Guaranteed Income

Legacy safety net programs in the United States are inefficient and inadequate in supporting the financially insecure – a reality made painfully apparent during the COVID-19 pandemic. Ample research has shown that unrestricted cash assistance can not only alleviate material hardship among the most vulnerable but also improve physical and mental wellbeing, child welfare, educational attainment, and more. Decades of advocacy and research into guaranteed income – whether a universal basic income or direct cash transfers through the tax system – offer a vision for a government whose support is more universal, less administratively burdensome, and more respectful of the dignity of ordinary people.

Since 2017, before the concept gained mainstream recognition, JFI has evaluated the feasibility of unconditional cash transfers and how they might be best situated among existing aspects of the social safety net in the United States & abroad. We have helped build guaranteed income pilots; conducted field evaluations on the efficacy and impact of cash programs, including the world’s largest in Maricá, Brazil; advised state and federal lawmakers on relevant legislative reforms, including the federal Child Tax Credit (CTC); and provided expert commentary to media and advocates on the state (and the future) of the field. Most recently, we have begun to sketch a vision for how the now myriad guaranteed income demonstrations can be translated into sustainable policy – and thereby help address our nation’s deepening inequality.

PARTNER WITH US

While JFI continues to share design and strategy expertise with pilots, we are increasingly focused on policy design: how cash transfers can make our social safety net work better for the working and middle classes, and what financing mechanisms can help sustain them. To that end, we provide policymakers (mayors, state legislators, economic development teams, etc.) and advocates with policy analysis, including microsimulations of proposed legislation and studies of interactions among existing programs. We are eager to partner with individuals or institutions to extend this work internationally – and to expand our field of study beyond traditional guaranteed income / UBI into other social programs (e.g. housing, healthcare) where the principles of unconditional cash may be beneficial.

PARTNERS

Guaranteed Income Tools & Resources

A collection of materials for practitioners and policymakers.

- Toolkit for creating a guaranteed income in your community: Our toolkit, published May 2021 and available here, provides a concrete starting point for anyone interested in supporting a guaranteed income for their community, particularly by launching a guaranteed income pilot. It begins by answering some of the key questions that arise in this undertaking, including what guaranteed income is, why it is gaining attention right now, what the open questions are that a pilot might answer, and what is involved in the creation of a local pilot.

- How to frame guaranteed income policy: a review of literature: This review of literature, published May 2021, covers a range of important guaranteed income messaging questions.

- Exploring a framework for federal policy: Find our white paper series, “From Idea to Reality: Getting to Guaranteed Income,” here. The series is an in depth examination into how to implement guaranteed income in the U.S.

- JFI Position on Guaranteed Income: Our research-informed guidance on basic parameters for guaranteed income.

Featured Partners

Guaranteed Income Contributors

Andrea Gama

Affiliate Researcher

Ege Aksu

Fellow

Jack Landry

Research Associate

Johannes Haushofer

Senior Fellow

Leah Hamilton

Senior Fellow

Marcella Cartledge

Fellow

Roberta Costa

Research Manager

Sara Franklin

Fellow

Sidhya Balakrishnan

Director of Research

Yunjie Xie

Fellow

Related Publication Series

From Idea to Reality: Getting to Guaranteed Income

Messaging Guaranteed Income

Policy Microsimulations

Recent Updates

Guaranteed Income In The Wild: Summarizing Evidence From Pilot Studies and Implications for Policy

How to make sense of competing claims about guaranteed income?

Household Responses to Guaranteed Income: Experimental Evidence from Compton, California

Press release: New evidence on GI from a randomized controlled trial.

New Release: First paper from the Maricá Basic Income Evaluation

Diverse impacts of the largest basic income program in Latin America on socioeconomic outcomes; crisis response use-case

HudsonUP Basic Income Pilot releases year three report

Qualitative interviews capture a comprehensive picture of the impact of a long-term guaranteed income pilot.

Policy Brief: On the tax liability red herring currently influencing Congressional debates on the child tax credit

"If changes to the CTC must go to families who owe federal income taxes, it would prevent most low-income working...

The Tax Liability Red Herring: Defending Child Tax Credit Reforms

Analysis responding to the latest Congressional debates: Insisting CTC improvements go to families who have federal tax liability would ensure...

Part of the series Policy Microsimulations

Policy Brief: Responding to critics of the new Child Tax Credit proposal

Will the Child Tax Credit reforms disincentivize work? Evidence suggests it will not.

Responding To the Bipartisan Child Tax Credit Expansion Critics: The Tenuous Evidence Behind Work Disincentives

This report attempts to explain comprehensively why objections to the CTC reforms on the grounds of disincentivizing work are mistaken.

Part of the series Policy Microsimulations

Policy brief: Analysis of the new Child Tax Credit proposal

Timely analysis of a Congressional proposal.

Bipartisan Child Tax Credit Expansion: Analysis of the Tax Relief for American Families and Workers Act of 2024

Congressional tax negotiators have announced an agreement to expand the Child Tax Credit (CTC). The proposal significantly increases benefits for...

Part of the series Policy Microsimulations

Sidhya Balakrishnan speaks to the Guardian on guaranteed income

On cash support in the Bay Area.

Vox covers JFI’s recent research on the Child Tax Credit

Jack Landry was quoted in Vox in a piece focusing on how Congress may come to a compromise regarding the...

New Report: The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

The Impact of Families with No Income on an Expanded Child Tax Credit

Breaking down the benefits of the expanded CTC by income group.

