Higher Education Finance

The American higher education system is afflicted by a crisis of quality, affordability, and access that belies its role in building an equitable and just society. This has found most pernicious expression in the mounting problem of student debt, a $1.7 trillion burden affecting over 42 million people. This burden often now extends to students’ families, and is disproportionately shouldered by historically marginalized groups. Absent any meaningful constraint on college costs, the student debt trap risks putting higher education – and its promise of economic mobility – out of reach for ordinary and low-income Americans.

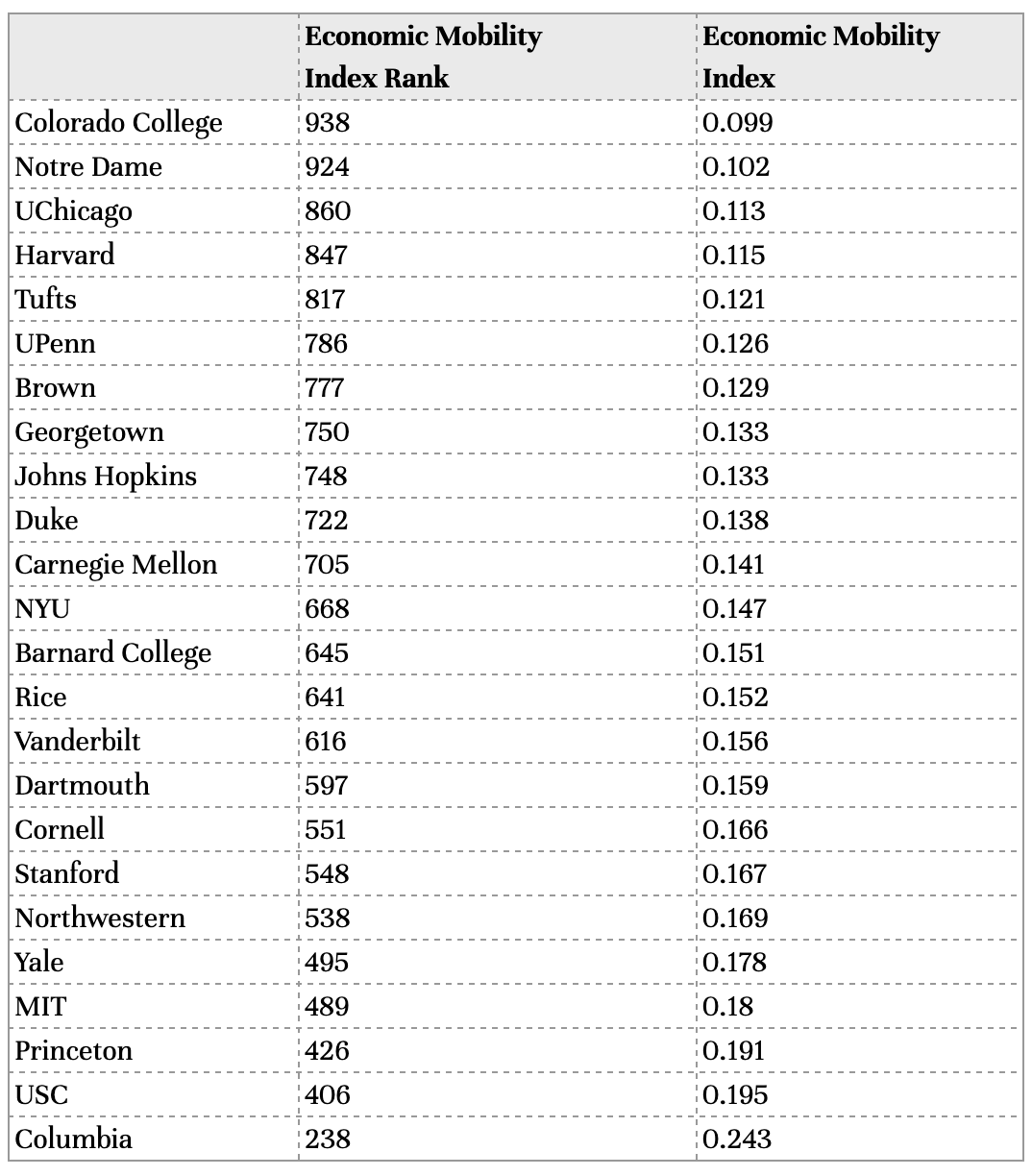

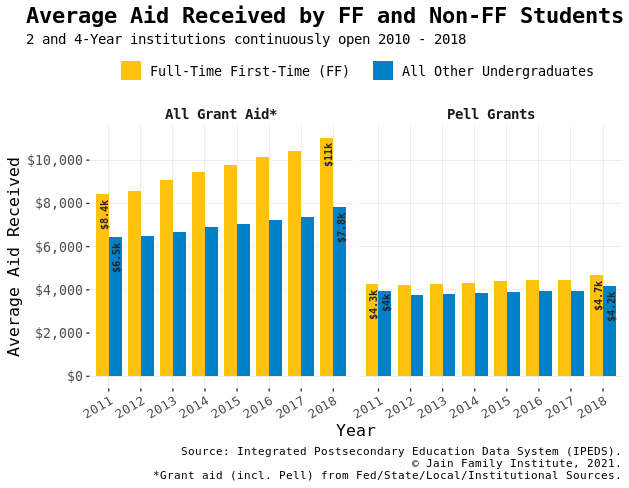

JFI approaches the problem of higher education finance in two principal ways: researching the system as it exists, and formulating new mechanisms for financing higher education in the future. We have broken new ground in our analysis of individual- and institution-level datasets, including pioneering work with credit reporting panel data, to offer a detailed picture of student debt, examining race, ethnicity and class intersections, labor markets, intergenerational wealth, and the impact of institution type and geographic concentration. Our findings have highlighted issues with the system for financing higher education well beyond rising tuition, questioning the assumption that student debt “pays for itself” through increased earning power. We have extended the policy picture to cover the problem of labor market credentialization and resulting non-repayment, especially for nontraditional borrowers whose economic life cycles are thereby delayed, as well as institutional segregation in the higher education system. Through this work, we have shined a light on the true long-term costs of a system financed by individual-level student loans.

With this analysis, we aim ultimately to identify high-impact policy interventions to address the existing debt burden and the broader affordability crisis. In an earlier phase of our work, we designed, consulted on, and produced research on income-contingent financing, an alternative to traditional student loans under which students pledge a percent of their income over a limited period.

PARTNER WITH US

We welcome academic and philanthropic partners interested in using our student debt data for collaborative or independent research. We have collaborated with educational institutions, scholarship funds (notably, the Student Freedom Initiative), workforce development agencies, and a range of investors on income contingent finance pilots, and we welcome further inquiries. We also provide analytics, evaluation, and design consulting for existing providers in order to ensure equitable, transparent and accountable financing.

