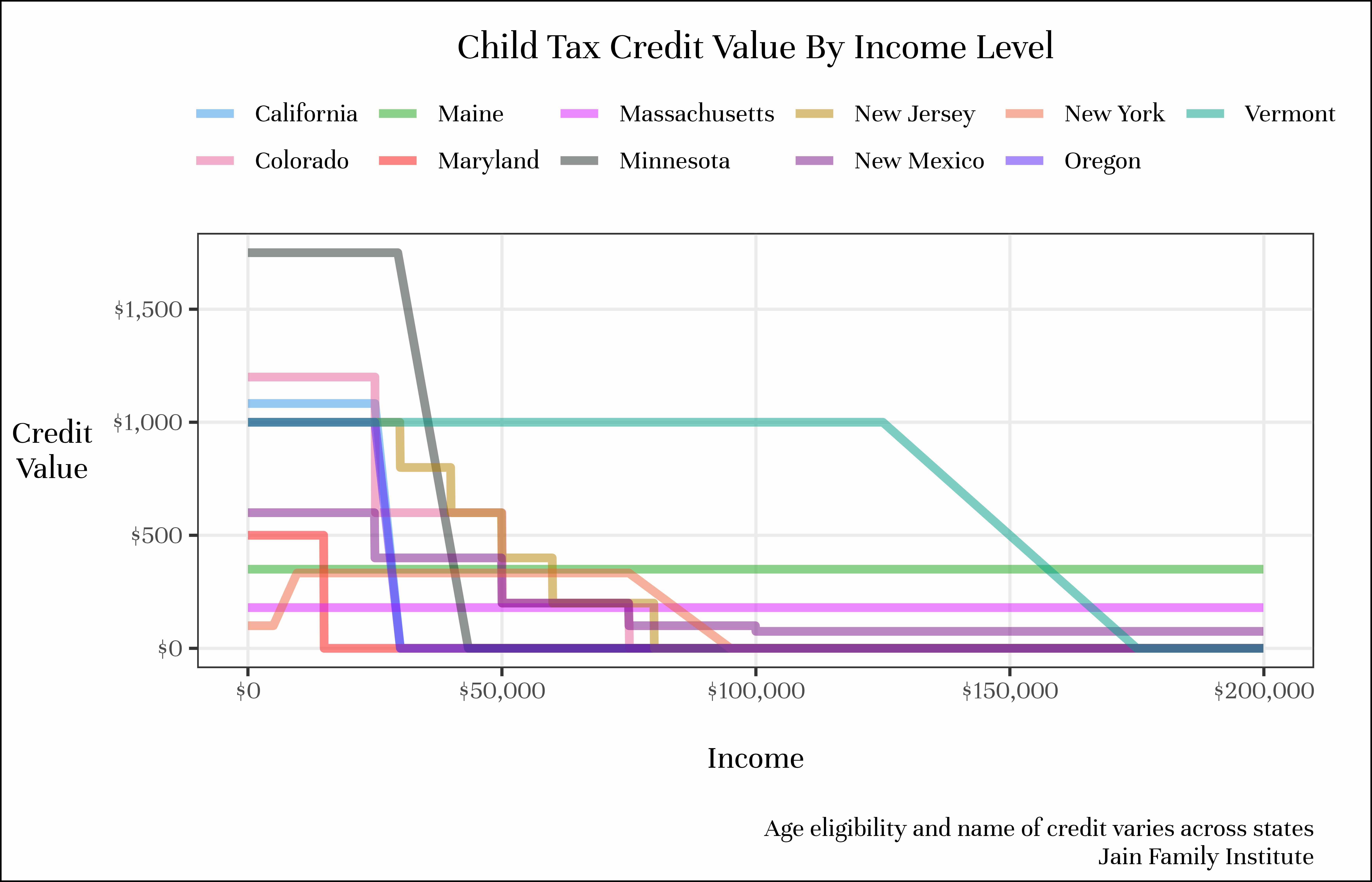

Our work on guaranteed income has spanned the continuum of policy development. On the foundational research and agenda-setting front, we authored an influential series on how guaranteed income fits within the existing safety net, providing valuable conceptual clarity at a time public understanding of guaranteed income was in its infancy. We led the evaluation of one of the earliest, largest, and most rigorous randomized control trial of basic income in the US–the Compton Pledge, providing unique evidence on different designs for cash disbursement. Internationally, we evaluated one of the largest permanent Guaranteed Income programs in the world in Maricá, Brazil. And we helped popularize state level refundable child tax credits when progress on the federal credit expansion stalled, placing a pair of articles in the New York Times news and opinion section.

On the applied policy analysis side, we have provided a compendium of research on the expanded child tax credit. Our work helped clarify the debate around the extension of the expanded credit, showing what potential compromise options would retain a significant anti-poverty impact and which would mostly serve to support middle and high-income parents. At the state-level, we have provided in-depth analytical support to several successful CTC expansions. For instance, we partnered with policymakers and state-level advocates in Colorado on reforms to their child tax credit program to ensure it included all low-income children–including the design of the credit, cost estimates, and implementation concerns. The bill we helped design passed with bipartisan support, increasing benefits for over 70,000 low-income children every year. And we have helped pioneer the idea of turning housing vouchers into a more flexible cash benefit–providing detailed policy advice to the federal government and working with partners on a pilot demonstration–the housing pledge.