Part of the series Policy Microsimulations

Vox covers JFI’s Child Tax Credit research

Jack Landry spoke with Vox following JFI's new report on state-led CTC expansions.

New Report: Guaranteed Income through the Child Tax Credit

"We estimate that these credits will likely be durable additions to state benefits and will increase cash assistance over the...

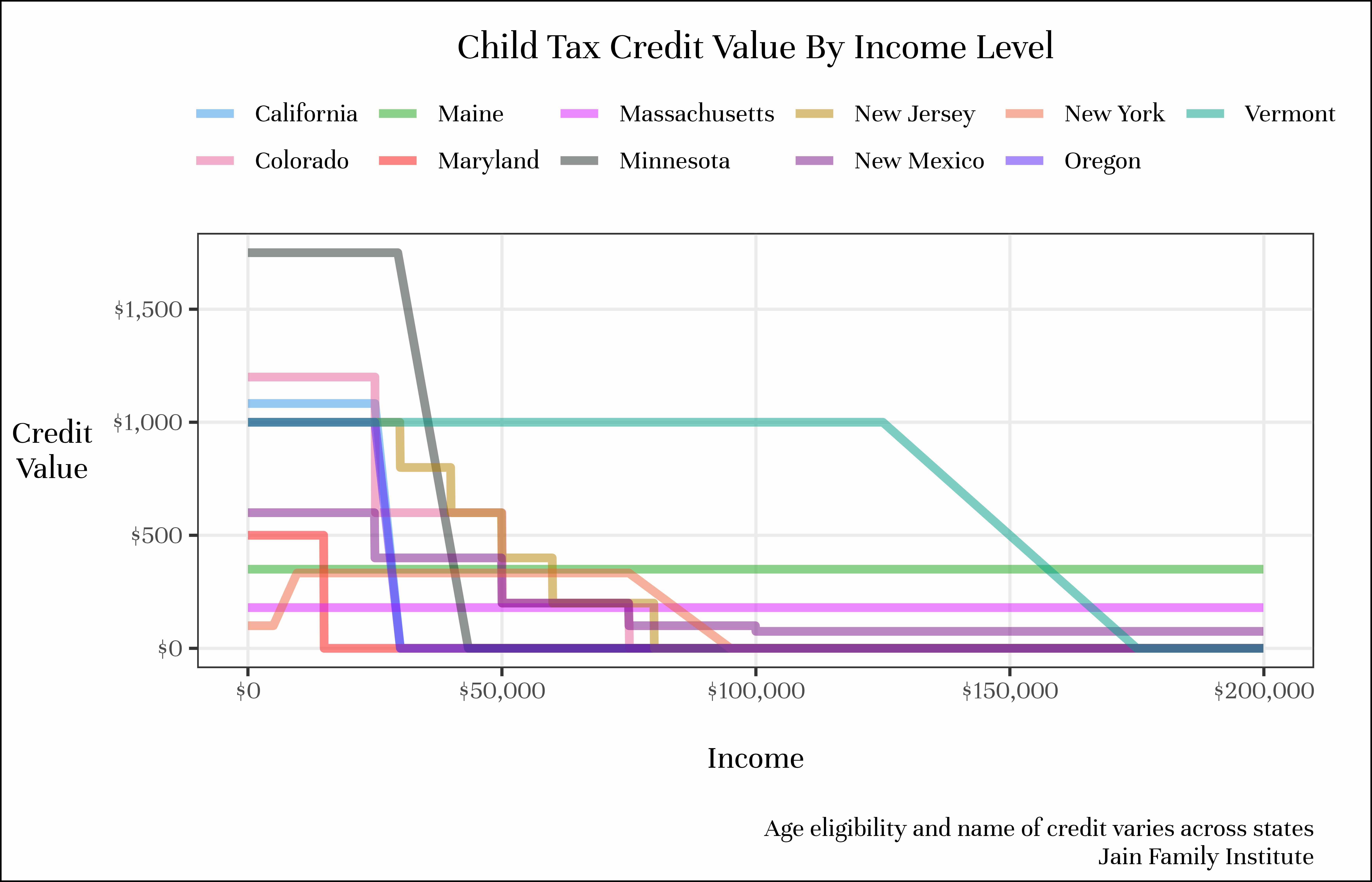

Cash at the State Level: Guaranteed Income Through the Child Tax Credit

Eleven states have passed refundable CTCs ranging in value from $300 to $1,750 per eligible child.

Two articles in the New York Times cover JFI’s Colorado Child Tax Credit work

JFI VP Halah Ahmad and research associate Jack Landry worked closely with Colorado lawmakers on a large expansion of the...

Center on Budget and Policy Priorities cites Jack Landry’s research

On the Child Tax Credit.

Press Release: Colorado Expands Child Tax Credit to Parents With No or Little Income

JFI researchers advised Colorado-based advocacy groups, legislators and the governor’s office on pivotal CTC reforms in a successful collaborative...

Now hiring: Research Fellow, Guaranteed Income

A part-time fellowship to work on the formal evaluation of HudsonUP, a multi-year guaranteed income program in Hudson, New York.

Halah Ahmad speaks on guaranteed income at the American Bar Association’s Economic Justice Summit

JFI vice president Ahmad spoke on a panel covering "What is the role of lawyers in guaranteed income programs and...

JFI’s SNAP analysis in the New York Times

Upcoming research by JFI's Jack Landry and Sidhya Balakrishnan, and Northwestern economist Diane Whitmore Schanzenbach

Director of Research Sidhya Balakrishnan in Gothamist

Balakrishnan spoke to Gothamist about New York City's increasing number of cash-assistance programs.