PARTNERS

Featured Partners

Higher Education Finance Contributors

Eduard Nilaj

Senior Research Associate

Ege Aksu

Fellow

Francis Tseng

Lead Developer

Laura Beamer

Lead Researcher

Marshall Steinbaum

Senior Fellow

Roberta Costa

Research Manager

Sérgio Pinto

Fellow

Sultana Fouzia

Research Fellow

Yunjie Xie

Fellow

Related Tools

Tooling

Tooling

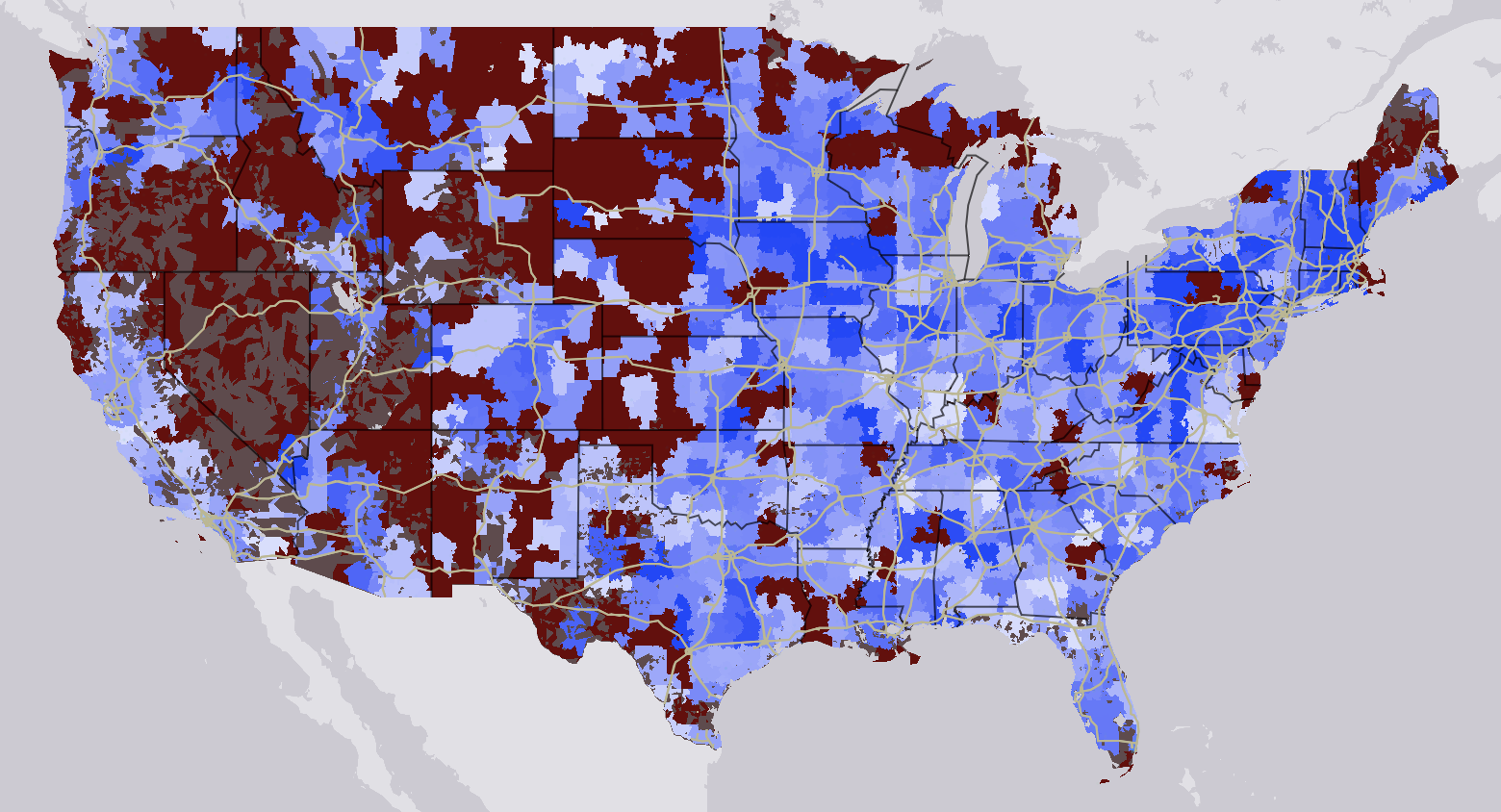

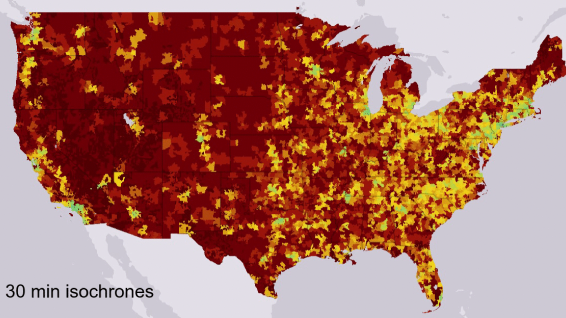

Mapping Student Debt

Tooling

Tooling

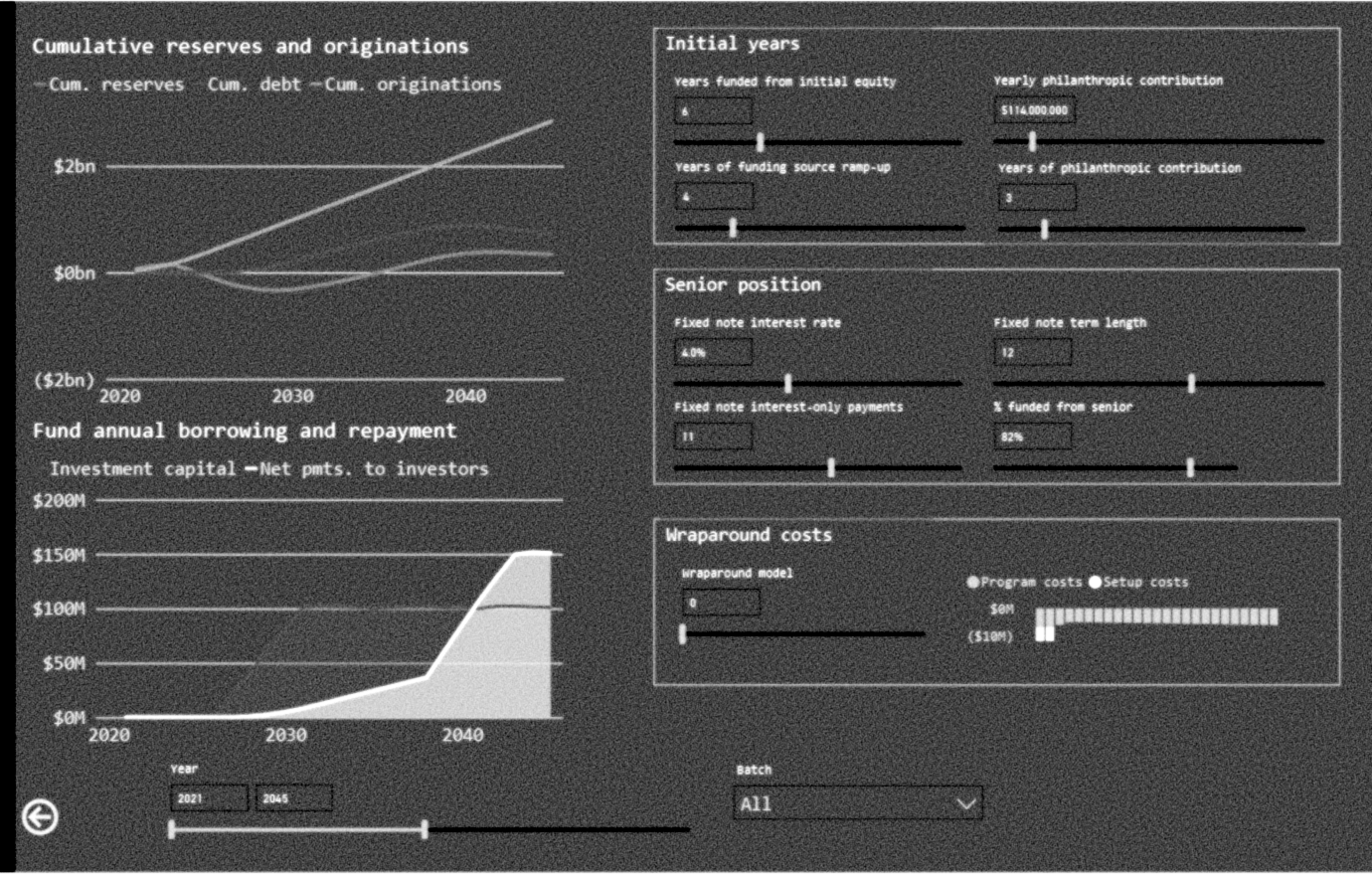

SFI Model

Related Publication Series

Millennial Student Debt

Recent Updates

Lead Researcher Laura Beamer on the Brian Lehrer Show

Beamer spoke about student debt cancellation

Cost Deception at Elite Private Colleges

Following Millennial Student Debt Part 7, "How Schools Lie: The Deceptive Financial Aid System at America's Colleges," Laura Beamer and Eduard...

Part of the series Millennial Student Debt

Rules, Accountability, and the Student Debt Crisis – New report from Laura Beamer

The paper explores the cross-section of the student debt crisis and key accountability measures under discussion in the Dept. of...

