Publications

Publication Series

Recent Publications

Municipal Bank of LA: Democratic Governance Frameworks

A briefing by Michael McCarthy of the Berggruen Institute on deliberative democracy for public finance and investment.

Part of the series Municipal Public Banking

Municipal Bank of LA: Housing Solutions and Portfolio Options

An analysis of how a public bank in Los Angeles could support the city’s broader infrastructure, housing, and sustainability...

Part of the series Municipal Public Banking

What a Public Bank Can Do for L.A. and Its People

A summary analysis of lending programs that create more affordable housing, empower worker ownership of small business, and accelerate the...

Part of the series Municipal Public Banking

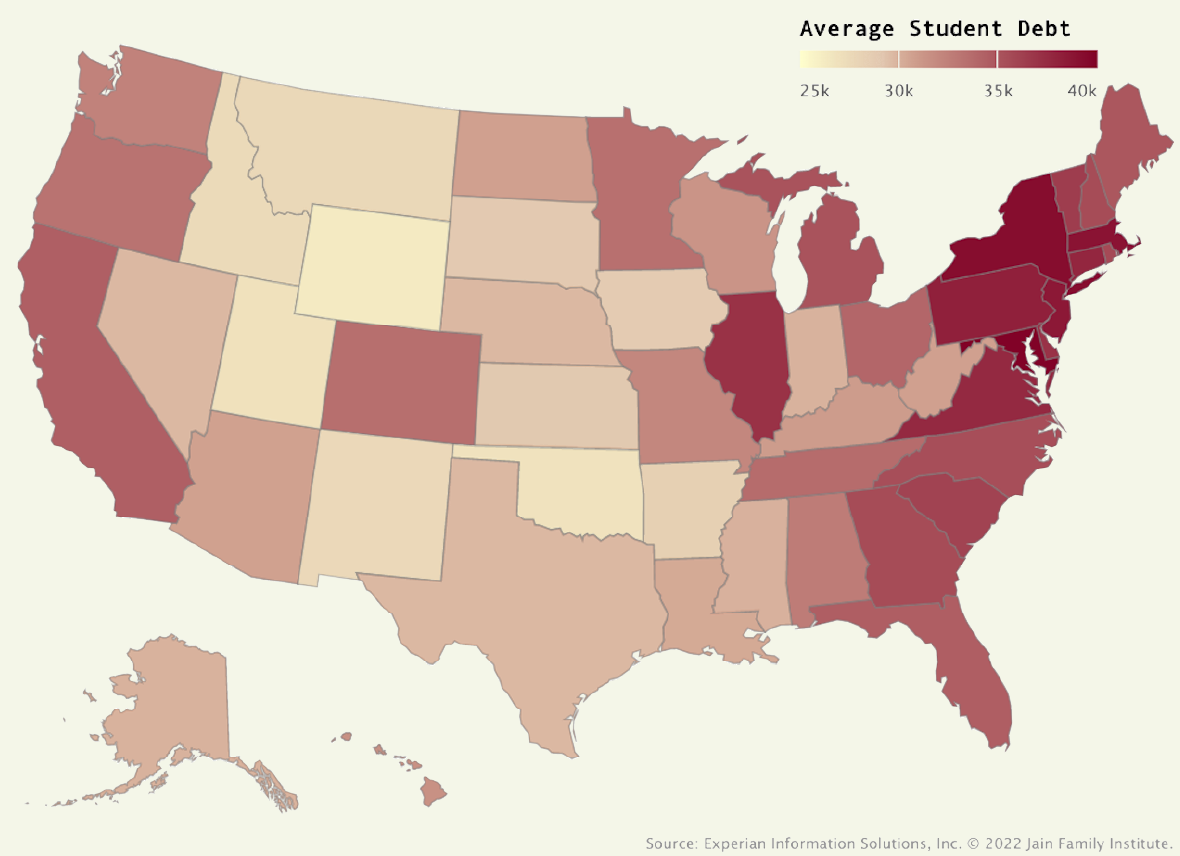

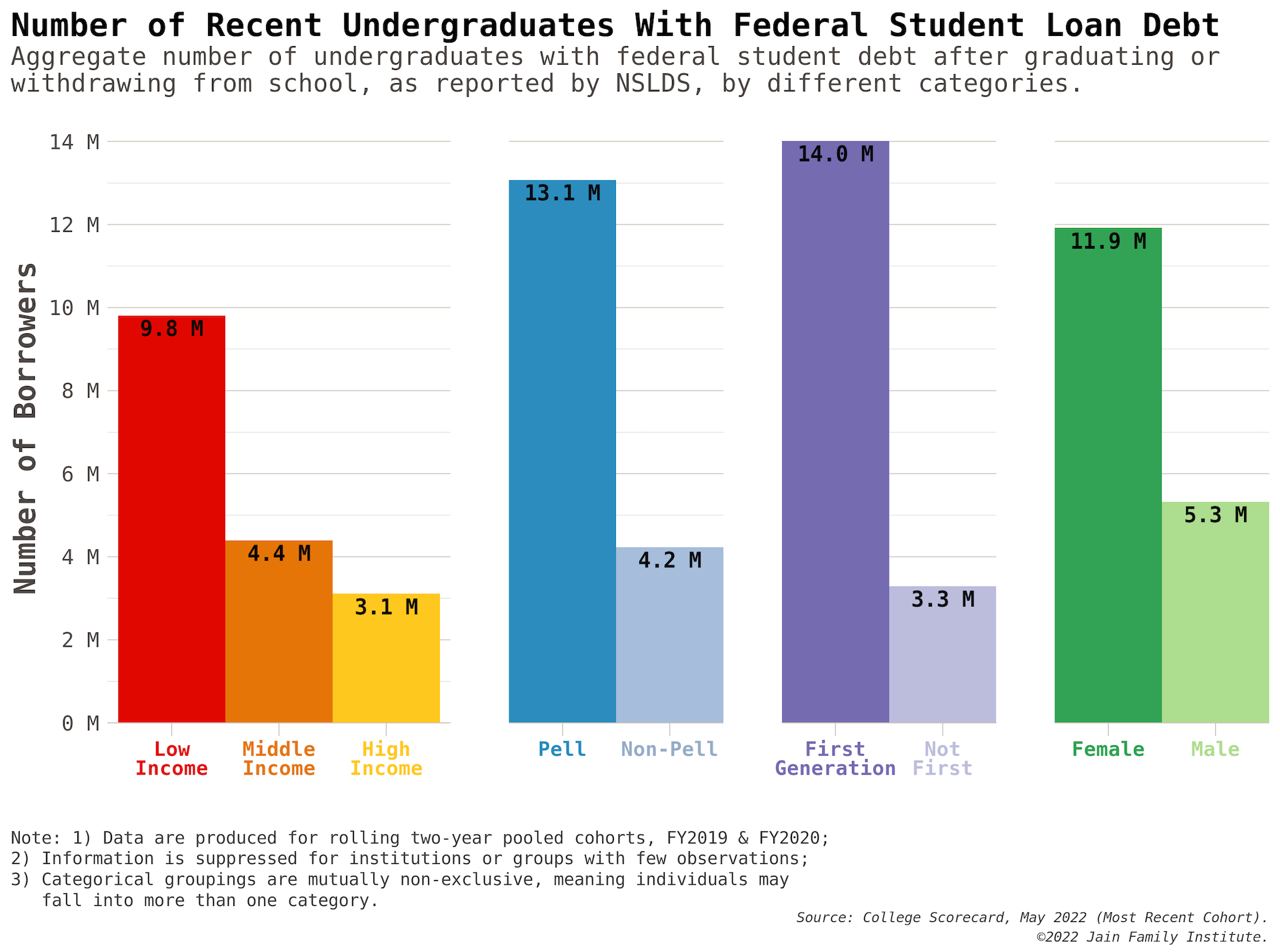

Student Debt and Young America in 2022 – Annual Report and Data Comparison Tool

The annual report provides a full analysis of the state of student debt in 2022—and what it could look like...

Part of the series Millennial Student Debt

Revisiting the Child Tax Credit for the Lame Duck Session: Comparing Parameters for Anti-Poverty Impacts

JFI researchers review recent CTC proposals and simulate the effects of varying key reforms that increase the policy's anti-poverty impacts,...

Part of the series Policy Microsimulations

The Distribution of Student Debtors: Data, Narrative, and Debt Cancellation

The report analyzes demographic distributions of student debt burdens and repayment, providing a counterpoint to narratives that suggest the wealthy...

Part of the series Millennial Student Debt

The Political Economy of Guaranteed Income: Where Do We Go From Here?

This paper is the fourth and final in a series on “Getting to Guaranteed Income,” analyzing the research to date...

Part of the series From Idea to Reality: Getting to Guaranteed Income

Research Brief: Migration and Housing Inflation, by Paul Williams

How rents impacted pandemic migrations, and migrations shape rent growth

Social Wealth Seminar: Paul Williams and Zachary Marks

"Building a Future for Public Developers."