PARTNER WITH US

While JFI continues to share design and strategy expertise with pilots, we are increasingly focused on policy design: how cash transfers can make our social safety net work better for the working and middle classes, and what financing mechanisms can help sustain them. To that end, we provide policymakers (mayors, state legislators, economic development teams, etc.) and advocates with policy analysis, including microsimulations of proposed legislation and studies of interactions among existing programs. We are eager to partner with individuals or institutions to extend this work internationally – and to expand our field of study beyond traditional guaranteed income / UBI into other social programs (e.g. housing, healthcare) where the principles of unconditional cash may be beneficial.

PARTNERS

Guaranteed Income Tools & Resources

A collection of materials for practitioners and policymakers.

- Toolkit for creating a guaranteed income in your community: Our toolkit, published May 2021 and available here, provides a concrete starting point for anyone interested in supporting a guaranteed income for their community, particularly by launching a guaranteed income pilot. It begins by answering some of the key questions that arise in this undertaking, including what guaranteed income is, why it is gaining attention right now, what the open questions are that a pilot might answer, and what is involved in the creation of a local pilot.

- How to frame guaranteed income policy: a review of literature: This review of literature, published May 2021, covers a range of important guaranteed income messaging questions.

- Exploring a framework for federal policy: Find our white paper series, “From Idea to Reality: Getting to Guaranteed Income,” here. The series is an in depth examination into how to implement guaranteed income in the U.S.

- JFI Position on Guaranteed Income: Our research-informed guidance on basic parameters for guaranteed income.

Featured Partners

Guaranteed Income Contributors

Andrea Gama

Affiliate Researcher

Ege Aksu

Fellow

Jack Landry

Lead Researcher

Johannes Haushofer

Senior Fellow

Leah Hamilton

Senior Fellow

Marcella Cartledge

Fellow

Roberta Costa

Research Manager

Sara Franklin

Fellow

Yunjie Xie

Fellow

Tools

Tooling

Tooling

The Mumbuca Network

Related Publication Series

From Idea to Reality: Getting to Guaranteed Income

Messaging Guaranteed Income

Policy Microsimulations

Recent Updates

Guaranteed Income In The Wild: Summarizing Evidence From Pilot Studies and Implications for Policy

How to make sense of competing claims about guaranteed income?

Household Responses to Guaranteed Income: Experimental Evidence from Compton, California

Press release: New evidence on GI from a randomized controlled trial.

New Release: First paper from the Maricá Basic Income Evaluation

Diverse impacts of the largest basic income program in Latin America on socioeconomic outcomes; crisis response use-case

HudsonUP Basic Income Pilot releases year three report

Qualitative interviews capture a comprehensive picture of the impact of a long-term guaranteed income pilot.

Policy Brief: On the tax liability red herring currently influencing Congressional debates on the child tax credit

"If changes to the CTC must go to families who owe federal income taxes, it would prevent most low-income working...

The Tax Liability Red Herring: Defending Child Tax Credit Reforms

Analysis responding to the latest Congressional debates: Insisting CTC improvements go to families who have federal tax liability would ensure...

Part of the series Policy Microsimulations

Policy Brief: Responding to critics of the new Child Tax Credit proposal

Will the Child Tax Credit reforms disincentivize work? Evidence suggests it will not.

Responding To the Bipartisan Child Tax Credit Expansion Critics: The Tenuous Evidence Behind Work Disincentives

This report attempts to explain comprehensively why objections to the CTC reforms on the grounds of disincentivizing work are mistaken.

Part of the series Policy Microsimulations

Policy brief: Analysis of the new Child Tax Credit proposal

Timely analysis of a Congressional proposal.

Bipartisan Child Tax Credit Expansion: Analysis of the Tax Relief for American Families and Workers Act of 2024

Congressional tax negotiators have announced an agreement to expand the Child Tax Credit (CTC). The proposal significantly increases benefits for...

Part of the series Policy Microsimulations

Sidhya Balakrishnan speaks to the Guardian on guaranteed income

On cash support in the Bay Area.

Vox covers JFI’s recent research on the Child Tax Credit

Jack Landry was quoted in Vox in a piece focusing on how Congress may come to a compromise regarding the...

New Report: The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

Part of the series Policy Microsimulations

Vox covers JFI’s Child Tax Credit research

Jack Landry spoke with Vox following JFI's new report on state-led CTC expansions.

New Report: Guaranteed Income through the Child Tax Credit

"We estimate that these credits will likely be durable additions to state benefits and will increase cash assistance over the...

Cash at the State Level: Guaranteed Income Through the Child Tax Credit

Eleven states have passed refundable CTCs ranging in value from $300 to $1,750 per eligible child.

Two articles in the New York Times cover JFI’s Colorado Child Tax Credit work

JFI VP Halah Ahmad and research associate Jack Landry worked closely with Colorado lawmakers on a large expansion of the...

Center on Budget and Policy Priorities cites Jack Landry’s research

On the Child Tax Credit.

Press Release: Colorado Expands Child Tax Credit to Parents With No or Little Income

JFI researchers advised Colorado-based advocacy groups, legislators and the governor’s office on pivotal CTC reforms in a successful collaborative...

Now hiring: Research Fellow, Guaranteed Income

A part-time fellowship to work on the formal evaluation of HudsonUP, a multi-year guaranteed income program in Hudson, New York.

Halah Ahmad speaks on guaranteed income at the American Bar Association’s Economic Justice Summit

JFI vice president Ahmad spoke on a panel covering "What is the role of lawyers in guaranteed income programs and...

JFI’s SNAP analysis in the New York Times

Upcoming research by JFI's Jack Landry and Sidhya Balakrishnan, and Northwestern economist Diane Whitmore Schanzenbach

Director of Research Sidhya Balakrishnan in Gothamist

Balakrishnan spoke to Gothamist about New York City's increasing number of cash-assistance programs.