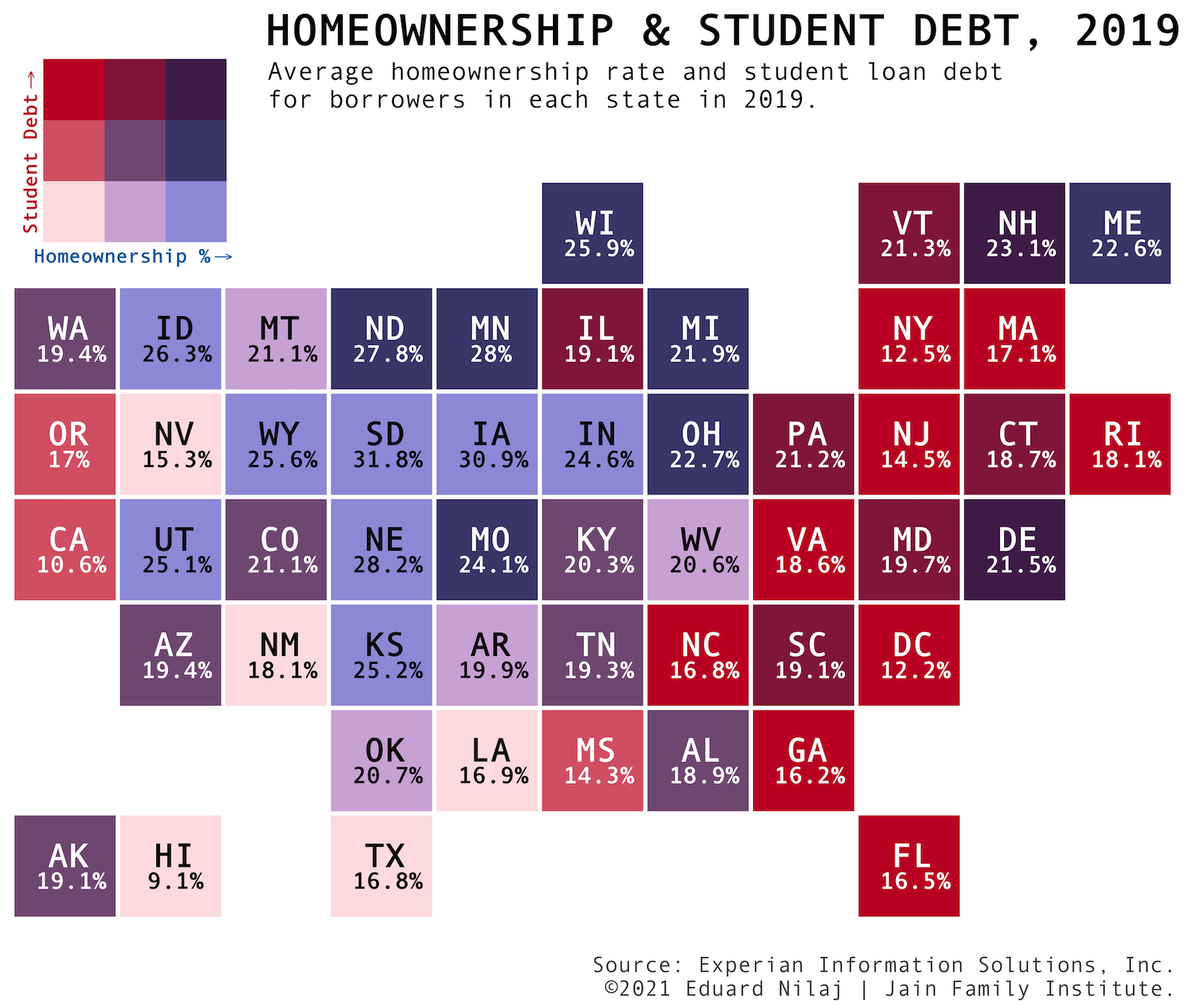

Coverage of “Homeownership and Student Debt” in Bloomberg, Politico

"Homeownership and Student Debt" is the eighth post in JFI's Millennial Student Debt project