Part of the series Social Wealth Seminar

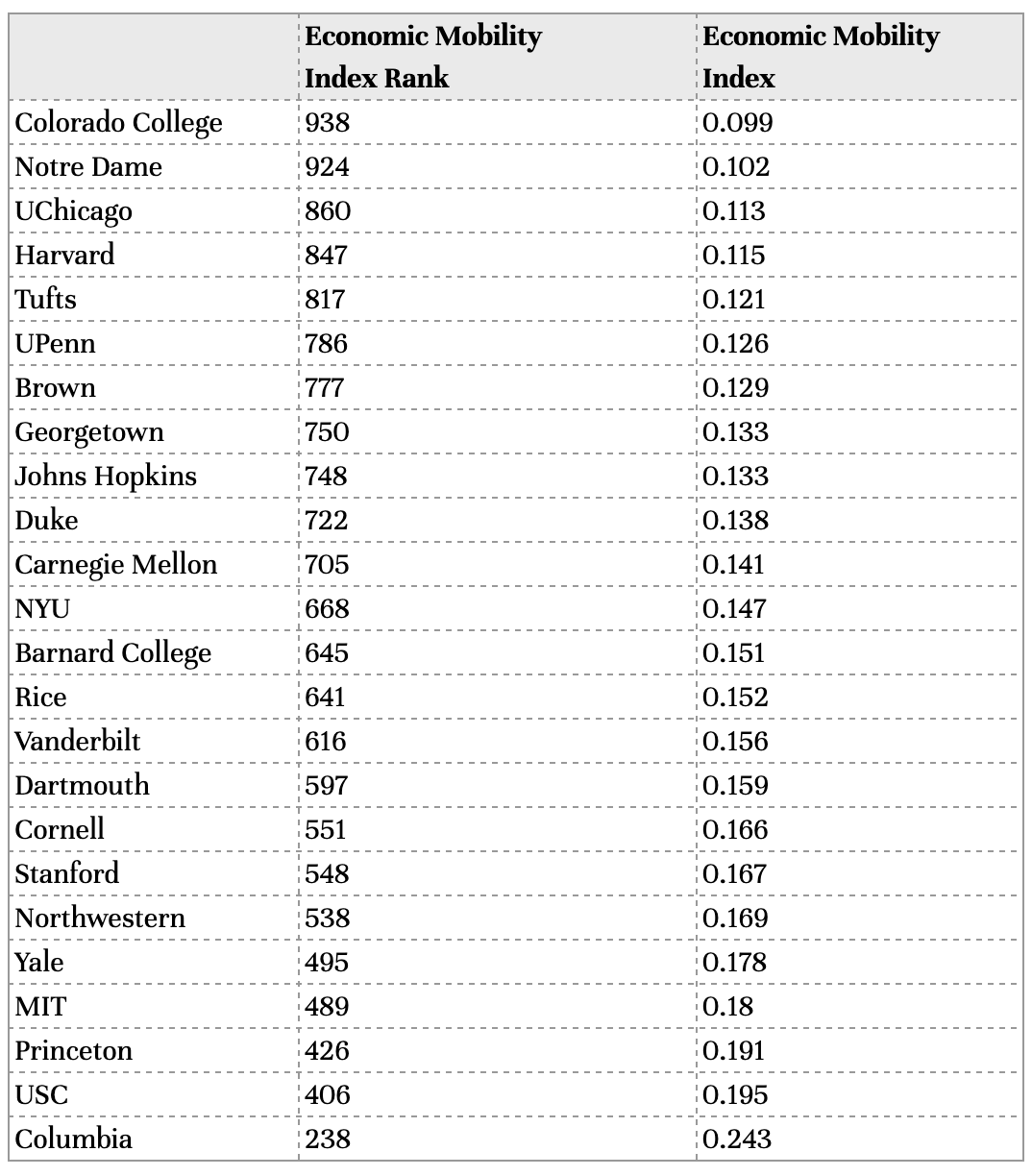

Cost Deception at Elite Private Colleges

Following Millennial Student Debt Part 7, "How Schools Lie: The Deceptive Financial Aid System at America's Colleges," Laura Beamer and Eduard...

Part of the series Millennial Student Debt

A New Public Housing Model — Addis Ababa’s Urban Transformation

The first report from JFI's Social Wealth Portfolio

The Expanded Child Tax Credit and Parental Employment: Tenuous Evidence Points to Work Disincentives

Some academics and policymakers argue that the expanded Child Tax Credit will disincentive work; this report points out the weak...

Part of the series Policy Microsimulations