Homeownership and the Student Debt Crisis

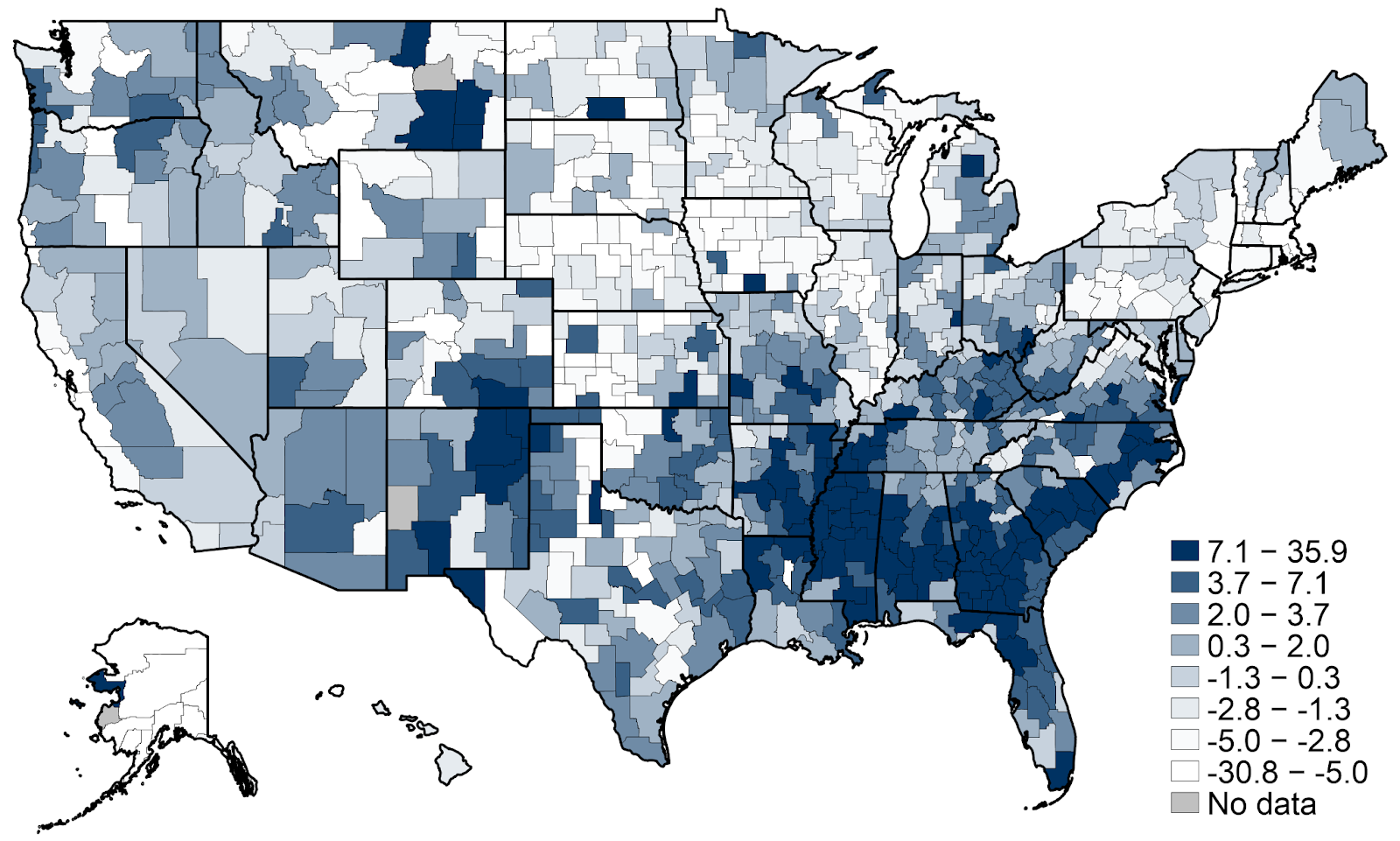

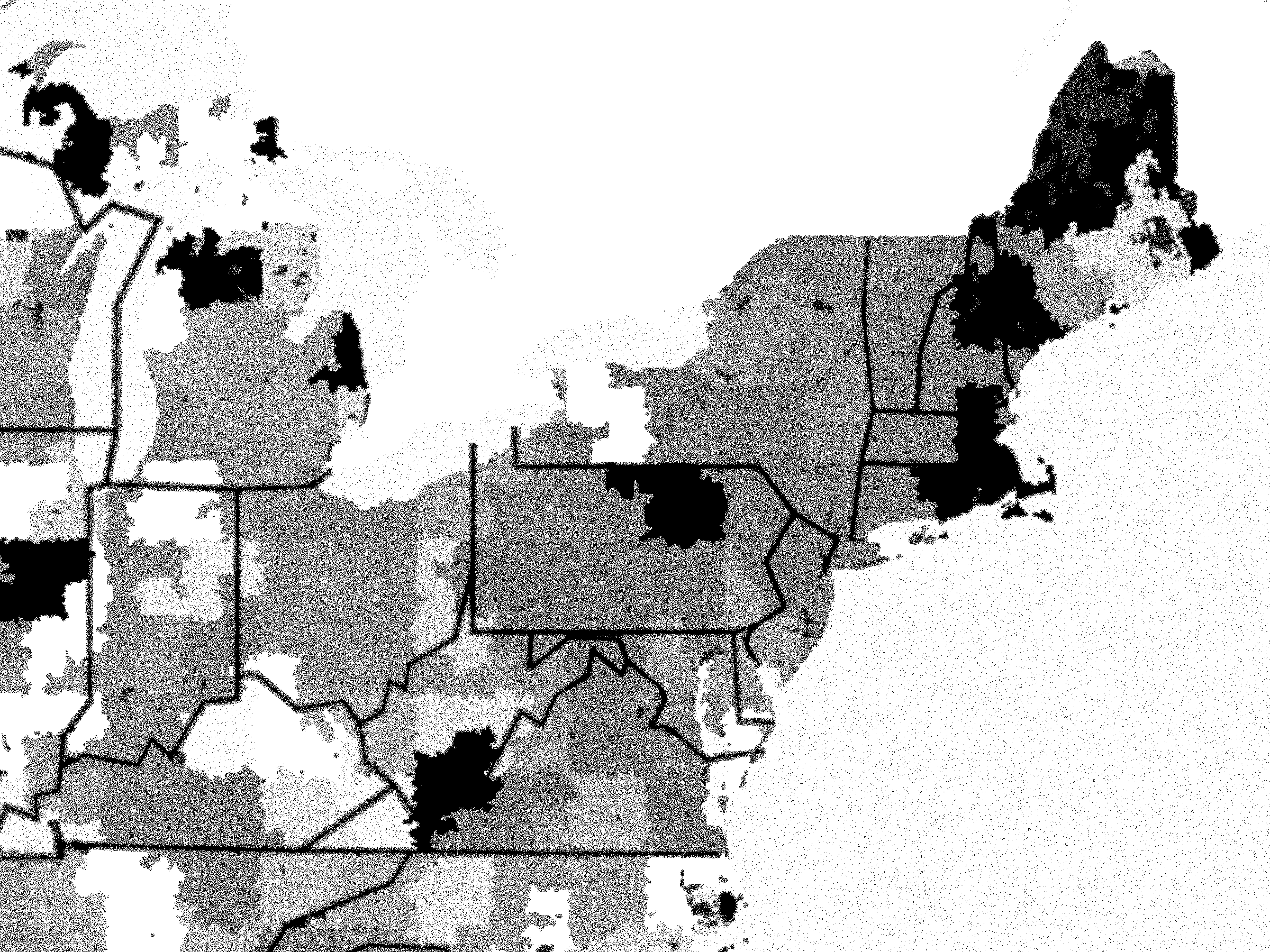

The homeownership rate among student borrowers declined by 24 percent from 2009 to 2019. Asian- and Black-plurality US Census Tracts saw the steepest...

Part of the series Millennial Student Debt

Homeownership and the Student Debt Crisis: Latest research from the Millennial Student Debt project

The eighth report in JFI’s student debt project, the research explores links between rising student debt and declining homeownership...

JFI higher education research supplements grassroots “Debt-Free College” week of action

As part of the Higher Ed Not Debt campaign of Generation Progress, JFI joined other research and policy organizations to...

Investments in Tuition-Free College: Where the US has been and where America’s College Promise would take us

Join us for a Research Session with Peter Granville, Senior Policy Associate at The Century Foundation, drawing on his recent...

Laura Beamer in Open Campus

Scott Smallwood: "We spend a lot of time talking about the cost of college. But what if the numbers we’...

How Schools Lie: The Deceptive Financial Aid System at America’s Colleges

A view into how colleges mislead students about the true cost of college, which exacerbates delays in completion, drop outs,...

Part of the series Millennial Student Debt

New Research in Millennial Student Debt: How Schools Lie

In "How Schools Lie: The Deceptive Financial Aid System at America's Colleges," JFI researchers explore how higher education institutions mislead...

Student loans, the racial wealth divide, and why we need full student debt cancellation

“No matter what you want to do with your life, I guarantee that you’ll need an education to do...

Part of the series Millennial Student Debt

Marshall Steinbaum publishes new student debt research; Brookings event

A report focusing on three student debt–related outcomes: total individual balances, total required monthly payments, and whether an individual...

Hysteresis and Student Debt

Sérgio Pinto and Marshall Steinbaum bring together the labor economics literature on hysteresis and ongoing research into shape of...

Part of the series Millennial Student Debt

New Publication: The Right Way to Cancel Student Debt

A data-driven case for universal, automatic, and generous debt cancellation.

The Right Way to Cancel Student Debt

A collaboration between JFI and Debt Collective, the issue brief makes a data-driven case for universal, automatic, and generous debt...

Part of the series Millennial Student Debt

Laura Beamer speaks to Vox about student debt

"There are no easy answers on canceling student debt," writes Vox's Emily Stewart

Rules, Accountability, and the Student Debt Crisis

An overview of institutional trends in higher education which heavily influence student access and indebtedness.

Part of the series Millennial Student Debt

Millennial Student Debt in Newsweek and NPR

Laura Beamer, Lead Researcher on Higher Education Finance, speaks about the student debt crisis

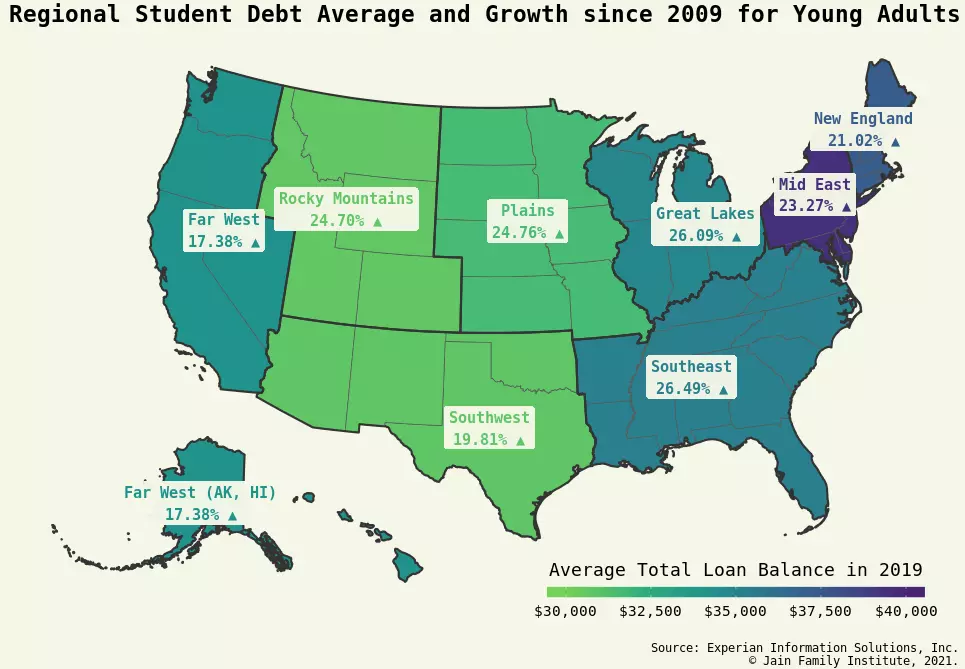

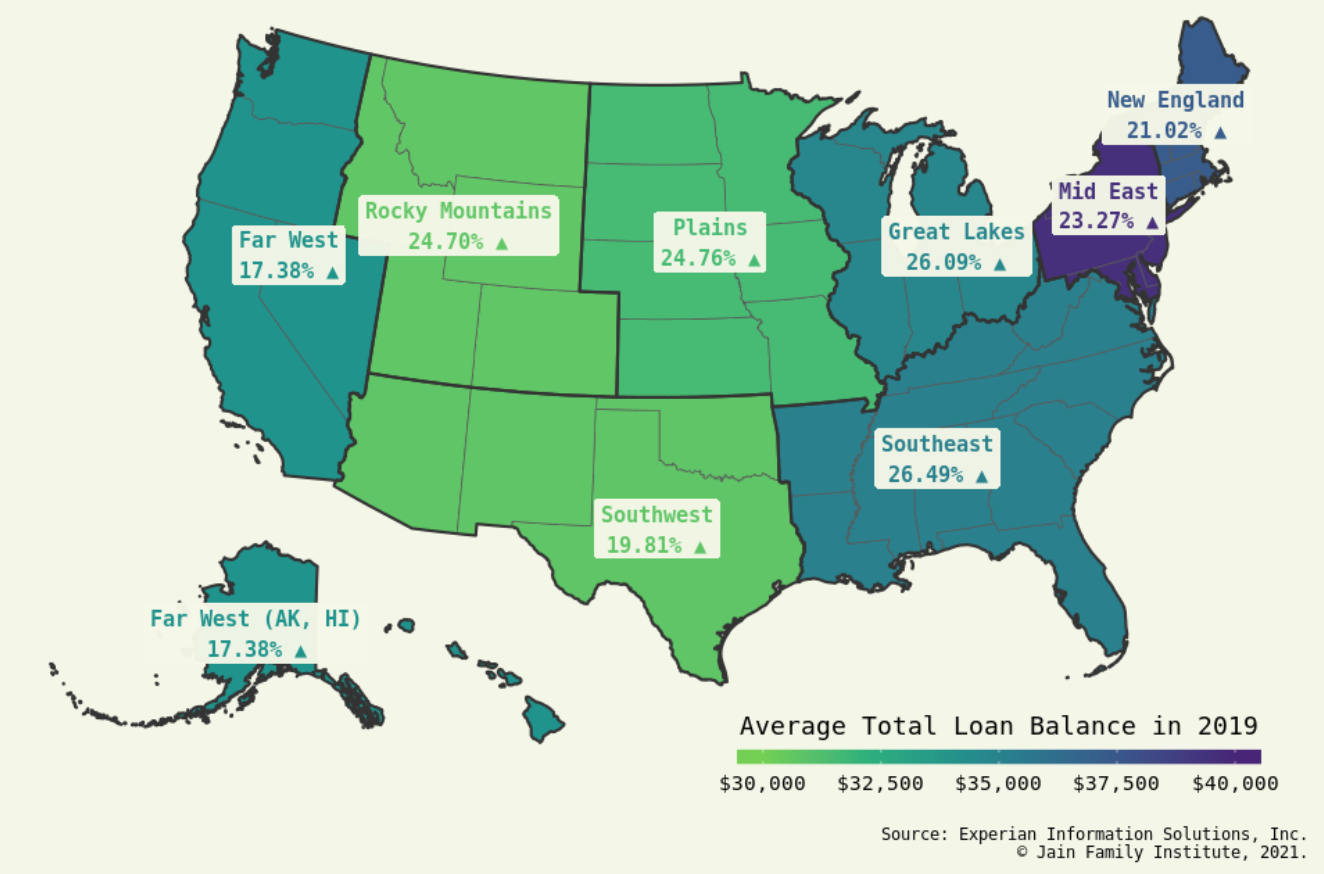

Student Debt and Young America Annual Report and Comparison Tool

This tool allows for interactive comparisons of higher education and debt statistics for specific geographic areas at the national, state...

Part of the series Millennial Student Debt

Student Debt and Young America: JFI’s annual report and new geographic comparison tool

The new report summarizes the state of student debt for 18 to 35 year olds; the accompanying comparison tool facilitates comparisons across...

Laura Beamer speaks to the Texas Standard about the student debt crisis

The conversation draws on JFI's Millennial Student Debt project

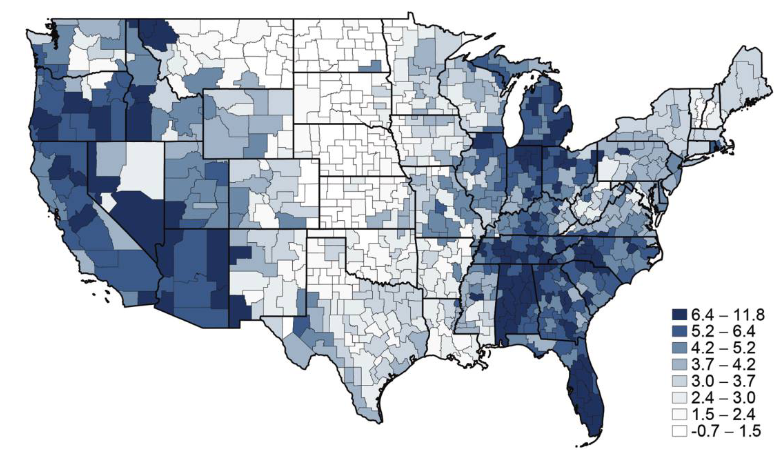

Millennial Student Debt maps win Dignity+Debt data visualization contest

Francis Tseng's maps show the geography of student debt across the United States

Business Insider, The American Prospect, Open Campus, Courier cover JFI’s Millennial Student Debt project

JFI's ongoing series on the higher education landscape provides evidence for the benefits of student debt cancellation